Second quarter revenue grew 59% as the Company continues to scale operations

Recent capital raise and debt conversion represent meaningful inflection points, strengthening the Company's balance sheet and financial flexibility

HOUSTON, TX / ACCESSWIRE / August 14, 2024 / MultiSensor AI Holdings, Inc. (NASDAQ:MSAI), a pioneer in AI-powered industrial condition-based maintenance and process control solutions, announced results for the second quarter ended June 30, 2024.

Financial Highlights:

First half of 2024 revenue increased 90% year over year from $2.3 million to $4.4 million; Q2 revenue increased 59% year over year from $1.3 million to $2.1 million.

Annual recurring revenue1 at the end of the period increased approximately 500% from approximately $450 thousand to $2.7 million.

Subsequent to quarter end, the Company raised $26.5 million through a combination of a $11.5 million public offering and a $15 million private placement.

During the quarter, MSAI completed the conversion of all remaining convertible notes and other debt to equity.

Subsequent to quarter end, the Company strengthened its balance sheet by improving net working capital, decreasing current liabilities, and increasing liquidity.

Strategic Business Highlights:

MSAI demonstrated compliance with NASDAQ listing requirements as a result of significantly strengthening its shareholders equity.

Announced strategic channel partner relationship with Denali Advanced Integration which will make it easier for Denali's customers to purchase MSAI's multi-sensor solutions.

MSAI launched its Inspections business, expanding service offerings to include additional sensor modalities and services to meet the needs of enterprise customers.

David Gow, MultiSensor AI's Chair, commented: "I am pleased with the recent milestones and financial strength of the business as MSAI continues to mature as a public company. We continue to position the Company for sustained growth and to expand our presence within our existing customer base. We continue to implement our commercial strategy, highlighted by the launch of our Inspections business and our strategic channel partnership with Denali Advanced Integration. These successes demonstrate the Company's commitment to continue scaling our offerings while expanding within current and new blue-chip customers. We expect these efforts to support ARR growth and momentum during the second half of 2024 and into our bright future."

Mr. Gow continued, "Subsequent to quarter end, we closed on a combined $26.5 million in public and private equity offerings. We are focused on maintaining a conservative balance sheet and financial flexibility, as well as the overall free float. The recent capital raise is a testament to investors' belief in the direction of the Company, and the ability of the management team to sustain this strategic momentum as we deliver value to our stakeholders. Further, we have significantly strengthened our balance sheet and our overall financial flexibility by effectively eliminating our future debt obligations of $7.05 million by converting them to equity. This eliminates future liabilities and potential capital requirements associated with servicing the debt."

The Company's Quarterly Report is filed with the SEC, and is available at www.sec.gov as well as in the Investor Relations section of the Company's website (www.multisensorai.com).

About MultiSensor AI

MultiSensor AI provides turnkey condition-based maintenance and process control solutions, which combine cutting edge imaging and sensing technologies with AI-powered enterprise software. Powered by AWS, MSAI's software leverages a continuous stream of data from thermal imaging, visible imaging, acoustic imaging, vibration sensing, and laser sensing devices to provide comprehensive, real-time condition monitoring for a customer's critical assets, processes, and manufactured outputs. This full-stack solution measures heat, vision, vibration, and gas in the surrounding environment, helping companies gain predictive insights to better manage their asset reliability and manufacturing processes. MSAI Cloud and MSAI Edge software solutions are deployed by customers to protect critical assets across a wide range of industries including distribution & logistics, manufacturing, utilities, and oil & gas.

For more information, please visit https://www.multisensorai.com

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as "will," "believe," "anticipate," "expect," "estimate," "intend," "plan," or their negatives or variations of these words, or similar expressions. All statements contained in this press release that do not strictly relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company management's expectations regarding its financial outlook, strategic priorities and objectives, future plans, business prospects and financial performance. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including the "Risk Factors" section of the Company's Annual Report on Form 10-Q filed with the SEC on August 14, 2024 and the Company's other periodic filings with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. Any forward-looking statement made in this press release is based only on information currently available and speaks only as of the date on which it is made. Except as required by applicable law, the Company expressly disclaims any obligations to publicly update any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Media Contact:

MultiSensor AI

Andrew Klobucar

Director of Marketing

andrew.klobucar@multisensorai.com

Investor Contact:

Alpha IR Group

Mike Cummings or Griffin Morris

MSAI@alpha-ir.com

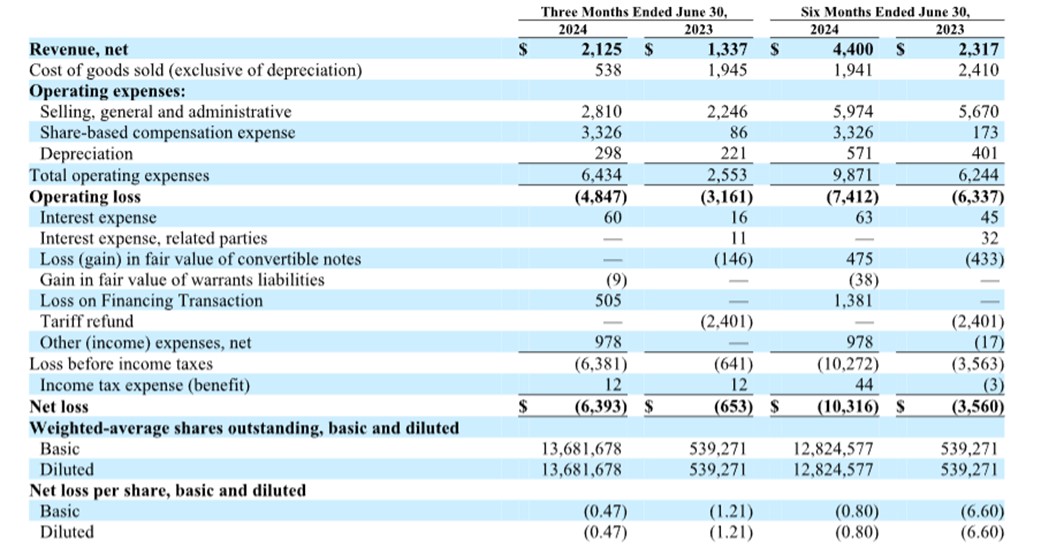

MultiSensor AI Holdings, Inc.

Condensed Consolidated Statements of Operations

(Amounts in thousands of U.S. dollars, except share and per share data)

____________

1 Non-GAAP measure, defined as annualized current software and services revenue under contract for one year or longer.

SOURCE: MultiSensor AI, Inc.

View the original press release on accesswire.com