Reported figures all in U.S. Dollars

Boston, MA, Aug. 19, 2024 (GLOBE NEWSWIRE) -- MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial results for the 13 and 26 weeks ended June 30, 2024 ("Q2 2024" and "H1 2024", respectively). The fiscal year of MiniLuxe is a 52-week reporting cycle ending on the Sunday closest to December 31, which periodically necessitates a fiscal year of 53 weeks; fiscal years referred to in this release consist of 52-week periods. Unless otherwise specified, all amounts are reported in U.S. dollars.

MiniLuxe's H1 2024 represented record growth across several dimensions, including record revenue levels on Core Studios. Compared to the Company's peak revenue level pre-COVID (2019), studio average daily revenue reached new peak levels that are approximately 25% higher than prior to the pandemic. Additionally, Core Studios revenue for the trailing twelve months Q2 2024 is outperforming the same period from Q2 2019 by 37%.

MiniLuxe continued its consistent, organic, year-over-year growth as Q2 2024 revenue increased 9% over Q2 2023 at $6.9M with gross profit of $3.0M, a 12% increase from Q2 2023. The Company views gross profit dollar growth as a key indicator of MiniLuxe's positive trajectory towards long-term profitability and, in conjunction with the reduced cost base, moved materially to a narrowing loss rate. Q2 2024 operating loss was ($1.5M), representing a $1.1M or 43% reduction of loss when compared to Q2 2023. This increased operating efficiency was driven by reduced general and administrative expenses, while overall fixed cost leverage gained significant strides. Cost efficiencies coupled with overall growth of the business brought corporate HQ SG&A from 28% of revenue down to 19% of revenue in the last 12 months.

As in past periods, the majority of the Company's growth came organically from the MiniLuxe Core Studios. The Core Studio base continued its consistent, multi-year trend of growth in Q2 2024 as revenue increased $0.45M to $6.4M, or 8% over Q2 2023. MiniLuxe also saw good trends on the demand and supply side of its business: (a) positive momentum on the demand side (new client and loyal client growth) and (b) growth and development of supply side (Talent Ecosystem growth). Some of the other key areas that demonstrate the strengthening brand resiliency and loyal demand for MiniLuxe in-studio service offerings include:

- Impact of loyal client base: MiniLuxe's loyal client base continues to grow, with over 10,000 studio clients that average 10+ visits per year, a 10% increase year-over-year. MiniLuxe defines its "super fans" as those who have 20 or more visits per year and have an average annual spend of ~$2,000, representing in aggregate 25% of MiniLuxe's total Talent Revenue. Additionally, general client retention remains strong as approximately 42% of MiniLuxe's clients in a given month are repeat loyal clients from the prior month.

- Attracting, developing and retaining talent: MiniLuxe's annual retention of its hourly worker base has continued its trend of holding to over 80%. MiniLuxe's key priority is the continued growth, development and scaling of the MiniLuxe Talent Ecosystem (i.e. its team of nail designers and waxing specialists working in the field). MiniLuxe's differentiation in attracting, developing and retaining talent comes from providing a safe and empowering workplace environment that offers strong training and workforce development, and highly competitive earnings and earnings potential. Over 50% of MiniLuxe's field team members have been with the company for more than 5 years, and those team members participate in the company's equity ownership program.

- Growing studio economics on a revenue and gross profit basis: The combination of a growing, loyal client base and the dedication to continuously improving the quality and staffing of the designer base has contributed to the consistent, same-store year-over-year growth and consistent trailing-twelve month (TTM) quarterly growth.

Subsequent Events

As was discussed earlier and as disclosed in the Company's Q1 2024 Financial Statements and MD&A, on May 3, 2024 MiniLuxe entered into a majority-controlled joint venture agreement with an Atlanta-based firm Sugarcoat (the "Sugarcoat JV"), a regional nail services brand with 5 locations in the Atlanta area. The Sugarcoat JV, which was ultimately closed subsequent to the end of Q2 2024, will initially operate an existing Sugarcoat nail services salon location in Atlanta with intentions to convert into a MiniLuxe-branded studio while also considering further expansion, partnership and conversion opportunities.

"The market for nail care and related self-care services remains as large and robust as ever. Our team seeks to win in this market by remaining laser-focused on the set of strategic and executional priorities that can accelerate gross profit and overall studio contribution. With our strongest unit economics in our history, this quarter also saw us advancing on our franchise, M&A, and corporate development initiatives." said Tony Tjan, Chief Executive Officer and Co-founder of MiniLuxe.

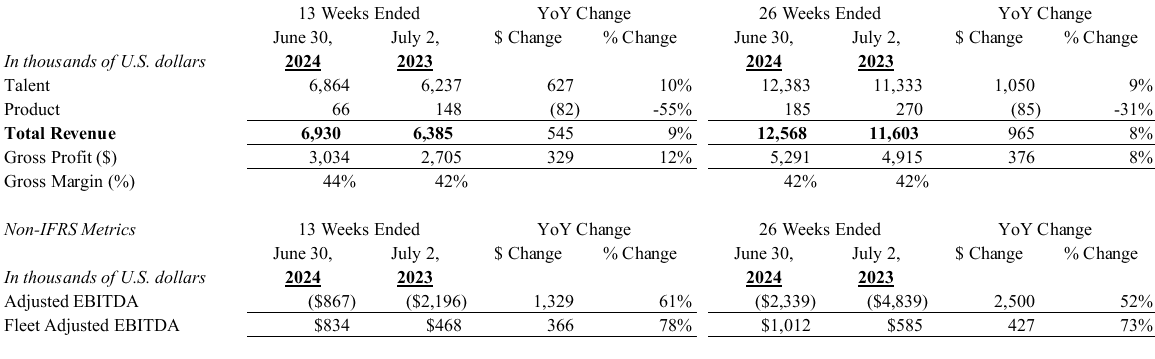

Q2 & H1 2024 Results

Selected Financial Measures

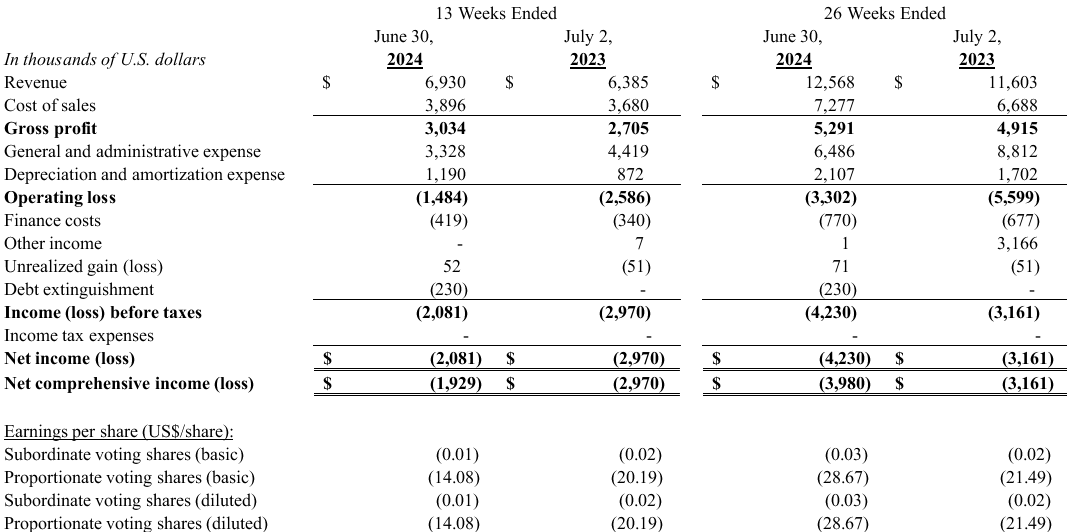

Results of Operations

The following table outlines the consolidated statements of loss and comprehensive loss for the thirteen and 26 weeks ended June 30, 2024 and July 2, 2023:

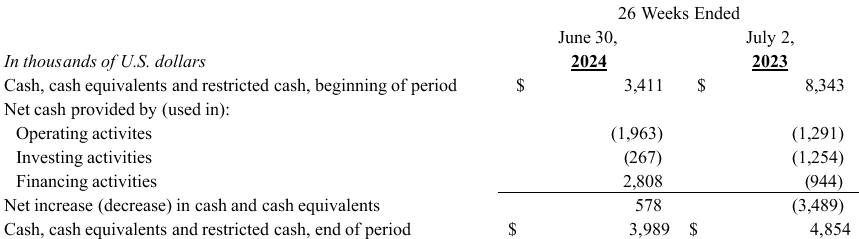

Cash Flows

The following table presents cash and cash equivalents as at June 30, 2024 and July 2, 2023:

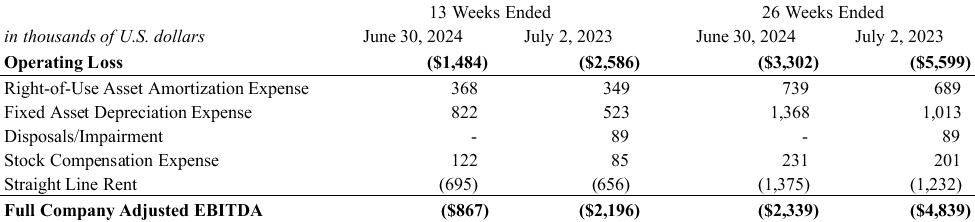

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release references certain non-IFRS measures used by management. These measures are not recognized under International Financial Reporting Standards ("IFRS"), do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company's results of operations from management's perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of the Company's financial information reported under IFRS. The non-IFRS measures referred to in this press release are "Adjusted EBITDA" and "Fleet Adjusted EBITDA".

Adjusted EBITDA

Management believes Adjusted EBITDA most accurately reflects the commercial reality of the Company's operations on an ongoing basis by adding back non-cash expenses. Additionally, the rent-related adjustments ensure that studio-related expenses align with revenue generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back fixed asset depreciation, right-of-use asset amortization under IFRS 16, asset disposal, and share-based compensation expense to IFRS operating income, then deducting straight-line rent expenses1 net of lease abatements. IFRS operating income is revenue less cost of sales (gross profit), additionally adjusted for general and administrative expenses, and depreciation and amortization expense.

A reconciliation of IFRS operating income to Adjusted EBITDA is included in Selected Consolidated Financial Information.

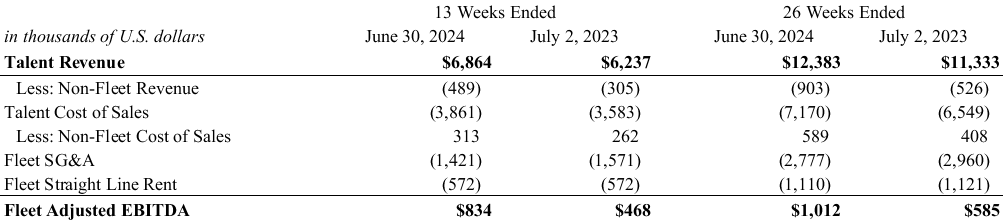

The Company also uses Fleet Adjusted EBITDA to evaluate the performance of its MiniLuxe Core Studio business (19 MiniLuxe-branded studios operating for 18+ months). This metric is calculated in a similar manner, starting with Talent revenue and adjusting for non-fleet Talent revenue and cost of sales, further adjusted by fleet general and administrative expenses and finally subtracting straight line rent expense (similar to amount used in the full company Adjusted EBITDA, less amounts allocated to locations outside of MiniLuxe's core studio business, i.e. Paintbox). The Company believes that this metric most closely mirrors how management views the fleet portion of the business. A reconciliation of Talent revenue to Fleet Adjusted EBITDA is included in Selected Consolidated Financial Information.

The following table reconciles Adjusted EBITDA to net loss for the periods indicated:

The following table reconciles Fleet Adjusted EBITDA to net loss for the periods indicated:

About MiniLuxe

MiniLuxe, a Delaware corporation based in Boston, Massachusetts. MiniLuxe is a lifestyle brand and talent empowerment platform servicing the beauty and self-care industry. The Company focuses on delivering high-quality nail care and esthetic services and offers a suite of trusted proprietary products that are used in the Company's owned-and-operated studio services. For over a decade, MiniLuxe has been elevating industry standards through healthier, ultra-hygienic services, a modern design esthetic, socially responsible labor practices, and better-for-you, cleaner products. MiniLuxe's aims to radically transform a highly fragmented and under-regulated self-care and nail care industry through its brand, standards, and technology platform that collectively enable better talent and client experiences. For its clients, MiniLuxe offers best-in-class self-care services and better-for-you products, and for nail care and beauty professionals, MiniLuxe seeks to become the employer of choice. In addition to creating long-term durable economic returns for our stakeholders, the brand seeks to positively impact and empower one of the most diverse and largest hourly worker segments through professional development and certification, economic mobility, and company ownership opportunities (e.g., equity participation and future franchise opportunities). Since its inception, MiniLuxe has performed over 4 million services.

For further information

Christine Mastrangelo

Investor Relations, MiniLuxe Holding Corp.

cmastrangelo@MiniLuxe.com

MiniLuxe.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This press release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") concerning the Company and its subsidiaries within the meaning of applicable securities laws. Forward-looking information may relate to the future financial outlook and anticipated events or results of the Company and may include information regarding the Company's financial position, business strategy, growth strategies, acquisition prospects and plans, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, information regarding the Company's expectations of future results, performance, achievements, prospects or opportunities or the markets in which the Company operates is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "targets", "expects", "budgets", "scheduled", "estimates", "outlook", "forecasts", "projects", "prospects", "strategy", "intends", "anticipates", "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" occur. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management's expectations, estimates and projections regarding future events or circumstances.

Many factors could cause the Company's actual results, performance, or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking information, including, without limitation, those listed in the "Risk Factors" section of the Company's filing statement dated November 9, 2021. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance, or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this press release.

Forward-looking information, by its nature, is based on the Company's opinions, estimates and assumptions in light of management's experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company currently believes are appropriate and reasonable in the circumstances. Those factors should not be construed as exhaustive. Despite a careful process to prepare and review forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking information. Although the Company bases its forward-looking information on assumptions that it believes were reasonable when made, which include, but are not limited to, assumptions with respect to the Company's future growth potential, results of operations, future prospects and opportunities, execution of the Company's business strategy, there being no material variations in the current tax and regulatory environments, future levels of indebtedness and current economic conditions remaining unchanged, the Company cautions readers that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which the Company operates may differ materially from the forward-looking statements contained in this press release. In addition, even if the Company's results of operations, financial condition and liquidity, and the development of the industry in which it operates are consistent with the forward-looking information contained in this press release, those results or developments may not be indicative of results or developments in subsequent periods.

Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to the Company or that the Company presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made (or as of the date they are otherwise stated to be made). Any forward-looking statement that is made in this press release speaks only as of the date of such statement.

1 Straight-line rent expense for a given payment period is calculated by dividing the sum of all payments over the life of the lease (the figure used in the present value calculation of the right-of-use asset) by the number of payment periods (typically months). This number is then annualized by adding the rent expenses calculated for the payment periods that comprise each fiscal year. For leases signed mid-year, the total straight-line rent expense calculation applies the new lease terms only to the payment periods after the signing of the new lease.