WASHINGTON & CHARLESTON, W. Va.--(BUSINESS WIRE)--United Bankshares, Inc. (NASDAQ: UBSI) ("United"), today reported earnings for the second quarter of 2024 of $96.5 million, or $0.71 per diluted share. Second quarter of 2024 results produced annualized returns on average assets, average equity and average tangible equity, a non-GAAP measure, of 1.32%, 7.99% and 13.12%, respectively.

"UBSI continues to consistently deliver exceptional results," stated Richard M. Adams, Jr., United's Chief Executive Officer. "In the second quarter we saw increases in profitability, capital, loans, and deposits, as well as decreases in expenses and non-performing assets. We anticipate continued success in the second half of the year, and are excited about our recent acquisition announcement of Piedmont Bancorp, Inc. in Atlanta."

United previously announced during the second quarter of 2024 that it entered into a definitive merger agreement with Piedmont Bancorp, Inc. ("Piedmont"). The combined organization will have more than $32 billion in assets and a network of over 240 locations across eight states and Washington, D.C., in some of the most desirable banking markets in the nation. The merger is expected to close late in the fourth quarter of 2024 or early in the first quarter of 2025, subject to satisfaction of customary closing conditions.

Earnings for the first quarter of 2024 were $86.8 million, or $0.64 per diluted share, and annualized returns on average assets, average equity and average tangible equity were 1.19%, 7.25% and 11.98%, respectively. Earnings for the second quarter of 2023 were $92.5 million, or $0.68 per diluted share, and annualized returns on average assets, average equity and average tangible equity were 1.26%, 7.96% and 13.47%, respectively.

Second quarter of 2024 compared to the first quarter of 2024

Net interest income for the second quarter of 2024 increased $3.2 million, or 1%, from the first quarter of 2024. Tax-equivalent net interest income, a non-GAAP measure which adjusts for the tax-favored status of income from certain loans and investments, for the second quarter of 2024 also increased $3.2 million, or 1%, from the first quarter of 2024. The increase in net interest income and tax-equivalent net interest income was driven by a higher yield on average net loans and loans held for sale, organic loan growth and a decrease in average long-term borrowings partially offset by higher interest expense driven by the impact of deposit rate repricing. The net interest spread increased 3 basis points to 2.52% for the second quarter of 2024 driven by an increase in the yield on average earning assets of 9 basis points partially offset by an increase in the average cost of funds of 6 basis points. The yield on average net loans and loans held for sale increased 6 basis points to 6.14% for the second quarter of 2024. The first quarter of 2024 included a $593 thousand interest reversal due to a commercial & industrial loan relationship being placed on nonaccrual whereas the second quarter of 2024 included a $654 thousand interest recovery from a commercial real estate nonaccrual loan payoff. Average net loans and loans held for sale increased $127.6 million, or 2% on an annualized basis, from the first quarter of 2024. Average long-term borrowings decreased $209.8 million, or 14%, from the first quarter of 2024. The yield on average interest-bearing deposits increased 8 basis points to 3.18% for the second quarter of 2024. The net interest margin of 3.50% for the second quarter of 2024 was an increase of 6 basis points from the net interest margin of 3.44% for the first quarter of 2024.

The provision for credit losses was $5.8 million for the second quarter of 2024 as compared to $5.7 million for the first quarter of 2024.

Noninterest income for the second quarter of 2024 decreased $2.0 million, or 6%, from the first quarter of 2024. The decrease in noninterest income was primarily due to a decrease in income from mortgage banking activities of $1.4 million driven by lower mortgage loan sale volume and a lower margin. During the second quarter of 2024, United recognized a $6.9 million gain on the VISA share exchange, of which $4.6 million was realized through the sale of eligible shares and the remainder of which related to shares held at fair value at quarter-end and which will be eligible to be sold in the third quarter of 2024. Additionally, during the second quarter of 2024, United sold $102.7 million of available for sale ("AFS") investment securities at a loss of $6.8 million.

Noninterest expense for the second quarter of 2024 decreased $6.0 million, or 4%, from the first quarter of 2024. The decrease in noninterest expense was primarily driven by decreases in employee benefits of $2.5 million, Federal Deposit Insurance Corporation ("FDIC") insurance expense of $1.4 million as well as smaller decreases in other categories of noninterest expense. The decrease in employee benefits was primarily driven by lower Federal Insurance Contributions Act ("FICA") and postretirement benefit costs. The decrease in FDIC insurance expense was primarily due to the inclusion in the first quarter of 2024 of an incremental $1.8 million of expense related to the FDIC special assessment. Other noninterest expense was $32.8 million for the second quarter of 2024 compared to $33.5 million for the first quarter of 2024. The decrease in other noninterest expense was driven by lower amounts of certain general operating expenses partially offset by $1.3 million in merger-related expenses related to the Piedmont acquisition.

For the second quarter of 2024, income tax expense was $18.9 million as compared to $21.4 million for the first quarter of 2024. The decrease of $2.5 million was driven by the impact of discrete tax benefits recognized in the second quarter of 2024 partially offset by higher earnings. United's effective tax rate was 16.4% and 19.8% for the second quarter of 2024 and first quarter of 2024, respectively.

Second quarter of 2024 compared to the second quarter of 2023

Earnings for the second quarter of 2024 were $96.5 million, or $0.71 per diluted share, as compared to earnings of $92.5 million, or $0.68 per diluted share, for the second quarter of 2023.

Net interest income for the second quarter of 2024 of $225.7 million slightly decreased by $1.7 million, or less than 1%, from the second quarter of 2023. Tax-equivalent net interest income for the second quarter of 2024 of $226.6 million slightly decreased by $2.0 million, or less than 1%, from the second quarter of 2023. The slight decrease in net interest income and tax-equivalent net interest income was primarily due to higher interest expense driven by deposit rate repricing, an increase in average interest-bearing deposits and a decrease in acquired loan accretion income. The decrease was largely offset by the impact of rising market interest rates on earning assets, organic loan growth and a decrease in average long-term borrowings. The yield on average interest-bearing deposits increased 81 basis points from the second quarter of 2023. Average interest-bearing deposits increased $1.2 billion from the second quarter of 2023. Acquired loan accretion income for the second quarter of 2024 decreased $671 thousand from the second quarter of 2023. The yield on average earning assets increased 46 basis points from the second quarter of 2023 to 5.79% driven by an increase in the yield on average net loans and loans held for sale of 36 basis points. Average net loans and loans held for sale increased $912.0 million from the second quarter of 2023. Average long-term borrowings decreased $1.0 billion from the second quarter of 2023. The net interest margin for the second quarter of 2024 and 2023 was 3.50% and 3.51%, respectively.

The provision for credit losses was $5.8 million for the second quarter of 2024 as compared to $11.4 million for the second quarter of 2023.

Noninterest income for the second quarter of 2024 was $30.2 million, which was a decrease of $5.0 million, or 14%, from the second quarter of 2023. Mortgage loan servicing income decreased $9.1 million driven by an $8.1 million gain on the sale of mortgage servicing rights ("MSRs") in the second quarter of 2023. Income from mortgage banking activities decreased $4.0 million from the second quarter of 2023 mainly due to lower mortgage loan origination and sale volume and a lower quarter-end valuation of mortgage derivatives. Net losses on investment securities were $218 thousand for the second quarter of 2024 which included a $6.9 million gain on the VISA share exchange partially offset by a $6.8 million loss on the sale of AFS investment securities. Net losses on investment securities for the second quarter of 2023 were $7.3 million driven by a $7.2 million loss on the sale of AFS investment securities. Fees from brokerage services increased $1.0 million from the second quarter of 2023 primarily due to higher volume.

Noninterest expense for the second quarter of 2024 was flat from the second quarter of 2023, decreasing $514 thousand, or less than 1%. Several categories of noninterest expense decreased which were largely offset by increases in other categories, none of which were significant. Within other noninterest expense, lower amounts of certain general operating expenses were partially offset by $1.3 million in merger-related expenses and a $1.0 million increase in tax credit amortization.

For the second quarter of 2024, income tax expense was $18.9 million as compared to $23.5 million for the second quarter of 2023. The decrease of $4.6 million was driven by the impact of discrete tax benefits recognized in the second quarter of 2024. United's effective tax rate was 16.4% and 20.2% for the second quarter of 2024 and second quarter of 2023, respectively.

First half of 2024 compared to the first half of 2023

Earnings for the first six months of 2024 were $183.3 million, or $1.35 per diluted share, as compared to earnings of $190.8 million, or $1.41 per diluted share, for the first six months of 2023.

Net interest income for the first half of 2024 decreased $13.6 million, or 3%, from the first half of 2023. Tax-equivalent net interest income for the first half of 2024 decreased $14.1 million, or 3%, from the first half of 2023. The decrease in net interest income and tax-equivalent net interest income was primarily due to higher interest expense driven by deposit rate repricing, an increase in average interest-bearing deposits and a decrease in acquired loan accretion income. These decreases were partially offset by the impact of rising market interest rates on earning assets, organic loan growth and a decrease in average long-term borrowings. The yield on average interest-bearing deposits increased 104 basis points from the first half of 2023. Average interest-bearing deposits increased $1.3 billion from the first half of 2023. Acquired loan accretion income for the first half of 2024 of $4.9 million was a decrease of $1.3 million from the first half of 2023. The yield on average earning assets increased 53 basis points from the first half of 2023 to 5.74% driven by an increase in the yield on average net loans and loans held for sale of 44 basis points. Average net loans and loans held for sale increased $856.2 million from the first half of 2023. Average long-term borrowings decreased $967.1 million from the first half of 2023. The net interest margin for the first half of 2024 and 2023 was 3.47% and 3.57%, respectively.

The provision for credit losses was $11.5 million for the first six months 2024 as compared to $18.3 million for the first six months of 2023.

Noninterest income for the first six months of 2024 was $62.4 million, which was a decrease of $5.5 million, or 8%, from the first six months of 2023. Mortgage loan servicing income decreased $10.5 million from the first half of 2023 driven by the aforementioned sale of MSRs. Income from mortgage banking activities decreased $5.1 million from the first half of 2023 mainly due to lower mortgage loan origination and sale volume and a lower quarter-end valuation of mortgage derivatives and mortgage loans held for sale. Net losses on investment securities were $317 thousand for the first half of 2024 which included a $6.9 million gain on the VISA share exchange partially offset by a $6.8 million loss on the sale of AFS investment securities. Net losses on investment securities for the first six months of 2023 were $7.7 million driven by a $7.2 million loss on the sale of AFS investment securities. Fees from brokerage services increased $2.1 million from the first half of 2023 primarily due to higher volume.

Noninterest expense for the first six months of 2024 was $275.5 million, an increase of $2.8 million, or 1%, from the first six months of 2023 driven by increases in employee compensation of $3.9 million, other noninterest expense of $2.9 million and FDIC insurance expense of $2.4 million partially offset by decreases in the expense for the reserve for unfunded loan commitments of $4.5 million and mortgage loan servicing expense of $1.6 million. The increase in employee compensation was driven by higher employee incentives, base salaries and employee severance associated with the previously announced mortgage delivery channel consolidation. The increase in other noninterest expense was primarily driven by a $2.0 million increase in tax credit amortization, $1.3 million in merger-related expenses incurred in the second quarter of 2024 and higher amounts of certain general operating expenses. The increase in FDIC insurance expense was driven by $1.8 million of expense recognized in the first quarter of 2024 for the FDIC special assessment. The decrease in the expense for the reserve for unfunded loan commitments was driven by a decrease in the outstanding balance of loan commitments. The decrease in mortgage loan servicing expense was driven by the sale of MSRs.

For the first six months of 2024, income tax expense was $40.3 million as compared to $47.9 million for the first six months of 2023 primarily due to the impact of discrete tax benefits recognized in the second quarter of 2024 and lower earnings. United's effective tax rate was 18.0% for the first six months of 2024 and 20.1% for the first six months of 2023.

Credit Quality

United's asset quality continues to be sound. At June 30, 2024, non-performing loans were $65.3 million, or 0.30% of loans & leases, net of unearned income. Total non-performing assets were $67.5 million, including other real estate owned ("OREO") of $2.2 million, or 0.23% of total assets at June 30, 2024. At December 31, 2023, non-performing loans were $45.5 million, or 0.21% of loans & leases, net of unearned income. Total non-performing assets were $48.1 million, including OREO of $2.6 million, or 0.16% of total assets at December 31, 2023. As previously disclosed in the first quarter of 2024, the increase in non-performing loans and non-performing assets from year-end was driven by one commercial & industrial loan relationship. Non-performing loans decreased $9.1 million from March 31, 2024 primarily due to a partial paydown of the aforementioned commercial & industrial loan relationship.

As of June 30, 2024, the allowance for loan & lease losses was $267.4 million, or 1.24% of loans & leases, net of unearned income, as compared to $259.2 million, or 1.21% of loans & leases, net of unearned income, at December 31, 2023. Net charge-offs were $1.3 million for the second quarter of 2024 compared to $1.2 million for the second quarter of 2023. Annualized net charge-offs as a percentage of average loans & leases, net of unearned income were 0.02% for both the second quarter of 2024 and 2023. Net charge-offs were $3.3 million for the first half of 2024 compared to $2.4 million for the first half of 2023. Annualized net charge-offs as a percentage of average loans & leases, net of unearned income were 0.03% and 0.02% for the first half of 2024 and 2023, respectively. Net charge-offs were $2.1 million for the first quarter of 2024.

Capital

United continues to be well-capitalized based upon regulatory guidelines. United's estimated risk-based capital ratio is 15.8% at June 30, 2024, while estimated Common Equity Tier 1 capital, Tier 1 capital and leverage ratios are 13.5%, 13.5% and 11.6%, respectively. The June 30, 2024 ratios reflect United's election of a five-year transition provision, allowed by the Federal Reserve Board and other federal banking agencies in response to the COVID-19 pandemic, to delay for two years the full impact of CECL on regulatory capital, followed by a three-year transition period. The regulatory requirements for a well-capitalized financial institution are a risk-based capital ratio of 10.0%, a Common Equity Tier 1 capital ratio of 6.5%, a Tier 1 capital ratio of 8.0% and a leverage ratio of 5.0%. United did not repurchase any shares of its common stock during 2024 or 2023.

About United Bankshares, Inc.

As of June 30, 2024, United had consolidated assets of approximately $30.0 billion and is the 38th largest banking company in the U.S. based on market capitalization. United is the parent company of United Bank, which comprises more than 225 offices located throughout Washington, D.C., Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, Pennsylvania, and Georgia. United's stock is traded on the NASDAQ Global Select Market under the quotation symbol "UBSI".

Cautionary Statements

The Company is required under generally accepted accounting principles to evaluate subsequent events through the filing of its June 30, 2024 consolidated financial statements on Form 10-Q. As a result, the Company will continue to evaluate the impact of any subsequent events on critical accounting assumptions and estimates made as of June 30, 2024 and will adjust amounts preliminarily reported, if necessary.

Use of non-GAAP Financial Measures

This press release contains certain financial measures that are not recognized under U.S. generally accepted accounting principles ("GAAP"). Generally, United has presented these "non-GAAP" financial measures because it believes that these measures provide meaningful additional information to assist in the evaluation of United's results of operations or financial position. Presentation of these non-GAAP financial measures is consistent with how United's management evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the banking industry.

Specifically, this press release contains certain references to financial measures identified as tax-equivalent (FTE) net interest income, average tangible equity, return on average tangible equity and tangible book value per share. Management believes these non-GAAP financial measures to be helpful in understanding United's results of operations or financial position.

Net interest income is presented in this press release on a tax-equivalent basis. The tax-equivalent basis adjusts for the tax-favored status of income from certain loans and investments. Although this is a non-GAAP measure, United's management believes this measure is more widely used within the financial services industry and provides better comparability of net interest income arising from taxable and tax-exempt sources. United uses this measure to monitor net interest income performance and to manage its balance sheet composition. The tax-equivalent adjustment combines amounts of interest income on federally nontaxable loans and investment securities using the statutory federal income tax rate of 21%.

Tangible equity is calculated as GAAP total shareholders' equity minus total intangible assets. Tangible equity can thus be considered the most conservative valuation of the company. Tangible equity is also presented on a per common share basis and considering net income, a return on average tangible equity. Management provides these amounts to facilitate the understanding of as well as to assess the quality and composition of United's capital structure. By removing the effect of intangible assets that result from merger and acquisition activity, the "permanent" items of equity are presented. These measures, along with others, are used by management to analyze capital adequacy and performance.

Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as reconciliation to that comparable GAAP financial measure can be found in the attached financial information tables to this press release. Investors should recognize that United's presentation of these non-GAAP financial measures might not be comparable to similarly titled measures at other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and United strongly encourages a review of its condensed consolidated financial statements in their entirety.

Forward-Looking Statements

In this report, we have made various statements regarding current expectations or forecasts of future events, which speak only as of the date the statements are made. These statements are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are also made from time-to-time in press releases and in oral statements made by the officers of the Company. Forward-looking statements can be identified by the use of the words "expect," "may," "could," "intend," "project," "estimate," "believe," "anticipate," and other words of similar meaning. Such forward-looking statements are based on assumptions and estimates, which although believed to be reasonable, may turn out to be incorrect. Therefore, undue reliance should not be placed upon these estimates and statements. United cannot assure that any of these statements, estimates, or beliefs will be realized and actual results may differ from those contemplated in these "forward-looking statements." The following factors, among others, could cause the actual results of United's operations to differ materially from its expectations: uncertainty in U.S. fiscal and monetary policies, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets, interest rate, securities market and monetary supply fluctuations; increasing rates of inflation and slower growth rates; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those involving the Federal Reserve, FDIC, and CFPB; the effect of changes in the level of checking or savings account deposits on United's funding costs and net interest margin; future provisions for credit losses on loans and debt securities; changes in nonperforming assets; risks relating to the merger with Piedmont, including the successful integration of operations of Piedmont; competition; changes in legislation or regulatory requirements; and the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events. For more information about factors that could cause actual results to differ materially from United's expectations, refer to its reports filed with the Securities and Exchange Commission, including the discussion under "Risk Factors" in the Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission and available on its website at www.sec.gov. Further, any forward-looking statement speaks only as of the date on which it is made, and United undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. You are advised to consult further disclosures United may make on related subjects in our filings with the SEC.

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | ||||||||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||||||||

EARNINGS SUMMARY: | June 2024 | June 2023 | March 2024 | June 2024 | June 2023 | |||||||||||||||||

Interest income | $ | 374,184 | $ | 345,932 | $ | 369,180 | $ | 743,364 | $ | 675,235 | ||||||||||||

Interest expense | 148,469 | 118,471 | 146,691 | 295,160 | 213,454 | |||||||||||||||||

Net interest income | 225,715 | 227,461 | 222,489 | 448,204 | 461,781 | |||||||||||||||||

Provision for credit losses | 5,779 | 11,440 | 5,740 | 11,519 | 18,330 | |||||||||||||||||

Noninterest income | 30,223 | 35,178 | 32,212 | 62,435 | 67,922 | |||||||||||||||||

Noninterest expense | 134,774 | 135,288 | 140,742 | 275,516 | 272,707 | |||||||||||||||||

Income before income taxes | 115,385 | 115,911 | 108,219 | 223,604 | 238,666 | |||||||||||||||||

Income taxes | 18,878 | 23,452 | 21,405 | 40,283 | 47,900 | |||||||||||||||||

Net income | $ | 96,507 | $ | 92,459 | $ | 86,814 | $ | 183,321 | $ | 190,766 | ||||||||||||

PER COMMON SHARE: | ||||||||||||||||||||||

Net income: | ||||||||||||||||||||||

Basic | $ | 0.71 | $ | 0.68 | $ | 0.64 | $ | 1.36 | $ | 1.42 | ||||||||||||

Diluted | 0.71 | 0.68 | 0.64 | 1.35 | 1.41 | |||||||||||||||||

Cash dividends | $ | 0.37 | $ | 0.36 | 0.37 | 0.74 | 0.72 | |||||||||||||||

Book value | 35.56 | 35.92 | 34.37 | |||||||||||||||||||

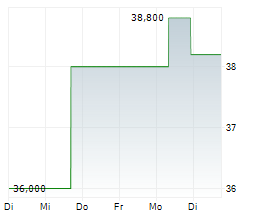

Closing market price | $ | 35.79 | $ | 32.44 | $ | 29.67 | ||||||||||||||||

Common shares outstanding: | ||||||||||||||||||||||

Actual at period end, net of treasury shares | 135,192,675 | 135,195,704 | 134,934,858 | |||||||||||||||||||

Weighted average-basic | 135,137,901 | 134,683,010 | 134,808,634 | 134,881,314 | 134,472,074 | |||||||||||||||||

Weighted average-diluted | 135,314,785 | 134,849,818 | 135,121,380 | 135,103,288 | 134,748,868 | |||||||||||||||||

FINANCIAL RATIOS: | ||||||||||||||||||||||

Return on average assets | 1.32 | % | 1.26 | % | 1.19 | % | 1.25 | % | 1.31 | % | ||||||||||||

Return on average shareholders' equity | 7.99 | % | 7.96 | % | 7.25 | % | 7.62 | % | 8.34 | % | ||||||||||||

Return on average tangible equity (non-GAAP)(1) | 13.12 | % | 13.47 | % | 11.98 | % | 12.55 | % | 14.20 | % | ||||||||||||

Average equity to average assets | 16.54 | % | 15.83 | % | 16.36 | % | 16.45 | % | 15.66 | % | ||||||||||||

Net interest margin | 3.50 | % | 3.51 | % | 3.44 | % | 3.47 | % | 3.57 | % | ||||||||||||

PERIOD END BALANCES: | June 30 2024 | December 31 2023 | June 30 2023 | March 31 2024 | ||||||||||||||||||

Assets | $ | 29,957,418 | $ | 29,926,482 | $ | 29,694,651 | $ | 30,028,798 | ||||||||||||||

Earning assets | 26,572,087 | 26,623,652 | 26,335,600 | 26,659,694 | ||||||||||||||||||

Loans & leases, net of unearned income | 21,598,727 | 21,359,084 | 20,764,291 | 21,520,076 | ||||||||||||||||||

Loans held for sale | 66,475 | 56,261 | 91,296 | 44,426 | ||||||||||||||||||

Investment securities | 3,650,582 | 4,125,754 | 4,342,714 | 3,954,519 | ||||||||||||||||||

Total deposits | 23,066,440 | 22,819,319 | 22,369,753 | 22,919,746 | ||||||||||||||||||

Shareholders' equity | 4,856,633 | 4,771,240 | 4,637,043 | 4,807,441 | ||||||||||||||||||

Note: (1) See information under the "Selected Financial Ratios" table for a reconciliation of non-GAAP measure.

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | |||||||||||||||||||

Consolidated Statements of Income | Three Months Ended | Six Months Ended | |||||||||||||||||

June | June | March | June | June | |||||||||||||||

2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||

Interest & Loan Fees Income (GAAP) | $ | 374,184 | $ | 345,932 | $ | 369,180 | $ | 743,364 | $ | 675,235 | |||||||||

Tax equivalent adjustment | 867 | 1,144 | 872 | 1,739 | 2,279 | ||||||||||||||

Interest & Fees Income (FTE) (non-GAAP) | 375,051 | 347,076 | 370,052 | 745,103 | 677,514 | ||||||||||||||

Interest Expense | 148,469 | 118,471 | 146,691 | 295,160 | 213,454 | ||||||||||||||

Net Interest Income (FTE) (non-GAAP) | 226,582 | 228,605 | 223,361 | 449,943 | 464,060 | ||||||||||||||

Provision for Credit Losses | 5,779 | 11,440 | 5,740 | 11,519 | 18,330 | ||||||||||||||

Noninterest Income: | |||||||||||||||||||

Fees from trust services | 4,744 | 4,516 | 4,646 | 9,390 | 9,296 | ||||||||||||||

Fees from brokerage services | 4,959 | 3,918 | 5,267 | 10,226 | 8,118 | ||||||||||||||

Fees from deposit services | 9,326 | 9,325 | 8,971 | 18,297 | 18,687 | ||||||||||||||

Bankcard fees and merchant discounts | 1,355 | 1,707 | 1,873 | 3,228 | 3,414 | ||||||||||||||

Other charges, commissions, and fees | 869 | 949 | 858 | 1,727 | 2,087 | ||||||||||||||

Income from bank-owned life insurance | 2,549 | 2,022 | 2,418 | 4,967 | 3,913 | ||||||||||||||

Income from mortgage banking activities | 3,901 | 7,907 | 5,298 | 9,199 | 14,291 | ||||||||||||||

Mortgage loan servicing income | 783 | 9,841 | 789 | 1,572 | 12,117 | ||||||||||||||

Net losses on investment securities | (218 | ) | (7,336 | ) | (99 | ) | (317 | ) | (7,741 | ) | |||||||||

Other noninterest income | 1,955 | 2,329 | 2,191 | 4,146 | 3,740 | ||||||||||||||

Total Noninterest Income | 30,223 | 35,178 | 32,212 | 62,435 | 67,922 | ||||||||||||||

Noninterest Expense: | |||||||||||||||||||

Employee compensation | 58,501 | 58,502 | 59,293 | 117,794 | 113,916 | ||||||||||||||

Employee benefits | 12,147 | 12,236 | 14,671 | 26,818 | 25,671 | ||||||||||||||

Net occupancy | 11,400 | 11,409 | 12,343 | 23,743 | 23,242 | ||||||||||||||

Data processing | 7,290 | 7,256 | 7,463 | 14,753 | 14,729 | ||||||||||||||

Amortization of intangibles | 910 | 1,279 | 910 | 1,820 | 2,558 | ||||||||||||||

OREO expense | 268 | 315 | 159 | 427 | 982 | ||||||||||||||

Net losses (gains) on the sale of OREO properties | 32 | 16 | (83 | ) | (51 | ) | (27 | ) | |||||||||||

Equipment expense | 7,548 | 8,026 | 6,853 | 14,401 | 15,022 | ||||||||||||||

FDIC insurance expense | 5,058 | 4,570 | 6,455 | 11,513 | 9,157 | ||||||||||||||

Mortgage loan servicing expense and impairment | 1,011 | 1,699 | 1,015 | 2,026 | 3,583 | ||||||||||||||

Expense for the reserve for unfunded loan commitments | (2,177 | ) | (2,021 | ) | (1,790 | ) | (3,967 | ) | 579 | ||||||||||

Other noninterest expense | 32,786 | 32,001 | 33,453 | 66,239 | 63,295 | ||||||||||||||

Total Noninterest Expense | 134,774 | 135,288 | 140,742 | 275,516 | 272,707 | ||||||||||||||

Income Before Income Taxes (FTE) (non-GAAP) | 116,252 | 117,055 | 109,091 | 225,343 | 240,945 | ||||||||||||||

Tax equivalent adjustment | 867 | 1,144 | 872 | 1,739 | 2,279 | ||||||||||||||

Income Before Income Taxes (GAAP) | 115,385 | 115,911 | 108,219 | 223,604 | 238,666 | ||||||||||||||

Taxes | 18,878 | 23,452 | 21,405 | 40,283 | 47,900 | ||||||||||||||

Net Income | $ | 96,507 | $ | 92,459 | $ | 86,814 | $ | 183,321 | $ | 190,766 | |||||||||

MEMO: Effective Tax Rate | 16.36 | % | 20.23 | % | 19.78 | % | 18.02 | % | 20.07 | % | |||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | ||||||||||||||||||||||||

Consolidated Balance Sheets | ||||||||||||||||||||||||

June 2024 | June 2023 | June 30 | December 31 | June 30 | March 31 | |||||||||||||||||||

Q-T-D Average | Q-T-D Average | 2024 | 2023 | 2023 | 2024 | |||||||||||||||||||

Cash & Cash Equivalents | $ | 1,174,885 | $ | 1,282,923 | $ | 1,858,861 | $ | 1,598,943 | $ | 1,692,357 | $ | 1,732,646 | ||||||||||||

Securities Available for Sale | 3,472,389 | 4,320,055 | 3,315,726 | 3,786,377 | 4,005,324 | 3,613,975 | ||||||||||||||||||

Less: Allowance for credit losses | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||

Net available for sale securities | 3,472,389 | 4,320,055 | 3,315,726 | 3,786,377 | 4,005,324 | 3,613,975 | ||||||||||||||||||

Securities Held to Maturity | 1,020 | 1,020 | 1,020 | 1,020 | 1,020 | 1,020 | ||||||||||||||||||

Less: Allowance for credit losses | (19 | ) | (19 | ) | (19 | ) | (17 | ) | (19 | ) | (19 | ) | ||||||||||||

Net held to maturity securities | 1,001 | 1,001 | 1,001 | 1,003 | 1,001 | 1,001 | ||||||||||||||||||

Equity Securities | 12,832 | 8,081 | 11,094 | 8,945 | 8,443 | 8,762 | ||||||||||||||||||

Other Investment Securities | 312,684 | 332,904 | 322,761 | 329,429 | 327,946 | 330,781 | ||||||||||||||||||

Total Securities | 3,798,906 | 4,662,041 | 3,650,582 | 4,125,754 | 4,342,714 | 3,954,519 | ||||||||||||||||||

Total Cash and Securities | 4,973,791 | 5,944,964 | 5,509,443 | 5,724,697 | 6,035,071 | 5,687,165 | ||||||||||||||||||

Loans held for sale | 56,298 | 72,966 | 66,475 | 56,261 | 91,296 | 44,426 | ||||||||||||||||||

Commercial Loans & Leases | 15,815,382 | 14,980,069 | 15,894,244 | 15,535,204 | 15,083,157 | 15,725,038 | ||||||||||||||||||

Mortgage Loans | 4,763,655 | 4,347,941 | 4,759,798 | 4,728,374 | 4,437,158 | 4,769,495 | ||||||||||||||||||

Consumer Loans | 1,016,764 | 1,322,889 | 956,385 | 1,109,607 | 1,261,611 | 1,038,035 | ||||||||||||||||||

Gross Loans | 21,595,801 | 20,650,899 | 21,610,427 | 21,373,185 | 20,781,926 | 21,532,568 | ||||||||||||||||||

Unearned income | (12,201 | ) | (18,356 | ) | (11,700 | ) | (14,101 | ) | (17,635 | ) | (12,492 | ) | ||||||||||||

Loans & Leases, net of unearned income | 21,583,600 | 20,632,543 | 21,598,727 | 21,359,084 | 20,764,291 | 21,520,076 | ||||||||||||||||||

Allowance for Loan & Lease Losses | (263,050 | ) | (240,611 | ) | (267,423 | ) | (259,237 | ) | (250,721 | ) | (262,905 | ) | ||||||||||||

Net Loans | 21,320,550 | 20,391,932 | 21,331,304 | 21,099,847 | 20,513,570 | 21,257,171 | ||||||||||||||||||

Mortgage Servicing Rights | 4,116 | 14,662 | 3,934 | 4,554 | 4,627 | 4,241 | ||||||||||||||||||

Goodwill | 1,888,889 | 1,888,889 | 1,888,889 | 1,888,889 | 1,888,889 | 1,888,889 | ||||||||||||||||||

Other Intangibles | 11,275 | 17,164 | 10,685 | 12,505 | 16,339 | 11,595 | ||||||||||||||||||

Operating Lease Right-of-Use Asset | 85,210 | 78,872 | 83,045 | 86,986 | 80,641 | 86,074 | ||||||||||||||||||

Other Real Estate Owned | 2,335 | 4,070 | 2,156 | 2,615 | 3,756 | 2,670 | ||||||||||||||||||

Bank Owned Life Insurance | 491,599 | 482,791 | 493,498 | 486,895 | 483,906 | 490,596 | ||||||||||||||||||

Other Assets | 536,101 | 542,502 | 567,989 | 563,233 | 576,556 | 555,971 | ||||||||||||||||||

Total Assets | $ | 29,370,164 | $ | 29,438,812 | $ | 29,957,418 | $ | 29,926,482 | $ | 29,694,651 | $ | 30,028,798 | ||||||||||||

MEMO: Interest-earning Assets | $ | 26,012,725 | $ | 26,121,011 | $ | 26,572,087 | $ | 26,623,652 | $ | 26,335,600 | $ | 26,659,694 | ||||||||||||

Interest-bearing Deposits | $ | 16,740,124 | $ | 15,520,461 | $ | 17,134,728 | $ | 16,670,239 | $ | 15,918,927 | $ | 16,902,397 | ||||||||||||

Noninterest-bearing Deposits | 5,976,971 | 6,500,259 | 5,931,712 | 6,149,080 | 6,450,826 | 6,017,349 | ||||||||||||||||||

Total Deposits | 22,717,095 | 22,020,720 | 23,066,440 | 22,819,319 | 22,369,753 | 22,919,746 | ||||||||||||||||||

Short-term Borrowings | 206,234 | 177,315 | 203,519 | 196,095 | 176,739 | 207,727 | ||||||||||||||||||

Long-term Borrowings | 1,290,405 | 2,307,485 | 1,489,764 | 1,789,103 | 2,188,438 | 1,739,434 | ||||||||||||||||||

Total Borrowings | 1,496,639 | 2,484,800 | 1,693,283 | 1,985,198 | 2,365,177 | 1,947,161 | ||||||||||||||||||

Operating Lease Liability | 91,437 | 83,335 | 89,308 | 92,885 | 85,038 | 92,266 | ||||||||||||||||||

Other Liabilities | 207,100 | 190,863 | 251,754 | 257,840 | 237,640 | 262,184 | ||||||||||||||||||

Total Liabilities | 24,512,271 | 24,779,718 | 25,100,785 | 25,155,242 | 25,057,608 | 25,221,357 | ||||||||||||||||||

Preferred Equity | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||

Common Equity | 4,857,893 | 4,659,094 | 4,856,633 | 4,771,240 | 4,637,043 | 4,807,441 | ||||||||||||||||||

Total Shareholders' Equity | 4,857,893 | 4,659,094 | 4,856,633 | 4,771,240 | 4,637,043 | 4,807,441 | ||||||||||||||||||

Total Liabilities & Equity | $ | 29,370,164 | $ | 29,438,812 | $ | 29,957,418 | $ | 29,926,482 | $ | 29,694,651 | $ | 30,028,798 | ||||||||||||

MEMO: Interest-bearing Liabilities | $ | 18,236,763 | $ | 18,005,261 | $ | 18,828,011 | $ | 18,655,437 | $ | 18,284,104 | $ | 18,849,558 | ||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | |||||||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||||||

June | June | March | June | June | |||||||||||||||||

Quarterly/Year-to-Date Share Data: | 2024 | 2023 | 2024 | 2024 | 2023 | ||||||||||||||||

Earnings Per Share: | |||||||||||||||||||||

Basic | $ | 0.71 | $ | 0.68 | $ | 0.64 | $ | 1.36 | $ | 1.42 | |||||||||||

Diluted | $ | 0.71 | $ | 0.68 | $ | 0.64 | $ | 1.35 | $ | 1.41 | |||||||||||

Common Dividend Declared Per Share | $ | 0.37 | $ | 0.36 | $ | 0.37 | $ | 0.74 | $ | 0.72 | |||||||||||

High Common Stock Price | $ | 36.08 | $ | 35.61 | $ | 38.18 | $ | 38.18 | $ | 42.45 | |||||||||||

Low Common Stock Price | $ | 30.68 | $ | 27.68 | $ | 32.92 | $ | 30.68 | $ | 27.68 | |||||||||||

Average Shares Outstanding (Net of Treasury Stock): | |||||||||||||||||||||

Basic | 135,137,901 | 134,683,010 | 134,808,634 | 134,881,314 | 134,472,074 | ||||||||||||||||

Diluted | 135,314,785 | 134,849,818 | 135,121,380 | 135,103,288 | 134,748,868 | ||||||||||||||||

Common Dividends | $ | 50,204 | $ | 48,628 | $ | 50,213 | $ | 100,417 | $ | 97,348 | |||||||||||

Dividend Payout Ratio | 52.02 | % | 52.59 | % | 57.84 | % | 54.78 | % | 51.03 | % | |||||||||||

June 30 | December 31 | June 30 | March 31 | ||||||||||||||||||

EOP Share Data: | 2024 | 2023 | 2023 | 2024 | |||||||||||||||||

Book Value Per Share | $ | 35.92 | $ | 35.36 | $ | 34.37 | $ | 35.56 | |||||||||||||

Tangible Book Value Per Share (non-GAAP) (1) | $ | 21.87 | $ | 21.27 | $ | 20.25 | $ | 21.50 | |||||||||||||

52-week High Common Stock Price | $ | 38.74 | $ | 42.45 | $ | 44.15 | $ | 38.74 | |||||||||||||

Date | 12/14/23 | 2/3/2023 | 11/11/22 | 12/14/23 | |||||||||||||||||

52-week Low Common Stock Price | $ | 25.35 | $ | 25.35 | $ | 27.68 | $ | 25.35 | |||||||||||||

Date | 10/24/23 | 10/24/23 | 5/12/23 | 10/24/23 | |||||||||||||||||

EOP Shares Outstanding (Net of Treasury Stock): | 135,195,704 | 134,949,063 | 134,934,858 | 135,192,675 | |||||||||||||||||

Memorandum Items: | |||||||||||||||||||||

Employees (full-time equivalent) | 2,644 | 2,736 | 2,799 | 2,716 | |||||||||||||||||

Note: | |||||||||||||||||||||

(1) Tangible Book Value Per Share: | |||||||||||||||||||||

Total Shareholders' Equity (GAAP) | $ | 4,856,633 | $ | 4,771,240 | $ | 4,637,043 | $ | 4,807,441 | |||||||||||||

Less: Total Intangibles | (1,899,574 | ) | (1,901,394 | ) | (1,905,228 | ) | (1,900,484 | ) | |||||||||||||

Tangible Equity (non-GAAP) | $ | 2,957,059 | $ | 2,869,846 | $ | 2,731,815 | $ | 2,906,957 | |||||||||||||

÷ EOP Shares Outstanding (Net of Treasury Stock) | 135,195,704 | 134,949,063 | 134,934,858 | 135,192,675 | |||||||||||||||||

Tangible Book Value Per Share (non-GAAP) | $ | 21.87 | $ | 21.27 | $ | 20.25 | $ | 21.50 | |||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | ||||||||||||||||||||||||||||||

Three Months Ended June 2024 | Three Months Ended June 2023 | Three Months Ended March 2024 | ||||||||||||||||||||||||||||

Selected Average Balances and Yields: | Average | Average | Average | Average | Average | Average | ||||||||||||||||||||||||

ASSETS: | Balance | Interest(1) | Rate(1) | Balance | Interest(1) | Rate(1) | Balance | Interest(1) | Rate(1) | |||||||||||||||||||||

Earning Assets: | ||||||||||||||||||||||||||||||

Federal funds sold and securities purchased under agreements to resell and other short-term investments | $ | 930,453 | $ | 12,787 | 5.53 | % | $ | 994,072 | $ | 12,706 | 5.13 | % | $ | 882,656 | $ | 12,303 | 5.61 | % | ||||||||||||

Investment securities: | ||||||||||||||||||||||||||||||

Taxable | 3,496,310 | 33,968 | 3.89 | % | 4,274,123 | 36,721 | 3.44 | % | 3,743,157 | 34,722 | 3.71 | % | ||||||||||||||||||

Tax-exempt | 209,114 | 1,488 | 2.85 | % | 387,918 | 2,718 | 2.80 | % | 212,375 | 1,474 | 2.78 | % | ||||||||||||||||||

Total securities | 3,705,424 | 35,456 | 3.83 | % | 4,662,041 | 39,439 | 3.38 | % | 3,955,532 | 36,196 | 3.66 | % | ||||||||||||||||||

Loans and loans held for sale, net of unearned income (2) | 21,639,898 | 326,808 | 6.07 | % | 20,705,509 | 294,931 | 5.71 | % | 21,508,611 | 321,553 | 6.01 | % | ||||||||||||||||||

Allowance for loan losses | (263,050 | ) | (240,611 | ) | (259,341 | ) | ||||||||||||||||||||||||

Net loans and loans held for sale | 21,376,848 | 6.14 | % | 20,464,898 | 5.78 | % | 21,249,270 | 6.08 | % | |||||||||||||||||||||

Total earning assets | 26,012,725 | $ | 375,051 | 5.79 | % | 26,121,011 | $ | 347,076 | 5.33 | % | 26,087,458 | $ | 370,052 | 5.70 | % | |||||||||||||||

Other assets | 3,357,439 | 3,317,801 | 3,344,925 | |||||||||||||||||||||||||||

TOTAL ASSETS | $ | 29,370,164 | $ | 29,438,812 | $ | 29,432,383 | ||||||||||||||||||||||||

LIABILITIES: | ||||||||||||||||||||||||||||||

Interest-Bearing Liabilities: | ||||||||||||||||||||||||||||||

Interest-bearing deposits | $ | 16,740,124 | $ | 132,425 | 3.18 | % | $ | 15,520,461 | $ | 91,577 | 2.37 | % | $ | 16,663,765 | $ | 128,377 | 3.10 | % | ||||||||||||

Short-term borrowings | 206,234 | 2,206 | 4.30 | % | 177,315 | 1,489 | 3.37 | % | 203,570 | 2,082 | 4.11 | % | ||||||||||||||||||

Long-term borrowings | 1,290,405 | 13,838 | 4.31 | % | 2,307,485 | 25,405 | 4.42 | % | 1,500,237 | 16,232 | 4.35 | % | ||||||||||||||||||

Total interest-bearing liabilities | 18,236,763 | 148,469 | 3.27 | % | 18,005,261 | 118,471 | 2.64 | % | 18,367,572 | 146,691 | 3.21 | % | ||||||||||||||||||

Noninterest-bearing deposits | 5,976,971 | 6,500,259 | 5,941,866 | |||||||||||||||||||||||||||

Accrued expenses and other liabilities | 298,537 | 274,198 | 306,469 | |||||||||||||||||||||||||||

TOTAL LIABILITIES | 24,512,271 | 24,779,718 | 24,615,907 | |||||||||||||||||||||||||||

SHAREHOLDERS' EQUITY | 4,857,893 | 4,659,094 | 4,816,476 | |||||||||||||||||||||||||||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 29,370,164 | $ | 29,438,812 | $ | 29,432,383 | ||||||||||||||||||||||||

NET INTEREST INCOME | $ | 226,582 | $ | 228,605 | $ | 223,361 | ||||||||||||||||||||||||

INTEREST RATE SPREAD | 2.52 | % | 2.69 | % | 2.49 | % | ||||||||||||||||||||||||

NET INTEREST MARGIN | 3.50 | % | 3.51 | % | 3.44 | % | ||||||||||||||||||||||||

(1) The interest income and the yields on federally nontaxable loans and investment securities are presented on a tax-equivalent basis using the statutory federal income tax rate of 21%. | ||||||||||||||||||||||||||||||

(2) Nonaccruing loans are included in the daily average loan amounts outstanding. | ||||||||||||||||||||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | ||||||||||||||||||||||

Six Months Ended June 2024 | Six Months Ended June 2023 | |||||||||||||||||||||

Selected Average Balances and Yields: | Average | Average | Average | Average | ||||||||||||||||||

ASSETS: | Balance | Interest(1) | Rate(1) | Balance | Interest(1) | Rate(1) | ||||||||||||||||

Earning Assets: | ||||||||||||||||||||||

Federal funds sold and securities purchased under agreements to resell and other short-term investments | $ | 906,555 | $ | 25,090 | 5.57 | % | $ | 965,393 | $ | 23,689 | 4.95 | % | ||||||||||

Investment securities: | ||||||||||||||||||||||

Taxable | 3,619,733 | 68,690 | 3.80 | % | 4,339,132 | 72,980 | 3.36 | % | ||||||||||||||

Tax-exempt | 210,745 | 2,962 | 2.81 | % | 387,795 | 5,458 | 2.81 | % | ||||||||||||||

Total securities | 3,830,478 | 71,652 | 3.74 | % | 4,726,927 | 78,438 | 3.32 | % | ||||||||||||||

Loans and loans held for sale, net of unearned income (2) | 21,574,254 | 648,361 | 6.04 | % | 20,694,619 | 575,387 | 5.60 | % | ||||||||||||||

Allowance for loan losses | (261,196 | ) | (237,726 | ) | ||||||||||||||||||

Net loans and loans held for sale | 21,313,058 | 6.11 | % | 20,456,893 | 5.67 | % | ||||||||||||||||

Total earning assets | 26,050,091 | $ | 745,103 | 5.74 | % | 26,149,213 | $ | 677,514 | 5.21 | % | ||||||||||||

Other assets | 3,350,473 | 3,324,719 | ||||||||||||||||||||

TOTAL ASSETS | $ | 29,400,564 | $ | 29,473,932 | ||||||||||||||||||

LIABILITIES: | ||||||||||||||||||||||

Interest-Bearing Liabilities: | ||||||||||||||||||||||

Interest-bearing deposits | $ | 16,701,944 | $ | 260,802 | 3.14 | % | $ | 15,354,468 | $ | 160,169 | 2.10 | % | ||||||||||

Short-term borrowings | 204,902 | 4,288 | 4.21 | % | 171,994 | 2,646 | 3.10 | % | ||||||||||||||

Long-term borrowings | 1,395,321 | 30,070 | 4.33 | % | 2,362,437 | 50,639 | 4.32 | % | ||||||||||||||

Total interest-bearing liabilities | 18,302,167 | 295,160 | 3.24 | % | 17,888,899 | 213,454 | 2.41 | % | ||||||||||||||

Noninterest-bearing deposits | 5,959,418 | 6,697,549 | ||||||||||||||||||||

Accrued expenses and other liabilities | 301,673 | 272,575 | ||||||||||||||||||||

TOTAL LIABILITIES | 24,563,258 | 24,859,023 | ||||||||||||||||||||

SHAREHOLDERS' EQUITY | 4,837,306 | 4,614,909 | ||||||||||||||||||||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 29,400,564 | $ | 29,473,932 | ||||||||||||||||||

NET INTEREST INCOME | $ | 449,943 | $ | 464,060 | ||||||||||||||||||

INTEREST RATE SPREAD | 2.50 | % | 2.80 | % | ||||||||||||||||||

NET INTEREST MARGIN | 3.47 | % | 3.57 | % | ||||||||||||||||||

(1) The interest income and the yields on federally nontaxable loans and investment securities are presented on a tax-equivalent basis using the statutory federal income tax rate of 21%. | ||||||||||||||||||||||

(2) Nonaccruing loans are included in the daily average loan amounts outstanding. | ||||||||||||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | |||||||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||||||

June | June | March | June | June | |||||||||||||||||

Selected Financial Ratios: | 2024 | 2023 | 2024 | 2024 | 2023 | ||||||||||||||||

Return on Average Assets | 1.32 | % | 1.26 | % | 1.19 | % | 1.25 | % | 1.31 | % | |||||||||||

Return on Average Shareholders' Equity | 7.99 | % | 7.96 | % | 7.25 | % | 7.62 | % | 8.34 | % | |||||||||||

Return on Average Tangible Equity (non-GAAP) (1) | 13.12 | % | 13.47 | % | 11.98 | % | 12.55 | % | 14.20 | % | |||||||||||

Efficiency Ratio | 52.66 | % | 51.51 | % | 55.26 | % | 53.96 | % | 51.48 | % | |||||||||||

Price / Earnings Ratio | 11.40 | x | 10.84 | x | 13.96 | x | 11.98 | x | 10.50 | x | |||||||||||

Note: | |||||||||||||||||||||

(1) Return on Average Tangible Equity: | |||||||||||||||||||||

(a) Net Income (GAAP) | $ | 96,507 | $ | 92,459 | $ | 86,814 | $ | 183,321 | $ | 190,766 | |||||||||||

(b) Number of Days | 91 | 91 | 91 | 182 | 181 | ||||||||||||||||

Average Total Shareholders' Equity (GAAP) | $ | 4,857,893 | $ | 4,659,094 | $ | 4,816,476 | $ | 4,837,306 | $ | 4,614,909 | |||||||||||

Less: Average Total Intangibles | (1,900,164 | ) | (1,906,053 | ) | (1,901,074 | ) | (1,900,619 | ) | (1,906,689 | ) | |||||||||||

(c) Average Tangible Equity (non-GAAP) | $ | 2,957,729 | $ | 2,753,041 | $ | 2,915,402 | $ | 2,936,687 | $ | 2,708,220 | |||||||||||

Return on Average Tangible Equity (non-GAAP) [(a) / (b)] x 366 or 365 / (c) | 13.12 | % | 13.47 | % | 11.98 | % | 12.55 | % | 14.20 | % | |||||||||||

Selected Financial Ratios: | June 30 2024 | December 31 2023 | June 30 2023 | March 31 2024 | |||||||||||||||||

Loans & Leases, net of unearned income / Deposit Ratio | 93.64 | % | 93.60 | % | 92.82 | % | 93.89 | % | |||||||||||||

Allowance for Loan & Lease Losses/ Loans & Leases, net of unearned income | 1.24 | % | 1.21 | % | 1.21 | % | 1.22 | % | |||||||||||||

Allowance for Credit Losses (2)/ Loans & Leases, net of unearned income | 1.43 | % | 1.42 | % | 1.43 | % | 1.42 | % | |||||||||||||

Nonaccrual Loans / Loans & Leases, net of unearned income | 0.25 | % | 0.14 | % | 0.13 | % | 0.29 | % | |||||||||||||

90-Day Past Due Loans/ Loans & Leases, net of unearned income | 0.06 | % | 0.07 | % | 0.07 | % | 0.05 | % | |||||||||||||

Non-performing Loans/ Loans & Leases, net of unearned income | 0.30 | % | 0.21 | % | 0.20 | % | 0.35 | % | |||||||||||||

Non-performing Assets/ Total Assets | 0.23 | % | 0.16 | % | 0.15 | % | 0.26 | % | |||||||||||||

Primary Capital Ratio | 17.06 | % | 16.79 | % | 16.45 | % | 16.86 | % | |||||||||||||

Shareholders' Equity Ratio | 16.21 | % | 15.94 | % | 15.62 | % | 16.01 | % | |||||||||||||

Price / Book Ratio | 0.90 | x | 1.06 | x | 0.86 | x | 1.01 | x | |||||||||||||

Note: | |||||||||||||||||||||

(2) Includes allowances for loan losses and lending-related commitments. | |||||||||||||||||||||

UNITED BANKSHARES, INC. AND SUBSIDIARIES Washington, D.C. and Charleston, WV Stock Symbol: UBSI (In Thousands Except for Per Share Data) | ||||||||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||||||||

June 30 | June 30 | March 31 | June 30 | June 30 | ||||||||||||||||||

Mortgage Banking Data: (1) | 2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||||

Loans originated | $ | 185,322 | $ | 271,829 | $ | 176,906 | $ | 362,228 | $ | 449,637 | ||||||||||||

Loans sold | 163,273 | 248,709 | 188,741 | 352,014 | 415,220 | |||||||||||||||||

June 30 | December 31 | June 30 | March 31 | |||||||||||||||||||

Mortgage Loan Servicing Data: | 2024 | 2023 | 2023 | 2024 | ||||||||||||||||||

Balance of loans serviced | $ | 1,138,443 | $ | 1,202,448 | $ | 1,242,441 | $ | 1,173,246 | ||||||||||||||

Number of loans serviced | 11,853 | 12,419 | 12,843 | 12,163 | ||||||||||||||||||

June 30 | December 31 | June 30 | March 31 | |||||||||||||||||||

Asset Quality Data: | 2024 | 2023 | 2023 | 2024 | ||||||||||||||||||

EOP Non-Accrual Loans | $ | 52,929 | $ | 30,919 | $ | 26,545 | $ | 63,053 | ||||||||||||||

EOP 90-Day Past Due Loans | 12,402 | 14,579 | 15,007 | 11,329 | ||||||||||||||||||

Total EOP Non-performing Loans | $ | 65,331 | $ | 45,498 | $ | 41,552 | $ | 74,382 | ||||||||||||||

EOP Other Real Estate Owned | 2,156 | 2,615 | 3,756 | 2,670 | ||||||||||||||||||

Total EOP Non-performing Assets | $ | 67,487 | $ | 48,113 | $ | 45,308 | $ | 77,052 | ||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||||||||

June 30 | June 30 | March 31 | June 30 | June 30 | ||||||||||||||||||

Allowance for Loan & Lease Losses: | 2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||||

Beginning Balance | $ | 262,905 | $ | 240,491 | $ | 259,237 | $ | 259,237 | $ | 234,746 | ||||||||||||

Gross Charge-offs | (2,542 | ) | (2,274 | ) | (3,576 | ) | (6,118 | ) | (5,210 | ) | ||||||||||||

Recoveries | 1,281 | 1,065 | 1,506 | 2,787 | 2,856 | |||||||||||||||||

Net Charge-offs | (1,261 | ) | (1,209 | ) | (2,070 | ) | (3,331 | ) | (2,354 | ) | ||||||||||||

Provision for Loan & Lease Losses | 5,779 | 11,439 | 5,738 | 11,517 | 18,329 | |||||||||||||||||

Ending Balance | $ | 267,423 | $ | 250,721 | $ | 262,905 | $ | 267,423 | $ | 250,721 | ||||||||||||

Reserve for lending-related commitments | 40,739 | 46,768 | 42,915 | 40,739 | 46,768 | |||||||||||||||||

Allowance for Credit Losses (2) | $ | 308,162 | $ | 297,489 | $ | 305,820 | $ | 308,162 | $ | 297,489 | ||||||||||||

Notes: | ||||||||||||||||||||||

(1) During the first quarter of 2024, United completed its previously announced consolidation of its mortgage delivery channels. Based on an evaluation performed in accordance with ASC 280, Segment Reporting, beginning with the periods as of March 31, 2024, United operates one reportable business segment. Mortgage banking data above is presented on a consolidated basis for all current and prior periods. | ||||||||||||||||||||||

(2) Includes allowances for loan losses and lending-related commitments. | ||||||||||||||||||||||

Contacts

W. Mark Tatterson

Chief Financial Officer

(800) 445-1347 ext. 8716