Hole V-24-075, drilled at 180 degrees to recent highlight hole V-24-072, returned 471.6 m averaging 2.38 g/t Au, including 302.1 m of 3.20 g/t Au from surface, surpassing initial Valley deposit MRE block model grade predictions by +9%

Hole V-24-073 returned 325.0 m averaging 2.57 /t Au, including 136.0 m averaging 4.84 g/t Au from surface, slightly outperforming the model near surface

Widespread alteration and associated oxide + sulphide mineralization along with granodiorite dikes seen in first-ever drilling of Aurelius target, Rogue Project

Updated NI 43-101 technical report filed for Snowline's Einarson Project, Yukon.

VANCOUVER, BC / ACCESSWIRE / August 7, 2024 / SNOWLINE GOLD CORP (TSX-V:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce analytical results from additional early-season drill holes on its 2024 exploration campaign and to provide an exploration update from its ongoing 5-drill program in Canada's Yukon Territory. Highlight intervals from the Valley deposit are summarized in Table 1 below. Holes V-24-075 and V-24-073 are the third and fourth highest ranking holes in terms of contained gold from the Valley deposit to date, with V-24-075 exceeding projections based on the initial mineral resource estimate (MRE) by 9% within the resource-limiting pit shell and by 140% outside of it (18% overall). At the Rogue Project's Aurelius target, widespread alteration with oxide and sulphide mineralization is present in volcanic and sedimentary rocks, with granodiorite dikes intersected in two holes in the first ever drill testing of the target. Drilling is ongoing at Valley and on other targets, with assays pending for an additional 15,600 m drilled to date.

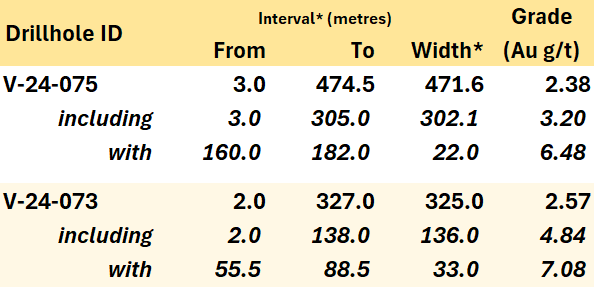

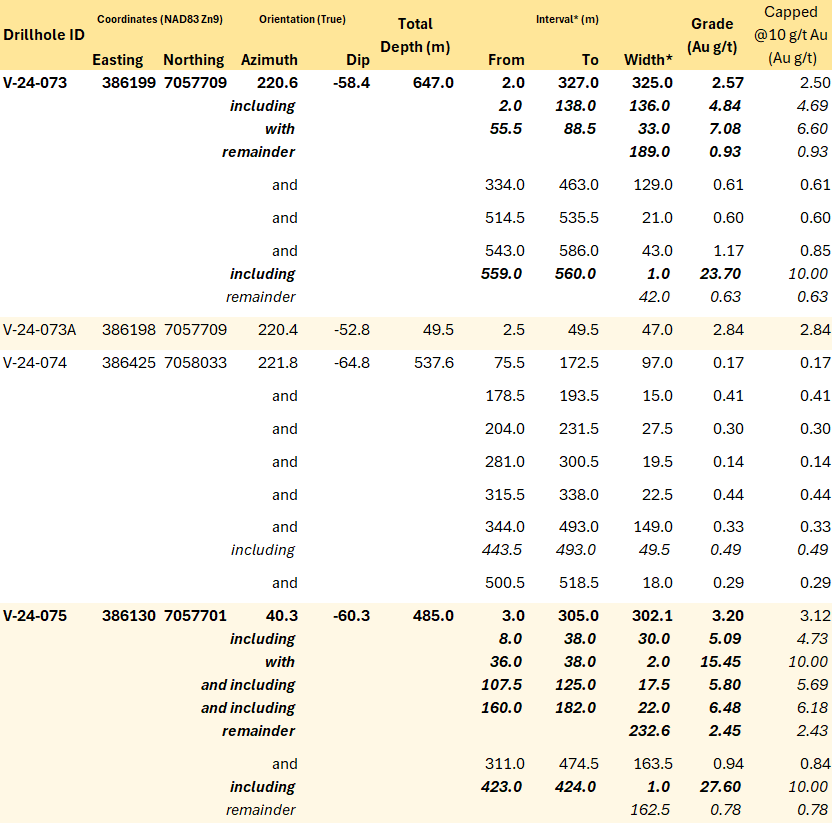

Table 1 -Highlight summary of Snowline's latest assay results. Note that the headline interval for V-24-075 comprises two intervals separated by 7 m zone of <0.1 g/t Au; see Table 2 for details. *Interval widths reported; true widths of the system are not yet known.

"We had extremely high expectations for these latest holes at Valley, and they did not disappoint," said Scott Berdahl, CEO & Director of Snowline. "Based on the block model from our initial mineral resource estimate, we would expect a run of 448 m averaging 2.1 g/t Au for hole V-24-075. We meaningfully exceeded this target in both length and grade, with the hole averaging 2.38 g/t Au over the top 471.6 m from bedrock surface, and with an internal interval of 6.48 g/t Au over 22.0 m from 160.0 m downhole exceeding the grade of anything we had predicted. The results exceed the block model most dramatically outside of the current resource estimate boundary. We expect that this demonstration of robust continuity and of viability in our modelling will assist with de-risking and upgrading mineralization, and it could potentially help to expand our resource-limiting pit shell, pending additional results from our ongoing drilling at Valley."

VALLEY DRILLING, ROGUE PROJECT

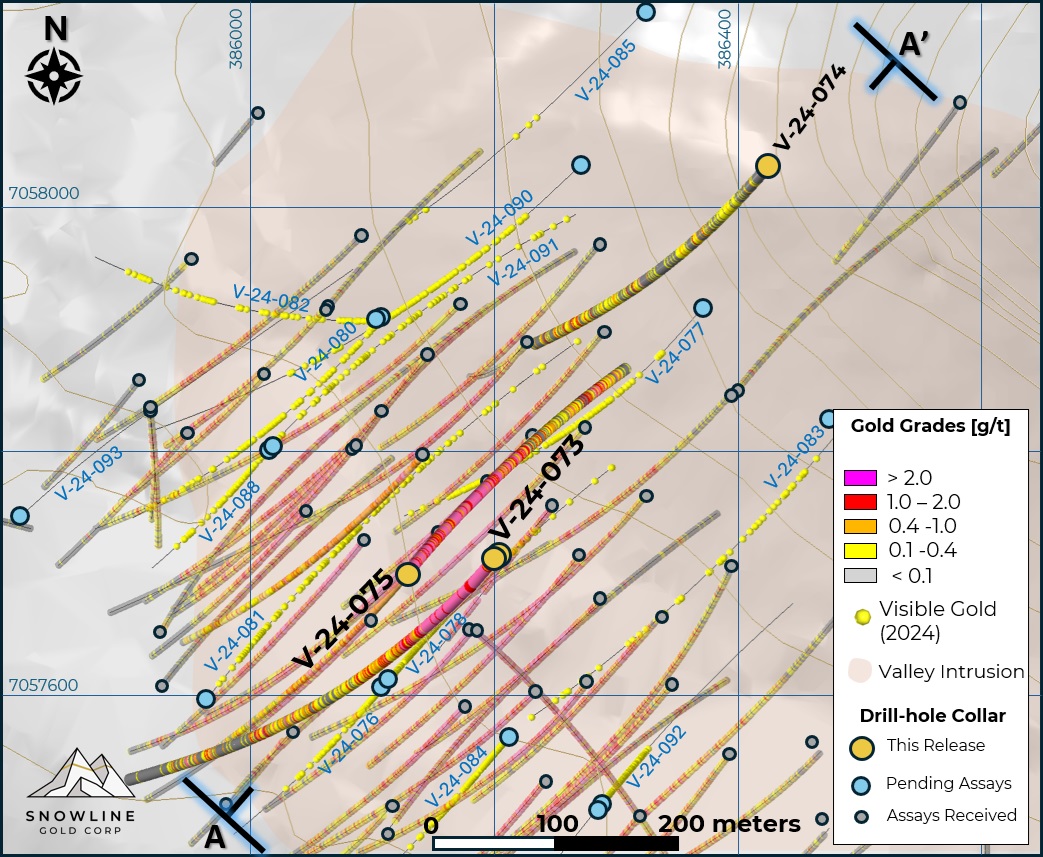

Drilling at the Rogue Project's Valley deposit is ongoing. To date, roughly 13,600 m have been drilled at Valley in 28 holes in 2024 (Figure 1). Trace instances of visible gold and sheeted quartz vein arrays have been observed both within and beyond the confines of the current, initial MRE for Valley. The Company awaits additional assay results from the ongoing drill campaign to assess the significance of these observations and their impact on the MRE.

Figure 1 - Plan map of drill results and progress on the Rogue Project's Valley deposit, highlighting current results in drill holes V-24-073 through V-24-075. Past analytical results are faded, while instances of visible gold in holes awaiting assay are marked by yellow spheres.

Hole V-24-075

Hole V-24-075 is collared within the Valley intrusion, from the same location as recent hole V-24-072 (404.8 m @ 2.27 g/t Au including 100.8 m @4.67 g/t Au from bedrock surface, see Snowline news release dated July 24, 2024) but in the opposite direction-to the northeast instead of the southwest (Figure 2). The hole was drilled in this orientation to provide infill in its upper portions and exploration along the northeast margin of the system in its lower portions. It remains primarily in coarse-grained granodiorite, the dominant phase of the intrusion, for the length of the hole.

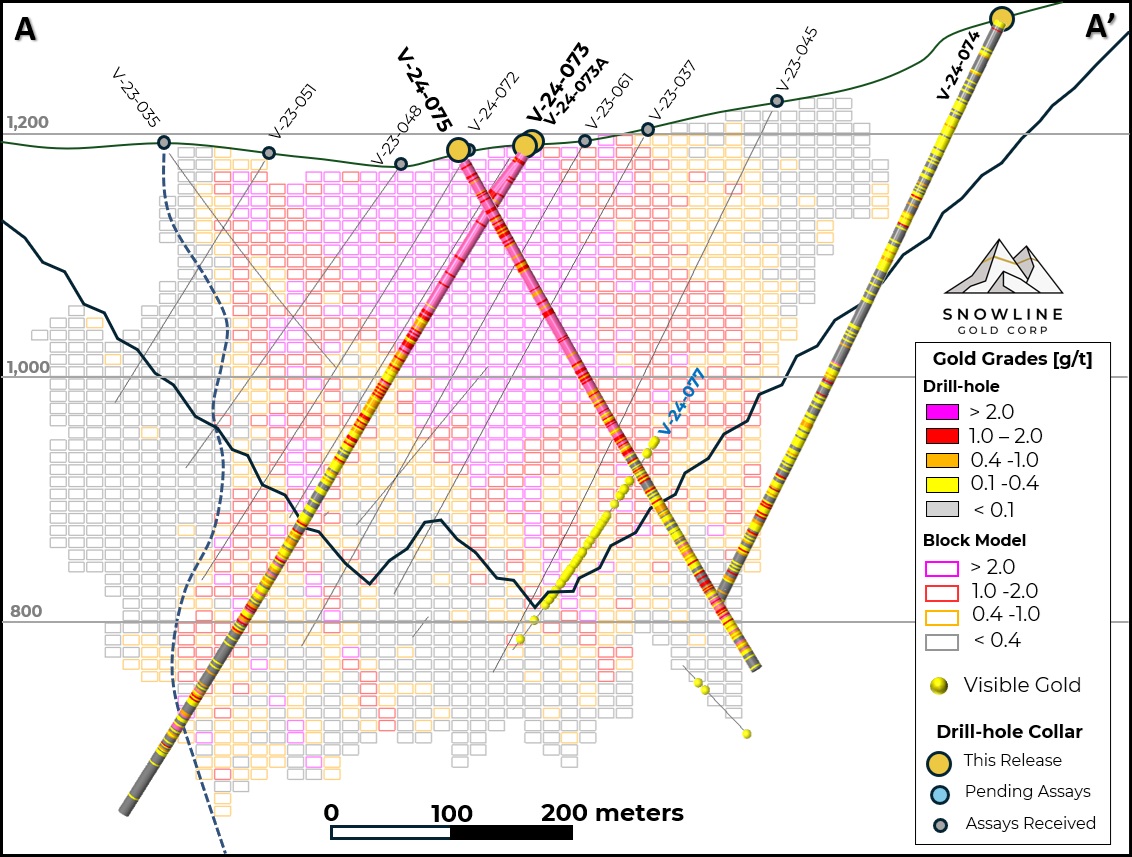

Figure 2 - Cross-section A-A', showing V-24-073 through 075 in the context of the initial Valley MRE block model and MRE-constraining revenue factor 0.72 pit shell. The block model has not been updated to reflect the current results, and blocks shown outside of the current pit shell constraint are not included in the initial MRE for Valley. Instances of visible gold in holes awaiting assay results are marked by yellow spheres. The released holes are projected onto the same plane from a total width of roughly 100 m-relative positions can be seen in the plan map in Figure 1. Hole V-24-074 is collared as a 200 m step-back from V-23-045, to assess block model data voids.

The hole averages 2.38 g/t Au over 471.6 m, with the top 302.1 m continuous interval from bedrock surface (at 3.0 m downhole) averaging 3.20 g/t Au. Within this, a 22.0 m interval from 160.0 m downhole averages 6.48 g/t Au. Gold grade continuity is a primary feature of the hole, and as with many holes drilled at Valley, the highest grades are near surface. Owing to this consistency, applying a 10 g/t Au cut-off has a limited effect on results, with the top 302.1 m interval only dropping 2.6% from 3.20 g/t Au to 3.12 g/t Au overall (Table 2).

In weighting observed grades by sample distance-effectively the amount of gold contained within the drill core-versus that predicted for the hole by the Company's initial mineral resource estimate, the results outperform the MRE by 18% overall, and by 9% within the top 322 m downhole from bedrock surface. V-24-075 exits the current MRE pit-constraint at approximately 322 m downhole, and thus all mineralization below this point, including 152.5 m of the 163.5 m downhole interval averaging 0.94 g/t from 311.0 m downhole (Table 2) are outside of the space considered in the present, initial MRE, outperforming the block model for this area by 140%. The ultimate effect of this result will be quantified along with analytical results of all subsequent holes in an updated mineral resource estimate at a later time.

Figure 3 - Mineralization in V-24-075. Quartz carbonate veins cut through relatively unaltered granodiorite. Orange and blue flags denote observations of trace visible gold within the drill core, with the gold itself hosted in the veins. The 8.0 m downhole interval shown from 117.0 m to 125.0 m downhole averages 6.56 g/t Au. While such grades are among higher values for the hole (see Table 2), the image is representative of mineralization throughout the hole and across much of the rest of the Valley gold deposit, with a higher abundance of veins generally corresponding to higher gold grades.

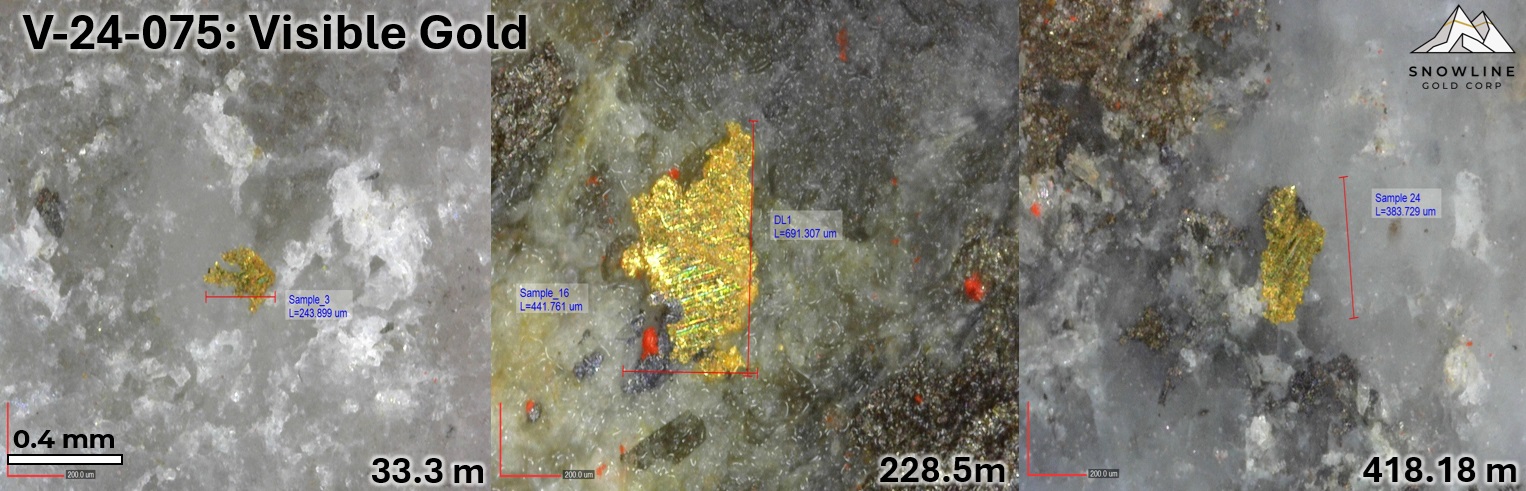

Figure 4 - Select instances of visible gold in V-24-075, at 33.3 m, 228.5m and 418.2 m downhole. As with other holes at Valley, gold is present in V-24-075 within multiple generations of quartz veins, occurring primarily as native gold and commonly associated with trace to minor bismuthinite. 221 different veins throughout the 485.0 m length of V-24-075 were observed to host trace visible gold.

Hole V-24-073

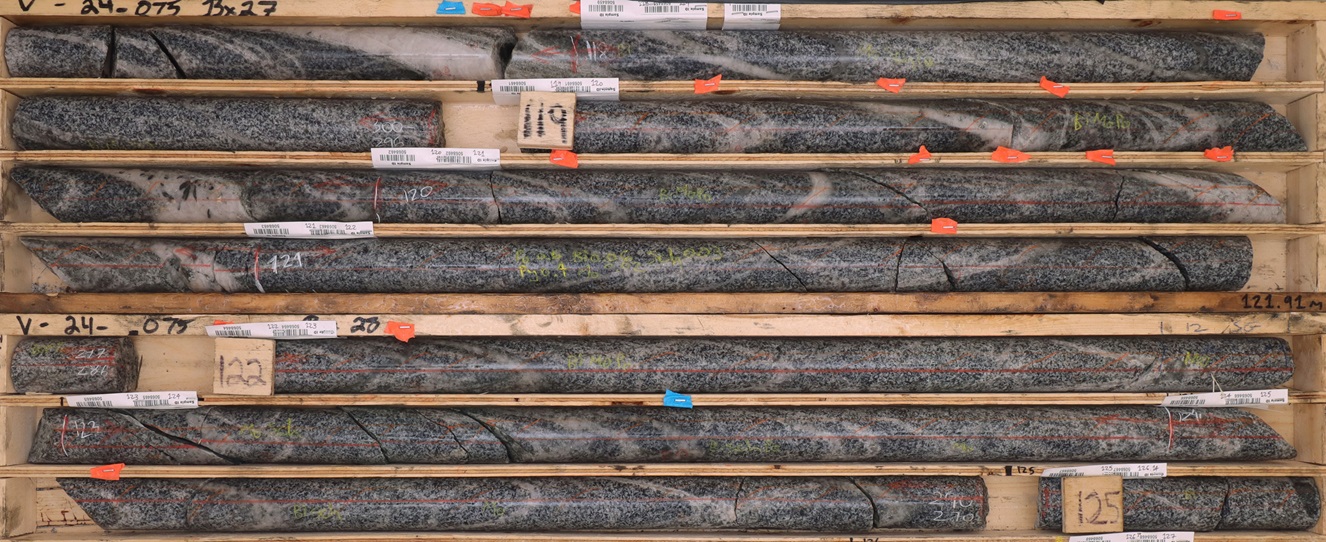

Hole V-24-073 is also collared in the Valley intrusion, as just the second hole in a new 50 m "fence" across the Valley deposit. It is located 54 m from and nearly on strike with V-23-039 (553.8 m @ 2.48 g/t Au from surface including 132.0 m @ 4.98 g/t Au, see Snowline news release dated August 3, 2023). The only other complete, non-metallurgical hole currently on section with V-24-073 is V-23-066 (383.0 m @ 2.00 g/t Au including 107.5 m @ 3.95 g/t Au from surface, see Snowline news release dated January 15, 2024), collared roughly 64 m to the northeast. (A PQ-sized metallurgical hole was drilled from the collar site of V-23-066 late in the 2023 field season.) The hole begins in the high-grade, near surface zone of gold mineralization and ends at 647.0 m shortly after exiting the intrusion through a 49.0 m zone of dikes and intrusive breccia into surrounding hornfels from 568 m to 617.0 m downhole.

The first continuously mineralized interval in V-24-073 averages 2.57 g/t Au over 325.0 m, including 136.0 m at 4.84 g/t Au from bedrock surface at 2.0 m downhole, with a 33.0 m stretch of mineralization averaging 7.08 g/t Au from 55.5 m downhole (Table 2). This high grade, near surface zone is consistent with those seen in surrounding holes, demonstrating strong continuity of multiple gram-per-tonne gold mineralization within this high-level zone at Valley. The top 584.0 m of the hole from bedrock surface, including barren intervals, averages 1.68 g/t Au.

Table 2 - Summary of significant mineralization returned from current holes at Valley. The consistency of strong mineralization in the deposit is reinforced by the capped values in the rightmost column, wherein any assay result >10 g/t Au is replaced by 10.0 g/t Au to calculate the average interval grades. V-24-073A was aborted at 49.5 m downhole due to an incorrect dip and was redrilled as V-24-073 from the same location. Note that the headline interval for V-24-075 is a combination of two separate mineralized intervals separated by a small (6 m) gap below <0.1 g/t Au. *Interval widths reported; true widths of the system are not yet known, with different vein generations, orientations, and grade distributions present within various intervals through the bulk tonnage gold target at Valley.

EXPLORATION UPDATES

Snowline currently has three drill rigs active on regional targets in the vicinity of Valley: one each on the Rogue Project's reduced intrusion-related gold system (RIRGS) Reid and Sydney targets, and one on the Einarson Project's Jupiter orogenic gold target. To date in 2024, 1,184 m has been drilled in 3 holes at Aurelius and 2,407 m has been drilled in 6 holes at Jupiter, while Phase II drilling has recently commenced at Reid and Phase I drilling is scheduled to begin imminently at Sydney. Including the 1,067 m, 3-hole Phase II program completed earlier in the season at Cujo, assays are currently pending for more than 4,600 m on regional targets.

Aurelius Target, Rogue Project

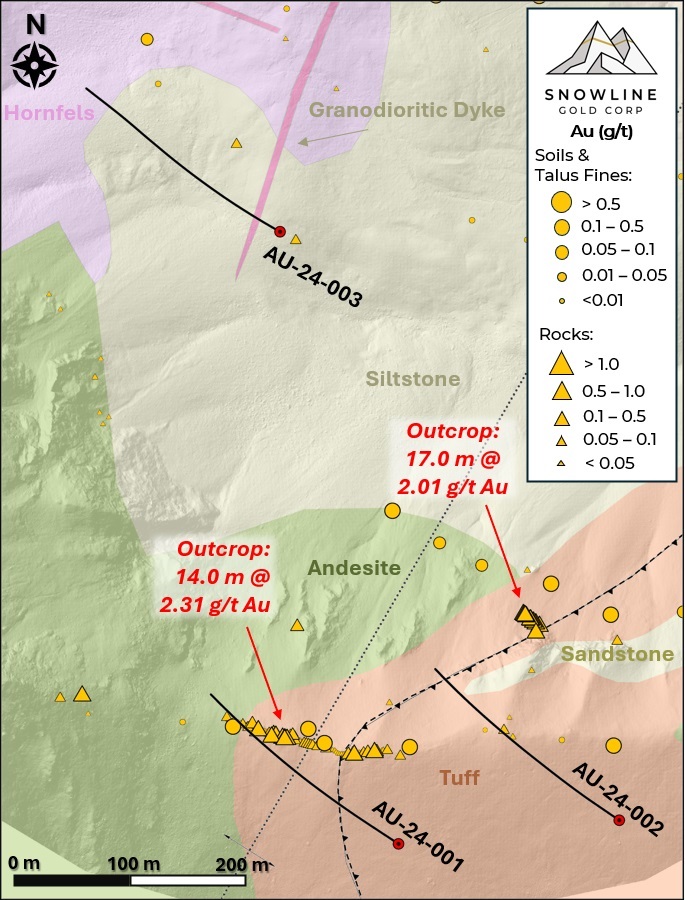

A 3-hole, 1,184 Phase I drilling program has recently been completed at the Aurelius target, representing the first-ever drill testing of the recently delineated target. Widespread clay and silica alteration and zones of brecciation cemented by pyrite and minor chalcopyrite are present in drill holes at Aurelius, along with strong, pervasive oxidation to roughly 70 m vertical depth (Figure 8).

At Aurelius, a thick unit of lapilli tuff appears to be a receptive host to fluids thought to be associated with an RIRGS system. Zones of mineralization observed in drill holes correspond in alteration style and host rock lithology to the mineralized trenches reported from the Aurelius target earlier this year (see Snowline news release dated February 20, 2024). Of note, holes AU-24-001 and AU-24-003 also encountered metre-scale granodiorite dikes with equigranular and porphyritic textures.

Assays for all holes (1,184 m) at Aurelius are pending. The drill rig is currently mobilizing for the first-ever drill testing of the Sydney RIRGS target on the Company's 100% owned Cynthia Project, south of the Rogue Project (Figure 7). A follow-up Phase II drill program at the Aurelius target may follow later in 2024, pending analytical results from the current drilling.

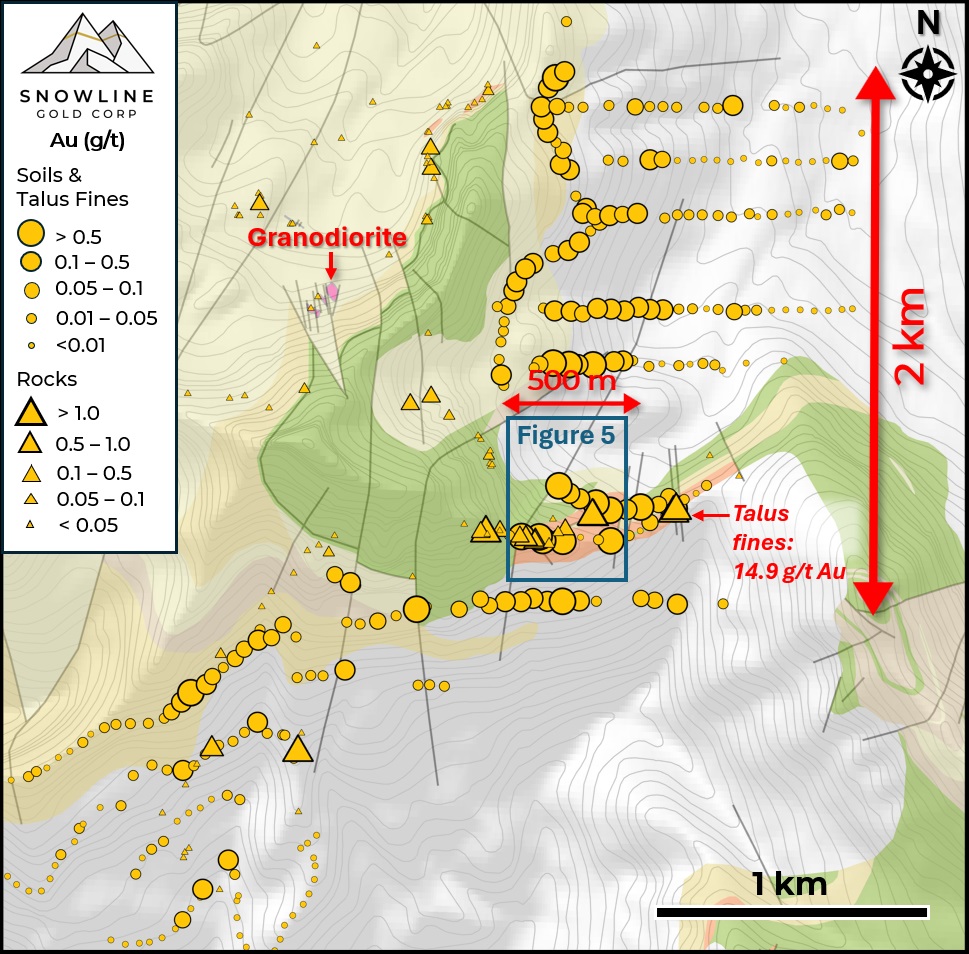

Figure 5 - Plan map of drill traces from Phase I drilling at the Rogue Project's Aurelius target, plotted on geology, geochemistry, and high-resolution shaded surface relief. The location of this figure within the broader Aurelius target geochemical anomaly can be seen in Figure 6.

Figure 6 - Plan map of surface geochemistry at the Rogue Project's Aurelius target, highlighting the scale and intensity of the open-ended anomaly that is interpreted as an upper level of a RIRGS. The 2024 Phase I drill program is located within the blue square, as detailed in Figure 5.

Figure 7 - Hydrothermal breccia in AU-24-002, at roughly 220 m downhole (the interval for this instance of the breccia texture is 211 to 224 m, true width unclear). The breccia is cemented by fine dark pyrite with weak chalcopyrite along with variably silicified rock flour, with fragments of lapilli tuff, volcanic sandstone and silica-altered rock.

Figure 8 - Oxide mineralization in AU-24-001, from 46.6 to 59.3 m downhole, showing hydrothermal crackle breccia with goethite cement, angular fragments of silicified and strongly muscovite-altered lapilli tuff and volcanic sedimentary rocks, continuing into lapilli tuff with silica-dickite alteration. Traces of bismuthinite have been observed in partially oxidized sulphide veins.

EINARSON PROJECT TECHNICAL REPORT

The Company has filed an updated technical report for its Einarson Project. The report, entitled "NI 43-101 Technical Report on the Einarson Gold Project" with an effective date of May 24, 2024, is prepared in accordance with National Instrument 43-101: Standards of Disclosure for Mineral Projects (NI 43-101) standards. The report can be found under the Company's profile on SEDAR+ and on the Company's website (snowlinegold.com).

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's "Forks" Camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

For the purposes of this release, contiguous mineralized intervals are defined as runs of mineralization with no break >5.0 m assaying <0.1 g/t Au, including any subsections thereof. The headline interval in V-24-075 (471.6 m of 2.38 g/t Au) is a composite of two intervals with an intervening 6 m gap of <0.1 g/t Au material, as seen in Table 2.

ABOUT ROGUE

Snowline Gold's 100%-owned Rogue Project, in Canada's Yukon Territory, covers a 60 x 30 km cluster of intrusions in the eastern Tombstone Gold Belt known as the Rogue Plutonic Complex.

Since its launch in 2021, Snowline has progressed the Rogue Project's Valley target from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with 4.05 Moz gold indicated mineral resource at 1.66 g/t Au and an additional 3.26 Moz inferred mineral resource at 1.25 g/t Au within a pit-shell constraint. The resource estimate numbers are supported by the recent technical report for Rogue, prepared in accordance with NI 43-101 standards, entitled "Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate," authored by Heather Burrell, P. Geo., Daniel J. Redmond, P. Geo., and Steven C. Haggarty, P. Eng., with an effective date of May 15, 2024.

Exploration of the open Valley system is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross's Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

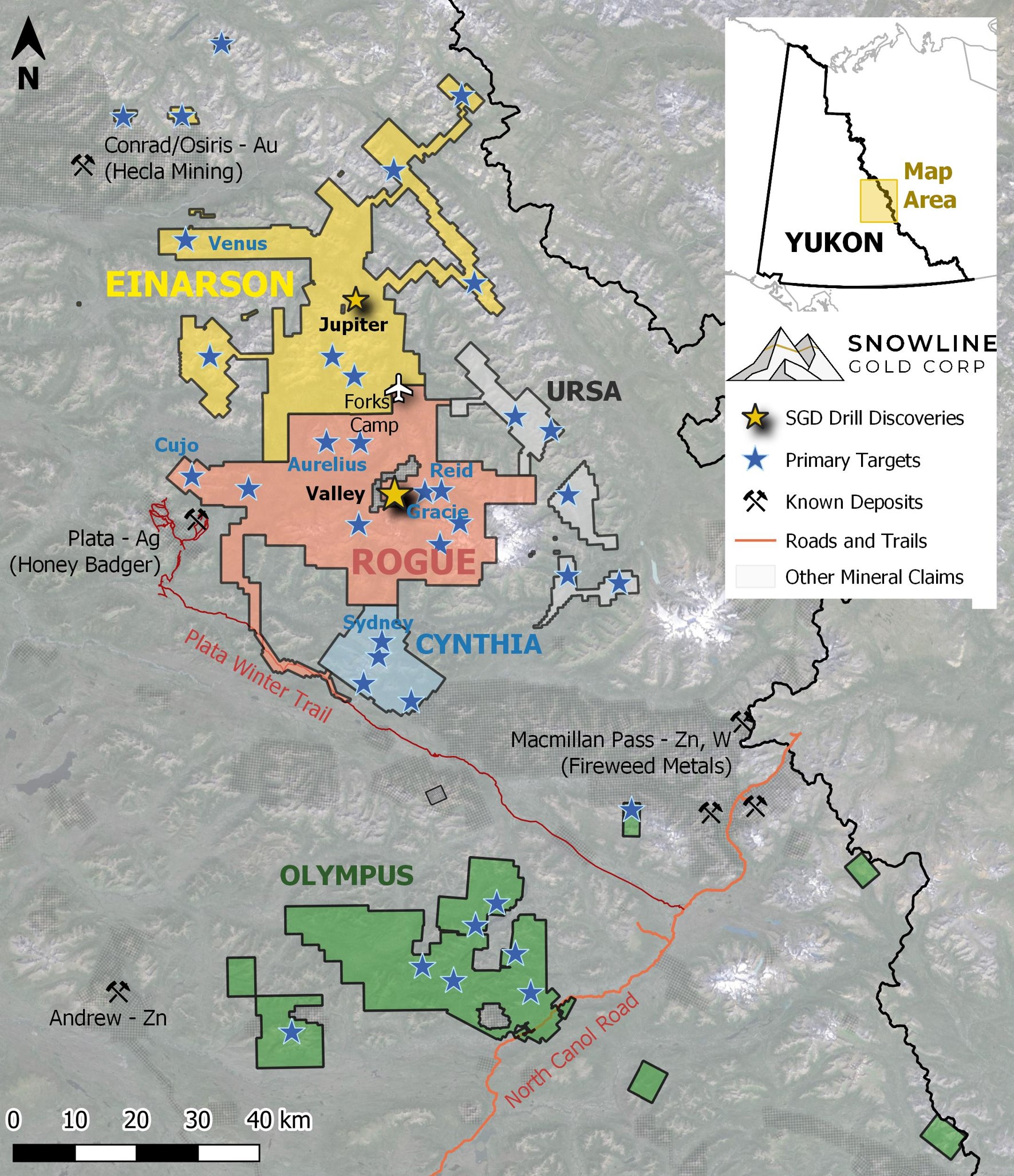

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering roughly 360,000 ha (3,600 km 2). The Company is exploring its flagship 111,000 ha (1,110 km 2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits. The Company's first-mover position and extensive exploration database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

Figure 9 - Project location map for Snowline Gold's eastern Selwyn Basin properties: Rogue, Einarson, Ursa, Cynthia and Olympus. The Valley target is one of several prospective reduced intrusion-related gold targets on the broader 30 x 60 km Rogue Project.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the significance of visual drill core observations, the potential effects of current analytical results on future mineral resource estimates, the discovery potential within the Valley intrusion and on other exploration targets, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com