Binding Agreement Executed for the Large, Effectively Unexplored Cosmo Newbery Gold Project

PERTH, AUSTRALIA AND VANCOUVER, BC / ACCESSWIRE / August 13, 2024 / Sarama Resources Ltd. ("Sarama" or the "Company") (ASX:SRR)(TSX-V:SWA) is pleased to announce that it has entered into a binding agreement to acquire a majority interest(1) in the Cosmo Newbery Gold Project (the "Project") in Western Australia (refer Figure 1).

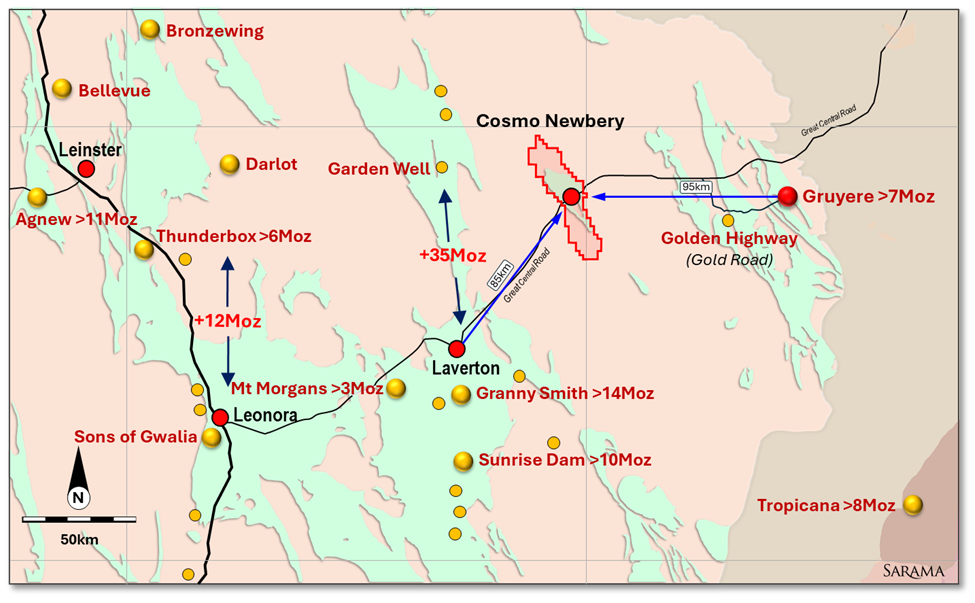

The 580km² project(2) covers the entirety of the Cosmo-Newbery Greenstone Belt and is located approximately 85km north-east of Laverton in a region known for its prolific gold endowment. As one of the last effectively unexplored greenstone belts in Western Australia, the Project presents a unique and compelling opportunity for the Company.

Highlights

Binding agreement to acquire majority interest and control of Cosmo Newbery Gold Project in Western Australia

580km² landholding capturing +50km strike length in highly prospective gold producing region

One of the last effectively unexplored greenstone belts in Western Australia

Virtually no effective exploration undertaken for several decades

Excellent access to infrastructure and nearby producing gold mines

Sarama to initially acquire an 80% interest in the majority of the Project(1)

Ability for Sarama to increase ownership to 100% in the majority of the Project(1) via an option to acquire the vendor's remaining interest within a 2-year period post completion

Sarama's President, CEO & MD, Andrew Dinning commented:

"We are pleased to have reached this milestone in the acquisition of a majority interest in the Cosmo Newbery Gold Project and look forward to completing the transaction in due course. The Company considers the Project to be highly prospective for a number of commodities and its scale, location, favourable geological setting and truly underexplored status presents a unique exploration opportunity."

Cosmo Newbery Project

The Project is comprised of 7 contiguous exploration tenements covering 580km² in the Eastern Goldfields of Western Australia, approximately 85km north-east of Laverton and 95km west of the world-class Gruyere Gold Mine. The Project is readily accessible via the Great Central Road which services the Cosmo Newbery Community.

The Project captures one of the last unexplored greenstone belts in Western Australia and with a strike length of +50km, the Cosmo Newbery Belt represents a large and prospective system with gold first being discovered in the area in the 1890's. Multiple historical gold workings are documented within the Project area and work undertaken to date, has identified multiple exploration targets for follow up.

Despite this significant prospectivity, the Project has seen virtually no modern exploration or drilling of merit due to a lack of land access persisting over a significant period. As a result, the Project has not benefited from the evolution of geochemical and geophysical techniques which now facilitate effective exploration in deeply weathered and complex regolith settings which is particularly pertinent given approximately 75% of the Project area is under cover.

Following the relatively recent securing of land access, the Project is now available for systematic and modern-day exploration programs to be conducted on a broad-scale. It is anticipated that future exploration programs will initially follow-up preliminary targets generated from regional soil sampling and limited reconnaissance drilling programs, a majority of which extended to approximately 5m below surface with a small percentage extending up to 30m below surface.

Transaction Terms

Pursuant to the binding Asset Sale and Purchase Agreement ("SPA") executed by Sarama, and one of its 100%-owned subsidiaries, with Cosmo Gold Limited ("Cosmo") and Adelong Gold Limited ("Adelong"), Sarama will acquire 80% of Cosmo's interest in the Project (the "Transaction") and will be granted the right to acquire the remainder of Cosmo's interest in the Project within a 2-year period post completion. Further, an existing debt obligation of Cosmo to Adelong will be satisfied and discharged as part of the transaction. The key commercial terms are summarised as follows:

Sarama (via its subsidiary) to acquire 80% of Cosmo's interest in the Project for the following consideration and payment of certain Project-related expenses on behalf of Cosmo:

issuance of 25 million shares in Sarama (in the form of Chess Depository Instruments ("CDI")) to Adelong;

issuance of 7.5 million unlisted options to acquire shares in Sarama (in the form of CDIs) to Adelong (2-year expiry, A$0.05/option strike price, converting on 1:1 basis);

payment of A$50,000 to Cosmo within 21 days of execution of the SPA;

payment of A$50,000 to Cosmo upon Sarama receiving shareholder approval for the transaction;

payments relating to Native Title Access Agreements totalling approximately A$112,000;

payments relating to statutory tenement fees totalling approximately A$76,000; and

payments relating to exploration activities totalling approximately A$139,000.

The above payments relating to Native Title Access Agreements, statutory tenement fees and exploration activities will form a debt owed to Sarama by Cosmo which will be forgiven upon completion of the Transaction.

Upon completion of the Transaction, Sarama (via its subsidiary) and Cosmo will form an unincorporated joint venture ("JV") (in respect of Cosmo's current interest in the Project) with key terms as follows:

initial participating interests of 80% Sarama / 20% Cosmo;

Sarama shall 'free carry' Cosmo's interest in the JV and will solely fund all JV activities through to a 'decision to mine' being made;

Sarama shall assume initial operatorship of the Project and will have the right to determine direction of JV activities;

for a minimum period of 24 months following completion of the Transaction, Sarama undertakes to maintain the Project tenements in 'good standing', including satisfying all expenditure conditions and payment of all tenement-related fees, administrative costs and assuming Cosmo's obligations (including cost responsibility) under certain third-party agreements;

following a 'decision to mine' being made, Sarama and Cosmo must each fund all expenditure under the JV on a pro-rata basis, with standard provisions for dilution in the event a party does not fund its pro-rata share;

in the event a party's interest in the JV falls below 10%, the party's interest will automatically convert to 0.5% net smelter return royalty; and

within the period of 24 months following completion of the Transaction, Sarama has the right to purchase Cosmo's 20% interest in the JV for A$1.25M, which may be satisfied by either a cash payment or shares (CDIs) in Sarama.

Completion of the Transaction is subject to the satisfaction of certain conditions precedent including regulatory and shareholder approval (including Sarama shareholder approval for the issue of securities pursuant to ASX Listing Rule 7.1) and assignment of land access agreements.

The date of execution of the binding agreement was August 13, 2024 and the date of the news release relating to the signing of the non-binding Memorandum of Understanding was June 17, 2024.

For further information, please contact:

Company Activities

Andrew Dinning or Paul Schmiede

Sarama Resources Ltd

e: info@saramaresources.com

t: +61 8 9363 7600

FOOTNOTES

Upon completion of the Transaction, Sarama, via its 100%-owned subsidiary, will acquire from Cosmo an 80% interest in all the Project's Exploration Licences, with the exception of E38/2274 for which Sarama will acquire an effective 60% interest (with Cosmo retaining a 15% interest and an existing joint tenement holder retaining a 25% interest). The tenements in which Sarama will acquire an 80% interest account for approximately 80% of the total area of the Project. For a period of 2-years following completion of the Transaction, Sarama will have the right to acquire Cosmo's remaining 20% interest all the above Exploration Licences (with the exception of E38/2274 which would be held 75% by Sarama and 25% by an existing joint tenement holder in the event that Sarama exercises the option to acquire Cosmo's remaining interest in the Project).

The Project is comprised of the following contiguous Exploration Licences: E38/2851, E38/3456, E38/2627, E38/2274, E38/3525, E38/3249 and E38/2774 covering approximately 580km². Cosmo currently has a 100% interest in all the Project's Exploration Licences with the exception of E38/2274 for which Cosmo holds a 75% interest.

CAUTION REGARDING FORWARD LOOKING INFORMATION

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the prospectivity of the Cosmo Newbery Project, information with respect to Sarama having or acquiring mineral interests in areas which are considered highly prospective for gold and other commodities and which remain under-explored, costs and timing of future exploration, the potential for exploration discoveries, the intention to gain the best commercial outcome for shareholders of the Company, timing and receipt of approvals, consents and permits under applicable legislation and the completion of a transaction to acquire the Cosmo Newbery Project. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political and security-related events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information.

Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSON'S STATEMENT

Scientific or technical information in this disclosure that relates to exploration is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information in the form and context in which it appears.

This announcement has been authorised by the Board of Sarama Resources.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Sarama Resources Ltd.

View the original press release on accesswire.com