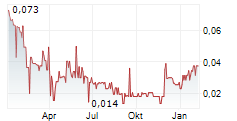

TSX and OTC: MPVD

TORONTO, July 25, 2024 /PRNewswire/ -- Mountain Province Diamonds Inc. ("Mountain Province", the "Company") (TSX: MPVD) (OTC: MPVD) today announces production and sales results for the second quarter ended June 30, 2024 ("the Quarter" or "Q2 2024") from the Gahcho Kué Diamond Mine ("GK Mine"). All figures are expressed in Canadian dollars unless otherwise noted.

Q2 2024 Production Takeaways

(all figures reported on a 100% basis unless otherwise stated)

- 1,318,680 carats recovered, 2% less than last year's comparable quarter (Q2 2023: 1,339,196 carats)

- Average grade of 1.37 carats per tonne, a 24% difference relative to Q2 2023 (1.79 carats per tonne)

- 971,311 ore tonnes mined, a 63% increase relative to last year's comparable quarter (Q2 2023: 595,990 ore tonnes mined)

- 965,984 ore tonnes treated, a 29% increase relative to last year's comparable quarter (Q2 2023: 750,241 tonnes treated)

Q2 2024 Production Figures | |||

2024 Q2 | 2023 Q2 | YoY Variance | |

Total tonnes mined (ore and waste) | 7,911,091 | 9,235,465 | -14 % |

Ore tonnes mined | 971,311 | 595,990 | 63 % |

Ore tonnes treated | 965,984 | 750,241 | 29 % |

Carats recovered | 1,318,680 | 1,339,196 | -2 % |

Carats recovered (49% share) | 646,153 | 656,206 | -2 % |

Recovered grade (carats per tonne) | 1.37 | 1.79 | -24 % |

Q2 2024 Sales Results

During the Quarter 557,361 carats were sold for total proceeds of $56.8 million (US$41.5 million), resulting in an average price of $102 per carat (US$74 per carat). These results compare to Q2 2023 when 360,308 carats were sold for total proceeds of $59.9 million (US$44.6 million), resulting in an average price of $166 per carat (US$124 per carat).

Mark Wall, the Company's President and Chief Executive Officer, commented:

"Q2 2024's carats recovered is largely unchanged compared to Q2 2023. The processing plant continued to perform well, with tonnes treated up 29% compared to Q2 2023. The good performance of the plant was offset by a lower grade in the Quarter. Lower grade had been expected as per the mine plan in Q2 2024, however, as noted previously, we have also seen a lower than expected grade at the deep portions of the pits, continue through the Quarter. The team has been working on identifying and isolating the small area of grade under performance and as stated previously, this will improve as we move through the year.

The diamond market continues to be softer than anticipated. At a macro level the return of demand in China has not materialized so far and the market is now expecting a more protracted U-shaped recovery in diamond demand. On the synthetic market, the Quarter saw De Beers' CEO, Al Cook announce it was pivoting to manufacture lab-grown diamonds for industrial uses and focusing its jewelry marketing efforts behind natural mined diamonds. We are also seeing a resurgence in US jewellers' interest in natural diamonds. The importance of diamond provenance continued to strengthen, which is helpful for Canadian diamond producers like Mountain Province."

Earnings Release and Conference Call Details

The Company will host its quarterly conference call on Thursday August 8th, 2024 at 11:00am ET. Prior to the conference call, the Company will release Q2 2024 financial results on August 7th, 2024 after-market.

Conference Call Dial-in Details:

Title: Mountain Province Diamonds Inc Q2 2024 Earnings Conference Call

Date of call: 08/08/2024

Time of call: 11:00 Eastern Time

Expected Duration: 60 minutes

Webcast Link:

https://app.webinar.net/94JwoV1MRDG

North American Toll-Free Number: (+1) 800-836-8184

Participant Local/International Number: (+1) 289-819-1350

A replay of the webcast and audio call will be available on the Company's website.

About Mountain Province Diamonds Inc.

Mountain Province Diamonds is a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories. The Gahcho Kué Joint Venture property consists of several kimberlites that are actively being mined, developed, and explored for future development. The Company also controls more than 113,000 hectares of highly prospective mineral claims and leases surrounding the Gahcho Kué Mine that include an Indicated mineral resource for the Kelvin kimberlite and Inferred mineral resources for the Faraday kimberlites.

For further information on Mountain Province Diamonds and to receive news releases by email, visit the Company's website at www.mountainprovince.com.

Qualified Person

The disclosure in this news release of scientific and technical information regarding Mountain Province's mineral properties has been reviewed and approved Dan Johnson, P.Eng., a director of Mountain Province Diamonds Inc. and Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Caution Regarding Forward Looking Information

This news release contains certain "forward-looking statements" and "forward-looking information" under applicable Canadian and United States securities laws concerning the business, operations and financial performance and condition of Mountain Province Diamonds Inc. Forward-looking statements and forward-looking information include, but are not limited to, statements with respect to operational hazards, including possible disruption due to pandemic such as COVID-19, its impact on travel, self-isolation protocols and business and operations, estimated production and mine life of the project of Mountain Province; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; the future price of diamonds; the estimation of mineral reserves and resources; the ability to manage debt; capital expenditures; the ability to obtain permits for operations; liquidity; tax rates; and currency exchange rate fluctuations. Except for statements of historical fact relating to Mountain Province, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as "anticipates," "may," "can," "plans," "believes," "estimates," "expects," "projects," "targets," "intends," "likely," "will," "should," "to be", "potential" and other similar words, or statements that certain events or conditions "may", "should" or "will" occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of Mountain Province and there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements include the development of operation hazards which could arise in relation to COVID-19, including, but not limited to protocols which may be adopted to reduce the spread of COVID-19 and any impact of such protocols on Mountain Province's business and operations, variations in ore grade or recovery rates, changes in market conditions, changes in project parameters, mine sequencing; production rates; cash flow; risks relating to the availability and timeliness of permitting and governmental approvals; supply of, and demand for, diamonds; fluctuating commodity prices and currency exchange rates, the possibility of project cost overruns or unanticipated costs and expenses, labour disputes and other risks of the mining industry, failure of plant, equipment or processes to operate as anticipated.

These factors are discussed in greater detail in Mountain Province's most recent Annual Information Form and in the most recent MD&A filed on SEDAR, which also provide additional general assumptions in connection with these statements. Mountain Province cautions that the foregoing list of important factors is not exhaustive. Investors and others who base themselves on forward-looking statements should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. Mountain Province believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Although Mountain Province has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Mountain Province undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking statements to the extent they involve estimates of the mineralization that will be encountered as the property is developed. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Further, Mountain Province may make changes to its business plans that could affect its results. The principal assets of Mountain Province are administered pursuant to a joint venture under which Mountain Province is not the operator. Mountain Province is exposed to actions taken or omissions made by the operator within its prerogative and/or determinations made by the joint venture under its terms. Such actions or omissions may impact the future performance of Mountain Province. Under its current note and revolving credit facilities Mountain Province is subject to certain limitations on its ability to pay dividends on common stock. The declaration of dividends is at the discretion of Mountain Province's Board of Directors, subject to the limitations under the Company's debt facilities, and will depend on Mountain Province's financial results, cash requirements, future prospects, and other factors deemed relevant by the Board.

FOR FURTHER INFORMATION, PLEASE CONTACT: Mark Wall, President and CEO, 151 Yonge Street, Suite 1100, Toronto, Ontario M5C 2W7, Phone: (416) 361-3562, E-mail: info@mountainprovince.com

![]() View original content:https://www.prnewswire.co.uk/news-releases/mountain-province-diamonds-announces-second-quarter-2024-production-and-sales-results-details-of-second-quarter-2024-earnings-release-and-conference-call-302207139.html

View original content:https://www.prnewswire.co.uk/news-releases/mountain-province-diamonds-announces-second-quarter-2024-production-and-sales-results-details-of-second-quarter-2024-earnings-release-and-conference-call-302207139.html