After Tax NPV5% of US$111 Million at US$2,100/oz Au price

After Tax NPV5% of US$153 Million at Spot prices1

Average annual production targeted at approx. 56,000 Gold Equivalent Ounces ("GEO")2

Life of Mine Average annual EBITDA of US$49 Million and FCF of US$25 Million

LOM average EBITDA of US$64 Million and FCF of US$29 Million at Spot prices1

Mine life of 5 years, from April 2024 based on existing Resources

Average Cash Costs of US$863/oz; Avg AISC US$1,144/oz

No Material Upfront Capital Expenditures required

Updated Mineral Resource Estimate contains 490,000ozs of Measured and Indicated Resources and 121,150 ozs of Inferred Resources with potential upside from continued drilling & resource expansion

1. Spot prices; Au: US$2,400/oz and Ag:US$29/oz

2. GEO calculated by multiplying recovered silver ounces by (25/2100)

TORONTO, ON / ACCESSWIRE / August 6, 2024 / CERRADO GOLD ("Cerrado" or the "Company") is pleased to announce the results of a NI 43-101 Preliminary Economic Assessment ("PEA") and an updated Mineral Resource Estimate ("MRE") for its Minera Don Nicolas mine located in Santa Cruz Province, Argentina. The work was completed by GeoEstima SpA. The final report is to be completed and available on SEDAR+ by 20th September 2024.

Mark Brennan, CEO of Cerrado Gold commented "The results of the PEA support the near-term operational performance we are targeting for Minera Don Nicolas. These results support our view that MDN is set to enter a period of stable operations, generating robust cash flows enabling the reduction of debt and enhancing the overall financial strength of Cerrado. When combined with the expected receipt of US$45MM in total cash payments for the recent sale of our Brazilian asset over the next two years, Cerrado will be well positioned for strong future growth. For the next few years, MDN will be focused on growing resources to extend the mine life and leverage the value of our existing operations. We continue to view MDN as early in its exploration life and see the potential for a world-class multi-deposit district moving forward."

PEA Summary Results

PEA Base Case1 |

|

Average Annual Gold Equivalent Production (ounces) | 55,869 |

Mine life (years) - Mine Plan start Date 1 April 2024 | 5.0 |

Total Gold Equivalent Production (ounces) | 279,345 |

NPV @ 5% discount rate (millions, after-tax) | $ 111 |

NPV @ 8% discount rate (millions, after-tax) | $ 105 |

Gold Price (US$/oz) | 2,100.0 |

Silver Price (US$/oz) | 25.0 |

Average Annual EBITDA | $ 49.2 M |

Average Annual FCF | $ 25.2 M |

Capital Costs |

|

Initial capital expenditure (Initial Capex) | $ 0 M |

Sustaining capital expenditures | $ 9.5 M |

Reclamation cost | $ 7 M |

Salvage Value | $ 3.3 M |

Operating Costs |

|

Total cash cost (per ounce sold) 2 | 864 |

Mine-site all-in-sustaining cost (per ounce sold) 3 | 1,146 |

Notes: |

|

Mineral Resource Estimate

The PEA is based on the updated Mineral Resource Estimate (MRE), prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, completed by GeoEstima, with an effective date of April 1st, 2024, as presented below. It should be noted that Mineral Resources, which are not Mineral Reserves do not have demonstrated economic viability. This update reflects not only those resources assumed to be mined in the PEA but also other defined resources within the greater MDN property. Estimation of depleted satellite Mineral Resources was validated by Cerrado's Qualified Persons ("QPs"), as defined in NI 43-10, keeping estimation parameters from the previous technical report (SRK 2020), and using updated drilling data bases and constraining pit shells.

Mineral Resources

The following table shows our estimates of Mineral Resources prepared with an effective date of April 01, 2024 (except as indicated below).

|

|

| Grade Values | Metal Content | ||

Mine | Classification | Tonnage | Au | Ag | Au | Ag |

|

| kt | g/t | g/t | k oz | k oz |

Calandrias Sur ¹ | Measured | 5,192.24 | 0.91 | 17.07 | 151.32 | 2,849.04 |

Indicated | 7,642.16 | 1.02 | 14.16 | 249.40 | 3,479.94 | |

M+I | 12,834.40 | 0.97 | 15.34 | 400.72 | 6,328.98 | |

Inferred | 2,261.42 | 0.62 | 3.32 | 44.99 | 241.64 | |

Calandrias Norte ¹ | Measured | 8.12 | 18.66 | 25.98 | 4.87 | 6.78 |

Indicated | 70.67 | 14.52 | 22.79 | 32.98 | 51.79 | |

M+I | 78.79 | 14.94 | 23.12 | 37.85 | 58.57 | |

Inferred | 10.58 | 10.69 | 12.17 | 3.64 | 4.14 | |

Zorro ¹ | Measured | 69.09 | 2.15 | 8.74 | 4.78 | 19.42 |

Indicated | 136.50 | 1.32 | 7.38 | 5.80 | 32.39 | |

M+I | 205.59 | 1.60 | 7.84 | 10.58 | 51.81 | |

Inferred | 120.88 | 0.81 | 6.38 | 3.16 | 24.79 | |

Depleted Satellites ² ³ | Measured | 29.91 | 2.04 | 0.00 | 1.96 | 0.00 |

Indicated | 14.99 | 1.80 | 0.00 | 0.87 | 0.00 | |

M+I | 44.90 | 1.96 | 0.00 | 2.83 | 0.00 | |

Inferred | 1,117.03 | 1.62 | 1.72 | 58.14 | 61.62 | |

Paloma Trend ¹ | Measured | 128.86 | 4.73 | 18.98 | 19.58 | 78.62 |

Indicated | 145.96 | 4.00 | 15.97 | 18.78 | 74.94 | |

M+I | 274.82 | 4.34 | 17.38 | 38.36 | 153.56 | |

Inferred | 88.91 | 3.93 | 13.15 | 11.22 | 37.58 | |

Total | Measured | 5,428.22 | 1.05 | 16.93 | 182.52 | 2,953.87 |

Indicated | 8,010.27 | 1.20 | 14.13 | 307.82 | 3,639.05 | |

M+I | 13,438.50 | 1.13 | 15.26 | 490.34 | 6,592.92 | |

Inferred | 3,598.83 | 1.05 | 3.20 | 121.15 | 369.77 | |

|

|

|

|

|

|

|

Stockpiles 4 | Measured | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Indicated | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

M+I | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

Inferred | 951.74 | 0.54 | 2.05 | 16.57 | 62.58 | |

Notes:

¹ Included in economic evaluation

² Not included in economic evaluation

³ Satellites include Armadillo, Baritina, Baritina NE, Cerro Oro, Coyote, Choique, Mara, and Trofeu

4 Include the stocks from: Armadillo, Cerro Oro, Coyote, Choique, and Mara.

Notes to Mineral Resources Table

Mineral Resource estimates were prepared by the May 10, 2014 edition of the Canadian Institute of Mining, Metallurgy and Petroleum (or CIM) Definition Standards for Mineral Resources and Mineral Reserves ("2014 CIM Definition Standards") and disclosed in accordance with National Instrument 43-101 - Standards of Disclosure for Minerals Project ("NI 43-101").

The Qualified Persons for the estimation of Mineral Resources are Calandrias Sur, Calandrias Norte, Zorro, Paloma Trend and Stockpiles - Orlando Rojas, P.Geo, Member AIG, a GeoEstima SpA employee and Armadillo, Baritina, Baritina NE, Cerro Oro, Coyote, Choique, Mara and Trofeu - Sergio Gelcich, P.Geo, MAusIMM (CP) Geo, Vice President, Exploration, a Cerrado Gold employee.

Mineral Resources have an effective date as of: (a) April 1st, 2024, for Calandrias Sur, Calandrias Norte, Zorro, Paloma Trend, Armadillo, Baritina, Baritina NE, Cerro Oro, Coyote, Choique, and Trofeu; (b) August 31st, 2020, for Mara satellite.

Mineral Resources estimated using an average long-term metal price of US$2,100.0/oz of Au and US$25.0/oz of Ag. For Mara satellite, an average long-term metal price of US$1,550.0/oz of Au is considered, assuming a mining cost of US$2.65/t, plant cost of US$32.0/t, and selling costs of US$127.0/t.

Recoveries depend on the type of host mineralization and the extraction method being utilized for the minerals. For the carbon-in-leach (CIL) process, Au recovery is based on historical metallurgical recovery, which is 90% for Au and 61% for silver. For the Heap Leach process (HL), Au recovery is based on metallurgical test works and depends on the zone. Au recovery is 70% in the Oxide zone, 60% in the Transitional zone, and 40% in the Primary zone. The silver recovery is 30% in all zones.

Mineral Resources in open pit are reported within pit shell constrain and above a cut-off grade: Calandrias Sur has a variable cut-off - 0.27 g/t Au for the Oxided zone, 0.31 g/t Au for the Transition zone and 0.46 g/t Au for Primary zone; Calandrias Norte - 1.46 g/t Au; Zorro, Armadillo, Baritina, Baritina NE, Cerro Oro, Coyote, Choique, Mara and Trofeu - 0.3 g/t Au. In Paloma Trend, Mineral Resources are reported within a cut-off grade of 1.95 g/t for underground mining shapes. A minimum mining width of 1.5m was used for resource shapes.

The estimated costs are: Calandrias Sur - plant cost of US$11.08/t; Calandrias Norte - plant cost of US$78.33/t; Zorro - plant cost varying from US$ 13.35 for HL process and US$ 68.20 for CIL process; Depleted Satellite - plant cost of US$40.0/t. The selling costs of US$242.90/t and mining costs of US$3.50/t was assumed for all open pit costs of US$3.50/t was assumed for all open pit were assumed for all open-pit mining. For underground shapes, the mining costs are US$40.0/t, plant costs are US$65.0/t and selling costs are US$242.9/t. The exchange rate considered is ARG 917.25 / 1 USD.

Density was assigned and interpolated based on specific gravity values by domain.

Numbers may not be added due to rounding.

Project Summary

The Minera Don Nicolas operation is a gold mining operation located in the province of Santa Cruz, Argentina. MDN is located in the prolific Deseado Masiff with exploration rights over 330K Ha. The operations commenced in 2019 as an open pit CIL operation with mineralized material produced from deposits in the Paloma and Martinetas regions which are mostly depleted of ready to mine resources. In 2023, MDN added a heap leach operation to process the mineralized material from Calandrias Sur open pit. The PEA is focused on the development and mining of the high grade Calandrias Norte open pit to be processed through the existing 1,000 tpd CIL plant until late 2024 and the ongoing operations and expansion of the Calandrias Sur heap leach operations until at least 2028. In addition, the PEA has envisaged the development of an initial small scale underground mining operation upon which future underground exploration is expected to extend the mine life; and the processing of low grade mined material in the Martinetas area from several stockpiles.

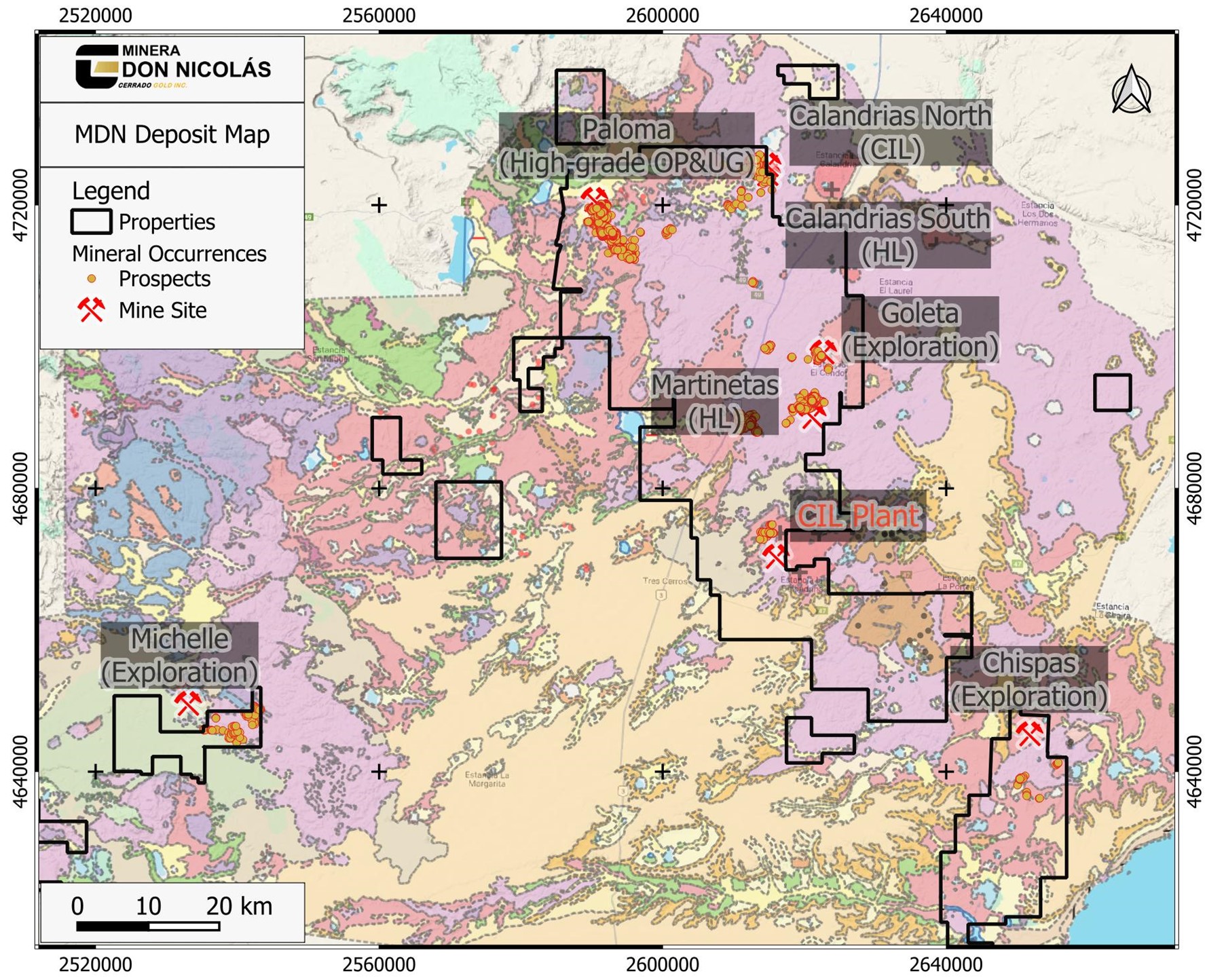

Figure 1. Project Location

Geology

MDN property includes several deposit styles all within the epithermal clan that defines the Deseado Massif province, including:

Low sulphidation sheeted and single vein systems: Martinetas

Intermediate sulphidation veins and vein/breccias: Paloma

Dome hosted bulk veins/stockworks and breccias: Calandrias North (HG) and Calandrias South (LG)

Figure 2. Location of MDN mineral deposits

Mining

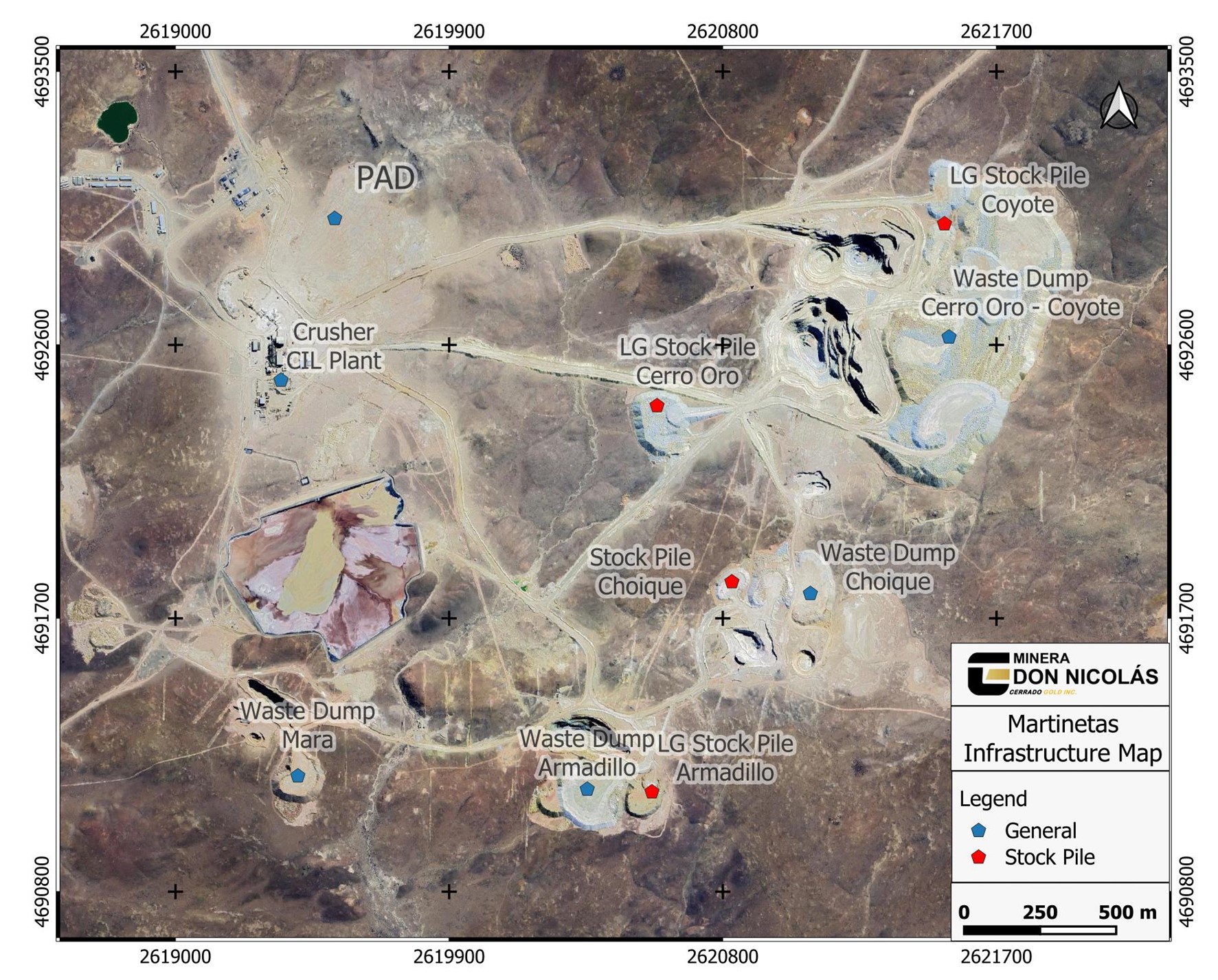

Mining is primarily aimed to exploit the Calandrias Norte high grade deposit and the Calandrias Sur low grade, heap leach, deposit. In addition, a modest underground mine based solely on currently known resources in the Paloma Trend and the smaller Zorro open pit near Martinetas are planned to add additional material for the CIL processing plant. The mine design is based on using standard open pit mining techniques of drill, blast and haul using a fleet of its own and rented mining equipment mining fleet to reduce capital needs. Mineralized material from Calandrias Norte is trucked to the CIL plant near the historical Martinetas mining operations for proceeding while material from the Calandrias Sur pit is crushed and placed on the leach pad in close proximity to the mining operations. The gold loaded carbon from the heap leach operations will be transported to the gold recovery circuit at the Martinetas site. Once processing of the Calandrias Norte and any additional high-grade material is completed, the CIL plant is to be placed on Care and Maintenance until mineralized material from the proposed underground mine becomes available in 2026 after underground development has been completed. Once this material is processed the CIL plant will once again be placed on Care and Maintenance until sufficient new sources of mineralized material have been upgraded to support ongoing mining operations which are expected from future exploration activities. This potential is currently excluded from the PEA mine plan.

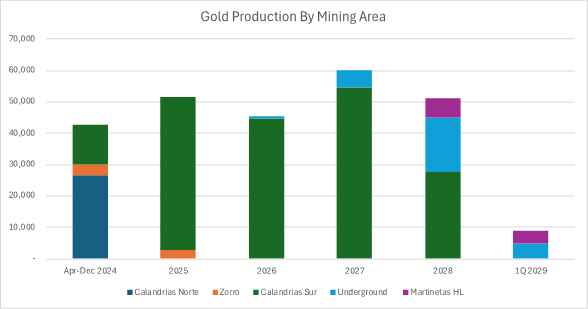

Gold Production from Mining Area

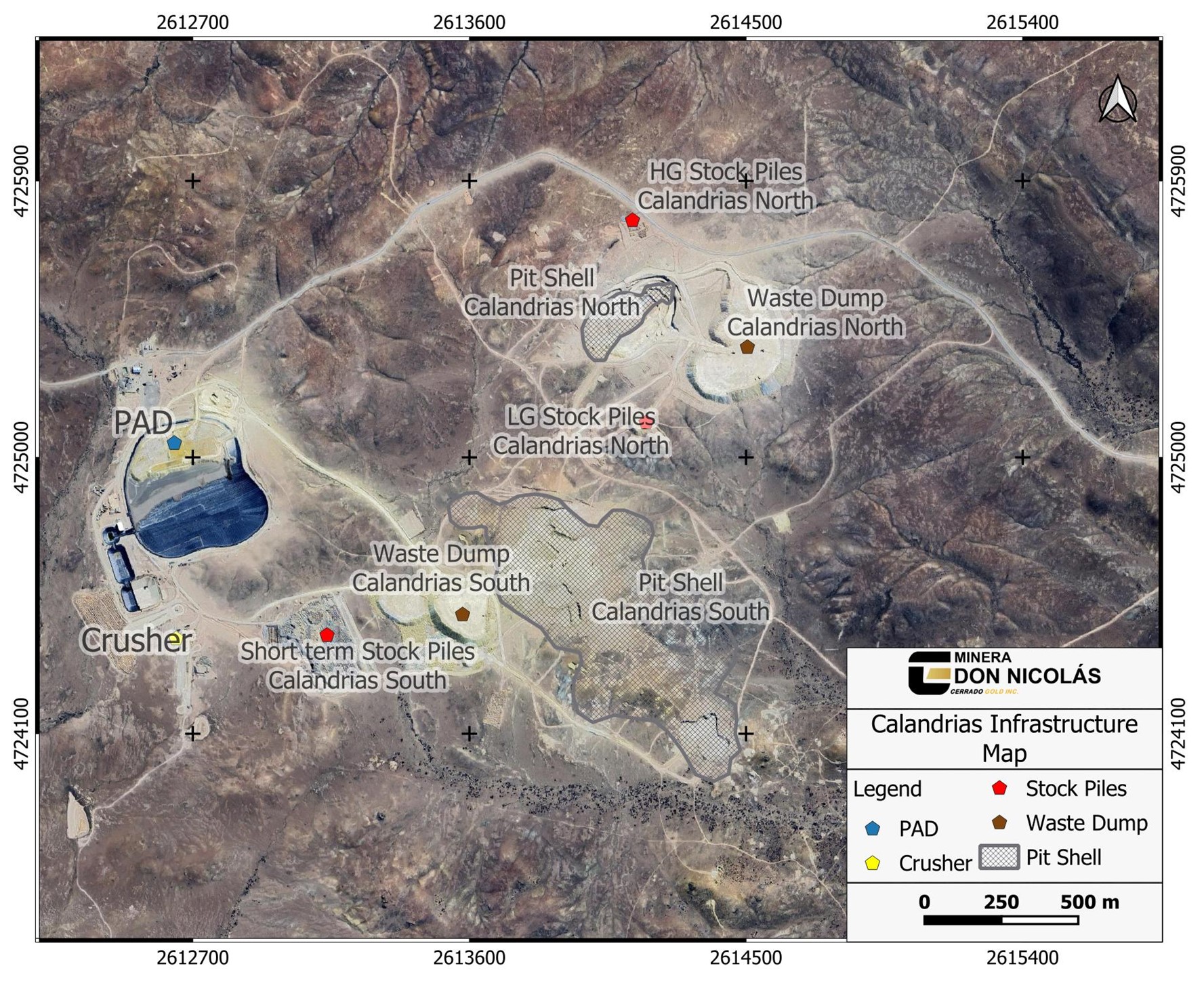

Figure 3. Calandrias complex infrastructure and mineral deposits.

Figure 4. Martinetas complex infrastructure and mineral deposits

Metallurgy and Processing

As outlined in the technical report, the metallurgical test work supports the recovery of gold by CIL process for the Calandrias Norte deposit and via heap leaching for the Calandrias Sur deposit. Gold recovery rates for Calandrias Sur varies by mineralized material type (oxide, transition and primary) from 35-70% with silver recovery of approximately 30%. Gold recovery of the higher-grade material from Calandrias Norte is targeted at 90% with silver recoveries of 61%, in line with historical averages.

Infrastructure

All infrastructure is already available on site with the exception of the expansion of the crushing capacity at Calandrias Sur used to double capacity. As noted, mineralized material from Calandrias Norte will be trucked and processed via the existing 1,000 tpd milling operations at Martinetas while crushing capacity at Calandrias Sur is in the processed of being doubled to over 10,000 tpd to support the higher production rates from late 2024 onward. A new mobile 250 tph crusher has recently been delivered to site and is in the process of being commissioned to commence ramp up in the coming weeks.

Capital Costs

No additional upfront capital costs are anticipated given the construction of the heap leaching pad and extraction circuit was completed in 2023 and pre stripping of Calandrias Norte was completed in early 2024. Remaining capital expenditures are to be funded from cash flow for the expansion of the crushing circuit at Calandrias Sur including pad expansions (US$7.1 MM), underground development (US$27.3 MM and US$6.5MM in additional drilling and studies) which began in 2024. Sustaining capital is estimated at $1.8 million per year. A closure cost of US$7 Million has been estimated beginning in 2030 with major costs in the first 3 years after closure and ongoing monitoring costs extending for a total period of 10 years after closure.

Operating Costs

The LOM mine operating costs are estimated at a total of US$4/t of ROM material moved in in the open pit and US$50/t for the underground, and processing costs depend on the processing method applied and range from $7.20/t for heap leach material and approximately $65/t when processed via the CIL plant. G&A costs are estimated at approximately US$3 million per annum. Operating costs have been benchmarked against the current operating costs and metallurgical performance.

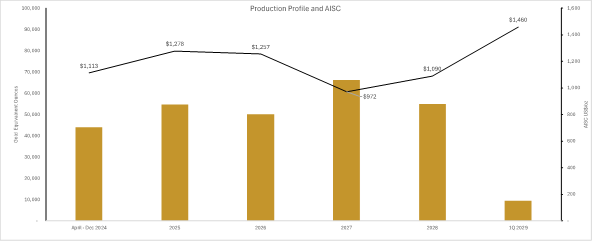

Gold Production Profile and AISC cost profile

The chart below highlights the expected production and cash cost/ AISC profile at MDN as per the PEA. Production in expected to average 55,869 GEO over the five year mine life with LOM AISC will average US$1,146 per year. The PEA outlines gold production from April onwards and excludes the production of 10,982 ozs of gold in Q1/24. A total of 15,938 oz of gold were produced in Q2/24.

Figure 5. Production Profile and AISC

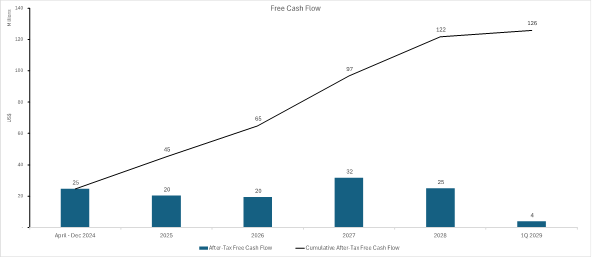

Overall Project Economics

The overall project shows potentially robust economic results with an after-tax NPV at a 5% discount rate of US$111 million at a flat gold price of $2,100/oz and Ag price of US$25/oz. Project economics are based on a potential 5 year mine life, with immediate positive after-tax cash flow commencing as at 1 April 2024. Total cumulative, after-tax free cash flow over the life of mine is estimated at US$122 million (US$25 million per annum) at a $2,100/oz gold price.

At Spot prices of US$2,400/oz of gold and US$29/oz of silver the project results with an after tax NPV at a 5% discount rate of US$153 million and average after-tax free cash flow is estimated at US$35 million per annum.

Figure 6. After-Tax Free Cash Flow

Upside Opportunities - Exploration Activities

The current PEA only considers known, easily exploitable resources and does not reflect the potential from ongoing exploration programs. In the near term the operations are focused on four initial high value target areas as noted below.

Underground Expansion in Paloma Region - Underground exploration is targeted to grow known resources from future underground exploration activities at Sulfuro and in the Sulfuro Est zones once development starts. Newly designed underground exploration ramps will allow efficient drilling targeting extensions and parallel structures of the current inventory included in the PEA.

Goleta The Goleta high grade under cover target is located approximately 7 km from Martinetas. Mineralization on surface is related to mineralized fragments of banded quartz veins (up to 1.g m in diameter) within presumably phreatic breccia. The exploration premise is that these large clasts are proximal to a primary source (high grade quartz vein system) located below the breccia. This concept is similar to the Marianas vein discovery in the Cerro Negro deposit (Newmont) also located in the Cerrado Massif.

Calandria North - The deposit is open to the Southwest following the plunge that controls the high-grade Mineralization. This target represents a potential low capital Underground development, making use of the current infrastructure in the area

Paula Andrea - Extensive exploration carried out last year outlined several areas with the potential of hosting high grade mineralization like the mined out Chulengo and Baritina pits. The are includes phreato-magmatic breccia hosted mineralization and extensional jogs along fertile structures.

Other Targets - In addition to the targets listed above numerous other targets are known on the projects such as the Chispas targets which is located along strike from the recently defined Naty deposit on the neighboring Cerro Moro operation (Pan American Silver). Various lower grade heap leach targets also remain to be more fully defined, notably the depleted resources reported for some of the mined Martinetas pits, which need to be evaluated further for extensions and viability of hybrid CIL and HL processing.

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources, and are preliminary in nature. Inferred Mineral Resources are considered to be too geologically speculative to have mining and to be used in an economic analysis except as allowed for by National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Cerrado Gold Inc. will publish a Technical Report prepared in accordance with NI 43-101 within 45 days that documents the PEA study and supports the current disclosure.

Independent Qualified Persons

Orlando Rojas, Javier Pizarro and Cristian Quezada are the Qualified Persons as defined in NI 43-101 responsible for the Technical Report and are all independent of the Company.

About GeoEstima

GeoEstima, based in Santiago, Chile, has a consolidated experience spanning over a decade. Is a specialized consulting firm in economic geology, geometallurgy, and mining, dedicated to providing services to the global minerals industry. Our mission is to offer top-tier advisory and consultancy services to clients, delivering comprehensive solutions developed by a highly experienced team deeply committed to their work.

The GeoEstima team comprises seventeen distinguished professionals, 41% of whom are women. Of these, 75% are highly qualified geologists, and 60% hold at least a master's degree in their respective fields. Furthermore, over half of the team members boast at least ten years of hands-on experience. At GeoEstima, we blend the extensive experience of our seasoned professionals with the innovative mindset of emerging talents embarking on their careers. The result is a dynamic and collaborative team that fosters innovation and continuous growth.

GeoEstima brings expertise across various areas spanning the entire mining business chain, including exploration, mine planning, mineral resource/reserve assessments, geometallurgy, strategic business planning, mining operations, financial evaluations, and exploration. Specifically, we provide guidance and consultancy in economic geology and strategic mining planning for exploration, mining, and engineering companies, as well as for acquisitions, mining planning, and control.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado, please visit our website at: www.cerradogold.com

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Cautionary Statement on Mineral Resource Estimates

All Mineral Resource estimates of the Company disclosed or referenced in this news release have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves dated May 10, 2014 ("2014 CIM Definition Standards"), whose definitions are incorporated by reference in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"):

Mineral resource: is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable.

Inferred mineral resource: is that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

Indicated mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve.

Measured mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. A measured mineral resource has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve.

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, estimates of resources, mineralized material, future business and exploration and mine and or plant development or expansion plans, estimates of market conditions and value, and commencement of operations. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on accesswire.com