CALGARY, Alberta, Aug. 13, 2024 (GLOBE NEWSWIRE) -- Condor Energies Inc. ("Condor" or the "Company") (TSX:CDR), a Canadian based, internationally focused energy transition company focused on Central Asia is pleased to announce the release of its unaudited interim condensed consolidated financial statements for the three and six months ended June 30, 2024 together with the related management's discussion and analysis. These documents will be made available under Condor's profile on SEDAR+ at www.sedarplus.ca and on the Condor website at www.condorenergies.ca. Readers are invited to review the latest corporate presentation available on the Condor website. All financial amounts in this news release are presented in Canadian dollars, unless otherwise stated.

HIGHLIGHTS

- Production in Uzbekistan for the second quarter of 2024 averaged 10,052 boe/d comprised of 59,033 Mcf/d (9,839 boe/d) of natural gas and 213 bopd of condensate.

- Uzbekistan gas and condensate sales for the second quarter of 2024 was $18.95 million.

- In June 2024, the Company initiated a multi-well workover campaign on the eight gas-condensate fields it operates in Uzbekistan.

- In July 2024, Condor signed its first LNG Framework Agreement for the production and utilization of liquefied natural gas ("LNG") to fuel Kazakhstan's rail locomotives.

- The Company received a natural gas allocation in January 2024 in Kazakhstan to be used as feed gas for the Company's first modular LNG production facility.

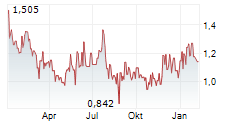

- On March 22, 2024, the Company issued three-year term convertible debentures bearing 9% interest per annum and convertible into 2,950,336 common shares for gross proceeds of USD $4.8 million (CAD $6.5 million).

MESSAGE FROM CONDOR'S CEO

Don Streu, President and CEO of Condor commented: "Since assuming the Uzbekistan field operations on March 1, 2024, the team has arrested a twenty percent natural production decline rate while initiating a multi-well workover program to grow production and reserves volumes. We're encouraged with the early gains we've realized by implementing proven technologies and operating practices. The first well workover yielded over a 100 percent production rate increase compared to its pre-workover rate. With more than 100 existing wells on the eight producing fields, we have a large inventory of enhancement opportunities and are working to increase production volumes and revenues beyond the second quarter of 2024 operating results. We are also excited to receive a reprocessed 3-D seismic data set this year to improve subsurface imaging that could identify additional well interventions and future infill and multi-lateral drilling programs.

We are equally excited with our first-mover LNG initiative in Kazakhstan, given that we've secured the feed gas supply for the first liquefaction facility and executed the Framework Agreement with KTZ and Wabtec, which introduces Condor as the LNG supplier and distributor. By applying field proven technologies to displace diesel fuel usage with LNG, end users can expect to reduce emissions and operating costs while increasing operating ranges with faster freight delivery times.

Over the past few years, we've truly built a strong foundation for continued growth with multiple near-term catalysts that are being actively matured."

Production in Uzbekistan

Production for the second quarter of 2024 was 10,052 boe/d, comprised of 59,033 Mcf/d (9,839 boe/d) of natural gas and 213 bopd of condensate, despite production being restricted in April and May for 18 days due to downstream infrastructure maintenance at non-Company operated facilities. Since assuming operations on March 1, 2024, the Company has been able to flatten the natural production decline rates, which previously exceeded twenty percent annually, by introducing downhole surfactants that allows produced water to be lifted more effectively, optimizing well choke-size settings, implementing facility upgrades, and introducing new operating methodologies.

In late June 2024, the Company initiated a multi-well workover campaign for the eight fields which includes installing proven artificial lift equipment, perforating newly identified pay intervals, performing downhole stimulation treatments, and production tubing replacements. The first well's production rate increased by over 100% compared to its pre-workover rate. Subsequent wells that have been worked-over are being cleaned up and restarted. The workover program is ongoing and with over 100 wells in the eight fields, the Company has a large inventory of both producing and shut-in wells available for evaluation, recompletion and optimization opportunities.

The Company recently fabricated Uzbekistan's first in-line flow separation unit which separates water from the gas streams at the field gathering network rather than at the production facility and thereby reducing pipeline flow pressure that can lead to higher reservoir flow rates. This separation unit was manufactured in Canada and is expected to be operational in the third quarter of 2024. Additional separation units will be manufactured and installed in the coming months. The existing pipeline and facilities infrastructure are also being evaluated to optimize water-handling, determine long term field compression requirements, and to enhance in-field gathering networks. The Company is also reprocessing previously acquired 3-D seismic data with plans to conduct infill drilling and well deepening programs commencing in 2025. Production guidance will be provided by the Company once it has gathered sufficient operating data to confirm the fields' baseline production, decline rates and the sustained impact of the ongoing workover program along with other optimization efforts that are being introduced.

LNG in Kazakhstan

Condor is developing Kazakhstan's first LNG facilities and will produce, distribute, and sell LNG to offset industrial diesel usage. LNG applications include rail locomotives, long-haul truck fleets, marine vessels, mining equipment, municipal bus fleets, agricultural machinery, and other heavy equipment and machinery with high-horsepower engines. These applications have all successfully used LNG fuel in other Countries.

In July 2024, the Company signed its first LNG Framework Agreement (the "Framework Agreement") for the production and utilization of LNG to fuel Kazakhstan's rail locomotives. The Framework Agreement was also signed by Kazakhstan Temir Zholy National Company JSC ("KTZ"), the national railway operator of Kazakhstan and Wabtec Corporation ("Wabtec") (NYSE: WAB), a U.S. based locomotive manufacturer with existing facilities in Kazakhstan. KTZ and Wabtec previously signed a memorandum of understanding which includes modernization work to retrofit KTZ's mainline locomotive fleet for LNG usage and incorporate LNG into new-build locomotives. The Framework Agreement introduces Condor into this locomotive fleet modernization strategy as the supplier and distributor of the LNG.

The Framework Agreement also provides a detailed framework whereby the three parties will coordinate efforts to ensure that Condor's LNG production volumes coincide with the delivery of new and converted LNG-powered rail locomotives from Wabtec. A working group comprised of members from each of the parties is responsible to identify and monitor the key performance indicators associated with this initiative.

The Framework Agreement is critical to supplying a stable, economic and more environmentally friendly fuel source for the Transcaspian International Transport Route ("TITR") expansion, which is currently the shortest, fastest and most geopolitically secure transit corridor for moving freight between Asia and Europe. The Government of Kazakhstan and KTZ are making significant investments in TITR infrastructure, including expanding the rail network, constructing a new dry port at the Kazakhstan - China border, and increasing the container-handling capacities at various Caspian Sea ports.

The planned first modular LNG facility will be constructed near the town of Alga and produce 120,000 metric tons of LNG annually, which is the energy equivalent volume of 450,000 litres of diesel per day. Phase 1 of the first facility is currently scheduled to commence LNG production in mid-2026, for which a stable feed gas supply was secured in January 2024. The Company is also advancing project funding alternatives.

Lithium License in Kazakhstan

The Company holds a 100% working interest in the contiguous 37,300-hectare area which provides the subsurface exploration rights for solid minerals for a six-year term (the "Lithium License"). Given its strategic access to Asian and European lithium markets, this region is ideally suited for the rapid deployment of emerging Direct Lithium Extraction ("DLE") technologies to generate lithium for EV batteries and other electricity storage applications.

The initial development plan for the Lithium License includes drilling and testing two wells to verify deliverability rates, confirm the lateral extension and concentrations of lithium in the tested and untested intervals, conduct preliminary engineering for the production facilities, and prepare a mineral resources or mineral reserves report compliant with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Convertible Debentures

On March 22, 2024, the Company issued convertible debentures (the "Debentures") convertible into 2,950,336 common shares for gross proceeds of USD $4.8 million (CAD $6.5 million) less debt issue costs of CAD $0.2 million for net proceeds of CAD $6.3 million. The Debentures are unsecured, bear interest at 9% payable in cash semi-annually in arrears, mature in three years, and the principal amount is convertible at any time on or before the maturity date at a conversion price of USD $1.61676 per common share. The Company can force conversion of the Debentures if the 20-day volume weighted average trading price of the Company's shares on the TSX exceeds CAD $3.00. The proceeds are available for general corporate purposes. The Debentures have no associated financial covenants.

RESULTS OF OPERATIONS

Production | ||||

| For the three months ended June 30 | 2024 | 2023 | Change | |

| Natural gas (Mcf) | ||||

| Uzbekistan | 5,372,044 | - | 5,372,044 | |

| Türkiye | 8,419 | 9,007 | (588 | ) |

| 5,380,463 | 9,007 | 5,371,456 | ||

| Condensate (barrels) | ||||

| Uzbekistan | 19,395 | - | 19,395 | |

| Türkiye | - | - | - | |

| 19,395 | - | 19,395 | ||

| For the six months ended June 30 | ||||

| Natural gas (Mcf) | ||||

| Uzbekistan | 7,399,949 | - | 7,399,949 | |

| Türkiye | 21,395 | 27,542 | (6,147 | ) |

| 7,421,344 | 27,542 | 7,393,802 | ||

| Condensate (barrels) | ||||

| Uzbekistan | 27,585 | - | 27,585 | |

| Türkiye | - | 10 | (10 | ) |

| 27,585 | 10 | 27,575 | ||

BARRELS OF OIL EQUIVALENT ADVISORY

References herein to barrels of oil equivalent ("boe") are derived by converting gas to oil in the ratio of six thousand standard cubic feet ("Mcf") of gas to one barrel of oil based on an energy conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6 Mcf to 1 barrel, utilizing a conversion ratio at 6 Mcf to 1 barrel may be misleading as an indication of value, particularly if used in isolation.

FORWARD-LOOKING STATEMENTS

Certain statements in this new release constitute forward-looking statements under applicable securities legislation. Such statements are generally identifiable by the terminology used, such as "expect", "plan", "estimate", "may", "will", "should", "could", "would", "increase", "introduce", "provide", "generate", "envision", "apply", "include", "conduct", "prepare", "require", "continue", "reduce", or other similar wording. Forward-looking information in this new release includes, but is not limited to, information concerning: the timing and ability to execute the Company's growth and sustainability strategies including the financing for these growth and sustainability strategies; the timing and ability to operate and increase production and overall recovery rates at eight gas fields in Uzbekistan; the timing and ability to add additional separation units; the timing and ability to increase domestic gas supply and contribute to carbon emissions reductions; the timing and ability to conduct production enhancement services, produce natural gas and realize domestic gas sales proceeds; the timing and ability to be responsible for all capital and operating costs and receive a percentage of revenues less prescribed royalties from the PEC Project while also contributing to carbon emission reductions; the timing and ability to increase production by implementing artificial lift, workover and drilling programs; the timing and ability to investigate deeper horizons; the timing and ability to reprocesses seismic data and conduct a 3-D seismic program; the timing and ability to collect reservoir and production data; the timing and ability to complete a report in compliance with National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities; the timing and ability to evaluate existing pipeline and facilities infrastructure for optimization of water handling, field compression and the field gathering network; the timing and ability to provide production guidance; the timing and ability to use the gas allocation from the Government of Kazakhstan as feed gas for the Company's first modular LNG production facility; the timing and ability to liquefy the gas to produce LNG; the timing and ability to fuel rail locomotives and large mine haul trucks; the timing and ability to contribute to carbon emissions reductions by displacing diesel fuel usage; the timing and ability to conduct detailed engineering; the timing and ability to confirm LNG volume commitments with end-users; the Company's expectations in respect of the future uses of LNG; the timing and ability to obtain funding and proceed with construction; the potential for the Lithium License area to contain commercial deposits; future lithium testing results; the timing and ability to fund, permit and complete planned activities including drilling two additional wells and conduct preliminary engineering for the production facilities; the timing and ability to optimize the planned method for direct lithium extraction; the timing and ability to generate a report in compliance with National Instrument 43-101 Standards of Disclosure for Mineral Projects; the timing and ability to produce the lithium by utilizing closed-looped DLE production technologies; the timing and ability to have a much smaller environmental footprint than existing lithium production operations; the timing and ability of the Company to conduct infill and extension drilling programs in 2025; the timing and ability to commence exploration mining activities to evaluate the potential for commercial lithium brine deposits; the timing and ability to evaluate the construction of a renewable power generation project to achieve net-zero emissions; projections and timing with respect to natural gas and condensate production; expected markets, prices and costs for future gas and condensate sales; the timing and ability to obtain various approvals and conduct the Company's planned exploration and development activities; the timing and ability to access natural gas pipelines; the timing and ability to access domestic and export sales markets; anticipated capital expenditures; forecasted capital and operating budgets and cash flows; anticipated working capital; sources and availability of financing for potential budgeting shortfalls; the timing and ability to obtain future funding on favourable terms, if at all; general business strategies and objectives; the timing and ability to obtain exploration contract, production contract and operating license extensions; the potential for additional contractual work commitments; the ability to meet and fund the contractual work commitments; the satisfaction of the work commitments; the results of non-fulfilment of work commitments; projections relating to the adequacy of the Company's provision for taxes; the expected impacts of adopting amendments to IFRS accounting policies; and treatment under governmental regulatory regimes and tax laws.

This news release also includes forward-looking information regarding health risk management including, but not limited to: travel restrictions including shelter in place orders, curfews and lockdowns which may impact the timing and ability of Company personnel, suppliers and contractors to travel internationally, travel domestically and to access or deliver services, goods and equipment to the fields of operation; the risk of shutting in or reducing production due to travel restrictions, Government orders, crew illness, and the availability of goods, works and essential services for the fields of operations; decreases in the demand for oil and gas; decreases in natural gas, condensate and crude oil prices; potential for gas pipeline or sales market interruptions; the risk of changes to foreign currency controls, availability of foreign currencies, availability of hard currency, and currency controls or banking restrictions which restrict or prevent the repatriation of funds from or to foreign jurisdiction in which the Company operates; the Company's financial condition, results of operations and cash flows; access to capital and borrowings to fund operations and new business projects; the timing and ability to meet financial and other reporting deadlines; and the inherent increased risk of information technology failures and cyber-attacks.

By its very nature, such forward-looking information requires Condor to make assumptions that may not materialize or that may not be accurate. Forward-looking information is subject to known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such risks and uncertainties include, but are not limited to: regulatory changes; the timing of regulatory approvals; the risk that actual minimum work programs will exceed the initially estimated amounts; the results of exploration and development drilling and related activities; prior lithium testing results may not be indicative of future testing results or actual results; imprecision of reserves estimates and ultimate recovery of reserves; the effectiveness of lithium mining and production methods including DLE technology; historical production and testing rates may not be indicative of future production rates, capabilities or ultimate recovery; the historical composition and quality of oil and gas may not be indicative of future composition and quality; general economic, market and business conditions; industry capacity; uncertainty related to marketing and transportation; competitive action by other companies; fluctuations in oil and natural gas prices; the effects of weather and climate conditions; fluctuation in interest rates and foreign currency exchange rates; the ability of suppliers to meet commitments; actions by governmental authorities, including increases in taxes; decisions or approvals of administrative tribunals and the possibility that government policies or laws may change or government approvals may be delayed or withheld; changes in environmental and other regulations; risks associated with oil and gas operations, both domestic and international; international political events; and other factors, many of which are beyond the control of Condor. Capital expenditures may be affected by cost pressures associated with new capital projects, including labour and material supply, project management, drilling rig rates and availability, and seismic costs.

These risk factors are discussed in greater detail in filings made by Condor with Canadian securities regulatory authorities including the Company's Annual Information Form, which may be accessed through the SEDAR+ website (www.sedarplus.ca).

Readers are cautioned that the foregoing list of important factors affecting forward-looking information is not exhaustive. The forward-looking information contained in this news release are made as of the date of this news release and, except as required by applicable law, Condor does not undertake any obligation to update publicly or to revise any of the included forward-looking information, whether as a result of new information, future events or otherwise. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

ABBREVIATIONS

The following is a summary of abbreviations used in this news release:

| Mcf | Thousands of standard cubic feet |

| Mcf/D | Thousands of standard cubic feet per day |

| boe | Barrels of oil equivalent |

| boe/d | Barrels of oil equivalent per day |

| bopd | Barrels of oil per day |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| 3-D | Three dimensional |

| CAD | Canadian Dollars |

| USD | United States Dollars |

| LNG | Liquefied Natural Gas |

| DLE | Direct Lithium Extraction |

| EV | Electric Vehicle |

The TSX does not accept responsibility for the adequacy or accuracy of this news release.

For further information, please contact Don Streu, President and CEO or Sandy Quilty, Vice President of Finance and CFO at 403-201-9694.