Originally published in American Airlines' 2023 Sustainability Report

NORTHAMPTON, MA / ACCESSWIRE / August 13, 2024 / American Airlines

Sustainable Aviation Fuel

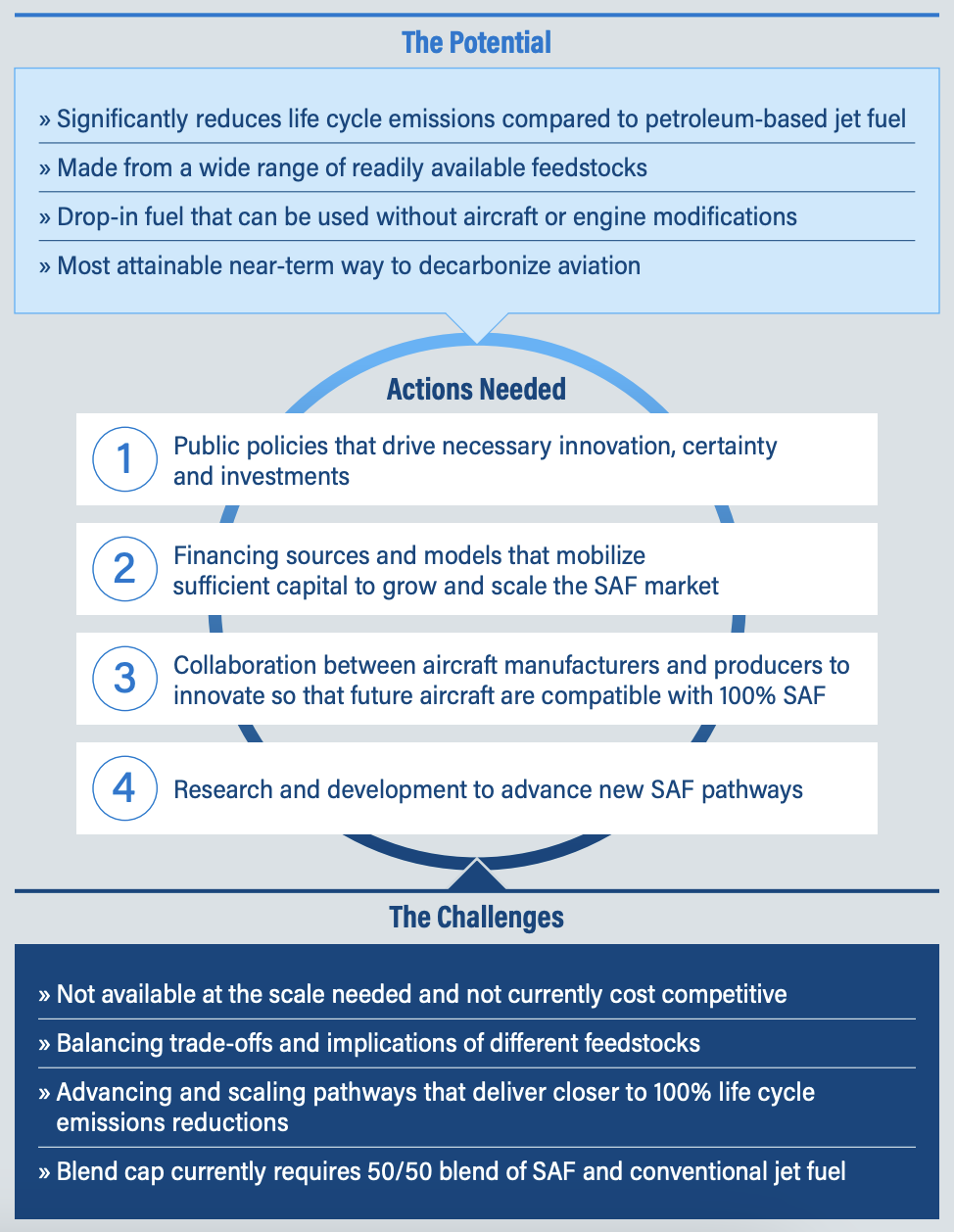

The clearest near-term way to decarbonize aviation based on current technological developments is by transitioning to sustainable aviation fuel (SAF). The SAF available on the market today can reduce life cycle GHG emissions by up to 85% compared with conventional, petroleum-based jet fuel, and new technologies and pathways hold the promise of delivering SAF with closer to 100% life cycle emission reductions. The reality, however, is that as critical as SAF is for achieving our own and the industry's climate goals, it is not yet available at the scale or price needed to be a feasible alternative for widespread commercial use - and achieving that will require the combined efforts of the private and public sectors.

How American is helping accelerate solutions

Purchasing and helping scale SAF production is a core part of American's climate strategy this decade. For example, we anticipate SAF will be key to achieving the insector reductions required to meet our science-based target for 2035, and we have set a goal to replace 10% of our jet fuel use with SAF in 2030. In 2023, we used nearly 2.7 million gallons of SAF on our flights, about a 4% increase over 2022, but still a small portion of the SAF we need to achieve our goal.

American is entering into offtake commitments with SAF producers to help secure the supply we need to achieve our goal. We're also working to advance the SAF market as an anchor member of Breakthrough Energy Catalyst, which invests in new decarbonization technologies. (See page 19 to read about our innovative agreement with Infinium.) Additionally, we continue to advocate for governments to deploy policy tools - including incentives, credits and investments in research - to help scale the SAF market.

The need for concerted action to scale the SAF market

The availability of SAF increased in 2023, but to reach the industry's goal of producing 3 billion gallons of cost-competitive SAF in 2030, the market needs to achieve a nearly 100% compound annual growth rate, based on Environmental Protection Agency (EPA) data.1 Clearly, there is a need to significantly accelerate the trajectory for the SAF market, which will require concerted effort by a range of stakeholders. Airlines have a key role to play, but it will also require engine and airframe manufacturers to enable higher SAF blends and the research community to advance innovation in the form of new SAF pathways. The energy sector needs to align its capital commitments, while the financial sector must find more effective ways to support the SAF market. Standard setters need to recognize new solutions, and policymakers need to enact smart policies that will drive further investment in the industry.

Advancing Next-Generation SAF Pathways

Achieving the decarbonization potential of SAF will be a journey, with the feedstocks that are available today being replaced over time with more efficient ones that provide greater reductions in life cycle emissions.

The past year has seen some progress, including the creation of U.S. Airline Principles on Use of Book and Claim in Sustainable Aviation Fuel Accounting, which provides a robust market mechanism for efficiently connecting SAF buyers and producers. The enactment of a SAF purchase tax credit in Illinois and the release of U.S. Treasury Department guidance on implementation of the SAF blenders tax credit (BTC) - enacted in the Inflation Reduction Act of 2022 - are further evidence of U.S. policy moving in the right direction, although the SAF BTC expires at the end of 2024. The advocacy efforts of initiatives such as the Low Carbon Fuels Coalition, the Center for Climate and Energy Solutions (C2ES) SAF working group and the SAF Coalition - all initiatives in which American participates - have and will continue to be key in driving policy progress.

Hydroprocessed Esters and Fatty Acids

Hydroprocessed Esters and Fatty Acids (HEFA) is the only SAF process producing jet fuel at scale today, but the supply of HEFA feedstocks - particularly used cooking oil and animal fat - is constrained and there are concerns that demand for these feedstocks could have other indirect environmental impacts.

Alcohol-to-Jet

Alcohol-to-Jet (ATJ) technology relies on ethanol as a feedstock to produce SAF, but it is not yet available at scale for commercial use by airlines. New feedstocks, farming practices and production processes offer the potential to significantly reduce ATJ GHG emissions compared to those that exist today, but they could potentially increase cost.

Fischer-Tropsch

Fischer-Tropsch (FT) gasification has the potential to produce SAF that virtually eliminates GHG emissions while also using waste products, like municipal solid waste, as a feedstock. FT can also use CO2 captured from industrial emissions - and one day CO2 removed from the atmosphere - but that process is still very expensive. While FT is a proven technology in other applications, successfully commercializing it for aviation has been difficult.

American's SAF Sourcing Principles

In determining what SAF to source for our operations, we apply the following standards for sustainability:

Life cycle GHG emissions reductions of at least 50%, inclusive of estimated indirect land use change, compared with conventional jet fuel

Analyze environmental and social impacts of SAF feedstocks, such as potential effects on food supply and land use

Achievement of sustainability certification, or completion of our own due diligence when certification is not practical2

Our SAF use and advocacy is also guided by the following principles:

Maintain strict adherence to jet fuel safety and performance standards

Engage and collaborate with stakeholders across the private and public sectors to break down barriers to SAF production and distribution

Undertake robust and transparent emissions accounting and work within our industry to further develop and harmonize SAF emissions accounting

Raising the Bar on SAF

Infinium is a U.S.-based provider of electrofuels - also known as eFuels. It is producing a sustainable aviation fuel, eSAF, by converting waste CO2 , water and renewable power into clean-burning aviation fuel

Infinium eSAF has the potential to reduce life cycle GHG emissions by approximately 90%, which is greater than the emissions reductions achieved using the SAF currently on the market today

The company plans to repurpose an existing brownfield gas-to-liquids project in West Texas into a first-of-its-kind, commercial-scale Power-to-Liquids (PtL) eFuels facility to produce eSAF. In 2023, Breakthrough Energy Catalyst announced its commitment to invest $75 million in Infinium's PtL project. To further support this investment and help accelerate the production of eFuels, American and Infinium have entered into a firm offtake agreement for Infinium to supply eSAF to the airline.

This innovative technology will be further supported by a second agreement between banking leader Citi and American, in which American will transfer the associated emissions reduction from the Infinium eSAF directly to Citi - enabling Citi to reduce a portion of its Scope 3 emissions generated by employee travel. Citi is also a partner of Breakthrough Energy Catalyst.

These novel agreements are critical enablers of further investment in Infinium's facility.

1 https://afdc.energy.gov/fuels/sustainable-aviation-fuel

2 As part of our due diligence, we refer to the United Nations Food and Agriculture Organization's Guidance for Responsible Agricultural Supply Chains and other leading references to help mitigate and manage the sustainability risk of SAF produced using bio-based feedstocks.

Read more.

View additional multimedia and more ESG storytelling from American Airlines on 3blmedia.com.

Contact Info:

Spokesperson: American Airlines

Website: https://www.3blmedia.com/profiles/american-airlines

Email: info@3blmedia.com

SOURCE: American Airlines

View the original press release on accesswire.com