MONTREAL and TORONTO, Aug. 09, 2024 (GLOBE NEWSWIRE) -- Harfang Exploration Inc. (TSX.V: HAR) ("Harfang") and NewOrigin Gold Corp. (TSX.V: NEWO) ("NewOrigin") are pleased to announce that they have entered into a definitive arrangement agreement dated August 8, 2024 (the "Agreement") pursuant to which Harfang has agreed, subject to certain conditions, to acquire all the issued and outstanding common shares of NewOrigin (the "NewOrigin Shares") that it does not already own or may acquire (the "Transaction"). Following completion of the Transaction, it is expected that the shareholders of NewOrigin will own approximately 20% of the issued and outstanding common shares of Harfang (the "Harfang Shares").

Pursuant to the terms of the Transaction, and as further discussed below (see Transaction Details), the expected share exchange ratio is 0.25694426 of a Harfang Share for each NewOrigin Share (except for any NewOrigin Shares held by Harfang, as applicable) (the "Exchange Ratio"), subject to adjustment in accordance with the Agreement. Warrants and stock options of NewOrigin will be adjusted or exchanged to become warrants and stock options, respectively, of Harfang based on the Exchange Ratio.

This Exchange Ratio implies a purchase price of $0.0229 per NewOrigin Share or gross consideration of $1.44 million, based on 10-day volume weighted average price (the "VWAP") of the Harfang Shares of $0.0893 ending on August 8, 2024. This represents an approximate 14.7% premium over the 10-day VWAP ending on August 8, 2024 of the NewOrigin Shares on the TSX Venture Exchange (the "TSXV").

Transaction Highlights

The Transaction offers several positive direct benefits to the shareholders of Harfang and NewOrigin, including:

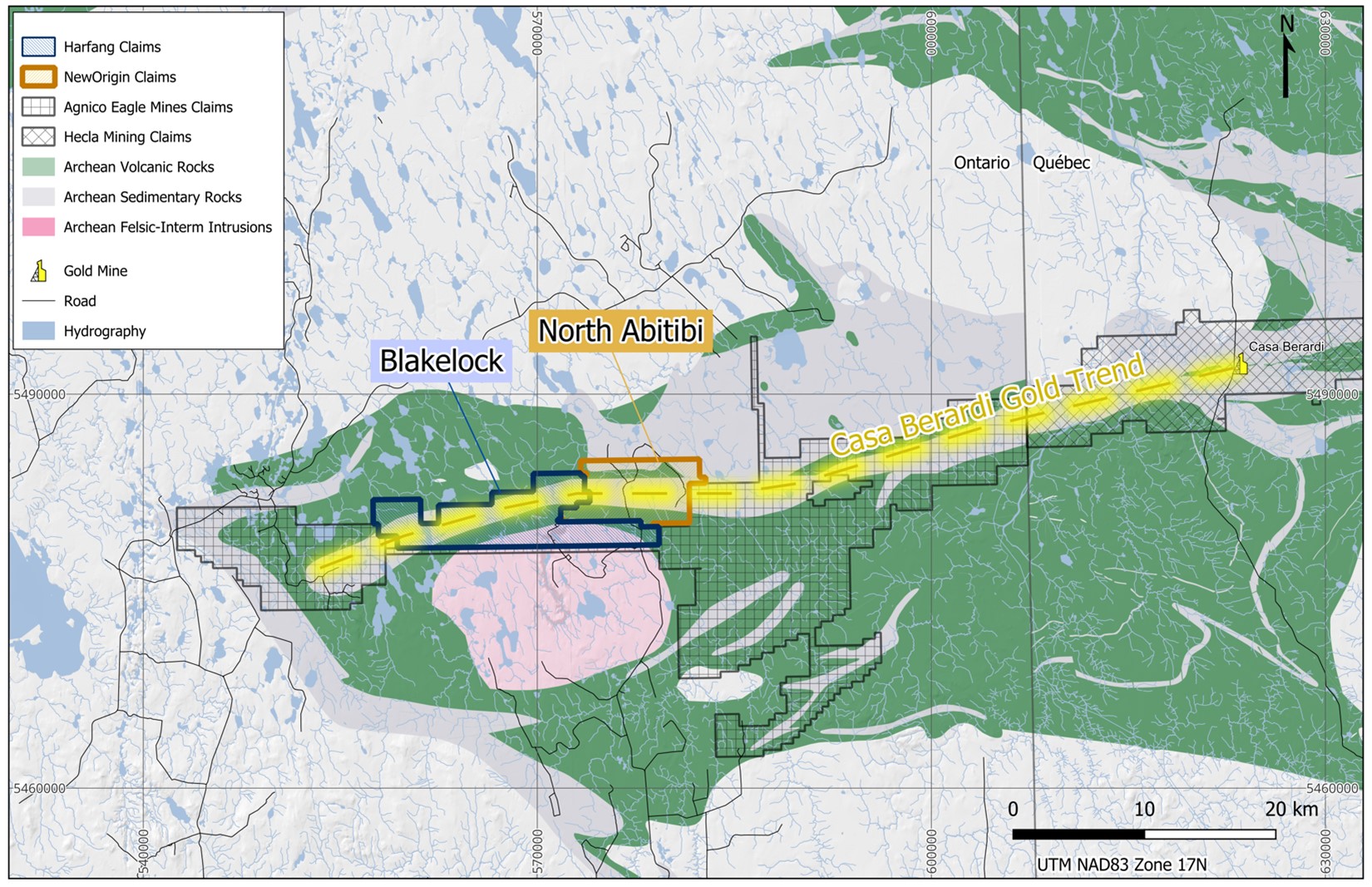

- 25-kilometre Strike Length Along the Prolific Casa Berardi Deformation Zone: combining Harfang's Blakelock project and NewOrigin's North Abitibi project results in an asset with a consolidated area of more than 11,000 hectares over a combined 25km strike length along a prolific deformation zone (Figure 1).

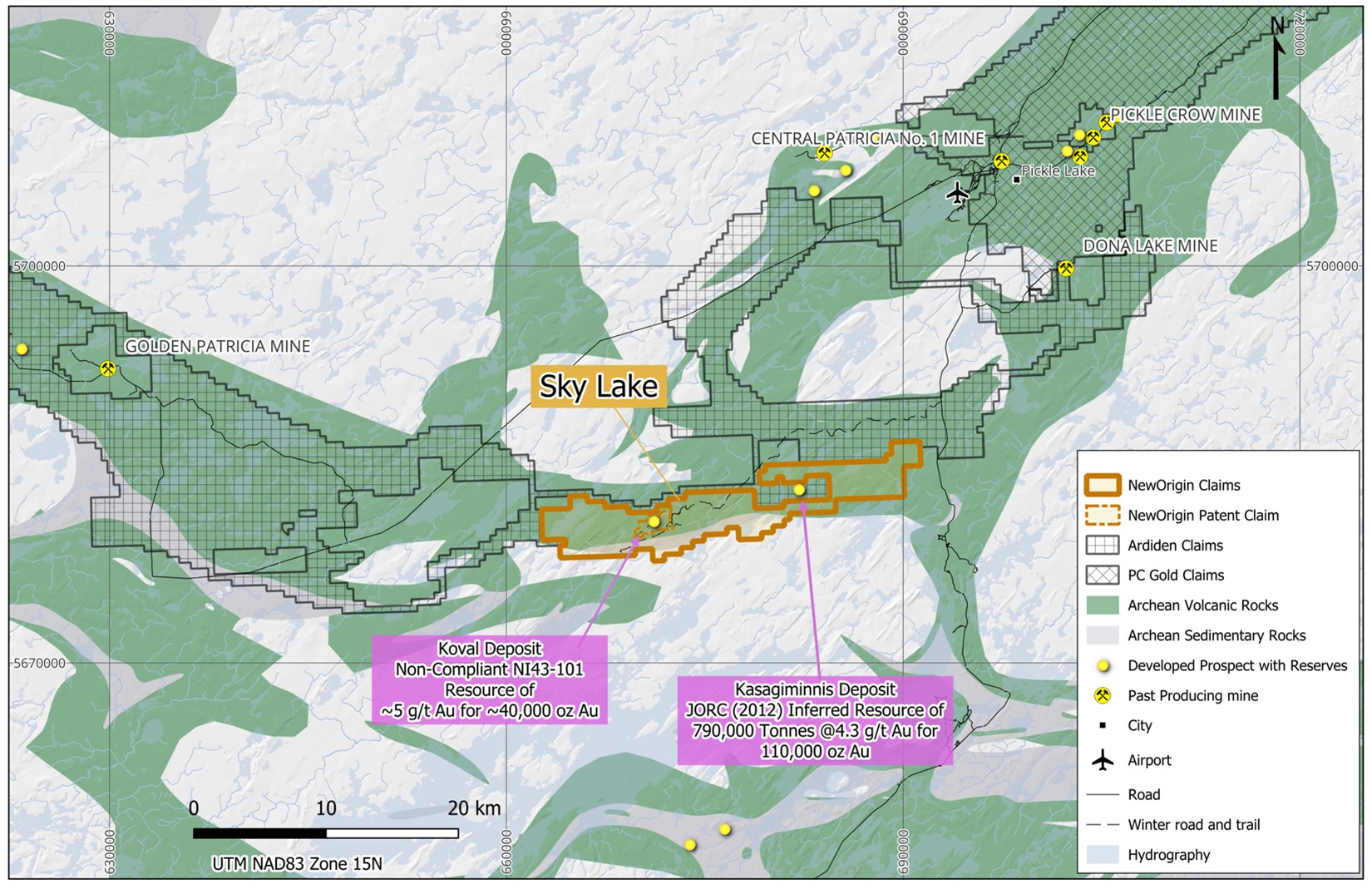

- Underexplored Asset in the Pickle Lake Gold Camp: the Sky Lake Gold Project covers 9,100 hectares over a 27km strike length in a favourable geological setting (Figure 2). Please see the technical report titled "Technical Report on the Sky Lake Gold Project Patricia Mining Division Ontario, Canada" with an effective date of March 31, 2023 and report date of April 6, 2023 which is available on NewOrigin's issuer profile on SEDAR+ at www.sedarplus.ca.

- Polymetallic Potential at South Abitibi in a Renewed Mining Camp: The South Abitibi Project benefits from exceptional infrastructures and a year-round road access, where VTEM and IP work suggest the potential for high priority targets along a 2 km length of underexplored anomalies associated with Ni-Cu mineralization.

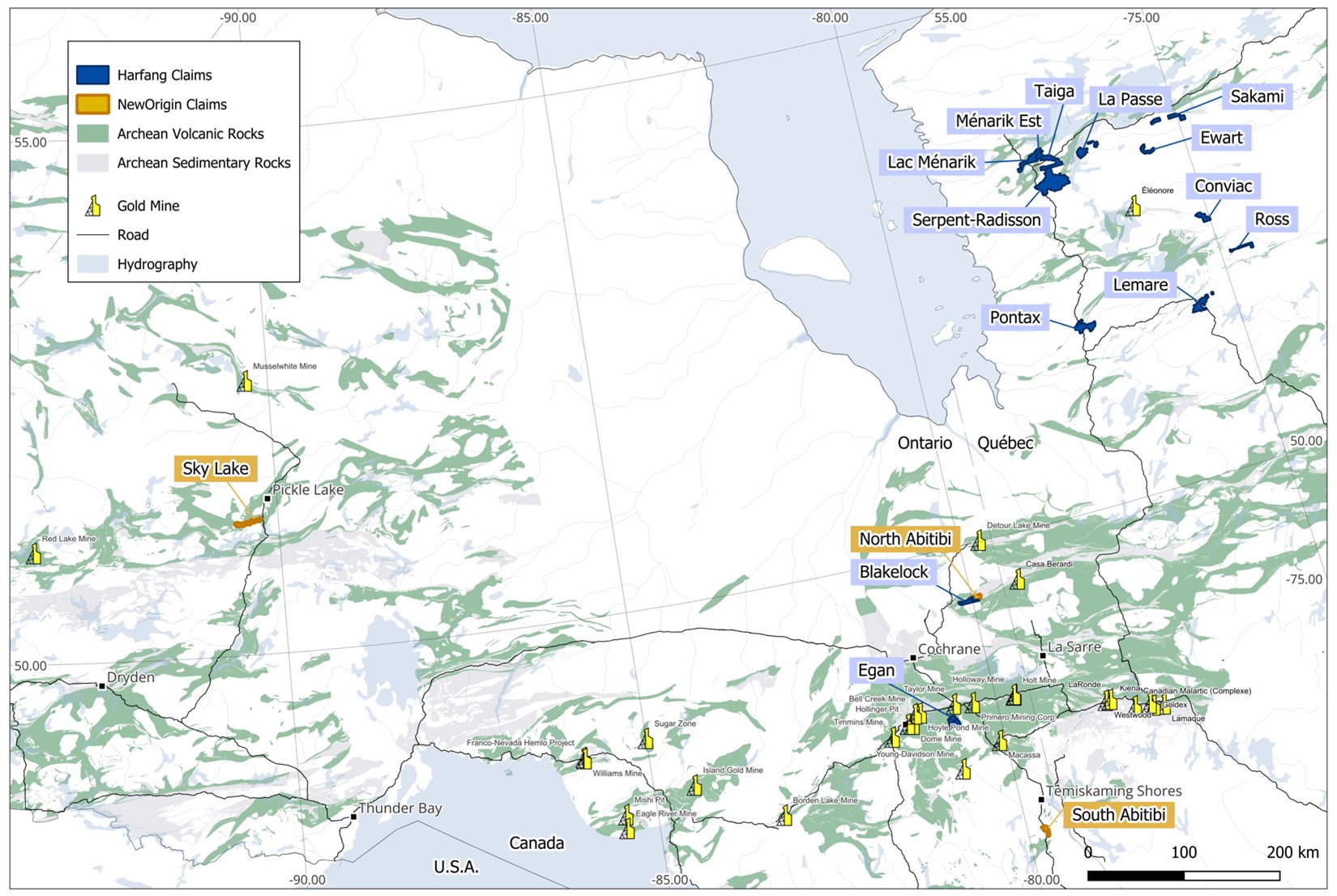

- Accelerated Growth Potential: adds significant depth to the asset portfolio and sets Harfang up for a greater potential of discovery (Figure 3).

- Additional Exposure to Ontario: the Transaction will result in a more balanced overall portfolio in Quebec and Ontario allowing Harfang to explore year-round and benefit from Ontario's infrastructure.

- Promotes Capital Efficiency in the Mining Industry: with over 1,100 mining companies listed on the TSX and TSXV, business combinations that consolidate assets and management teams are critical to drastically increasing the efficient use of resources.

"The acquisition of NewOrigin comes at an opportune time for Harfang to diversify and strengthen our portfolio," commented Vincent Dubé-Bourgeois, Interim President and CEO of Harfang. "With a new and highly engaged management team, these additional assets will accelerate our growth by increasing our ground along the Casa Berardi and gaining an underexplored asset in the incredible Pickle Lake mining camp. I truly believe this transaction will create significant value for existing Harfang shareholders, and I look forward to welcoming the NewOrigin shareholders and creating value for them as well."

"We are delighted that Harfang views NewOrigin as an important and strategic acquisition," commented Robert Valliant, Chairman and Interim CEO of NewOrigin. "We can now move forward as Harfang shareholders and share in ownership of a well-funded group with demonstrated access to capital and an energetic management team. It is also a testament to the work completed and prospectivity of our assets and will clearly benefit the ability to rapidly advance NewOrigin's key properties at Sky Lake and North Abitibi."

Board and Management

Upon closing of the Transaction, Robert Valliant will join Harfang's Board of Directors. As a result, Harfang's Board of Directors and management team be comprised of the following individuals:

| Board of Directors | Management Team |

|

|

Transaction Details

Prior to the completion of the Transaction, NewOrigin expects to complete a series of shares for debt transactions pursuant to which it will issue NewOrigin Shares to settle several outstanding accounts and loans, currently payable to certain current and former directors and officers of NewOrigin (including wholly-owned corporations thereof) and service providers, for a total amount of $181,110.50 (the "Shares for Debt Transactions"). Assuming the Shares for Debt Transactions are settled in the foregoing total aggregate amount, NewOrigin expects to issue 6,037,017 NewOrigin Shares at a deemed price of $0.03 per NewOrigin Share in connection with the Shares for Debt Transactions. The Shares for Debt Transactions are being consummated at approximately a 50% premium to the 10-day VWAP ending on August 8, 2024 of the NewOrigin Shares on the TSXV.

Under the terms of the Transaction, the Exchange Ratio will be adjusted depending on the number of NewOrigin Shares issued in the Shares for Debt Transactions such that the shareholders of NewOrigin will own approximately 20% of the issued and outstanding Harfang Shares regardless of the number of NewOrigin Shares issued in the Shares for Debt Transactions. Assuming the Shares for Debt Transactions are completed on the terms described above, the shareholders of NewOrigin will receive 0.25694426 of a Harfang Share in exchange for each NewOrigin Share.

The share exchange ratio in the Agreement provides for an exchange ratio of 0.28420966 of a Harfang Shares for each NewOrigin Share issued and outstanding as at the date hereof, however the Agreement provides that the Exchange Ratio will be adjusted to provide the NewOrigin shareholders (except Harfang, as applicable) the same economic effect as contemplated by the Agreement prior to such Shares for Debt Transactions, given the intent that existing NewOrigin shareholders (except Harfang, as applicable) will own approximately 20% of the issued and outstanding Harfang Shares immediately following the completion of the Transaction. NewOrigin may furthermore settle additional outstanding accounts payable in NewOrigin Shares at the condition that the aggregate amount of the Shares for Debt Transactions does not exceed $220,000, thereby further affecting the Exchange Ratio. It is a condition of the Agreement that NewOrigin complete the Shares for Debt Transactions prior to the completion of the Arrangement, subject to the approval of the TSXV. The NewOrigin Shares to be issued pursuant to Shares for Debt Transaction will be subject to a four month and one day statutory hold period from the date of issuance.

Harfang and NewOrigin have entered into a subscription agreement pursuant to which, as soon as reasonably practicable, NewOrigin will issue to Harfang a convertible debenture pursuant to which Harfang will loan a principal amount of $250,000 to NewOrigin (the "Debenture"). The principal amount of the Debenture will bear interest at a rate of 11.95% per annum. The proceeds arising from the Debenture are expected to be used by NewOrigin to pay certain accounts payable and loans currently outstanding, as well as various transaction fees. The maturity date of the Debenture will be the earlier of the closing of the Transaction and January 31, 2025. Subject to certain conditions, the principal amount of the Debenture will be convertible into NewOrigin Shares at a price of $0.05 per NewOrigin Share.

The Transaction will be completed by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) and will require the approval of the Ontario Superior Court of Justice (Commercial List) and the approval by 66?% of the votes cast by NewOrigin shareholders at a meeting of NewOrigin shareholders to be held no later than November 30, 2024 (the "NewOrigin Meeting"). The Transaction is expected to be completed shortly following the NewOrigin Meeting.

The Agreement includes customary representations and warranties of each party, non-solicitation covenants by NewOrigin, "right-to-match" provisions in favour of Harfang in the event of a Superior Proposal (within the meaning of the Agreement), as well as a covenant of Harfang to ensure that all mineral claims related to the Sky Lake, North Abitibi and South Abitibi Projects remain in good standing beginning on the date of the Agreement. A termination fee of $100,000 may be payable by either party in the case of certain termination events.

Directors and officers of NewOrigin holding an aggregate number of NewOrigin Shares which represent approximately 14.09% of the currently outstanding NewOrigin Shares have entered into customary support agreements with Harfang to vote their shares in favour of the Transaction.

The completion of the Transaction, Debenture and Shares for Debt Transactions remains subject to customary conditions, including receipt of all necessary court, shareholder and regulatory approvals.

Jean-Pierre Janson, Chairman of Harfang, is also a director of NewOrigin. As such, Harfang and NewOrigin are "Non-Arm's Length Parties" within the meaning of the policies of the TSXV. Jean-Pierre Janson did not take part in any deliberations or votes relating to the Transaction within each respective board of directors. Harfang and NewOrigin consider that the Transaction has been negotiated at arm's length and is not a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transaction ("MI 61-101").

Further information regarding the Transaction will be included in the management information circular to be prepared by NewOrigin (the "NewOrigin Circular") and mailed to its securityholders in connection with the NewOrigin Meeting. All securityholders of NewOrigin are urged to read the NewOrigin Circular once available, as it will contain important additional information concerning the Transaction.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and securities issued in the Transaction are anticipated to be issued in reliance on the exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) thereof and will be issued pursuant to similar exemptions from applicable state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

NewOrigin Board Recommendation

The board of directors of NewOrigin (except for Jean-Pierre Janson who declared his interest and did not participate in any deliberations or vote regarding the Transaction), following a review of the terms and conditions of the Agreement and consideration of a number of factors, including the receipt of a fairness opinion from its advisors, has unanimously determined that the Transaction is in the best interests of NewOrigin and will recommend that NewOrigin shareholders vote in favour of the Agreement. Prior to the execution of the Agreement, Working Capital Corporation provided a fairness opinion that, based upon and subject to the assumptions, limitations and qualifications in such opinion, the consideration to be received by the NewOrigin shareholders is fair, from a financial point of view to NewOrigin shareholders. A summary of the fairness opinion will be included in the NewOrigin Circular.

NewOrigin Delisting and SEDAR+

If the Transaction is completed, the NewOrigin Shares will be delisted from the TSXV. A copy of the Agreement will be available through NewOrigin and Harfang's filings with the applicable securities regulatory authorities in Canada on SEDAR+ at www.sedarplus.ca.

Shares for Debt Related Party Disclosure

Certain directors and officers of NewOrigin will be issued NewOrigin Shares in connection with the Shares for Debt Transactions, accordingly, such issuance of NewOrigin Shares to insiders of the NewOrigin will be considered a "related party transaction" within the meaning of MI 61-101. NewOrigin is relying on the exemption from the requirement for a formal valuation and minority shareholder approval under MI 61-101 on the basis of the exemptions contained in section 5.5(1)(a) and section 5.7(1)(a) of MI 61-101, as the fair market value of the consideration of the NewOrigin Shares to be issued to such directors and officers of NewOrigin in connection with the Shares for Debt Transaction is not expected to exceed 25% of NewOrigin's market capitalization.

Advisors and Counsel

Evans & Evans, Inc. is acting as financial advisor and Fasken Martineau DuMoulin LLP is acting as legal counsel to Harfang.

Working Capital Corporation has provided NewOrigin with a fairness opinion in respect of the Agreement and Peterson McVicar LLP is acting as legal counsel to NewOrigin.

Qualified Person

Ludovic Bigot, P.Geo., VP Exploration of Harfang, and Mr. Mark Petersen, P. Geo, have reviewed and approved the technical information contained in this news release. Mr. Bigot and Mr. Petersen are qualified persons within the meaning of National Instrument 43-101- Standards of Disclosure for Mineral Projects.

About Harfang Exploration Inc.

Harfang Exploration Inc. is a well-financed technically driven mineral exploration company with the primary mission to discover ore deposits in Québec and Ontario. The Company is managed by an experienced team of industry professionals with a proven track record of success and controls a portfolio of highly prospective projects. Harfang is dedicated to best practices through engagement with all stakeholders and commitment to the environment.

About NewOrigin Gold Corp.

NewOrigin Gold Corp. is a Canadian mineral exploration company focused on making discoveries at its portfolio of gold projects in the Canadian Shield. NewOrigin's management and Board have extensive experience in the delineation and development of gold deposits.

For further information, please contact:

Vincent Dubé-Bourgeois

Interim President and CEO of Harfang

vdubebourgeois@harfangexploration.com

Robert Valiant

Chairman and Interim CEO of NewOrigin

explore@neworigingold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding anticipated benefits of the Transaction, the closing of the Transaction and the timing and terms thereof, the potential of the combined projects (the "Projects"), the approval of shareholders of NewOrigin, the satisfaction of the conditions to the Transaction; the strengths, characteristics and potential of the Transaction; growth potential and expectations regarding the timing, receipt and anticipated effects of court approval and other consents and approvals; the impact of the Transaction on NewOrigin, Harfang and their respective shareholders and other stakeholders; and other anticipated benefits of the Transaction. Although each of Harfang and NewOrigin (collectively, the "Companies") believe that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Companies can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Companies' periodic filings with Canadian securities regulators, and assumptions made with regard to: the Companies' ability to complete the proposed Transaction; the Companies' ability to secure the necessary shareholder, securityholder, legal and regulatory approvals required to complete the Transaction; the estimated costs associated with the advancement of the Projects; and the Companies' ability to achieve the synergies expected as a result of the Transaction. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from the Companies' expectations include risks associated with the business of Harfang and NewOrigin; risks related to the satisfaction or waiver of certain conditions to the closing of the Transaction; non-completion of the Transaction; risks related to reliance on technical information provided by Harfang and NewOrigin; risks related to exploration and potential development of the Projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of the Projects and the issuance of required permits; the need to obtain additional financing to develop the Projects and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as identified in Harfang's and NewOrigin's filings with Canadian securities regulators on SEDAR+ (available at www.sedarplus.ca). Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Harfang and New Origin. The forward-looking information contained in this news release is made as of the date hereof and neither Harfang nor NewOrigin undertakes any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. The foregoing statements expressly qualify any forward-looking information contained herein.

Figure 1: The Casa Berardi Deformation Zone showing the strategic location of Harfang's Blakelock project and NewOrigin's North Abitibi project on the Ontario side of the gold trend.

Figure 2: Location of NewOrigin's Sky Lake Gold Project within the favourable geology of the Pickle Lake Gold Camp in Ontario.

Figure 3: Location map showing Harfang and NewOrigin's assets in Quebec and Ontario.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e166ec73-f559-4b31-bf42-2a1564aa86de

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdfa9bf9-eda4-421f-8378-ee7248cf1732

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6747f0a-1b81-49a5-8b0b-d00af8bbdb90