Hamilton, Bermuda August 15, 2024

Avance Gas Holding Ltd. («Avance Gas» or «Company») (OSE: AGAS) has on August 15, 2024, entered into an agreement with BW LPG Ltd ("BW LPG" or "the Buyer") to sell its fleet of Very Large Gas Carriers (VLGC) for a consideration of $1,050 million. The Avance Gas VLGC fleet today consist of eight 2015 built eco VLGCs and four dual fuelled VLGCs built 2022 and 2023. The transaction is regulated by 10 individual Memorandum of Agreement (MoA) for the 10 owned VLGCs while the remaining two VLGCs on sale-leaseback agreement (SLB) is agreed to be novated with the existing debt obligation.

The transactions and delivery of ships to the Buyer is scheduled to take place in the window September 15 to December 31, 2024, which enables a smooth handover while allowing Avance Gas to trade the ships for some further period in the winter market. Estimated book value of the VLGC fleet at delivery is between $730 to $740 million which thus is expected to generate a gain on sale to be between $310-320 million. In the first half of 2024, Avance Gas sold four VLGCs to other buyers with a gain of $121 million. As a result, gain on sale of the VLGC fleet is expected to be approximately $435 million for the full year 2024.

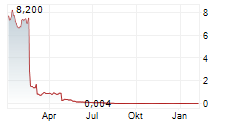

The sale of the ships is agreed to be settled with approximately $585 million of cash, novation of approximately $132 million of debt obligations under the SLB with the remainder being settled as with 19.282 million shares in BW LPG at a price of $17.25 per share representing a value of $333 million. The share consideration price of $17.25 reflect the fair value of the share on a Net Asset Value basis assessed by Avance Gas as part of the agreement. As a result of the transaction, Avance Gas will thus become the second largest shareholder of BW LPG with a shareholding of approximately 12.77%. Under the agreement, Avance Gas has agreed a 40 days lock-up on the consideration shares for each settlement under the MoAs.

The net cash proceed from the transaction is expected to be approximately $217 million. The cash proceeds are in addition to the pro forma cash balance of $257 million reported on May 15, 2024, in relation to the first quarter reporting 2024. The pro-forma cash comprised of the cash balance of $360m as of March 31, 2024, cash from the sale of "Avance Pollux" on May 10, 2024 less $165 million dividend paid to shareholders on May 31, 2024.

The Company also generate positive cashflow during the second quarter as we guided that 83 per cent of the second quarter was booked at an average Time Charter Equivalent (TCE) rate of approximately $48,000 per day, significantly higher than our cash break-even in the low $20,000 per day. Interest rate derivatives linked to Avance Gas existing loans will also be terminated prior delivery of the ships to the buyer and these derivatives had a positive market value of $10 million as of March 31, 2024.

After the closing of this transaction, Avance Gas will then be the owner of four medium sized gas carriers (MGC) capable of carrying full ammonia cargoes, a 12.77% shareholding in BW LPG as well as a substantial cash holding.

Avance Gas will report it's second quarter results on August 28, 2024, and will then provide more information about the transaction announced today and how the Company envision the way further after the sale of the VLGC fleet.

The transaction is subject to approval of novation of SLB for the leased VLGCs, charterer's approval of novation of Time Charter for the three VLGCs on Time Charter as well as customary closing procedures under the MoAs.

Øystein Kalleklev, Chief Executive Officer of Avance Gas Holding Ltd., commented:

"We are pleased to announce the sale of our VLGC fleet at what we consider very attractive terms and conditions. The fleet of Avance Gas is today a bit sub-scale and we have therefore found it more attractive for our shareholders to take advantage of the relatively high second-hand prices and sell the VLGC fleet to BW LPG. The sale will generate approximately $315 million of profit while at the same time enabling us to probably make a trading profit until delivery of these ships to the buyer.

During 2024, we have thus successfully agreed the sale of 16 VLGCs with a combined profit of about $435 million which have enabled us to distribute significant dividend to our shareholders and with this sale we will continue to do so until the completion of the transaction by end of the year. We are thereby crystalizing the value for our shareholders and becoming the second largest investor in BW LPG. We find BW LPG well positioned with an integrated business model priced at a relatively modest price and this transaction will further strengthen BW LPG with both cost and income synergies. In our pragmatic view, it doesn't matter whether the ships are black or light green as long as they are generating cash.

We will revert on more details in our second quarter results presentation on August 28, but shareholders can rest assure that the profits generated belongs to its shareholders and will be distributed in a timely manner once the transaction concludes".

For further queries, please contact:

Media contact: Øystein Kalleklev, Chief Executive Officer

Investor and Analyst contact: Randi Navdal Bekkelund, Chief Financial Officer

Tel: +47 23 11 40 00

ABOUT AVANCE GAS

Avance Gas operates in the global market for transportation of liquefied petroleum gas (LPG). The Company is one of the world's leading owners and operators of very large gas carriers (VLGCs) and owns sixteen LPG ships consisting of twelve modern VLGCs including four dual fuel LPG VLGCs and four dual fuel MGCs for delivery in 2025 and 2026. For more information about Avance Gas, please visit www.avancegas.com (http://www.avancegas.com).

This information is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act