VANCOUVER, British Columbia, Aug. 20, 2024 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. ("West Red Lake Gold" or "WRLG" or the "Company") (TSXV: WRLG) (OTCQB: WRLGF) is pleased to announce the start of a 2024 surface drilling program across its 100% owned Madsen Mine Property located in the Red Lake Gold District of Northwestern Ontario, Canada.

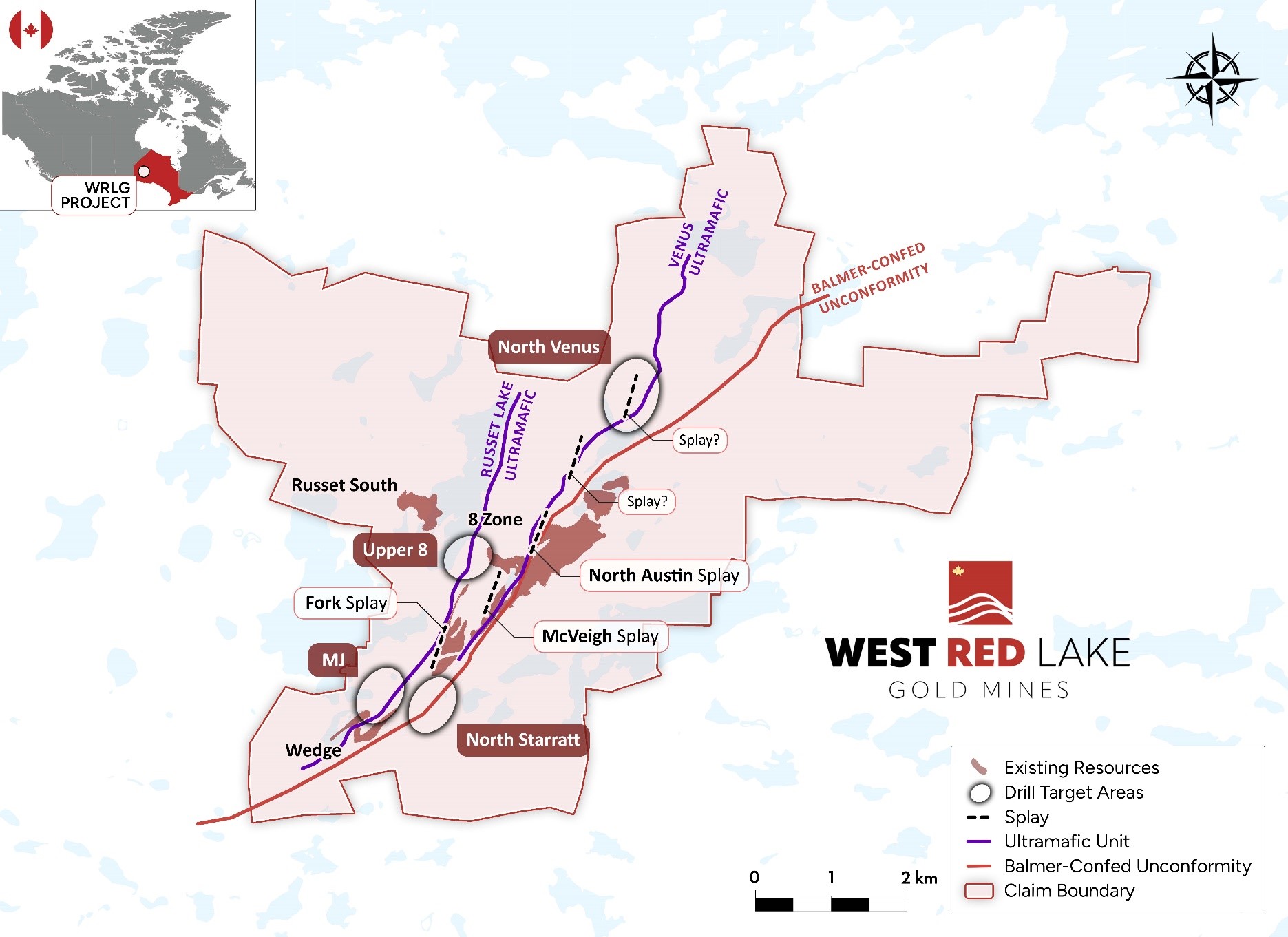

The Company plans to drill up to 10,000 meters ("m") of NQ diamond drill core testing a number of high-priority targets across the Madsen property that were generated through a systematic evaluation of all available geologic data (Figures 1 & 2). Drill targets were selected based on 1) their position along primary structural trends, 2) proximity to the Russet Lake and Venus ultramafic units, and 3) periodicity along strike of the main Madsen structural corridor relative to known mineralized splays (Fork, McVeigh and North Austin).

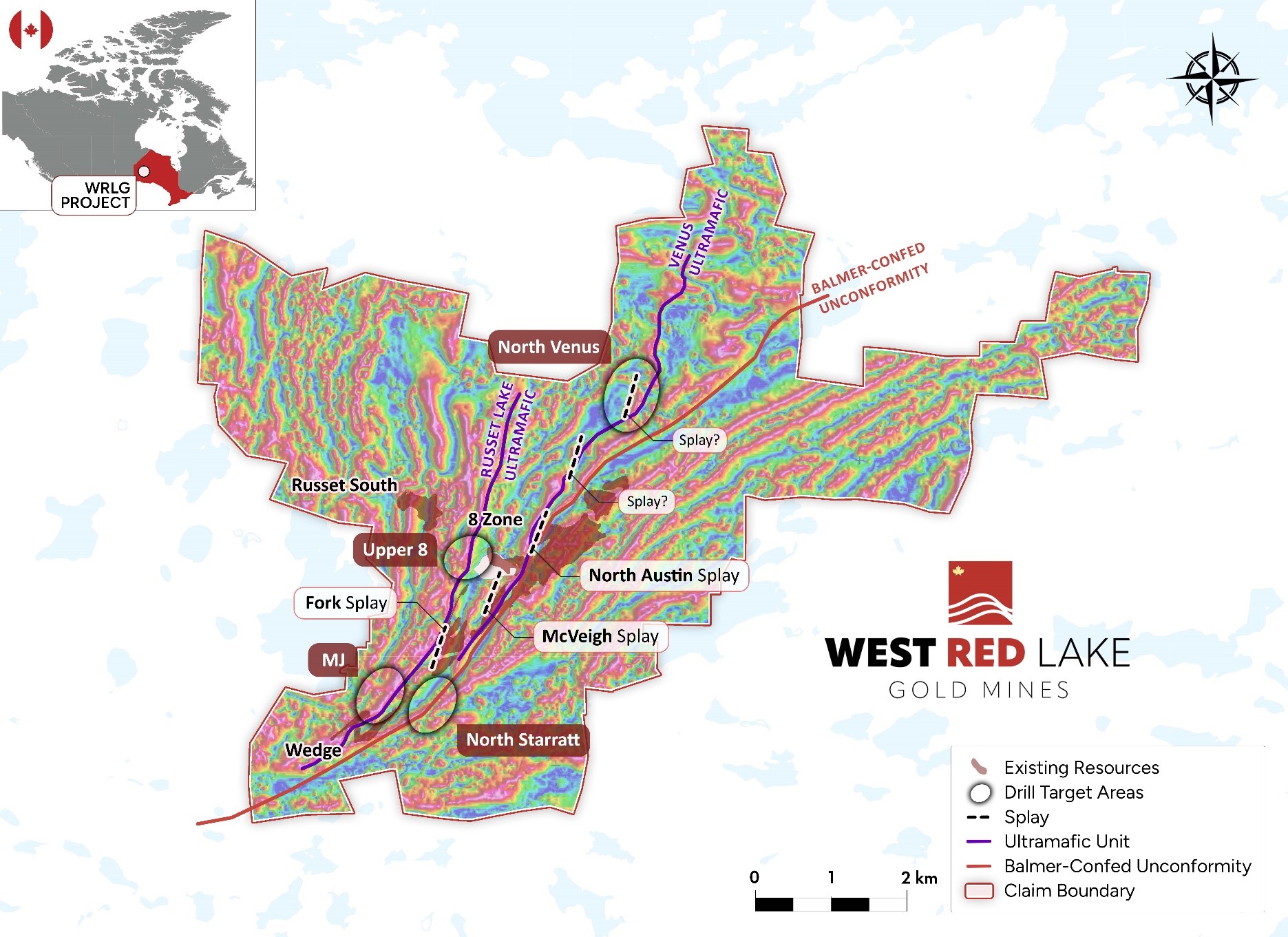

The Company recently recognized this periodicity of known mineralized splays along the Madsen structural corridor through an evaluation of deposit-scale structural relationships. The average spacing between these known mineralized splays is approximately 1 kilometer ("km"). Interpretation of the regional aeromagnetic dataset, which was flown in 2014, suggests that additional splays could be present along strike from Madsen to the northeast.

Will Robinson, Vice President of Exploration, stated, "After completing a thorough review of the available geologic data for the Madsen property our team has generated some new exploration concepts and identified a number of highly prospective targets that share characteristics with known resource areas, which suggests the geologic potential for hosting high-grade gold mineralization. We are very excited to test a number of these targets this year with the surface drilling program as we strive to make meaningful discoveries and add value across the Madsen property."

TARGET DESCRIPTIONS:

Upper 8

The Upper 8 target is a shallower geologic analog to the well-known high-grade 8-Zone and positioned within the same lithologic unit (Russet Lake Ultramafic) approximately 750m up-plunge from the main 8-Zone. The Upper 8 target horizon was intercepted in only a few historic drill holes, which encountered a zone of strong shearing, alteration and quartz veining equivalent to 8-Zone style mineralization. Based on available drilling data, there does not appear to have been sufficient follow-up drilling on this target.

MJ

The MJ target is currently a high-grade portion of the Wedge resource. It is also an 8-Zone analog hosted within two concordant shear zones up to 40 m in width and characterized by deformed gold-bearing quartz veins hosted within altered and deformed basalt and peridotite within the Russet Lake Ultramafic. Current drilling has delineated these shear zones over 500 m of strike length and to 320 m depth with the structure remaining open along strike and down-dip. Drilling in 2024 will be testing the extension of MJ along strike to the northeast, which remains completely open and mostly un-drilled.

North Venus

The North Venus target is located approximately 2km northeast along strike from the North Austin zone. The geophysical signature at North Venus displays a very similar magnetic response in size, orientation and magnitude to the Fork splay. This target area is located hanging-wall to the Venus ultramafic unit and is also located near a prominent bend or inflection in the local stratigraphy, as well as the Balmer-Confederation unconformity, which bodes well for potential structural modification and/or dilation in this area.

North Starratt

The Starratt Mine is located approximately 2km southwest of the Madsen Mine and was the second largest past producer on the Madsen property with ~164 koz of gold produced between 1948-1956[1]. The North Starratt target is testing the northeast extension of the Starratt mine trend. This area is considered highly prospective but remains mostly un-drilled.

1 Website: Ministry of Northern Development, Mines, Natural Resources and Forestry. "MDI52K13NW00011 - Ontario Geological Survey." GeologyOntario. Accessed August 15, 2024. http://www.geologyontario.mndm.gov.on.ca/mndmfiles/mdi/data/records/MDI52K13NW00011.html

FIGURE 1. Regional Targeting Map for 2024 Surface Drilling Program at Madsen.

FIGURE 2. Regional Targeting Map for 2024 Surface Drilling Program at Madsen w/ Magnetics (RTP) Tilt Derivative Overlay.

QUALITY ASSURANCE/QUALITY CONTROL

Exploration drilling completed on surface at the Madsen Mine consists of oriented NQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at the Madsen Mine core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Control samples (certified standards and uncertified blanks), along duplicates, are inserted at a target 5% insertion rate. Results are assessed for accuracy, precision, and contamination on an ongoing basis. The BQ-sized drill core is whole core sampled. The NQ-sized drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold ("VG"), a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is 'cleaned' with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties and transported by Madsen Mine personnel directly to SGS Natural Resource's Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm. A riffle splitter is then utilized to produce a 500g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish (SGS Code GO-FAA50V10). Samples returning gold values > 10 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample (SGS Code GO_FAG50V). Samples with visible gold or returning gold values > 30 g/t Au are also analyzed via metallic screen analysis (SGS code: GO_FAS50M). For multi-element analysis, samples are sent to SGS's facility in Burnaby, British Columbia and analyzed via four-acid digest with an atomic emission spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources analytical laboratories operates under a Quality Management System that complies with ISO/IEC 17025.

The Madsen Mine deposit presently hosts a National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") Indicated resource of 1.65 million ounces ("Moz") of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled "Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada", prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023, and amended April 24, 2024 (the "Madsen Report"). The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the Madsen Report. A full copy of the Madsen Report is available on the Company's website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 "Standards of Disclosure for Mineral Projects".

DIGITAL MARKETING AGREEMENT

The Company further reports that it has entered into an agreement with Machai Capital Inc. ("Machai") dated July 17, 2024, pursuant to which Machai will provide a digital marketing campaign (the "Machai Agreement"). The term of the Machai Agreement is for three months for a total retainer of $225,000, to be paid upfront.

Under the agreement Machai will execute a comprehensive digital media marketing campaign for the Company commencing in August including branding and content creation, data optimization services including search engine optimization, search engine marketing, lead generation, digital marketing, social media marketing, email marketing, and brand marketing.

Machai is a marketing, advertising and public awareness firm based out of Vancouver, British Columbia, specializing in advertising and public awareness in the metals & mining, technology, and special situation sectors. Machai and its principal, Suneal Sandhu are arms length to the Company and hold no interest, directly or indirectly, in the securities of the Company or any right to acquire such an interest. The engagement of Machai is subject to the approval of the TSX Venture Exchange.

ABOUT WEST RED LAKE GOLD MINES

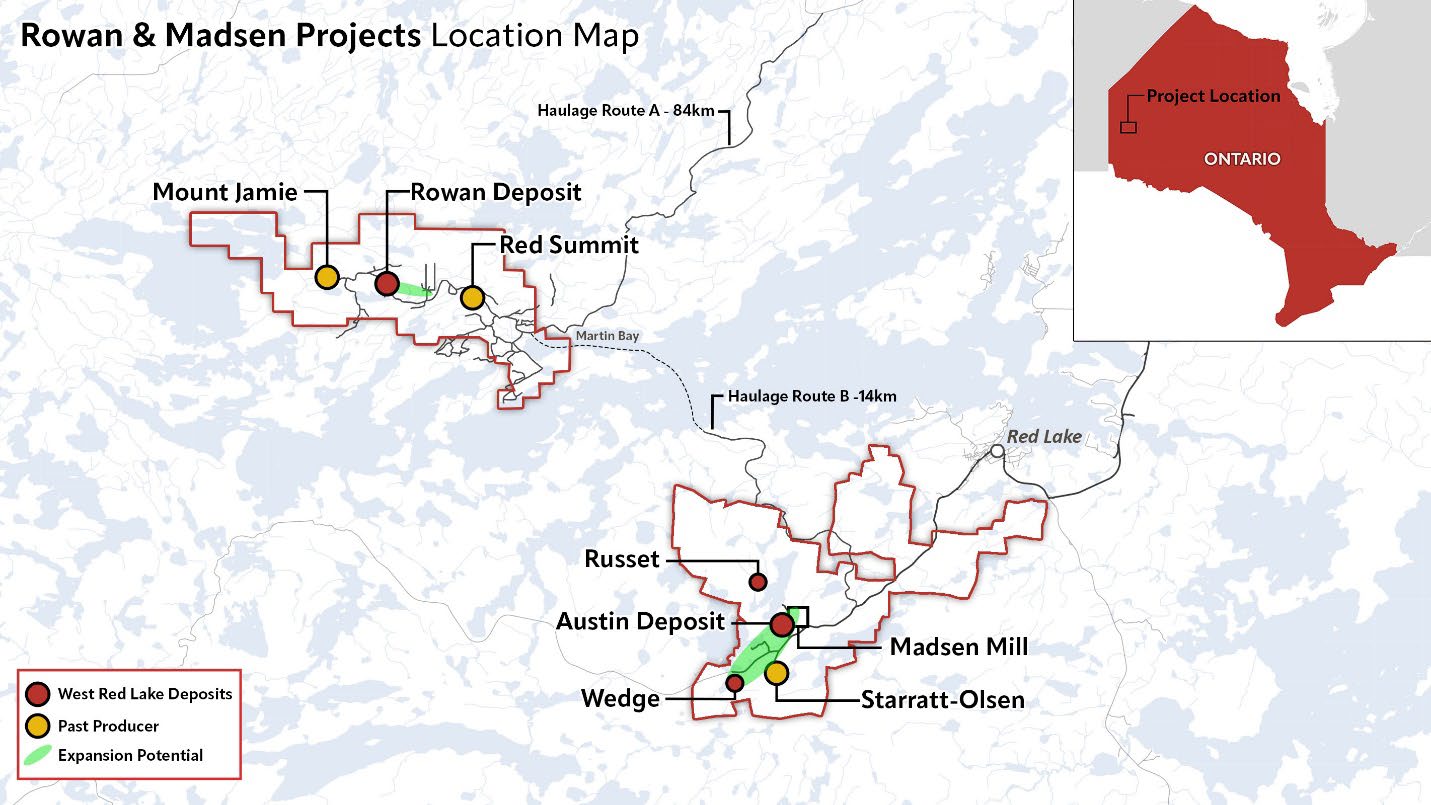

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world's richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines - Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

"Shane Williams"

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Freddie Leigh

Tel: (604) 609-6132

Email: investors@wrgold.com or visit the Company's website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as "anticipate", "expect", "estimate", "forecast", "planned", and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to plans for the potential restart of mining operations at the Madsen Mine, the potential of the Madsen Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company's future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company's business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company's management's discussion and analysis for the year ended November 30, 2023, and the Company's annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management's current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/b917bce7-f3d9-48f8-a291-7c31a2d71861

https://www.globenewswire.com/NewsRoom/AttachmentNg/08b0959b-16c3-4ffc-84e6-267c175b6a61

https://www.globenewswire.com/NewsRoom/AttachmentNg/3fe8810f-90b4-4c34-9b95-04f8e50125bd