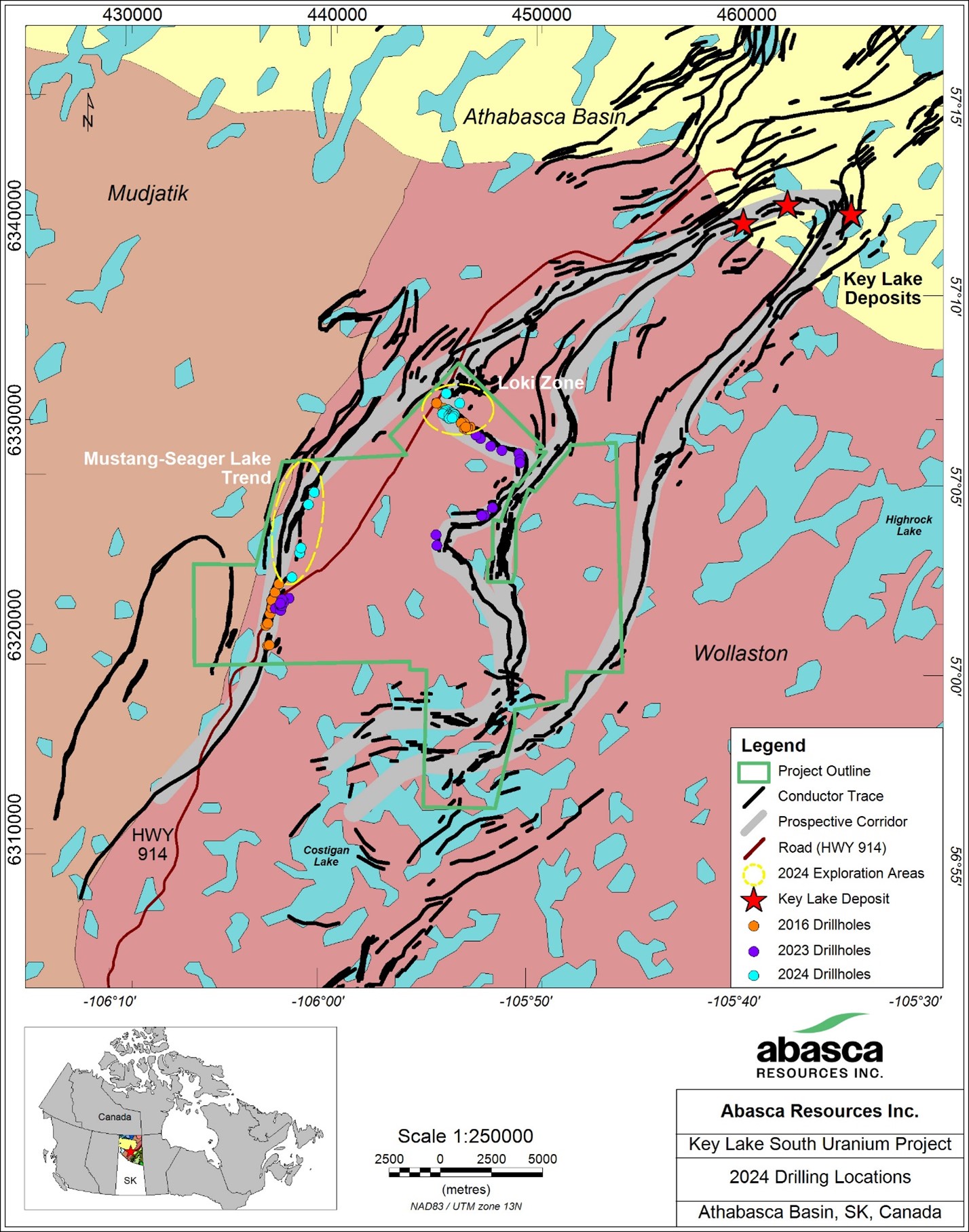

SASKATOON, SK / ACCESSWIRE / August 1, 2024 / Abasca Resources Inc. ("Abasca" or the "Company") (TSXV:ABA) is pleased to provide an update on its 2024 summer exploration program. The program has focused on defining the Flake Graphite potential at the Company's Loki Zone as well as drill testing prospective conductor corridors for uranium mineralization (Figure 1). The drill program is nearing completion and will be followed by the re-sampling of the 2016 drill cores that originally intersected the Loki Zone.

Loki Zone - Flake Graphite

The summer drilling at the Loki Zone included 21 drill holes for approximately 5,500 m. The drilling, which was conducted on a 100 x 100 m grid, focused on testing the vertical and lateral continuity of the known Flake Graphite zone that was discovered in 2016. All holes successfully intersected graphite mineralization (Figure 2) and samples have been submitted to SRC Geoanalytical Laboratories in Saskatoon for analyses. Samples from one hole have also been selected for metallurgical evaluation.

Brian McEwan, Vice-President of Exploration commented: "We are very pleased with the initial drilling at the Loki Zone. Visual estimates of the graphite intersections are very similar to the original drilling in 2016 and we're excited to receive the lab results. It's an attractive project and we're looking forward to supporting Saskatchewan's critical mineral sector."

Regional Exploration

A total of 7 drill holes totalling 3,593 m were completed along the Mustang-Seager Trend and the Loki Target area north of the Loki Zone. Strong silicification along with local clay alteration and oxide staining near fault zones were observed along the trend. Although no significant radioactivity was measured, the corridor remains largely untested with many prospective targets.

Figure 1: Map of the Key Lake South Uranium Project area showing the 2024 drilling locations.

Figure 2: Core photo of KLS-24-037 between 83.84 m and 99.47 m showing intense graphite mineralization in the Loki Zone. KLS-24-037 was drilled approximately 100 m southwest of KS-CC16-12 which included a sample grading up to 22.2 % Cg (graphite), as reported in the Company's news release on February 20, 2024.

Restatement

On December 29, 2022, Abasca and 101159623 Saskatchewan Ltd. ("SaskCo") completed a transaction whereby SaskCo sold the Key Lake South Uranium Project ("KLS" or the "KLS Project") to Abasca in consideration of 25,639,288 common shares of Abasca (the "Transaction"). Following discussions with its independent auditors, Abasca identified an error in the accounting treatment for the Transaction, and it has filed audited financial statements and management discussion and analysis for the year ended April 30, 2024 which includes restated comparative figures for the year ended April 30, 2023.

The 25,639,288 common shares of the Company received by SaskCo, the former owner of KLS, comprised 66.7% of the issued and outstanding common shares of the Company on the date of the Transaction, and the management of KLS continued as management of the Company. As a result of the Transaction, the former owner of KLS became the controlling shareholder of the Company. The Transaction therefore meets the definition of a reverse takeover transaction. The Company originally accounted for the Transaction as an asset acquisition of the KLS Project in the Company's financial statements for the year ended April 30, 2023.

On the date of closing of the Transaction, Abasca was not considered a business under IFRS 3, as Abasca did not have inputs and substantive processes that could collectively contribute to the creation of outputs. As a result, the Company has accounted for the Transaction in accordance with IFRS 2, Share Based Payments, as a reverse takeover, with KLS identified as the accounting acquirer and Abasca as the accounting acquiree. The financial statements for the Company's financial year ended April 30, 2024 are issued under the legal parent, Abasca Resources Inc., but are considered to be a continuation of the financial results of KLS.

At the date of closing of the Transaction, the Transaction was recorded as follows in the restated comparative figures:

Fair value of consideration | |

Common shares | 4,577,978 |

Stock options | 193,865 |

Total | 4,771,843 |

| |

Net assets (liabilities) acquired | |

Cash | 11,724 |

Amounts receivable | 15,851 |

Accounts payable and accrued liabilities | (327,437) |

Net liabilities | (299,862) |

| |

Fair value of consideration and net liabilities assumed | 5,071,705 |

Other transaction costs | 130,264 |

Listing expenses | 5,201,969 |

The difference between the consideration paid to acquire Abasca and the fair value of Abasca's net assets (liabilities) was recorded as a listing expense in the statement of loss and comprehensive loss.

The following tables summarize the effects of the adjustments described above as of April 30, 2022:

| As of April 30, 2022 (previously reported) | Adjustments | As of May 1, 2022 (restated) |

Statement of financial position | |||

Total current assets | 102,758 | (102,758) | - |

Total assets | 102,758 | (102,758) | - |

Total liabilities | 5,462 | (5,462) | - |

Share capital | 604,493 | (604,493) | - |

Net parent investment | - | 75,286 | 75,286 |

Contributed surplus | 122,500 | (122,500) | - |

Reserves | 68,687 | (68,687) | - |

Accumulated Deficit | (698,384) | 623,098 | (75,286) |

The following tables summarize the effects of the adjustments described above as at and for the year ended April 30, 2023:

| As of April 30, 2023 (previously reported) | Adjustments | As of April 30, 2023 (restated) |

Statement of financial position | |||

Total current assets | 1,687,981 | - | 1,687,981 |

Total assets | 1,759,595 | - | 1,759,595 |

Total liabilities | 287,281 | - | 287,281 |

Share capital | 5,894,172 | 1,839,752 | 7,733,924 |

Contributed surplus | 122,500 | (122,500) | - |

Reserves | 1,655,483 | 251,669 | 1,907,152 |

Accumulated Deficit | (6,199,841) | (1,968,921) | (8,168,762) |

| |||

Statement of loss and comprehensive loss | |||

Exploration expenses | 4,285,284 | (2,563,929) | 1,721,355 |

General administrative | 2,965 | 116,385 | 119,350 |

Investor relations and promotion | 21,543 | (2,908) | 18,635 |

Management fees and salaries | 34,532 | 149,130 | 183,662 |

Professional fees | 95,999 | (32,822) | 63,177 |

RTO Expenses | 276,744 | (276,744) | - |

Transfer agent and regulatory | 18,846 | (12,816) | 6,030 |

| |||

Loss before other items | 5,719,413 | (2,623,704) | 3,095,709 |

Listing expense | - | 5,201,969 | 5,201,969 |

Loss and comprehensive loss for the year | 5,515,211 | 2,578,265 | 8,093,476 |

| |||

Weighted average number of common shares outstanding | 23,955,980 | 8,534,721 | 32,490,701 |

Basic and diluted loss per share | 0.23 | 0.02 | 0.25 |

| |||

Statement of cash flows | |||

Cash used in operating activities | (2,124,970) | (248,452) | (2,373,422) |

Cash used in investing activities | (78,125) | (118,540) | (196,665) |

Cash provided from financing activities | 3,632,900 | 467,647 | 4,100,547 |

Full details of the restatement can be found in the Company's financial statements for the financial year ended April 30, 2024, as filed on SEDAR+.

Qualified Person

The technical information in this news release has been reviewed and approved by Brian McEwan, P.Geo, a Qualified Person as set out in National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. McEwan is the Vice-President of Exploration at Abasca.

About Abasca Resources Inc.

Abasca is a mineral exploration company that is primarily engaged in the acquisition and evaluation of mineral exploration properties. The Company owns the Key Lake South Uranium Project (KLS), a 23,977-hectare uranium exploration project located in the Athabasca Basin Region in northern Saskatchewan, approximately 15 km south of the former Key Lake mine and current Key Lake mill.

On behalf of Abasca Resources Inc.

Dawn Zhou, M.Sc, CPA, CGA

President, CEO and Director

For more information visit the Company's website at https://www.abasca.ca or contact:

Abasca Resources Inc.

Email: info@abasca.ca

Telephone: +1 (306) 933 4261

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

Forward-Looking Statements

This press release may contain certain forward-looking information and statements ("forward-looking information") within the meaning of applicable Canadian securities legislation that are not based on historical fact, including without limitation statements containing the words "believes", "anticipates", "plans", "intends", "will", "should", "expects", "continue", "estimate", "forecasts" and other similar expressions. Forward-looking information reflects management's current beliefs with respect to future events and is based on information currently available to management. Forward-looking information contained in this press release includes, but is not limited to, statements relating to a follow up exploration program at Mustang and the testing of the other target areas at KLS. Readers are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. Abasca undertakes no obligation to comment on analyses, expectations, or statements made by third-parties in respect of Abasca, its securities, or financial or operating results (as applicable). Although Abasca believes that the expectations reflected in forward-looking information in this press release are reasonable, such forward-looking information has been based on expectations, factors, and assumptions concerning future events which may prove to be inaccurate and are subject to numerous risks, uncertainties and factors, certain of which are beyond Abasca's control, including the impact of general business and economic conditions; risks related the exploration activities to be conducted on KLS, including risks related to government and environmental regulation; actual results of exploration activities; industry conditions, including uranium price fluctuations, interest and exchange rate fluctuations; the influence of macroeconomic developments; business opportunities that become available or are pursued; title, permit or license disputes related to KLS; litigation; fluctuations in interest rates; and other factors. In addition, the forward-looking information is based on several assumptions which may prove to be incorrect, including, but not limited to, assumptions about the availability of qualified employees and contractors for the Company's operations and the availability of equipment. The forward-looking information contained in this press release are expressly qualified by this cautionary statement and are made as of the date hereof. Abasca disclaims any intention and has no obligation or responsibility, except as required by law, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

SOURCE: Abasca Resources Inc.

View the original press release on accesswire.com