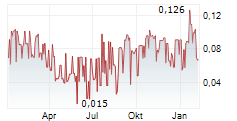

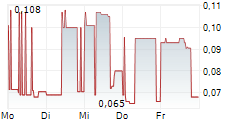

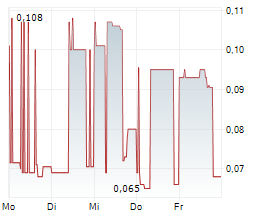

Vancouver, British Columbia--(Newsfile Corp. - August 6, 2024) - BMEX Gold Inc. (TSXV: BMEX) (FSE: 8M0) ("BMEX" or the "Company") announces that it has closed its non-brokered private placement financing which was previously announced on July 26, 2024 for gross proceeds of $1,201,244.

The Offering consisted of the sale of 2,998,300 non-flow-through units ("NFT Units") at a price of $0.15 per NFT Unit for gross non-flow through proceeds of $449,745, and the sale of 5,009,996 flow-through units ("FT Unit") at $0.15 per FT Unit for gross flow-through proceeds of $751,499. Each NFT Unit and each FT Unit consist of one common share (a "Common Share") of the Company and one full common share purchase warrant ("Warrant"), with each Warrant entitling the holder thereof to acquire one additional Common Share at a price of $0.20 per share until August 2, 2026.

The securities issued pursuant to the Offering were issued pursuant to the Listed Issuer Financing Exemption and are not subject to a statutory hold period. In consideration for services provided with respect to the Offering, the Company paid aggregate cash finder's fees of $51,359.68 to certain finders.

The gross proceeds from the sale of the FT Units will be used to further explore and evaluate the Company's Dunlop Bay project located in Quebec, Canada and proceeds from the sale of the NFT Units will be used for general and administrative expenses for the Company for the next 12 months.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About BMEX Gold Inc.

BMEX Gold Inc. is a junior Canadian mining exploration company with the primary objective to acquire, explore, and develop viable gold and base metal projects in the mining-friendly jurisdiction of Quebec, Canada. BMEX is currently fully focused its 100% interest in its two projects, both located in the prolific Abitibi greenstone belt:

- King Tut Project consists of 120 contiguous claims on 5,206 hectares

- Dunlop Bay Project consists of 76 mineral claims that cover 4,226 hectares

BMEX common shares trade under the symbol "BMEX" on the TSX-V and under the symbol 8M0 on the Frankfurt Exchange.

For further information please contact:

BMEX Gold Inc.

Robert Pryde President and CEO

Tel: +1 (403) 478-6042

Email: info@bmexgold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward-looking statements:

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, the completion of the Offering as described herein are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have', "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to obtain any necessary regulatory approvals, the termination of any agreement governing the Offering, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRES OR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/218982

SOURCE: BMEX Gold Inc