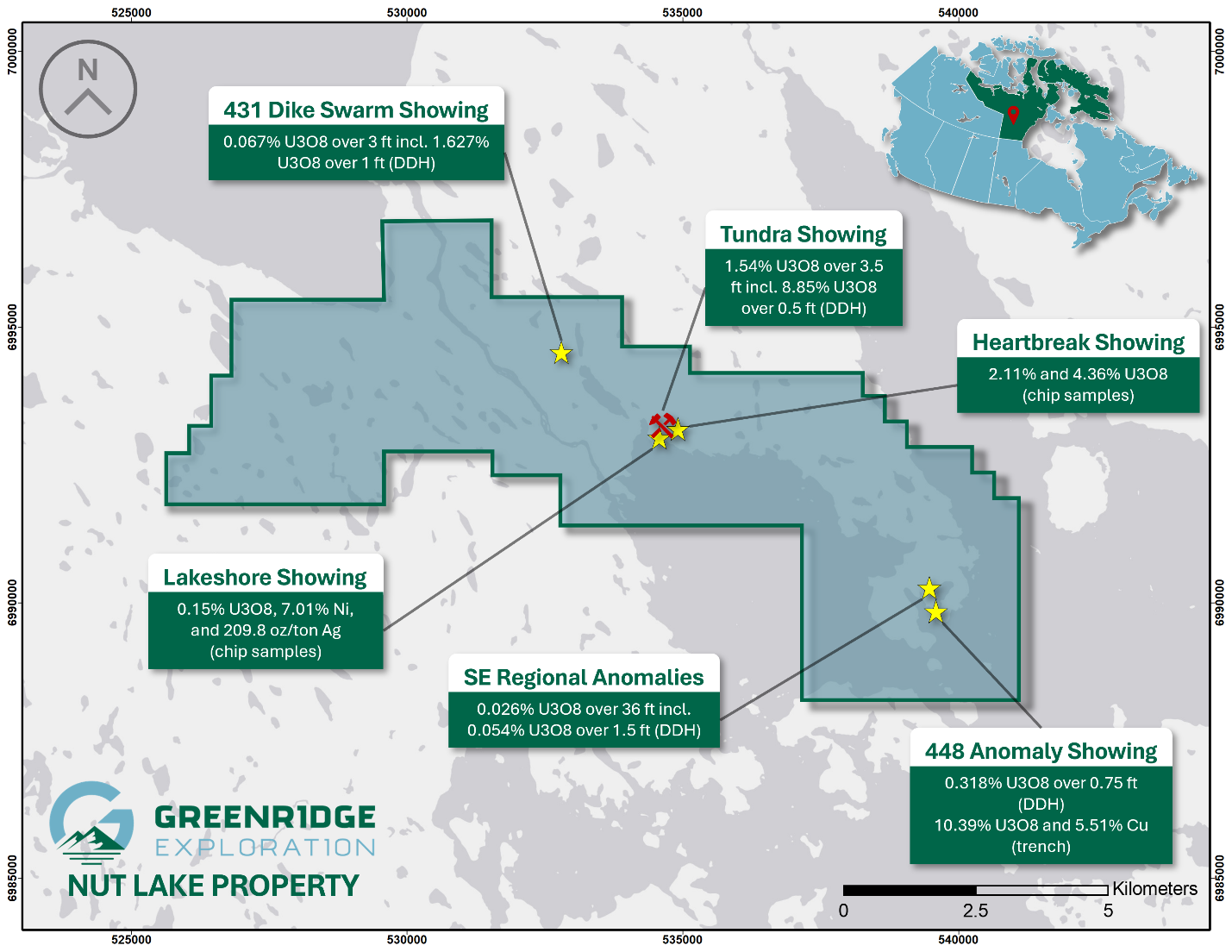

VANCOUVER, British Columbia, Aug. 15, 2024 (GLOBE NEWSWIRE) -- Greenridge Exploration Inc. ("Greenridge" or the "Company") (CSE: GXP | FRA: HW3), is pleased to announce it has completed an updated technical review of the Nut Lake Uranium Project (the "Nut Lake Property" or the "Project") located in the Thelon Basin in Nunavut. The Project covers approximately 5,853 hectares near the Northern Tip of the Yathkyed Basin, a sub-basin of the Thelon Basin (please see Figure 1).

Figure 1 - Nut Lake Property Claim Map

Technical Review Update

Dahrouge Geological Consulting Ltd. ("DGC"), on behalf of the Company, completed a secondary assessment of the historical data compiled for the Nut Lake Property, building on the previous technical review detailed in the Company's news release dated April 4, 2024. The second pass performed by DGC was focused on compiling and investigating historical data for the Project, including digitizing drillhole information, georeferencing maps, and pulling data from historical reports on or near the Nut Lake Property. The highlights of this secondary assessment are listed below:

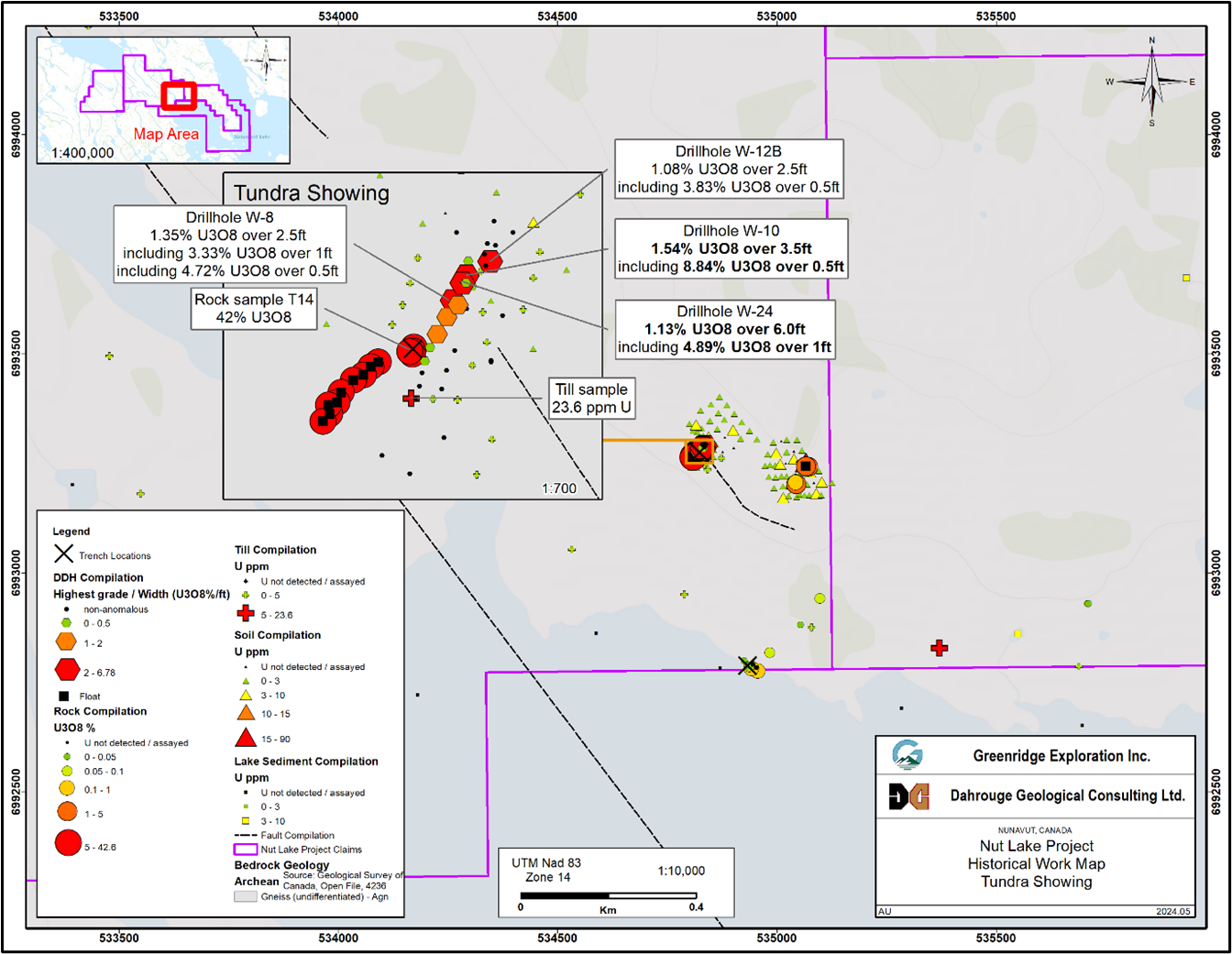

Tundra Showing

Historical Rock Sampling

- Fifteen (15) total samples with six (6) cut from trenches and nine (9) high-grade float samples2.

- Trench assayed up to 42% U3O8 in small, 6 cm wide, saw cut grab sample with four (4) samples containing >7% U3O8.

- Float samples assayed up to 28% U3O8.

Historical Drilling

- Thirty-five (35) drillholes completed on this showing, totaling 394 meters of drilling1&3.

- 1.54% U3O8 over 3.5 ft including 8.84% U3O8 over 0.5 ft (DDH: W-10).

- 1.13% U3O8 over 6.0 ft including 4.89% U3O8 over 1 ft (DDH: W-24).

- 1.35% U3O8 over 2.5 ft including 3.33% U3O8 over 1 ft, and including 4.72% over 0.5 ft (DDH: W-8).

- 1.08% U3O8 over 2.5 ft including 3.83% U3O8 over 0.5 ft (DDH: W-12B).

Figure 2 - Historical work map of the Tundra Showing on the Nut Lake Property

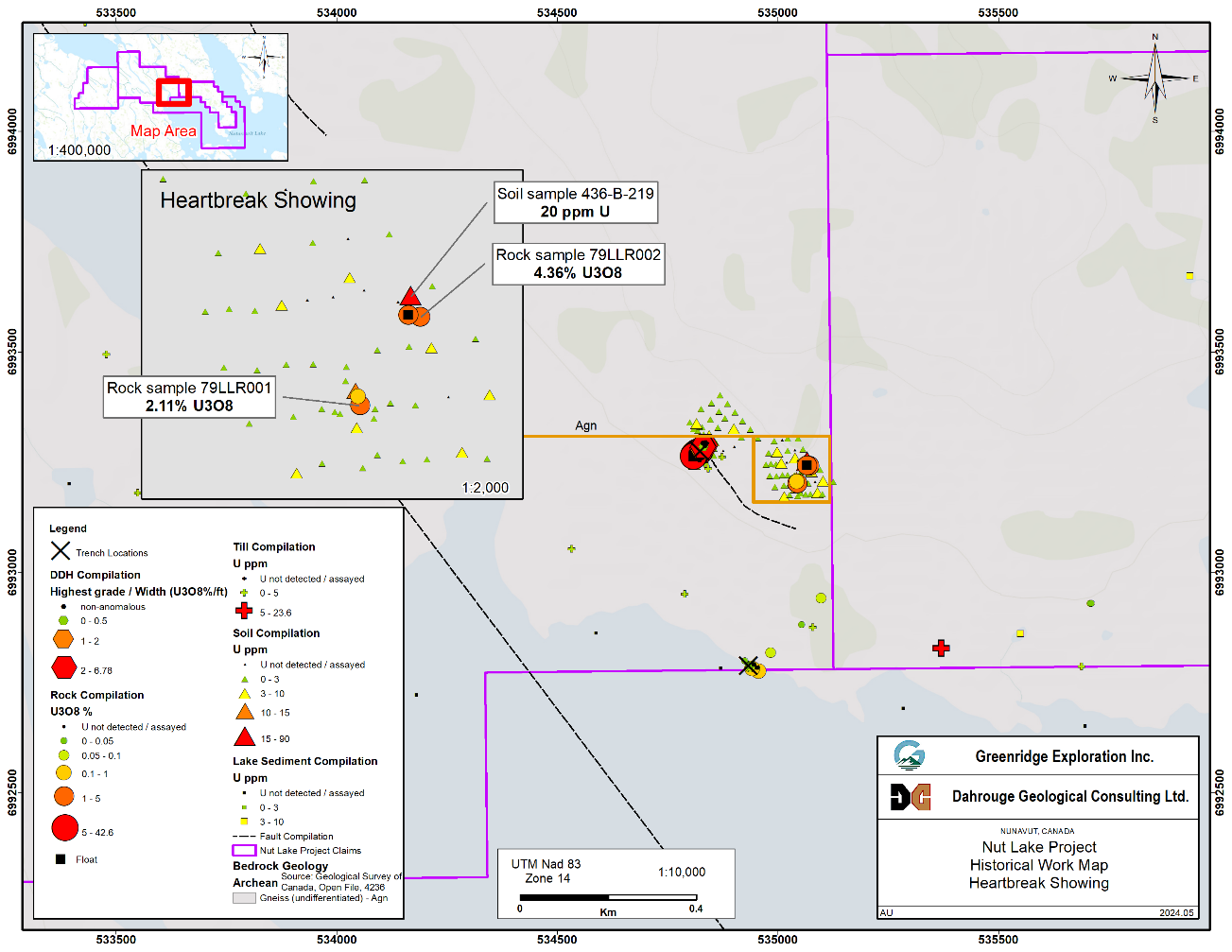

Heartbreak Showing1

- The Heartbreak showing uncovered two pitchblende fractures in an area where a swarm of biotite trachyte occurs, 200 meters to the east-southeast of the Tundra showing.

- The most noteworthy samples were from the Heartbreak showing which returned samples across a 3.0" and 3.5" fracture that assayed 2.11% U3O8 and 4.36% U3O8, respectively1.

- Fracture descriptions and assay results indicate significant mineralization potential.

- Frost heave on the surface suggests a potential strike length for the fractures.

Figure 3 - Historical work map of the Heartbreak Showing on the Nut Lake Property

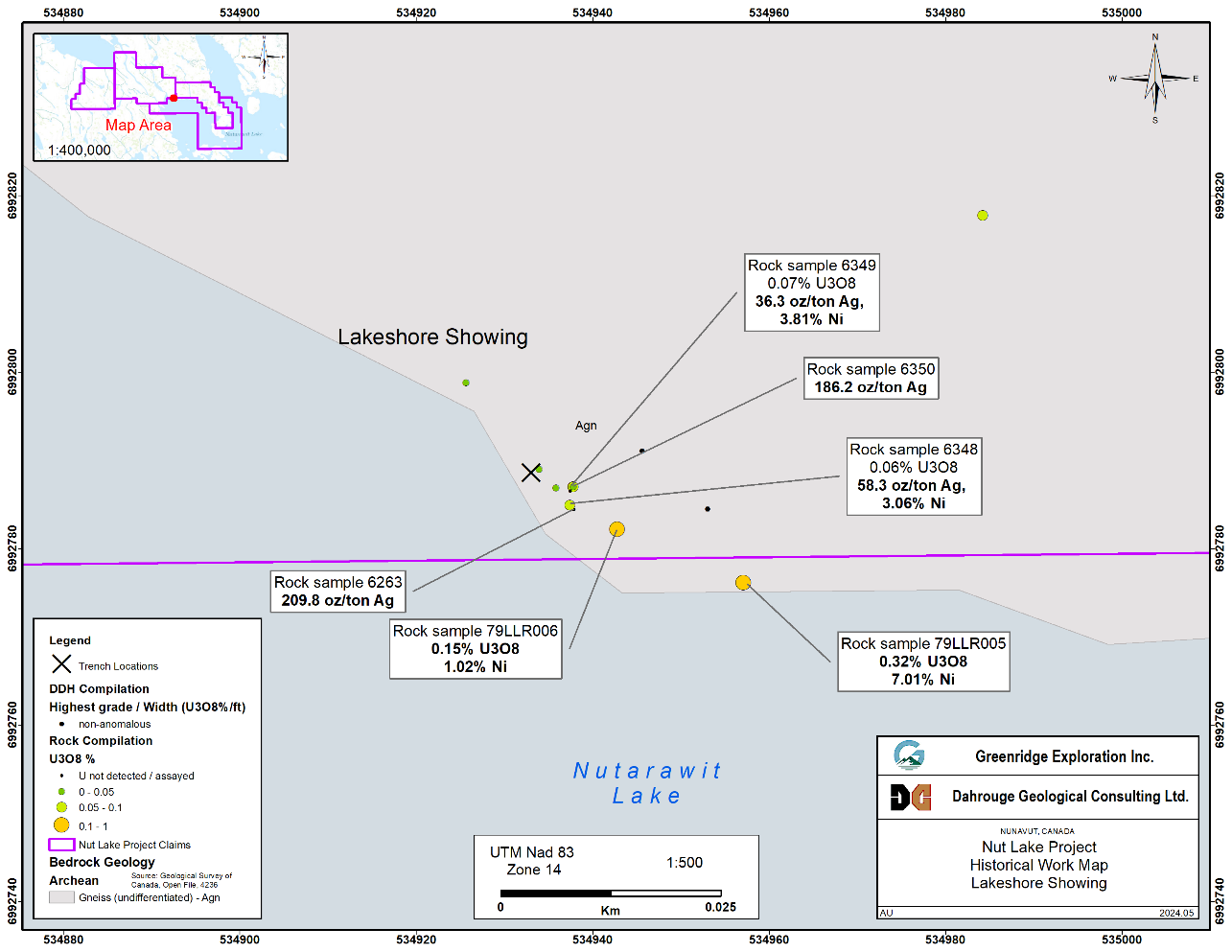

Lakeshore Showing

Historical Rock Sampling1&4

- 79LLR005 - 0.32% U3O8, 7.01% Ni, 23.46 oz/ton Ag.

- 79LLR006 - 0.15% U3O8, 1.02% Ni, 53.16 oz/ton Ag.

- L-6 - 0.08% U3O8.

- 6349 - 0.07% U3O8, 36.3 oz/ton Ag, 3.81% Ni.

- 6348 - 0.06% U3O8, 58.3 oz/ton Ag, 3.06% Ni.

- 6263 - 209.8 oz/ton Ag - fracture within mafic gneiss containing native silver.

- 6350 - 186.2 oz/ton Ag - fracture within mafic gneiss containing native silver.

- 6352 - 15.48 oz/ton Ag, 2.84% Pb.

- 6270 - 4.21% Pb.

Historical Drilling

- Four (4) drillholes completed on this showing, totaling 62 meters of drilling4:

- 0.015% U3O8 over 2 ft (DDH: Lake #3).

Figure 4 - Historical work map of the Lakeshore Showing on the Nut Lake Property

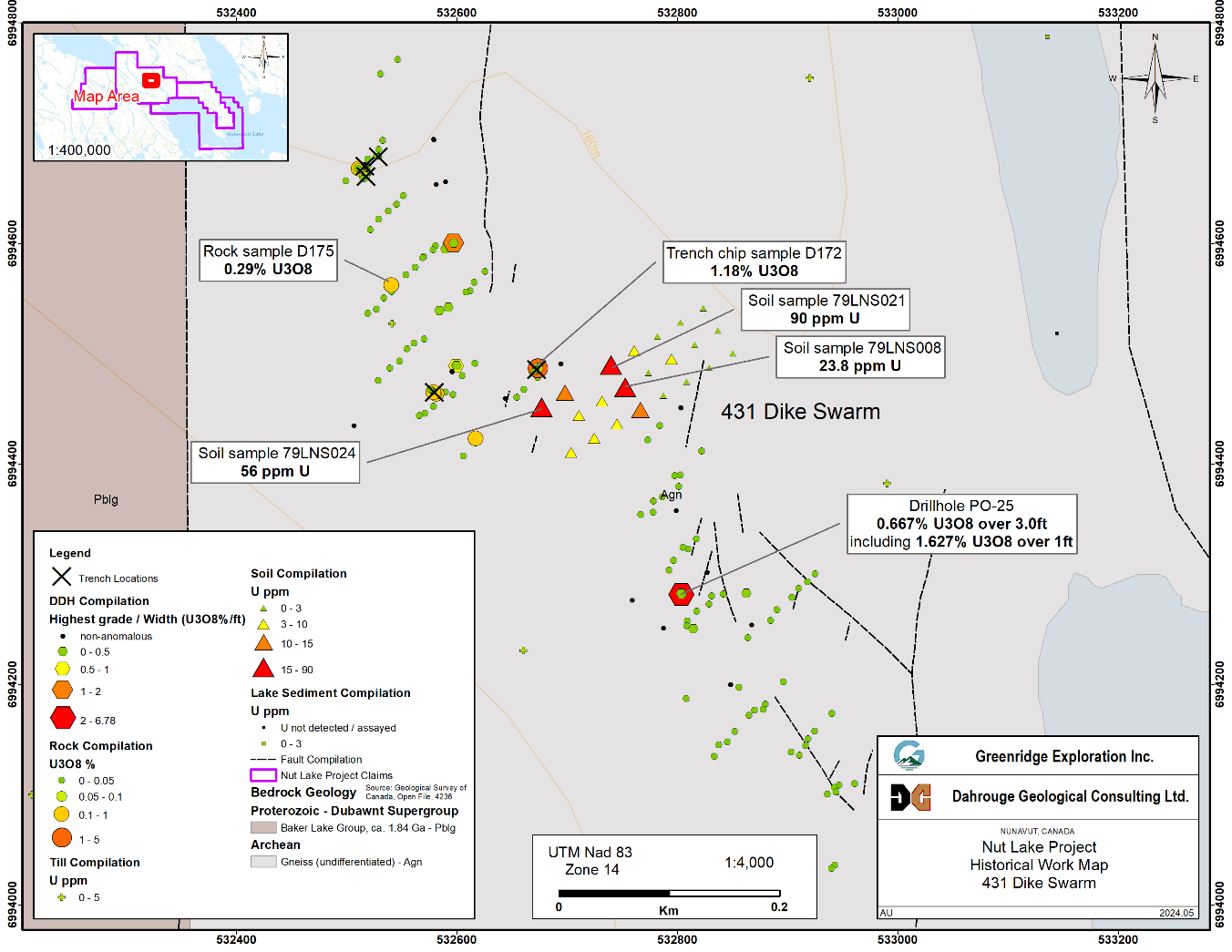

431 Dike Swarm Showing

Historical Rock Sampling

- Outcrop samples assayed up to 0.29% U3O8 (D175) with five (5) samples >0.02% U3O82.

- Trenches assayed up to 1.18% U3O8 (D172) with five (5) samples >0.1% U3O8 and nineteen (19) samples >0.02% U3O8.

Historical Drilling

- Forty-one (41) drillholes completed on this showing, totaling 2,735 meters of drilling1&3:

- 0.667% U3O8 over 3ft including 1.627% U3O8 over 1ft (DDH: PO-25).

- 0.485% U3O8 over 4ft including 1.7% U3O8 over 1ft (DDH: WC-5).

- 0.177% U3O8 over 3ft, including 0.425% U3O8 over 1ft (DDH: PO-18).

Figure 5 - Historical work map of the 431 Dike Swarm Showing on the Nut Lake Property

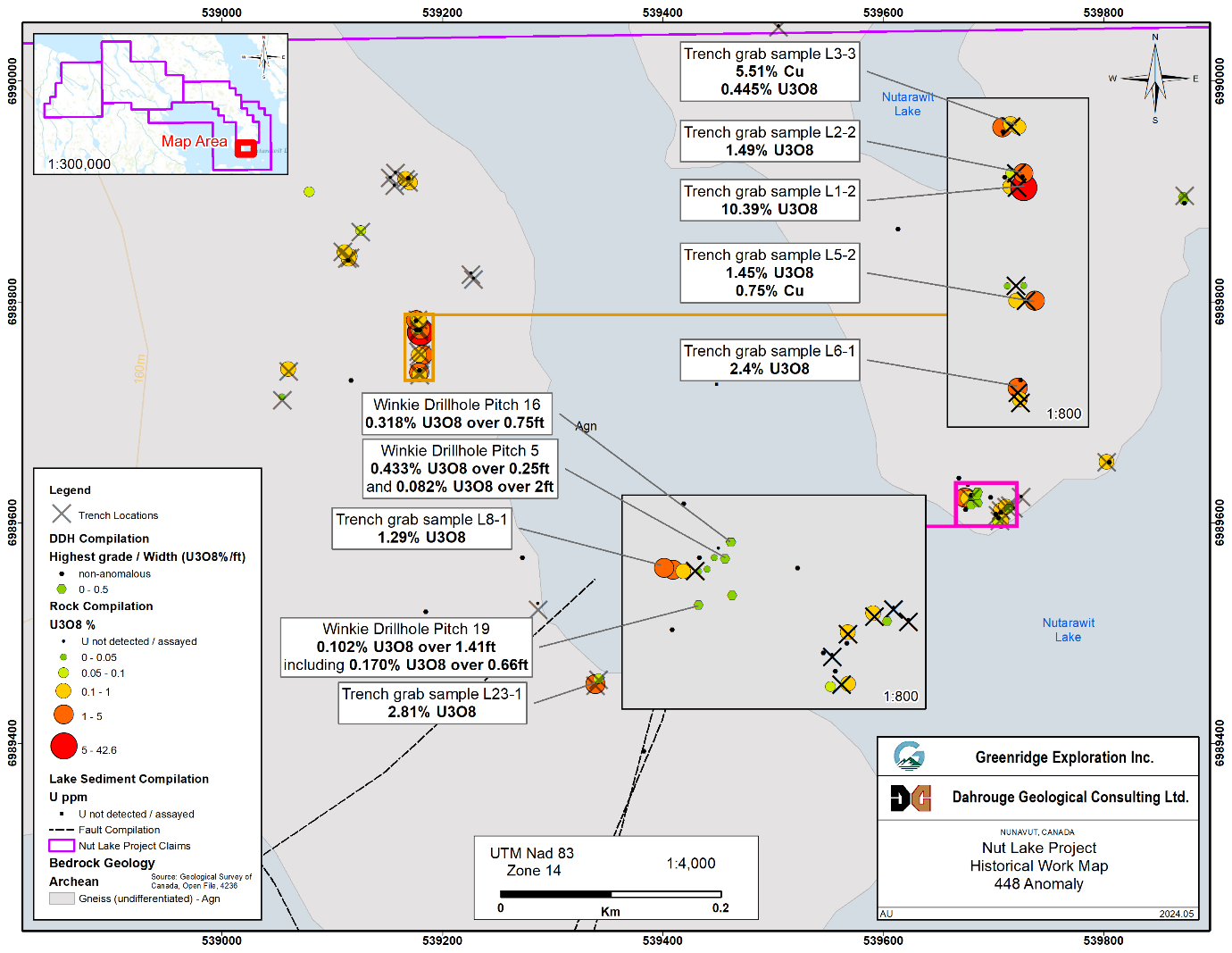

448 Anomaly Showing4

Historical Rock Sampling

- Outcrop samples assayed up to 0.10% U3O8.

- Samples from trenches assayed up to 10.39% U3O8 with nine (9) samples >1% U2O8 and twenty-four (24) samples >0.10% U3O8:

- Trench L3 grab sampled with 5.51% Cu and 0.45% U3O8.

- Trench L3 grab sampled with 5.51% Cu and 0.45% U3O8.

Historical Drilling

- Thirty-two (32) drillholes completed on this showing, totaling 320 meters of drilling:

- 0.318% U3O8 over 0.75ft (DDH: Pitch 16).

- 0.433% U3O8 over 0.25ft and 0.082% U3O8 over 2ft (DDH: Pitch 5).

- 0.102% U3O8 over 1.41ft including 0.170% U3O8 over 0.66ft (DDH: Pitch 19).

Figure 6 - Historical work map of the 448 Anomaly Showing on the Nut Lake Property

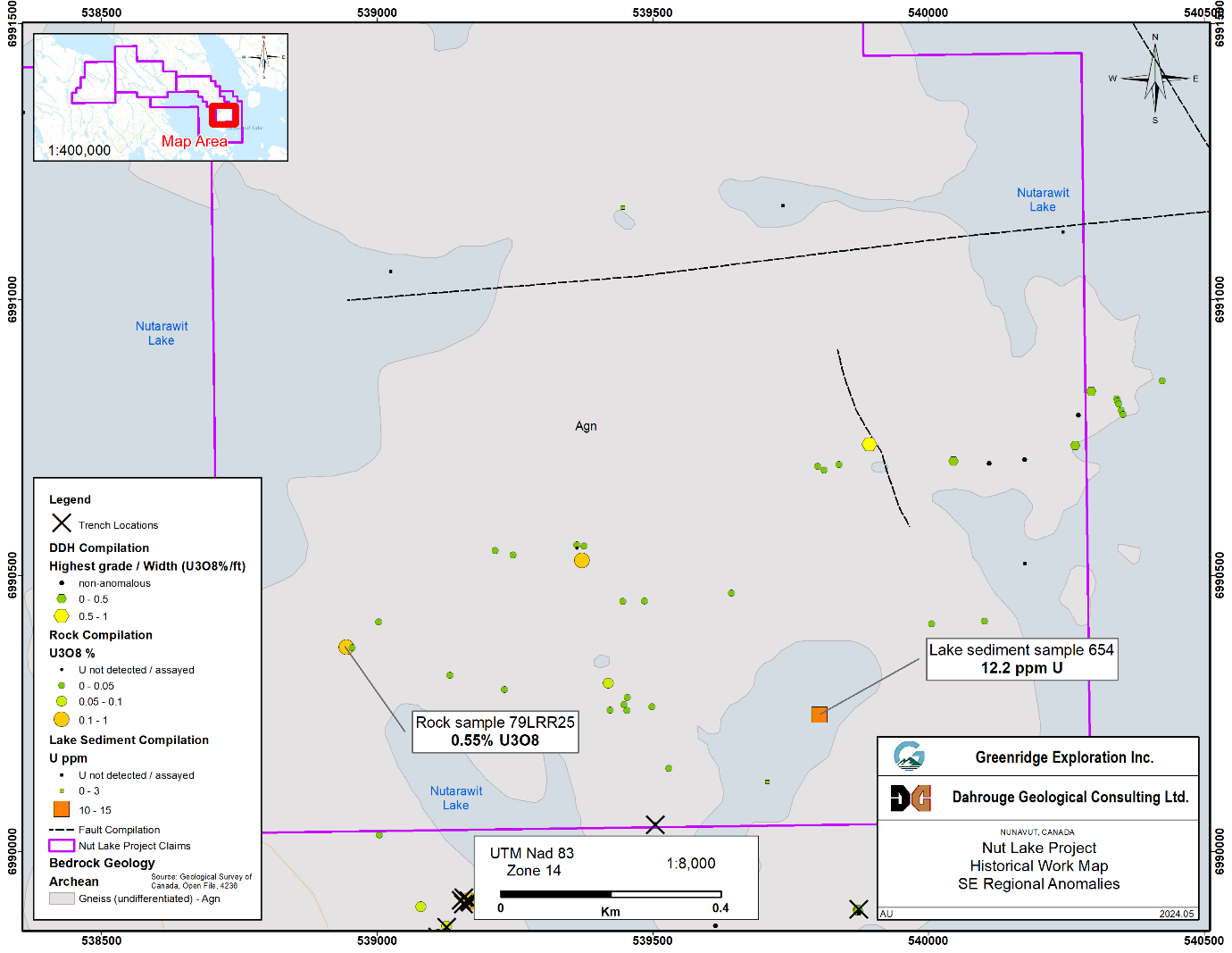

SE Regional Anomalies

Historical Rock Sampling

- Outcrop samples assayed up to 0.55% U3O8 with two (2) samples >0.1% U3O8 and thirteen (13) samples >0.02% U3O81&2.

Historical Drilling

- Twelve (12) drillholes completed in this region, totaling approximately 1,081 meters of drilling1&3:

- 0.026% U3O8 over 36ft including 0.054% U3O8 over 1.5ft (DDH: PO-46).

- 0.025% U3O8 over 15ft (DDH: PO-45).

- 0.025% U3O8 over 14.1ft (DDH: PO-44).

Figure 7 - Historical work map of the SE Regional Anomalies on the Nut Lake Property

About The Nut Lake Property

The Project is located approximately 55km north of the Angilak Uranium Deposit5 or 180Km southwest of Baker Lake, Nunavut in the Yathkyed Basin (a sub-basin of the prolific Thelon Basin) in Nunavut Territory, Canada. The Project consists of three contiguous mineral licences encompassing a total land area of approximately 4,036 hectares (~40km²).

In 1979, Pan Ocean Oil Ltd. performed an exploration program consisting of ground geophysics, geological mapping, prospecting and Winkie drilling as follow up to previous sampling with elevated uranium in dyke swarms, fractures and contacts between syenites and trachytes. The geology of the Project area consists of basal sedimentary rocks of the South Channel Formation, composed of white quartzites and pink to grey arkose and arkosic rocks. The sedimentary sequences of the lower Dubawnt Group are unconformably or disconformably overlain by volcanic rocks of the Christopher Island Formation.

The Project hosts high grade vein hosted grab samples of up to 4.36% U3O8, 53.16 oz/t Ag, 1.15% Pb and 7.0% Ni.¹

During the 1979 field season, geological mapping at a scale of 1:1,000 was completed on a major portion of the Project. This was concurrent with prospecting on, and in the immediate area of the Project. Results from prospecting were the discovery of two (41 m wide) syenite dikes and a frost heaved area of felsic gneiss with up to 3,000 cps on fracture surfaces. Two significant Uranium bearing showings were discovered, the "Lake Showing" and the "Heartbreak Showing". The most noteworthy was the Heartbreak showing which revealed 3.0" and 3.5" samples across a fracture that assayed 2.11% U3O8 and 4.36% U3O8 respectively. The results were followed up with a radon gal survey, a VLF-EM survey and an overburden sampling program. The radon survey results showed that the response is irregular with several good highs and the VLF-EM survey showed a series of northwesterly trending anomalies. It was concluded that further drilling of the Lake Showing is recommended.

The Project and surrounding proximal area have seen approximately 805ft of Winkie Drilling and 6,920ft of diamond drilling completed on it. Multiple holes intersected significant uranium mineralization, with the most noteworthy being at the "Tundra Showing" where Hole Winkie AX W-24 intersected 9ft of 0.69% U3O8 including 4.90% U3O8 over 1ft from 8ft depth.¹ Additional noteworthy holes were hole P049 which returned approximately 0.20% U3O8 over a one-foot interval and hole 068 which was drilled to intersect fracture mineralization and successfully encountered approximately 0.59% over 1 foot (Pan Ocean Oil Ltd., 1979 Assessment Report #81075).

The combination of historically defined anomalies and modern exploration techniques provides prime ingredients for the potential of discovering a high-grade uranium system within the Project area. The Nut Lake Property has the potential to host unconformity vein and breccia type, sygenentic and sandstone-hosted phosphatic type mineralization.

Qualified Person

The technical information contained in this news release has been reviewed by Neil McCallum B.Sc., P.Geo., of Dahrouge Geological Consulting Ltd., who is a "Qualified Person" as defined in NI 43-101 - Standards of Disclosure for Mineral Projects.

A qualified person has not done sufficient work to verify the results. The Company believes that the historical information is relevant to an appraisal of the merits of the Project and forms a reliable basis upon which to develop future exploration programs. The Company will need to conduct further exploration which will include drill testing and sampling to verify historical data, and there is no guarantee that the results obtained will reflect the historical results.

References

1Source: 1979 Assessment report (number 81075) by Pan Ocean Oil Ltd.

2Source: 1978 Assessment report (number 61692) by Pan Ocean Oil Ltd.

3Source: 1978 Assessment report (number 61815) by Pan Ocean Oil Ltd.

4Source: 1980 Assessment report (number 81190) by Pan Ocean Oil Ltd.

Assessment reports can be found here: https://nunavutgeoscience.ca/gateway/browseA.php

5Source: Reported by ValOre Metals Corp. in a Technical Report entitled "Technical Report and Resource Update For The Angilak Property, Kivalliq Region, Nunavut, Canada", prepared by Michael Dufresne, M.Sc., P.Geo. of APEX Geosciences, Robert Sim, B.Sc., P.Geo. of SIM Geological Inc. and Bruce Davis, Ph.D., FAusIMM of BD Resource Consulting Inc., dated March 1, 2013. Note: The historical mineral resource estimate was calculated in accordance with NI 43-101 and CIM standards at the time of publication and predates the current CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014) and CIM Estimation of Mineral Resources & Mineral Reserves Best Practices Guidelines (November, 2019).

About Greenridge Exploration Inc.

Greenridge Exploration Inc. (CSE: GXP | FRA: HW3) is a mineral exploration company dedicated to creating shareholder value through the acquisition, exploration, and development of critical mineral projects in North America. The Carpenter Lake Uranium Project is located in the Athabasca Basin consisting of 7 mineral claims covering 13,387 hectares across the Cable Bay Shear Zone and the Company is advancing the Project to test multiple high priority targets. The Company's Nut Lake Uranium Project located in the Thelon Basin includes historical drilling which intersected up to 9ft of 0.69% U3O8 including 4.90% U3O8 over 1ft from 8ft depth2. Additionally, the Company's Weyman Copper Project in southeast British Columbia sits on the south portion of the famous Quesnel Terrance. The Company is led by an experienced management team and board of directors with significant expertise in capital raising and advancing mining projects.

On Behalf of the Board of Directors

Russell Starr

Chief Executive Officer, Director

Telephone: +1 (778) 897-3388

Email: info@greenridge-exploration.com

Disclaimer for Forward-Looking Information

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the project acquisition bringing a low-risk opportunity, the Company, building a strong battery metals portfolio with low-risk opportunities that positively impact the Company and its shareholders and the Company providing an initial work plan are "forward-looking statements". Forward-looking statements in this news release include, but are not limited to, statements with respect to the Project and its mineralization potential; the Company's objectives, goals, or future plans with respect to the Project; the Company's anticipated exploration program at the Project. These forward-looking statements reflect the expectations or beliefs of management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether because of new information, future events or otherwise, unless so required by applicable securities laws.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/fffac19c-b7d2-4eab-bb92-329caf938e0d

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b7c9db0-9fae-40a9-9112-a9d9fa68fcce

https://www.globenewswire.com/NewsRoom/AttachmentNg/c87b4117-5d1a-440c-96c7-07805c1d8bcc

https://www.globenewswire.com/NewsRoom/AttachmentNg/498bafed-0f3d-4a3c-8042-baeb804f3b7b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8265418-cd8b-42b1-b71f-094627707e7d

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb5a49b0-b198-4e7d-a572-858e7dac55de

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8528c5b-8694-4901-86b2-7d825c8cd4d1