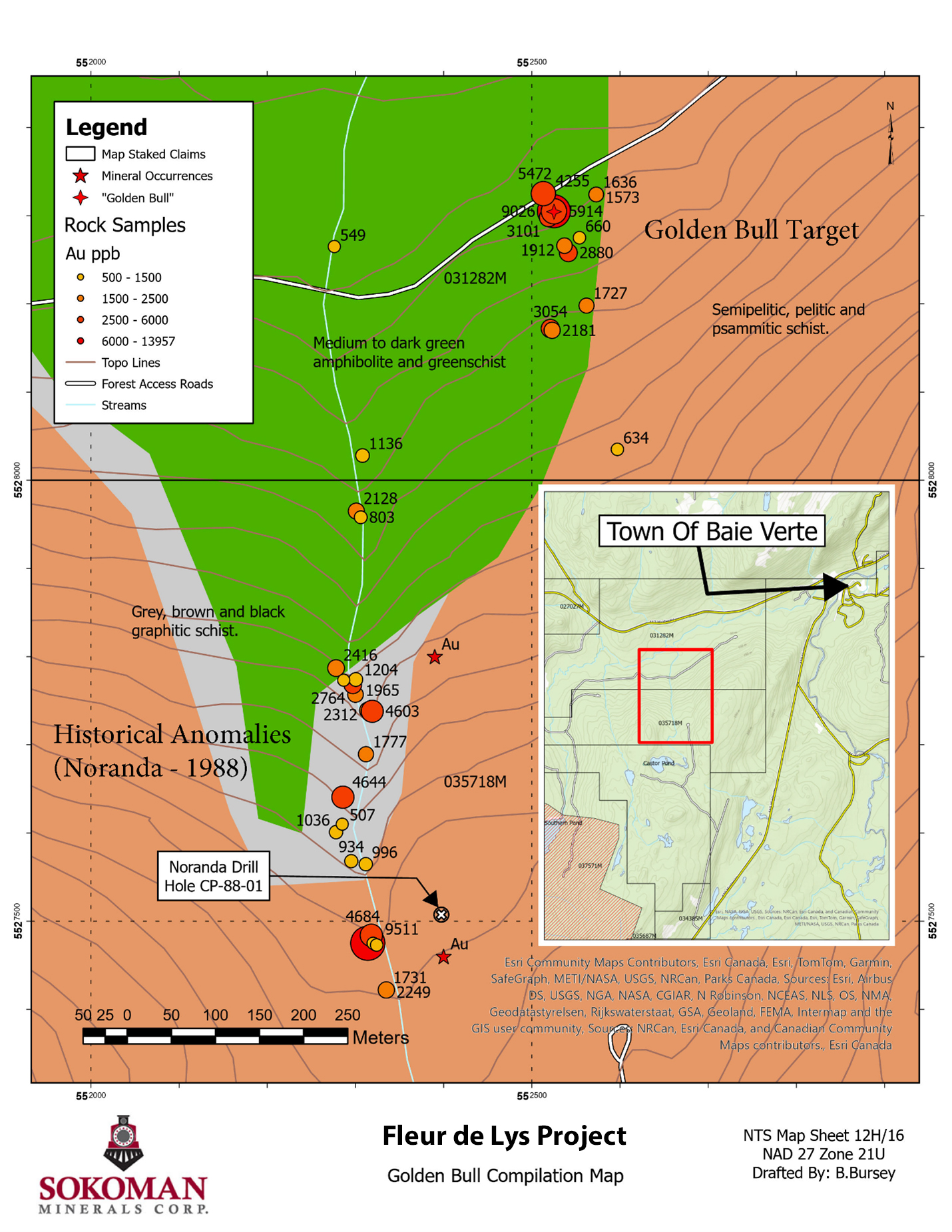

ST. JOHN'S, NL / ACCESSWIRE / July 25, 2024 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) ("Sokoman" or the "Company") is pleased to provide the following update from the 2024 exploration program at the 100%-owned Fleur de Lys Project in Newfoundland. An earlier-than-normal melting of snow cover throughout the northern and central portions of the Baie Verte Peninsula allowed an early start to the prospecting season. Since May 1, 2024, the Company has collected and received assay results for 89 rock samples from Fleur de Lys. Most samples were collected from the northern portion of the property, where winter logging activities have opened a large area of prospective ground, including several discreet target areas over a six to eight sq-km area highlighted by the Golden Bull Prospect discovered in late 2023. The total number of samples collected since late 2023 is 124, 34 of which returned gold values greater than 500 ppb to a maximum of 9,020 ppb gold (9.02 g/t Au). More than half of all samples collected over the broader Golden Bull target area since 2023 have returned greater than 100 ppb gold, suggesting potential for additional, undiscovered gold zones at Fleur de Lys.

Highlights of the 2024 rock sampling program include:

89 samples collected and assayed of quartz vein float and quartz vein bedrock samples

37 samples returned gold assays greater than 100 ppb gold (0.1 g/t Au)

12 samples returned gold assays greater than 1,000 ppb gold (1.0 g/t Au) to a maximum of 5,472 ppb gold (5.47 g/t Au)

Five samples greater than 1.0 g/t Au were from bedrock grabs

Multiple high-priority drill targets are now confirmed for the upcoming Phase 1 drill program, which will focus on the Golden Bull target area; four other areas will also be drill tested

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals, states; "We are very pleased with the progress we have made at Fleur de Lys this year, and we look forward to the start of our 2,000 m maiden drill program, pending receipts of all permits hopefully by mid-August. We are currently evaluating the bids from multiple diamond-drilling contractors while we continue to sharpen drill targets based on our 2024 (and 2023) rock sampling programs. We have received all but one of the required permits and expect the final (water-crossing) permit in the coming weeks. Most of the initial drilling will be in a 2-km by 1.5-km area defined as the Golden Bull Prospect and will consist of multiple 50- to 150-m-long drill holes. We have also confirmed at least one drill hole will test four other targets undergoing last-minute fine-tuning within a larger six to eight sq-km area enclosing the main target (Golden Bull) area. In the meantime, we continue work on other till and rock sample anomalies elsewhere on the property as part of the 2024 program to define future drill targets for later this year or early 2025."

Golden Bull Prospect

The Golden Bull Prospect was identified late in 2023, and assays from 35 rock grab samples collected returned assays up to 9.02 g/t Au, from variably banded (stylolitic) quartz blocks locally exceeding several tonnes in weight (Photo 1) and previously reported in a press release dated October 4, 2023. The 35 samples collected, 17 of which exhibited moderate to strong stylolitic banding (as shown in Photo 2), returned assays greater than 500 ppb (0.50 g/t Au) to a maximum of 9,020 ppb (9.02 g/t Au). The Golden Bull Prospect lies within a larger area (Map 1) of anomalous till and soil geochemistry outlined by Sokoman since 2023, as well as geochemical and geophysical (VLF-EM) anomalies identified by historical work completed by Noranda Inc. in the late 1980s.

The district-scale Fleur de Lys Project is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Curraghinalt is currently one of the largest undeveloped gold deposits in the Caledonian-Appalachian Orogen, hosting more than six million ounces of gold.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. All samples of quartz vein material were submitted for total pulp metallics and gravimetric finish. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp., based in Newfoundland and Labrador, Canada, focuses primarily on its gold projects, including the wholly-owned Moosehead, Crippleback Lake, and the extensive Fleur de Lys project near Baie Verte. This latter project aims to discover Dalradian-type orogenic gold mineralization like the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company has also partnered with Benton Resources Inc. on three large-scale joint ventures: Grey River, Killick Lithium formerly Golden Hope, and Kepenkeck, positioning Sokoman as one of the largest landholders in Canada's emerging gold districts.

In October 2023, Sokoman and Benton entered into an agreement with Piedmont Lithium Inc. to advance the Killick Lithium Project. Under this deal, Piedmont can acquire up to 62.5% of the project by investing up to $12 million in exploration and issuing $10 million in shares over three phases. The project, previously known as Golden Hope, is now part of Killick Lithium Inc., a subsidiary of Vinland Lithium Inc., in which Piedmont has acquired a 19.9% stake for $2 million. Sokoman and Benton maintain operational control during the earn-in phases and retain a 2% NSR royalty on future production. Additionally, Piedmont holds exclusive marketing and first-refusal rights on the lithium concentrates for the life of the mine.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO |

| Cathy Hume, VP Corporate Development, Director |

T: 709-765-1726 |

| T: 416-868-1079 x 251 |

E: tim@sokomanmineralscorp.com |

| E: cathy@chfir.com |

Website: www.sokomanmineralscorp.com |

| Twitter: @SokomanMinerals |

Facebook: @SokomanMinerals |

| LinkedIn: @SokomanMineralsCorp |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

View the original press release on accesswire.com