Assessment of near-surface gold resources could capitalize on record-high gold prices, positioning Pelangio for accelerated growth.

TORONTO, ON / ACCESSWIRE / August 15, 2024 / Pelangio Exploration Inc. (PX:TSX-V)(OTC PINK:PGXPF) ("Pelangio" or the "Company")?is pleased to announce that it is currently evaluating the potential for near-term production at its Manfo gold project in Southwest Ghana. A review of the resource models of the three deposits at Manfo to determine the gold content and tenor of mineralization at shallow depths which could be exploited by open-pit mining is underway and will proceed to a formal study of possible near-term production scenarios which could be economic under the current record high gold price.

Ingrid Hibbard, President and CEO, commented:

"The NI43-101 maiden mineral resource estimate ("MRE") for the Manfo gold project was conducted eleven years ago using a gold price of $1,450 USD and estimated 195,000 oz Au Indicated plus 298,000 oz Au Inferred to be present.¹ We believe that the 70% increase to the gold price over that used for the 2013 MRE has significantly upgraded the economics of gold production for the Manfo project. As such, we are evaluating possibilities for smaller-scale near term production at Manfo, and have commenced a review of the near-surface gold resource content to be followed by an economic assessment of potential development and production plans. Ongoing drilling efforts will continue with the potential for successful outcomes to complement profitable near-term production that could serve as a foundation for financing a larger-scale operation in the future."

About the Manfo Project

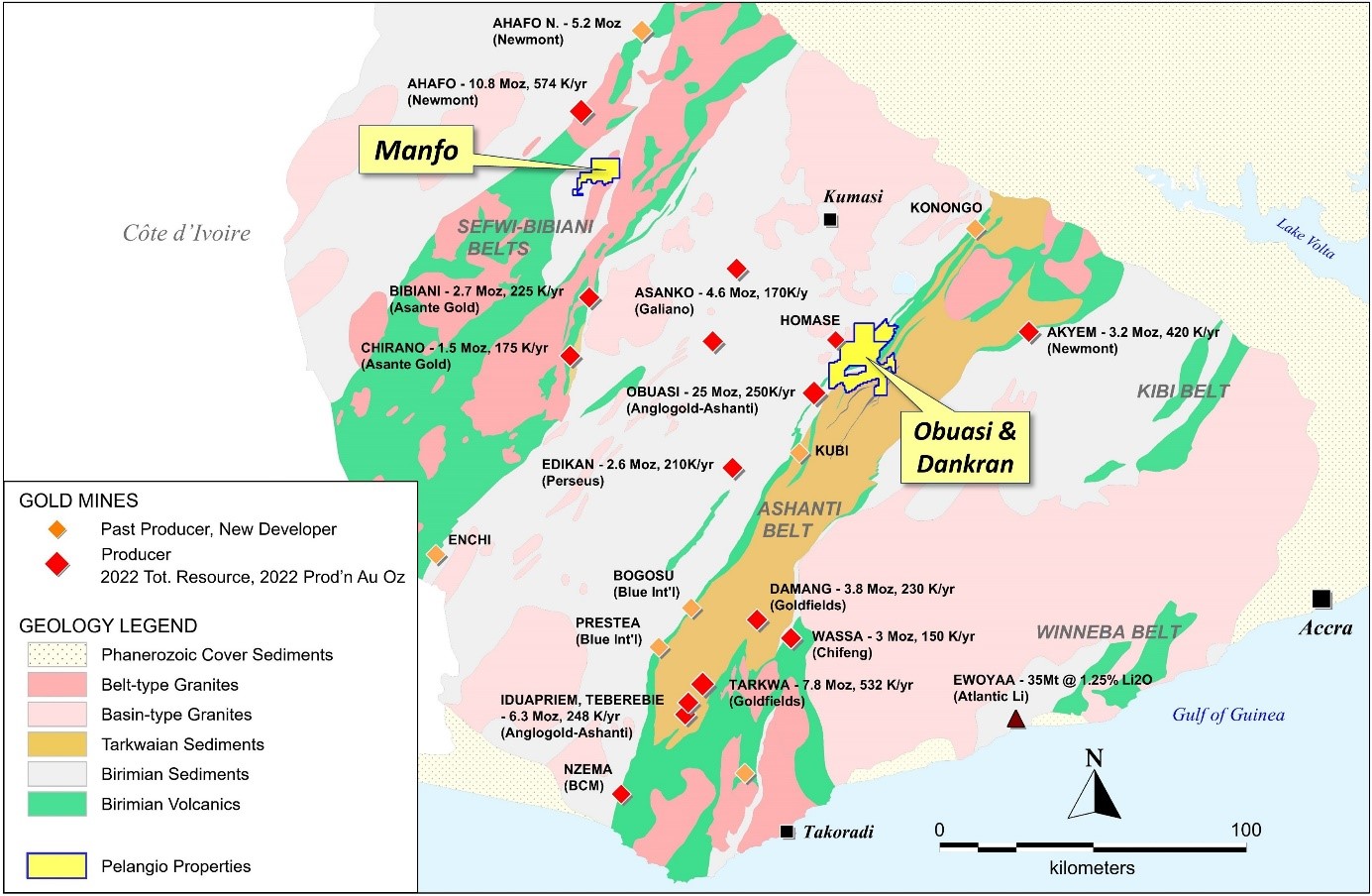

The 96 km² Manfo project is located in the Sefwi-Bibiani greenstone belts of the Paleoproterozoic Birimian of southwest Ghana, 15 km southeast of Newmont's Ahafo gold mine and 40 km north of Asante Gold's Bibiani gold mine. Pelangio acquired the property in 2010 and conducted considerable exploration resulting in seven significant gold discoveries with three of them drilled to a resource status. In 2013 SRK Consulting (Canada) estimated the project hosts a gold mineral resource of 195,000 oz (at 1.5 g/t Au) Indicated and 298,000 oz (at 1.0 g/t Au) Inferred with the majority of the resource contained in the adjacent Pokukrom East and West deposits.¹ SRK used a gold price of $1,450 USD per ounce Au and a cut-off grade of 0.5 g/t Au for their MRE. Refer to SRK's NI43-101 report "Mineral Resource Evaluation Technical Report, Manfo Gold Project, Ghana" released on June 21, 2013, for the details.

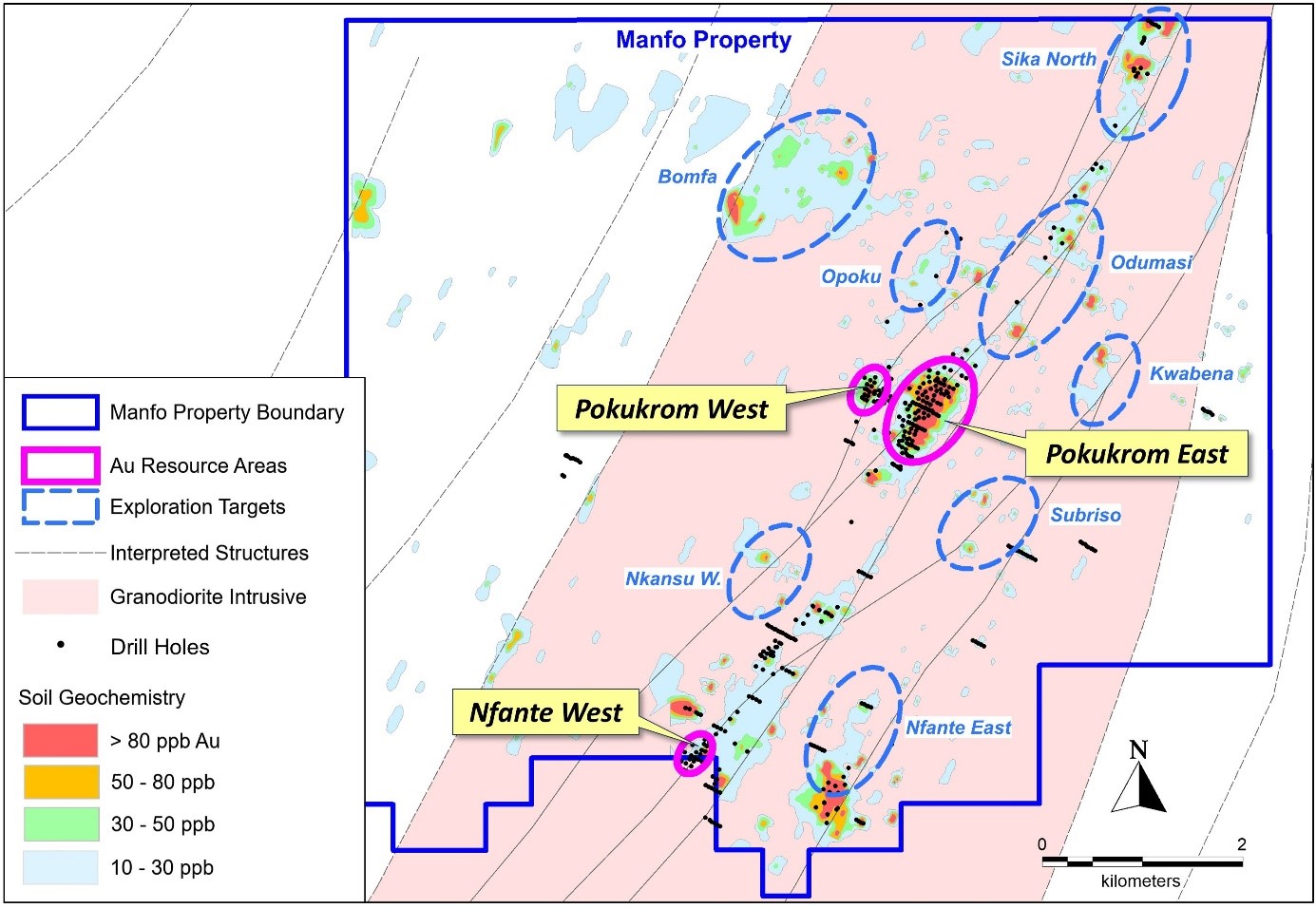

In 2021 Pelangio identified opportunities to grow the project through step-out drill testing of open-ended mineralization in the known deposits plus drill testing of multiple exploration targets along and near the 9 km of mineralized structures within the property. Diamond drilling programs were conducted by Pelangio in 2021 and 2023 with a total of 1,423 meters of drilling conducted at the Pokukrom East and West deposits. These drilling programs and their results are detailed in Pelangio's press releases of November 16, 2021 and July 24, 2023.

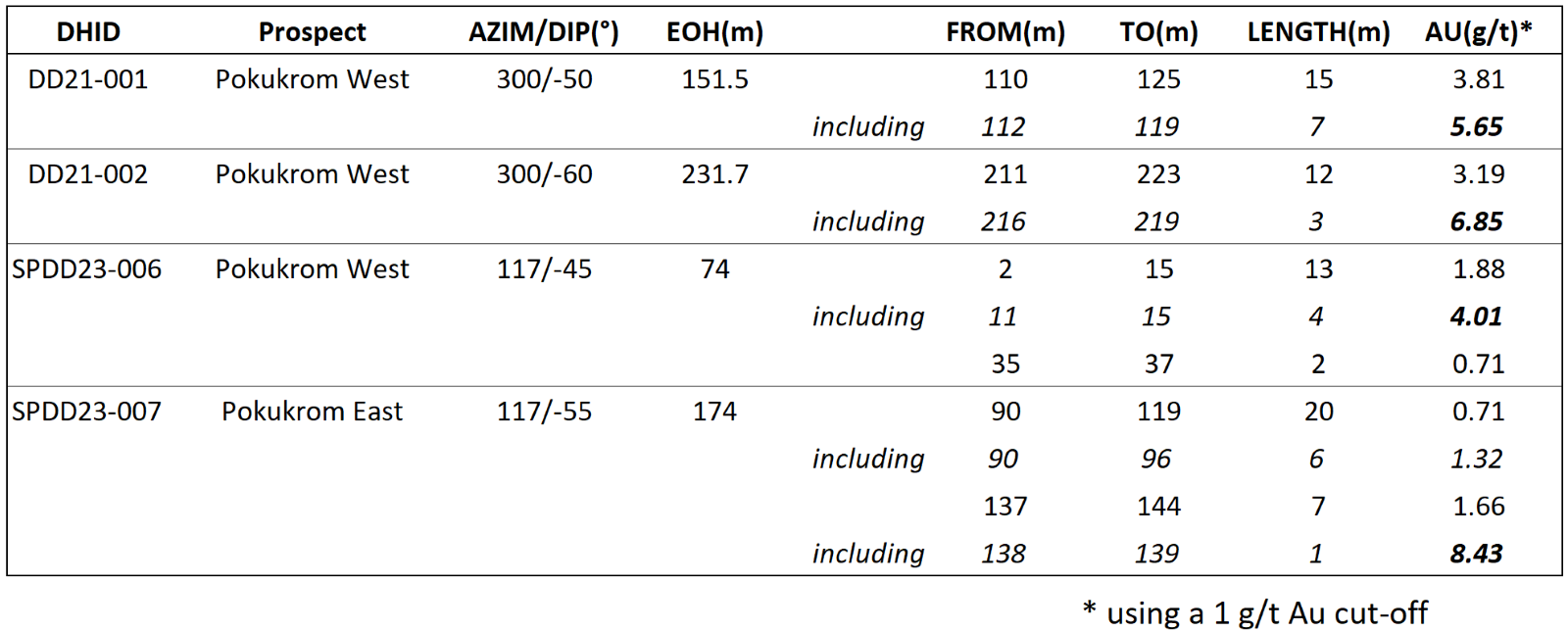

The results were encouraging and demonstrated extensions to the known mineralization in both deposits and concluded continued drilling around the deposits for potential resource additions is warranted. Significant intercepts from the 2021 and 2023 drill programs included:

A number of resource extensional targets around the Pokukrom deposits remain to be drill tested which could deliver additions to the two Pokukrom deposits with successful infill drilling, and property-wide exploration drilling planned to test 20+ targets has yet to be conducted. These targets consist principally of untested favourable geological and structural settings with lower-order Au in soils anomalism that could deliver one or several satellite deposits with drilling successes.

While the longer term goal is to develop Manfo into a significantly larger project through continued resource and exploration drilling programs, it is recognized that the significant resource contained at Manfo could present a near term opportunity for a smaller 'starter' mining project that exploits a shallower portion of the gold resource, which could capitalize a larger project down the road. The mineralization at Manfo comes to surface and some of the best gold grades are near surface. With the increase in the gold price from 1,450 USD in 2013 to $2,400 USD today, the economics of gold production at Manfo is expected to be much improved. A review of the resource models at Manfo to determine the gold content and tenor of mineralization at shallow depths which might be exploited by one or several smaller open-pits has commenced and will proceed to a formal study of possible near-term production scenarios which could be economic under the current record high gold price.

The Manfo mineral resource estimation was conducted by SRK Consulting and published in June 2013. (Refer to the Mineral Resource Evaluation Technical Report, Manfo Gold Project, by SRK Consulting (Canada) Inc., released on June 21, 2013 and available on Pelangio's website). The resource estimation was made in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects at the time of the mineral resource estimation in 2013. NI 43-101 standards for disclosure have been amended multiple times since 2013 and as a result, Pelangio's 2013 resource estimate is no longer NI 43-101 compliant under the current standards.

Figure 1. Location of the Manfo Project, Southwest Ghana Geology & Gold Mines

Figure 2. Manfo Project - Resource Areas and Exploration Target Areas

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario, #0191), is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Thomson approved the technical data disclosed in this release.

About Pelangio?

Pelangio acquires and explores prospective land packages located in world-class gold belts in Ghana, West Africa and Canada. In Ghana, the Company is focused on its two 100% owned camp-sized properties: the 100 km 2 Manfo property, the site of eight near-surface gold discoveries, and the 284 km 2 Obuasi property, located 4 km on strike and adjacent to AngloGold Ashanti's prolific high-grade Obuasi Mine, as well as the Dankran property located adjacent to its Obuasi property. See www.pelangio.com for further details on all Pelangio's properties.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements?

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's strategy of acquiring large land packages in areas of sizeable gold mineralization, and the Company's ability to complete the planned exploration programs. Regarding forward-looking statements and information contained herein, we have made many assumptions, including about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, near-term production may not be viable" delays due to COVID-19 or other safety protocols, and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.?

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Pelangio Exploration Inc.

View the original press release on accesswire.com