A YEAR OF MAJOR ACHIEVEMENTS

ANNUAL REVENUE 2023/2024 OF €24.8 M

GROWTH REBOUND EXPECTED IN 2024/2025

BETWEEN +20% AND +60%

- Revenue for 2023-2024 reached €24.8 million; gap from target is due to the production of orders deprioritized on 2 customers, the impact of the cancellation of 2 stations prior to their reassignment, and to the pace of market deployment. In addition, some orders arrived late in the last quarter also contributing to the gap;

- First significant contribution of €0.5m from the Maintenance business, an area of recurring revenue development for HRS;

- Acceleration of international development in high-potential regions with a 1st station order in Saudi Arabia;

- Order book of €47.1 M, including €19 M to be recognized on hydrogen stations already in production;

- Strategic review of the pipeline: €343 M almost exclusively composed of key accounts;

- Expected growth of between +20% and +60% for 2024-2025 revenue, i.e. a range of 30 to 40 million euros, taking into account longer decision-making cycles.

Grenoble, July 25, 2024 - HRS , a European designer and manufacturer of hydrogen refueling stations, presents its revenue for the 2023/2024 financial year (period from July 1er 2023 to June 30, 2024).

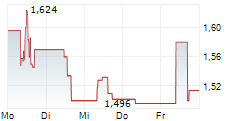

| €000 | 2022/2023 | 2023/2024 | Change |

| Revenue (unaudited) | 30,082 | 24,781 | -17.6% |

| Hydrogen Stations | 26,555 | 21,902 | -17.5% |

| Industrial Piping and other | 3,527 | 2,878 | -18.4% |

Hassen Rachedi, founder and CEO of HRS, a pure player in hydrogen refueling stations: " During this period, HRS continued its strategic development amidst a shifting economic landscape, focusing on innovation, international expansion, and enhancing production and maintenance capacities. Currently, HRS boasts one of Europe's largest installed bases, with 18 operational stations installed over 35 months, equating to an average of one station installed every 8 weeks. Additionally, two more stations are set to become operational in the coming months, bringing the total number of next-generation stations to 20. Each of our stations delivers a minimum of 200 kg of hydrogen daily, offering a combined minimum potential of 4 tons per day across our entire installed base.

Our comprehensive service offering, which includes 24/7/365 on-call maintenance and real-time monitoring via our "control room," has received enthusiastic feedback from our customers. By expanding our installed base, we aim to increase potential recurring revenue: maintenance revenue from these 20 stations could eventually reach nearly 2 million euros annually.

In the fiscal year ending June 30, 2024, our new production plant attracted a record number of prospects and customers, serving as a testament to our unique expertise and production capacity. HRS achieved significant commercial success by securing orders for 8 new stations during the year, including 3 HRS40s designed for heavy-duty mobility and 1 HRS14 destined for Saudi Arabia.

Despite revenue in 2023/2024 falling short of our expectations, it has opened up promising prospects and reinforced our position as a market leader. Delays in decision-making by primary contractors on certain tenders impacted results, but active projects indicate our strong market position.

Moreover, our revenue could have been higher if not for the deprioritization of two customers, including pHynix, with whom negotiations led to an agreement eventually being signed. Production for these orders has since normalized, allowing us to manage cash flow effectively while supporting our customers in advancing their projects. Additionally, late-arriving orders contributed to the variance from our targets.

For our other key accounts, such as SPAC (Groupe Colas for the HYNAMICS project in Dunkirk), TotalEnergies, Plug Power, Hympulsion, Engie, Seven, GCK, SYDEV, and a Saudi Arabian energy company, projects are proceeding as planned, underscoring the strength of our business relationships. This reinforces our strategic advantage of focusing on large-capacity, modular stations, particularly as 80% of current requests are for stations producing one ton or more of hydrogen per day.

We are fully committed to our deployment strategy and rigorous financial management. The upcoming phase will concentrate on deepening relationships with key accounts that offer a lower risk profile. Our current pipeline, valued at €343 million, is aligned with this objective, with ongoing projects progressing well. We aim to secure a significant portion of these projects by leveraging our competitive advantages in station reliability, industrial experience, installation, and commissioning. Adjustments to our targets have been made to align with current market conditions, while maintaining our long-term ambitions.

Hydrogen mobility development remains a pivotal solution supported by public authorities for decarbonizing transportation. With our technological, industrial, and commercial capabilities, we are well-positioned to strengthen and expand our leadership in the hydrogen refueling station sector. This marks the beginning of a new phase for HRS, driven by new installations, maintenance contracts, and a rapidly growing sales pipeline, promising substantial growth opportunities and enhancing future profitability.

We extend our gratitude to our shareholders for their support and to our employees for their unwavering commitment to our shared vision of HRS's success. I reaffirm my steadfast dedication to our family business, in which I maintain a 67% stake. Together, with the dedication of our entire team, we will continue advancing with determination and passion. "

REVENUE DOWN 17.6% FOR THE YEAR

As anticipated, HRS reported a year of intense operational and commercial activity, despite a changing economic context that is not conducive to the rapid launch of large-scale hydrogen mobility projects, even though they have already begun and are still active.

Annual revenue for 2023/2024 came to €24.8 million, down 17.6% on the previous year. Hydrogen station revenue of €21.9 million reflects the percentage-of-completion recognition method of stations in production during the year, new station orders and maintenance contracts. In detail, hydrogen station revenue break down as follows:

- €13.2 million from new stations ordered over the period (including the negative impact of the cancellation of 2 HRS40 stations, brought forward to around 30% as announced on June 23, 2024);

- €10.3 M from stations in production or deployment signed in previous years;

- €0.5 M from initial maintenance contracts;

- -€2.1 M due to the negative impact of the cancellation of 2 HRS40 stations as announced on June 23, 2024 (see below).

At the same time, the company's historical Industrial Piping business contributed €2.9 million. This business, which is complementary in training and developing key skills in the manufacture of hydrogen stations, is set to expand over the next few years.

The gap from the minimum revenue target of €31 million is due to the following factors:

• An impact of -€4.0 M related to the slowdown in station production for two customers with whom HRS was engaged in renegotiating the initially planned payment terms. In line with sound financial management, this has enabled HRS to avoid incurring additional expenses and preserve its cash position. For PHynix, following the successful conclusion of negotiations leading to the signing of a contract amendment, production of three HRS40 stations has resumed at a normal pace and will contribute to revenue over the next few years. The strategic decision made in the second half of the year demonstrates our ability to find flexible solutions and move forward despite the challenges;

• An impact of -€2.1 M related to the two HRS40 stations ordered by pHynix and subsequently canceled, which were only 30% complete. These two stations are in the process of being reallocated to the new HRS40 orders announced for the second half of the year and will again contribute to revenue in 2024-2025.

These impacts should have been offset by the expected materialization of new orders linked to major ongoing projects in which HRS is well positioned, but tender decisions were postponed by a few months. However, three new orders were booked in the second half.

For all the other HRS customers, mainly major accounts such as SPAC (Groupe Colas for the HYNAMICS project in Dunkirk), TotalEnergies, Plug Power, Hympulsion, Engie, Seven, GCK, SYDEV, and a Saudi Arabian energy company, progress on major projects was on schedule.

OPERATIONAL AND FINANCIAL HIGHLIGHTS FOR THE 2023/2024 FINANCIAL YEAR

HRS Europe's leading supplier of hydrogen stations

HRS now has one of the largest installed bases with 18 stations operational in 35 months, i.e. an average of one station installed every 8 weeks. During the 2023/2024 financial year, HRS installed and commissioned the Bercy sites for Hype and a site in England for Plug Power. Additionally, 2 further stations have been installed and will be operational in 2024.

New HRS production site fully operational

The new 14,300 m² production site in Champagnier has been fully operational since the autumn of 2024. It boosts HRS's annual production capacity to at least 180 stations. The test area is also operational, with an H14 station and an HRS40 station (1 ton/day) in the start-up phase. It was financed by €3.1 million in bank financing for its hydrogen refueling station test zone, supported by BPI and SOMUDIMEC, with the participation of BNP Paribas, Crédit Coopératif, LCL and SG Auvergne-Rhône-Alpes.

Start of maintenance contracts

To date, HRS has initiated 17 maintenance contracts, representing 100% of its operating base. These recurring revenues will make a significant contribution to revenue in the medium term and are already contributing €0.5 million to 2023/2024 revenue.

Amendment to framework agreement with pHYnix

On June 20, 2024, HRS announced an amendment to the framework agreement with pHYnix for the delivery of 6 stations by the end of 2027, worth a total of €12.5 million. The new payment schedule runs from June 2024 to December 2027. Two HRS40 stations initially ordered were cancelled but have since been redirected and adapted to the specific requirements of other orders.

Support from BPI with €1.35 million for innovation and international development

On April 29, 2024, HRS announced that it had received €1.35 million in funding from Bpifrance to accelerate its international expansion and step up its R&D activities, particularly in the field of large-capacity stations. Key advances in the development of solutions for heavy mobility and the rapid transfer of large masses of hydrogen (40-50kg) at high pressure (700bar) have been validated.

HRS plans to set up a US subsidiary in the second half of 2024, supported by Bpifrance's Garantie de Projets à l'international, marking a major step forward in its global expansion strategy.

INTERNATIONAL BUSINESS DEVELOPMENT IN HIGH-POTENTIAL REGIONS

At the same time, HRS is continuing to expand its business in highly attractive international regions, which could serve as new growth drivers for the revenue pipeline:

- In the Middle East, HRS confirmed the strong potential of this market for hydrogen mobility at COP28. On June 18, 2024, HRS announced the first order for an HRS14 hydrogen station for a project developer in Saudi Arabia. The station will fuel a fleet of 20 buses and light vehicles starting in summer 2024. This first sale outside Europe, with significant economic opportunities, marks a decisive step in HRS's strategy to expand in high-potential regions such as the Middle East;

- North America remains a priority target for commercial development. According to a study published by the Fuel Cell and Hydrogen Energy Association (FCHEA) titled "Road Map to a US Hydrogen Economy Full Report," the US hydrogen mobility market is expected to grow significantly, with a projection of 4,300 stations specifically for Heavy Duty Vehicles (HDVs). By 2030, 1.2 million FCEVs are expected to be sold in the USA. Additionally, California has set ambitious targets to create a network of 1,000 hydrogen stations by 2030 and has recently announced the establishment of the first hydrogen hub in the USA. With recent financial support from BPI France totaling €1.3 million, HRS aims to open a subsidiary in the United States in 2024, where there is strong political support for the development of hydrogen, with over $50 billion in announced plans;

- In China, HRS RS is continuing its market studies, supplier evaluations, and local contacts to estimate development potential before committing additional resources;

- In Asia-Pacific, HRS has recruited a business developer to target the region where over 20 station projects have already been identified. HRS is actively participating in calls for tender in this region.

ADJUSTED ORDER BOOK AT €47.1M

During the year, HRS secured 7 new orders in Europe, including 2 under the Plug Power agreement, 4 stations from existing customers (including GCK, Hympulsion and SEVEN) and 1 station for Saudi Arabia.

At June 30, 2024, the order book stood at €47.1 million, including €19.1 million worth of work still to be done on hydrogen stations currently in production, most of which should be converted into revenue in the 2024/2025 financial year.

PIPELINE OF €343M MULTIPLIED BY 2.9 IN 12 MONTHS, BUT DECISION CYCLES LENGTHENING

HRS's commercial pipeline strengthened significantly during the 2023/2024 financial year, driven by the many projects already underway. It is made up of potential orders and identified projects, including 170 stations in shortlist selection or final negotiation on still-active European tenders, representing potential revenue of €343 million with deliveries over the 2024-2030 period, naturally requiring in-depth preparatory phases.

Compared with April 30, 2024 (€480m), a strategic review of the commercial pipeline has enabled us to exclude projects considered at present or carried out by principals with overly risky profiles.

As a result, the €343 million figure mainly comprises projects for major accounts in Europe. The company plans to increase this pipeline by actively prospecting in new regions outside Europe.

Indeed, the global drive to decarbonize heavy mobility through various means, including hydrogen, necessitates the development of a global infrastructure. As a result, Europe is currently developing ambitious transnational hydrogen transport projects, such as MosaHYc (France-Germany-Luxembourg) or BarMar-H2Med (France-Spain), to supply the exponential demand for green hydrogen.

Against this backdrop, the hydrogen mobility market continues to develop, driven by major European plans, as well as in many national markets, driven by the logistics & transport sectors and major oil companies. The European Union has issued calls for projects worth over 1 billion euros through the Alternative Fuels Infrastructure Fund (AFIF), which is expected to lead to the installation of almost 50 stations.

In addition, around 700 stations are anticipated to be deployed as part of the AFIR program, supported by the Council of the EU, for the installation of one-ton-per-day hydrogen stations every 200 km on the TEN-T network and in every urban node by the end of 2030.

ANNUAL AMBITIONS ADJUSTED TO THE PACE OF DEPLOYMENT OF MAJOR NEW PROJECTS, WITH EXPECTED GROWTH OF BETWEEN 20% AND 60%

However, like all market players, HRS has noted a cyclical lengthening of decision-making cycles, with an increase in the number of large-scale projects.

Against this backdrop, HRS has decided to revise its targets to reflect of the current speed of the market and is now aiming for 2024/2025 revenue of between €30 and €40 million, representing growth of between 20% and 60% compared with 2023-2024.

HRS maintains its ambition to achieve revenue of €85 million with a timeframe to be confirmed, by building on the potential of its pipeline, while aiming for significant profitability with a positive EBIT margin by 2026.

HRS continues to lead an ambitious project, with a strong industrial base, an unrivalled installed base of stations with capacities in excess of 200 kg/day, a solid financial structure and the support of numerous commercial partners. Its development is underpinned by expertise that is unique in Europe, where concrete measures to promote the decarbonization of uses will enable hydrogen mobility infrastructures to become a key element in the ecological transition.

NEXT PUBLICATION

Annual results 2023/2024 on October 9, 2024 after close of trading.

ABOUT HRS (Hydrogen Refueling Solutions)

HRS is a leading global manufacturer of high-capacity hydrogen refueling stations. The company provides a comprehensive and unique range of modular and scalable stations, ranging from 200 kg/day to 4 tons/day.

As a pure player in station design and commissioning, HRS operates state-of-the-art industrial production facilities capable of assembling up to 180 stations per year, with lead times ranging from 6 to 12 weeks. This industrial site features a test area, the only one of its kind in Europe, designed to test and trial the full range of stations and develop future products and solutions for the hydrogen mobility market.

HRS also offers a complete service package, including 24/7/365 on-call maintenance. The performance of stations installed in Europe and globally is monitored in real time from a cutting-edge control room.

HRS currently boasts one of the largest installed bases of high-capacity stations on the market, with 18 stations each providing 200 kg/day, totaling a cumulative capacity of nearly 4 tons/day. All stations feature bi-pressure terminals and are equipped with 350-bar, 350-HF, and 700-bar nozzles, addressing all the needs of hydrogen mobility.

HRS is distinguished by its strict financial discipline, maintaining long-term financial stability while continuously investing substantial resources into R&D, thereby ensuring its leadership in innovation.

ISIN code: FR0014001PM5 - mnemonic: ALHRS.

For more information, visit our website www.hydrogen-refueling-solutions.fr

CONTACTS

| Relations investisseurs ACTUS finance & communication Grégoire SAINT-MARC hrs@actus.fr 00 33 1 53 67 36 94 | Financial press relations ACTUS finance & communication Deborah SCHWARTZ hrs-presse@actus.fr 00 33 1 53 67 36 35 | Corporate press relations ACTUS finance & communication Anne-Charlotte DUDICOURT hrs-presse@actus.fr 00 33 1 53 67 36 32 |

- SECURITY MASTER Key: x2meYZZpaWfJyW1sacaaZmJpmGtolWnIamGXm5JxZ8mWbZ6Wx5pol8eZZnFolWtr

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-87065-2024_07_25_ca_annuel-2023-2024-uk.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free