- Showroomprivé recorded stable GMV of €499 million (+0.1%) over the first six months of the year, and a decline in sales to €318.1 million (-4.0%), impacted by lower volumes in its historic business lines in France.

- Strong performance of the Group's growth drivers with a stronger contribution to revenues: continued growth of The Bradery (+50.0%), strong increase in Marketplace GMV (+62.8%), Travel & Leisure (+11.7 %) and International (+11.2 %).

- Positive EBITDA of €1.6 million, down due to a lower volume, lower contribution from SRP Services, and investment efforts to support transformation.

- Acceleration of the ACE roadmap deployment with first results expected in the last part of the year and reaffirmation of our strategic path to face the volatile market environment.

- Impact of investments undertaken to enhance profitable growth in the future due to accounting effects, including the revaluation of the acquisition debt related to the future acquisition of the remaining shares in The Bradery, in light of its exceptional performance: net loss of €20.7m.

La Plaine Saint Denis, July 25, 2024 - Showroomprivé (SRP Groupe), a European group specializing in flash sales, publishes its results for the first half of 2024, ended June 30, 2024, approved by the Board of Directors on July 25, 2024.

David Dayan, Co-founder and Chairman and CEO of Showroomprivé, comments: "During the first half of 2024, Showroomprivé faced a challenging market environment, which resulted in less dynamic traffic and sales. Faced with these uncertainties, the Group has reaffirmed its ability to adapt by accelerating the development of its growth drivers, while continuing to optimize its cost structure. Showroomprivé's agility and ability to navigate in low-visibility markets are illustrated by the renewal of strong sales momentum in strategic segments and the preservation of a positive EBITDA, despite major investments. Our operating performance is also reflected in the successful deployment of our ACE roadmap, with the first stages of several transformative projects completed by the Group: rationalization of the logistics network, marketing and commercial developments and a redesign of the UI on the website. These achievements give us full confidence in our ability to unlock the Group's potential for growth and profitability in the years ahead."

SUSTAINED DYNAMISM OF GROWTH DRIVERS, MITIGATING THE SLOWDOWN IN THE TRADITIONAL BUSINESS

Details of sales

| (€ million) | H1 2023 | H1 2024 | Variation 23-4 (%) |

| Internet Sales | |||

| France | 264.2 | 246.3 | -6.8% |

| International | 60.2 | 67.0 | +11.2% |

| Total Internet sales | 324.4 | 313.3 | -3.4% |

| Other sales | 6.9 | 4.8 | -30.7% |

| Net Sales | 331.3 | 318.1 | -4.0% |

Consolidated financial statements subject to a limited review

Sales were down -4.0% to 318.1 million euros for the 1st half-year 2024, penalized by lower volumes in a challenging market environment marked by opportunistic consumers behavior in search of the best prices. This difficult context is affecting the entire sector, as reflected by the latest FEVAD figures showing a -1.1% decline in online sales of products and a -2.6% decline in online sales of products and services on mobile terminals in May 2024. This trend comes on top of our repositioning, which now prioritizes offering quality over quantity, as defined in the ACE roadmap, temporarily impacting sales performance. Finally, unfavorable weather conditions and a particularly unfavorable comparison basis contributed to this trend.

- The Fashion segment reported growth, outperforming the market which, according to Fevad, shrank by -7.2% in May 2024. The activity benefited from Sport & Lifestyle sales still buoyant, though less than in previous quarters, due to the base effect and the large purchases already made on this type of items by members. Constraints on purchasing power have weighed on the other segments, but the high level of inventories of partner brands should nevertheless provide interesting opportunities for the second half of the year.

- The Home segment experienced a very difficult start to the year, due to a lack of attractive offer. An internal reorganization has been underway since the end of 2023, with a renewed and now fully staffed team since the end of the 2nd quarter 2024, accompanied by an overhaul of processes. The effects of this reorganization will begin to bear fruits in the second half of the year, given the time required for implementation.

Beauté Privée's recovery is confirmed, with sales stabilizing over the semester, demonstrating the first effects of the new value proposition, the structuring of the offering and the internal reorganization.

In a complicated environment, SRP Services recorded a -25% decline in sales, penalized by a drop in traffic and a general slowdown in marketing spending by brands and advertisers. The business unit also suffered from a lack of personnel in the first half.

In order to optimize its sourcing strategy while minimizing delivery times, Showroomprivé increased the proportion of firm purchases over the period, capitalizing on the opportunities offered by high brand inventory levels. Firm purchases thus accounted for 43% of delivery methods in the 1st half-year, compared with 31% for dropshipping and 26% for conditional sales.

Sales from other activities (notably physical wholesale destocking of unsold goods and Internet returns) totaled 4.2 million euros, down 1.7 million euros.

The growth drivers identified by Showroomprivé are confirming their full potential, and now represent a significant proportion in Group's business mix :

- The Bradery turned in an excellent performance in the 1st half-year, recording its 2nd best month of activity since its creation in May. Sales rose by 50% to 30 million euros. This very strong growth is accompanied by an accretive margin level for the Group, attesting to the economic relevance of the model, as well as its strong appeal to Millenials.

- The regular renewal of offers on the Marketplace has resulted in a +63% increase in GMV (Gross Merchandise Volume), driven in particular by the arrival of notorious brands. The increased selectivity of the Marketplace's offerings and sellers, as well as investments, have led to a significant improvement in customer satisfaction, reflected by an NPS of 54 over the last month. Efforts will continue over the coming months, with the expected an international launch of the Marketplace.

- The marketing and human resources investments made to support the international market are bearing fruits, with sales up 11%, driven by Italy and Spain, the two strategic priority areas for the year.

- The Travel & Leisure segment was able to consolidate its relationships with tour operators enabling a steady qualitative offering on its platform, despite lackluster performance of the sector. This growth driver for the Group thus confirmed its full potential, with growth of 12% over the 1st half-year compared to 2023, , even though its new, reworked Medium and Long-haul offering is still taking time to develop its full potential. The launch of this offering to the International market is planned for the second half of the year.

KEY PERFORMANCE INDICATORS

| H1 2023 | H1 2024 | Variation 23-24 % | |

| Gross Merchandise Volume (GMV) | 497.7 | 498.8 | 0.1% |

| Cumulative buyers* (in millions) | 15.1 | 16.2 | 7.1% |

| Buyers** (in millions) | 2.4 | 2,3 | -3.5% |

| of which loyal buyers*** | 1.9 | 1.8 | -4.4% |

| As % of total number of buyers | 80% | 79% | -75bps |

| Number of orders (in millions) | 6.1 | 5.8 | -4.0% |

| Sales by buyer (IFRS) | 136.0 | 136.0 | 0.0% |

| Average number of orders per buyer | 2.5 | 2.5 | -0.6 % |

| Average basket size | 53.7 | 54.0 | 0.6% |

* All buyers who have made at least one purchase on the Group's platform since its launch.

** Member who has placed at least one order during the year

*** Member having placed at least one order during the year and at least one order in previous years

GMV totaled 498.8 million euros in the first half of 2024, stable compared with the same period last year.

The acquisition of new members and conversion into new buyers continued in the first half of 2024, with an increase in cumulative buyers of +7.1% in the first half of 2024, taking their number to over 16 million on the new Group perimeter. The number of buyers over the period showed a very slight decline (-3.5%), as did the rate of loyal customers, who represent 79% of buyers. The number of orders fell, but the average shopping basket increased slightly to €54.0, leading to stable sales and illustrating the Group's strategy of organizing more qualitative but fewer sales.

The Group again achieved record levels of customer satisfaction during the period, with a delivered NPS of 58% vs. 57% in the first half of 2023.

ACCELERATION OF THE ACE ROADMAP, WITH THE FIRST EFFECTS EXPECTED IN THE SECOND HALF OF THE YEAR

Logistics network transformation

Showroomprivé has begun centralizing most of its logistical functions in a new, directly-operated warehouse, bringing together, in particular, the activities of sorting items, as well as the storage and management of returns. This new warehouse (Batiment F), which will operate closely with the mechanized warehouse Astrolab, will provide Showroomprivé with storage capacity for over 7 million ready-to-wear items spread over 4 floors on a floor area of 15,000 m2. This will reduce the number of warehouses managed from 13 by the end of 2022 to 4 by the end of 2024. Thanks to this new facility, located north of Paris, Showroomprivé will also be able to optimize its transport costs by consolidating and reducing transportation flows between its sites. It will also make it easier to reinject returns straight back into stock, reducing processing times and associated costs. The total investment in this warehouse, amounting to 16 million euros, will be fully spent during 2024. These investments will start to be amortized as early as 2025, and are expected to generate over 7 million euros in full-year savings on fixed logistics costs by 2026, with over 70% expected as early as 2025.

Revolution of marketing initiatives thanks to the delivery of cutting-edge tools enabling a targeted marketing strategy

In the first half-year, Showroomprivé introduced new processes and tools to manage its marketing investments more effectively and assess the impact of its actions more accurately. In order to accelerate the continuous improvement of its CRM tactics and marketing performance campaigns, the Group has set up an agile organization and built a system to systematize real-time AB testing, as well as ramping up its team's expertise in data science measurement techniques. The teams have also developed an attribution model to provide an objective view of the impact of each marketing campaign on a day-to-day basis, as well as a Media Mix Model to analyze the relative impact of each lever over the long term. These two tools enable the Group to build the most effective media plan in the short and long term, and to monitor the effectiveness of its initiatives in real time with a view to building a more effective and ROI-enhancing marketing strategy. Finally, the Group has installed a ROAS (return on advertising spend) based marketing performance management system to ensure the profitability of all its digital advertising investments, marking a paradigm shift from the historical approach.

In parallel with these initiatives to improve the profitability of its marketing investments, Showroomprivé has launched an ambitious project to build engagement programs to reward the loyalty of its best customers with dedicated benefits, services and discounts. A way of giving members additional reasons for choosing Showroomprivé for their purchases.

Overhaul of sales organization

Showroomprivé has reorganized its commercial teams to strengthen the business development functions and boost its conquest of new brands. These organizational improvements are accompanied by a more global overhaul of internal processes to gain in simplicity, responsiveness and efficiency. One of the most important measures has been to unify the internal point of contact for partner brands, in order to provide them with more privileged support. The Group is also working on another key initiative, a Sales Academy project to enhance the potential of its teams through training, and build loyalty by offering them a clearer picture of their career prospects within the Group. An overhaul of processes was also initiated in early 2024 to streamline and optimize value creation, with, in particular, the return of offer planning to the center of sales strategy in order to optimize the potential of each sale. Finally, AI solutions are currently being studied, and could significantly improve the productivity of sales teams. These changes are combined with a strict policy of talent recruitment in key teams, such as in the Home segment, where the positive results is expected notably with the recent arrival of a new sales director.

Improved UX and UI on the site

As part of its continuous improvement approach, the Group has launched a vast project to enhance the user experience and navigation quality on its platforms. A new site interface was launched in May, with a more premium design and easier navigation. This first evolution will be regularly completed to reach the final version targeted as part of the platform redesign in early 2025. In particular, over the course of the 3rd quarter, a new, improved search engine developed will be deployed to provide greater fluidity, efficiency and selectivity for the thousands of products in the sales events and Marketplace.

RESULTS REFLECTING LOWER VOLUMES AND DEVELOPMENT INVESTMENTS

| (€ millions) | H1 2023 | H1 2024 | Change (%) |

| Net sales | 331.3 | 318.1 | -4.0% |

| Cost of sales | -203.4 | -196.1 | -3.6% |

| Gross margin | 127,9 | 121.9 | -4.7% |

| Gross margin as % of sales | 38.6% | 38.3% | -27 bps |

| Marketing | -10.6 | -14.2 | +33.9% |

| in % of sales | 3.2% | 4.5% | +127 bps |

| Logistics and fulfillment | -78.3 | -74.9 | -4.3% |

| in % of sales | 23.6% | 23.6% | +27 bps |

| General and administrative expenses | -37.8 | -39.7 | +5.0% |

| in % of sales | 11.4% | 12.5% | +298 bps |

| Total current operating expenses | 126.7 | 128.9 | +1.7% |

| As % of sales | 38.2% | 40.5% | |

| Current operating profit | 1.2 | -6.9 | n.a. |

| EBITDA[1] | 9.3 | 1.6 | -82.8% |

| Of which France | 10.7 | 1.2 | |

| Of which International | -1.4 | 0.3 |

For the first half of 2024, gross margin came to 121.9 million euros, down by 6 million euros. It stood at 38.3% of sales, compared with 38.6% in the first half of 2023, reflecting the change in the sales mix, the growing strength of the Travel & Leisure segment, and of the Marketplace, whose margin alone is recognized in sales, despite the difficulties experienced by SRP Services.

Operating expenses amounted to 40.5% of sales, compared with 38.2% in the first half of 2023, a contained increase testifying to the success of the policy of strict cost control, despite the numerous operating investments made and continued salary inflation over the period. Cost control is broken down as follows:

- Increase in marketing expenditure to 4.5% of sales due to capital expenditure in the first semester 2024 but that will not be renewed in the second half of 2024;

- Logistics expenditure fell in amount and remained stable as a percentage of sales, at 23.6%, reflecting the downturn in business and the initial effects of ongoing rationalization of the logistics network, partially offsetting the effects of inflation;

- Increase in general and administrative expenses to 12.5% of sales over the period, compared with 11.4% in the first half of 2023, due to exceptional accounting restatements and one-off expenses incurred to drive the transformation.

Taking these items into account, EBITDA came out at 1.6 million euros, compared with 9.3 million euros in the first half of 2023, reflecting lower volumes in the events business in France and development investments.

Simplified presentation of the income statement, from current operating income to net income

| (€ millions) | H1 2023 | H1 2024 | Change (%) |

| Current operating profit | 1.2 | -6.9 | n.a. |

| Other operating income and expenses | -4.1 | -7.6 | 44.5% |

| Operating profit | -2.9 | -14.5 | n.a. |

| Net financial expenses | -0.9 | -1.1 | n.a. |

| Other financial income and expenses | 0.8 | -4.1 | n.a. |

| Profit before tax | -3.0 | -19.7 | n.a. |

| Income tax | +0.3 | -0.9 | n.a. |

| Net profit | -2.7 | -20.7 | n.a. |

*In accordance with AMF recommendations, the amortization of intangible assets recognized in connection with a business combination is presented under "recurring operating income" within marketing expenditure.

Other operating income and expenses of 7.6 million euros were mainly due to a pro rata share of acquisition debt relating to the future acquisition of the minority interests in the Bradery.

Net financial expenses came to -1.1 million euros, up slightly compared to the first half of 2023 despite the sharp rise in euribor rates between the 2 periods, thanks to optimized cash hedging. Other financial income and expenses came to -4.1 million euros, impacted by the balance of the future debt for the acquisition of minority interests in the Bradery company. Income before tax came to -19.7 million euros for the period.

The Group also recognized a tax charge of 0.9 million euros.

As a result, Group's net profit came to -20.7 million euros for the first half of 2024.

Simplified presentation of cash flow statement items reflecting structuring strategic investments and the impact of the decline in sales

| (€ millions) | H1 2023 | H1 2024 |

| Cash flow from operating activities | -1.8 | -8.9 |

| Cash flow from investing activities | -4.3 | -7.9 |

| Cash flows from financing activities | -2.7 | -2.9 |

| Net change in cash and cash equivalents | -8.9 | -19.7 |

Cash flow from operating activities came to -8.9 million euros in the first half of 2024, compared with -1.8 million euros in the same period in 2023, impacted by the downturn in sales, the one-off increase in operating expenses, and the intensity of firm purchases on well-known brands.

Cash flow related to investments amounted to -7.9 million euros over the period, up sharply compared to the first half of 2023, reflecting the Group's logistics investments in its new warehouse in order to generate significant cost savings over the coming years while optimizing flows.

Cash flow from financing activities amounted to -2.9 million euros, compared with -2.7 million euros in H1 2023, including 1.9 million euros in repayments of loans and rental debts and 0.8 million euros in financial interest.

OUTLOOK and aXes for development

The environment remains uncertain for the second half of the year. Against this backdrop, Showroomprivé will be relying on its agility to preserve profitability and cash generation, by focusing on the fine-tuning of costs and inventories. In the second half of the year, however, the company will benefit from the growing impact of the measures implemented in recent quarters.

Bolstered by the progress of the transformation realized, Showroomprivé will continue to make progress on structuring projects for the future:

- By finalizing its logistics reorganization and starting to overhaul its transport plan;

- By pursuing the development of its growth drivers, in particular the opening of the Travel & Leisure and Marketplace businesses internationally, event sales internationally and The Bradery;

- By accelerating the recovery of Beauté privée and the Home universe;

- By continuing to premiumize its offering with marketing tools reinforced by a ROI-based approach.

Showroomprivé will also be stepping up its efforts in two major strategic areas where numerous initiatives have already been launched:

- Environmental, Social and Governance (ESG) criteria, on which the Group will further develop its pioneering achievements and consolidate its lead as part of a global strategy to be unveiled this autumn.

- Artificial Intelligence, where the Group is at the forefront with several Generative and Non-Generative AI projects, which will lead to a roadmap to be presented at the end of this fiscal year.

NEXT PUBLICATION

Q3 2024 sales: October 17, 2024

FORWARD-LOOKING STATEMENTS

This press release contains only summary information and is not intended to be comprehensive.

This press release may contain forward-looking information and statements about the Group and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "goal" or similar expressions. Although the Group believes that the expectations reflected in such forward-looking statements are reasonable, investors and the Group's shareholders are advised that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Group, which could cause actual results and developments to differ materially and adversely from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in filings with the Autorité des Marchés Financiers (France's financial markets authority) made or to be made by the Group (particularly those detailed in Chapter 4 of the Company's registration document). The Group makes no commitment to publicly update its forward-looking statements, whether as a result of new information, future events or otherwise.

About showroomprive

Founded in 2006, Showroomprivé is a French e-commerce pioneer specializing in the event-driven sale of brand-name products at discounted prices. The Group currently operates in France and six other countries. The company, co-founded and managed by David DAYAN, has achieved gross merchandise volume of over €1 billion in 2023, and employs 1100 people.

Through its three sites (Showroomprivé, Beauté privée and The Bradery), the Group offers its 21 million members ephemeral sales featuring major discounts on fashion, beauty, home decoration, travel & leisure brands. The Group supports 3,000 partner brands in their inventory clearance, visibility and digital growth strategies through its various services.

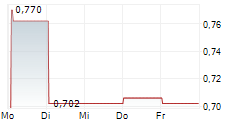

Showroomprivé is listed on Euronext Paris (code: SRP).

Contact

| Showroomprivé | NewCap |

| Sylvie Chan Diaz, Investor Relations investor.relations@showroomprive.net | Financial communication Théo Martin, Louis-Victor Delouvrier |

| Anne Charlotte Neau- Julliard Relations. presse@showroomprive.net | Financial media relations Gaelle Fromaigeat, Nicolas Merigeau showroomprive@newcap.eu |

[1] EBITDA, according to the definition used by the Company, is obtained by eliminating from net income: amortization of assets recognized in connection with a business combination; depreciation of intangible assets and property, plant and equipment; share-based payment costs, which include the charge resulting from the spreading of the fair value of bonus shares and stock options granted to employees; other non-recurring operating income and expenses, net borrowing costs and other financial income and expenses, and the tax charge for the year.

- SECURITY MASTER Key: lJxtlJSXlmeYlmueaJ5paWlnm2+WkpPHa2eYl5ZqmJbInGlllGyXbsXIZnFolWto

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-87062-2024.07.25-en-srp-h1-2024-results-pr.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free