- Order intake grew YoY in Energy Systems, Plants & Infrastructure Systems, and Logistics, Thermal & Drive Systems, with largest increases seen in GTCC.

- Revenue increased YoY in all segments driven by strength in GTCC, Aero Engines, and Defense & Space.

- Business profit was up in Energy Systems, Plants & Infrastructure Systems, and Aircraft, Defense & Space due to revenue increases, improved project margins, and impact from the weak yen.

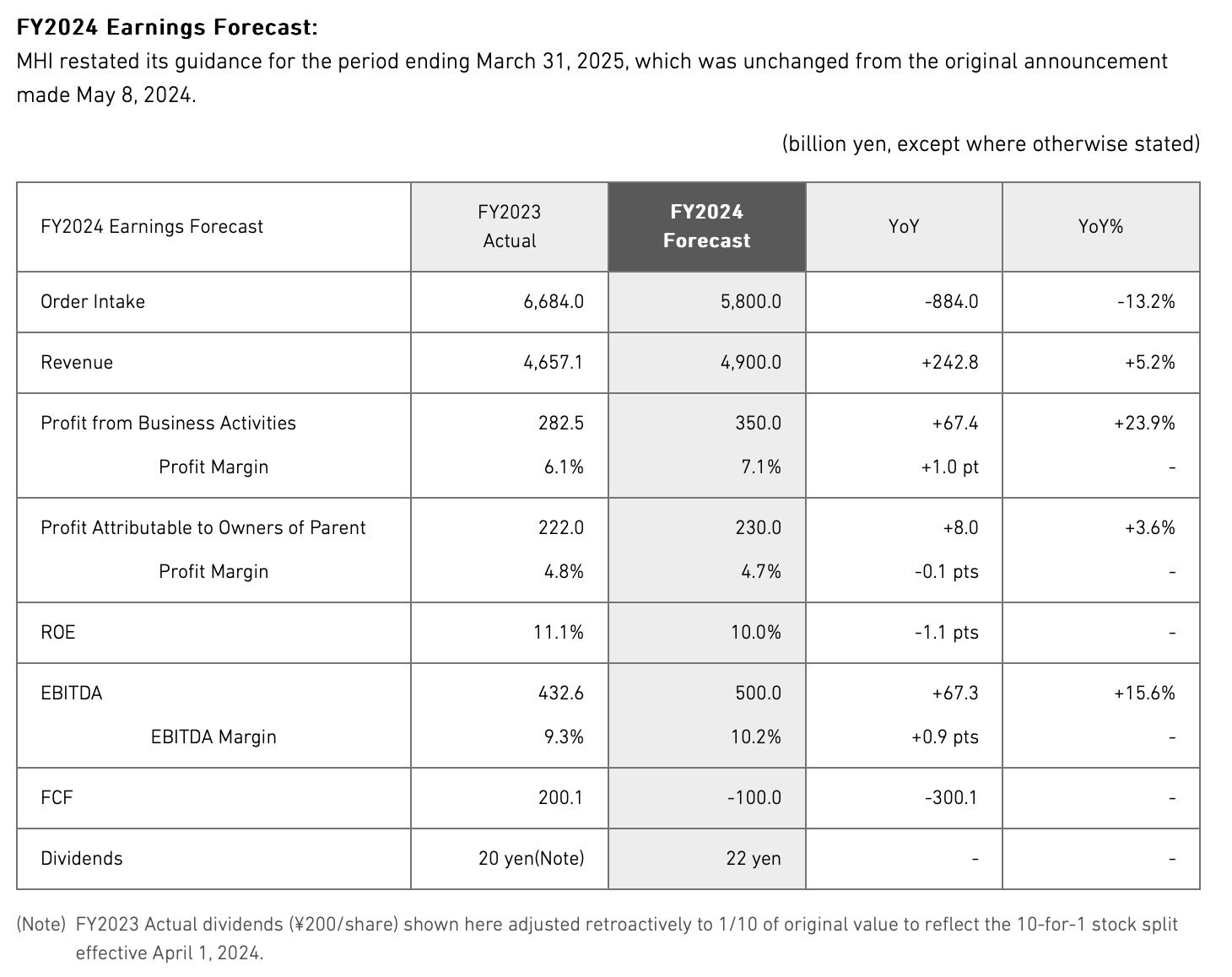

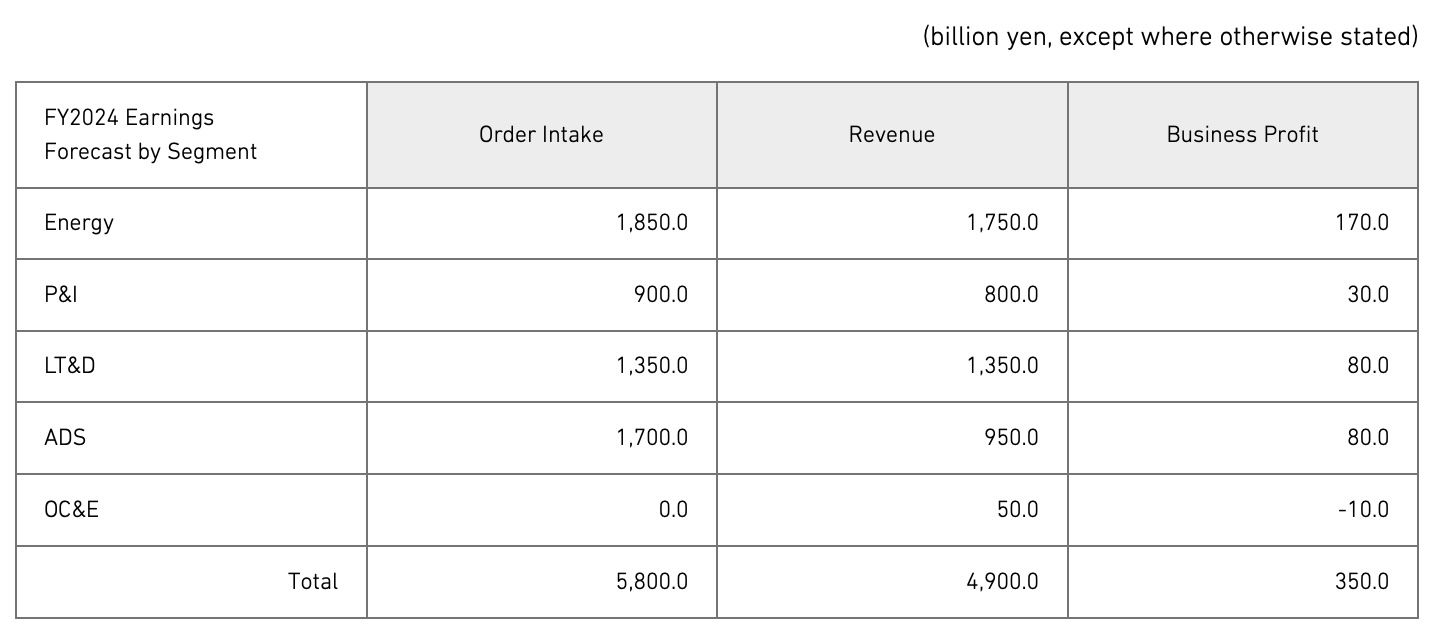

- Restated full-year FY2024 earnings guidance, unchanged from the previous announcement.

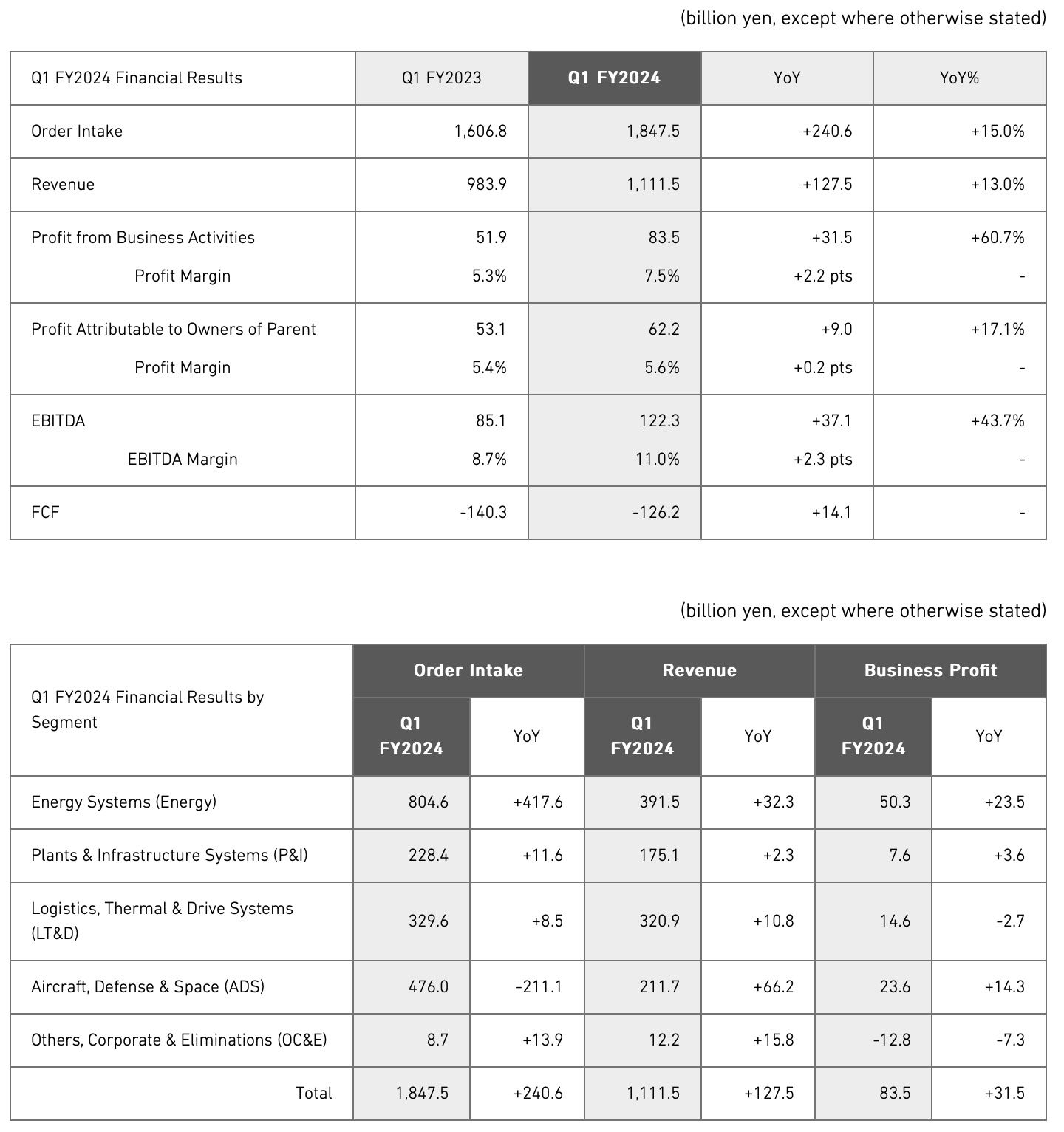

TOKYO, Aug 6, 2024 - (JCN Newswire) - Mitsubishi Heavy Industries, Ltd. (MHI, TSE Code: 7011) announced that order intake rose 15.0% year-over-year to JPY1,847.5 billion in the quarter ended June 30, 2024. Revenue rose 13.0% to JPY1,111.5 billion year-over-year, resulting in profit from business activities (business profit) of JPY83.5 billion, a 60.7% increase over the previous fiscal year, which represented a profit margin of 7.5%. Profit attributable to owners of parent (net income) was JPY62.2 billion, an increase of 17.1% year-over-year, with a profit margin of 5.6%. EBITDA was JPY122.3 billion, a 43.7% increase over Q1 FY2023, with an EBITDA margin of 11.0%, up 2.3 percentage points year-over-year.

|

|

|

In Energy, order intake increased by JPY417.6 billion YoY driven by Gas Turbine Combined Cycle (GTCC) order bookings in the Americas. A total of six large frame gas turbine units were booked globally. Margin improvements in all major businesses served to increase segment business profit by JPY23.5 billion YoY.

In P&I, order intake rose by JPY11.6 billion YoY due to a large order for a waste-to-energy system. Margin improvements in major businesses led to a JPY3.6 billion YoY increase in segment business profit.

In LT&D, impact from the weak yen contributed to a JPY10.8 billion YoY increase in segment revenue. A decrease in unit deliveries led to a JPY2.7 billion YoY drop in segment business profit.

In ADS, Defense & Space showed strong orders performance, but due to several large stand-off defense-related orders booked in Q1 FY2023, segment order intake decreased by JPY211.1 billion YoY. Steady backlog execution in Defense & Space and foreign exchange effects in Commercial Aviation caused segment revenue to increase by JPY66.2 billion YoY. Increased revenue and margin improvements contributed to a JPY14.3 billion YoY increase in segment business profit.

CFO Message:

"MHI achieved large year-over-year increases in order intake, revenue, business profit, and net income in the first quarter of this fiscal year," Hisato Kozawa, MHI Chief Financial Officer commented. Kozawa continued, "In line with the framing of our businesses laid out in the 2024 Medium-Term Business Plan, we saw continued strength in our growing core businesses: GTCC, Nuclear Power, and Defense. Order intake was particularly strong in GTCC, specifically in the Americas, which is one the main regions of focus for this business. Revenue increased in many businesses as we worked to execute with excellence the large backlog accumulated over the last several years, and margin improvements together with the impact of the weak yen helped to bolster both business profit and net income."

Kozawa noted, "We did, however, see some softness in the shorter-cycle businesses in Logistics, Thermal & Drive Systems, and we will continue to monitor the situation closely. That said, we do not currently expect any negative impact on our full-year earnings, which has led us to reiterate our FY2024 forecast with no changes from the previous announcement. Developments in the volatile global economic and geopolitical landscapes will likely affect our operating environment in the coming quarters, but we will do everything within our power to guide the organization toward achieving our targets for March 2025."

Note regarding forward looking statements:

Forecasts regarding future performance outlined in these materials are based on judgments made in accordance with information available at the time they were prepared. As such, these projections include risk and uncertainty. Investors are recommended not to depend solely on these projections when making investment decisions. Actual results may vary significantly from these projections due to a number of factors, including, but not limited to, economic trends affecting the Company's operating environment, fluctuations in the value of the Japanese yen to the U.S. dollar and other foreign currencies, and trends in Japan's stock markets. The results projected here should not be construed in any way as a guarantee by the Company.

About MHI Group

Mitsubishi Heavy Industries (MHI) Group is one of the world's leading industrial groups, spanning energy, smart infrastructure, industrial machinery, aerospace and defense. MHI Group combines cutting-edge technology with deep experience to deliver innovative, integrated solutions that help to realize a carbon neutral world, improve the quality of life and ensure a safer world. For more information, please visit www.mhi.com or follow our insights and stories on spectra.mhi.com.

Source: Mitsubishi Heavy Industries, Ltd.

Copyright 2024 JCN Newswire . All rights reserved.

© 2024 JCN Newswire