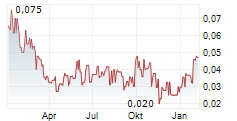

TSX Venture Exchange: BSK

Frankfurt Stock Exchange: MAL2

OTCQB Venture Market (OTC): BKUCF

VANCOUVER, BC, Aug. 20, 2024 /PRNewswire/ - Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2) (OTC: BKUCF), "Blue Sky" or the "Company") is pleased to provide an update on activities at its Amarillo Grande Uranium-Vanadium Project ("AGP") in Argentina. Field work is currently concentrating on surface exploration while the updating of environmental permits for further drilling is underway. The aim of the on-going program is to apply different techniques to detect the presence and continuity of blind uranium mineralization at depth. The recent work included mapping, soil and pit sampling, auger drilling and the first isotopic survey. The isotopic technique uses geochemical analysis of soils to detect uranium at depth based on its natural decay into specific lead isotopes detectable in surface samples, a method that has been successfully demonstrated in other uranium districts. Blue Sky's work to date was concentrated in the Ivana sector, where anomalous isotopic patterns or footprints identified at the Ivana deposit will be compared with samples collected at other areas of known mineralization, like Ivana Central, in order to identify new drill targets. If successful, this technique will be used as a regional tool to identify new targets and vector drilling for the potential discovery of blind uranium mineralization throughout the 145-km long AGP. Final results of sample analyses and interpreted target generation from the program are in progress.

"This new program is another step in the execution of our strategic plan to discover and develop a cluster of deposits that could feed a central processing facility at Ivana and expand the proposed development scenario presented in the recent positive PEA. Once the Company closes the proposed JV transaction with COAM, and in light of the recent positive tax measures in Argentina, summarized below, we anticipate advancing Ivana towards pre-feasibility, and, if positive, then feasibility and development, as quickly as possible," commented Nikolaos Cacos, Blue Sky President & CEO.

These exploration activities continue while the Company works towards finalizing the transaction with Corredor Americano S.A. ("COAM"). As announced on June 10, 2024, Blue Sky has signed a binding term sheet with COAM, an Argentine affiliate of Corporación América Group, to complete an option agreement in respect to the Company's Ivana Uranium-Vanadium deposit. The transaction provides COAM the option to earn up to a 50% indirect interest in the Property by advancing Ivana through to completion of a feasibility study. Following a positive feasibility study, COAM can earn an additional 30% interest by funding 100% of the estimated capital costs to achieve commercial production.

In addition, the term sheet includes a call-option that will allow COAM to fund the exploration programs at targets located in adjacent areas of the Ivana deposit over the next five years.

Both companies are currently advancing the transaction towards the conclusion of due diligence and finalization of the definitive agreement.

New Argentina Investment Legislation:

On June 28, 2024, Argentine President Javier Milei obtained approval of his main legislative initiative, termed the Bases Law (Ley de Bases), that includes a package of proposed changes over a significant number of laws and regimes in Argentina. In particular, the Bases Law contains an Incentive Regime for Large Investments (RIGI) applicable to new investments over US$200 million in mining, among others, presented within the next 2 to 3 years. The RIGI grants 30-year special status for these investments, including tax stability, reduction of income tax (25% tax rate rather than general scale which ranges from 25-35%), exemptions of import-export duties, accelerated depreciation, staged ability to keep export proceeds in foreign currency reaching 100% after 3-4years, and the option to settle disputes using international arbitration courts, as the main benefits.

The Amarillo Grande Project is located in Rio Negro Province, which was the first province to adopt the RIGI shortly after the approval of the new law. By the end of July, the joint-venture between YPF, the national oil and gas (O&G) company, and Petronas, the Malaysian O&G national company, chose Rio Negro as the location in which to invest US$30 billion on the construction of a liquification plant for the exportation of the unconventional natural gas produced from the Neuquén basin.

Qualified Persons

The design of the Company's exploration program was undertaken by the Company's geological staff under the supervision of David Terry, Ph.D., P. Geo. Dr. Terry is a Director of the Company and a Qualified Person as defined in National Instrument 43-101. The technical contents of this news release have been reviewed and approved by Dr. Terry.

About the Amarillo Grande Project

The Company's 100% owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina is a new uranium district controlled by Blue Sky. The Ivana deposit is the cornerstone of the Project and the first part of the district for which both a Mineral Resource Estimate and a Preliminary Economic Assessment have been completed. Mineralization at the Ivana deposit has characteristics of sandstone-type and surficial-type uranium-vanadium deposits. The sandstone-type mineralization is related to a braided fluvial system and indicates the potential for a district-size system. In the surficial-type deposits, mineralization coats loosely consolidated pebbles, and is amenable to leaching and simple upgrading.

The Project includes several other target areas over a regional trend, at or near surface. The area is flat-lying, semi-arid and accessible year-round, with nearby rail, power and port access. The Company's strategy includes delineating resources at multiple areas and advancing the project to prefeasibility level.

For additional details on the project and properties, please see the Company's website: www.blueskyuranium.com.

About Blue Sky Uranium Corp.

Blue Sky Uranium Corp. is a leader in uranium discovery in Argentina. The Company's objective is to deliver exceptional returns to shareholders by rapidly advancing a portfolio of surficial uranium deposits into low-cost producers, while respecting the environment, the communities, and the cultures in all the areas in which we work. Blue Sky has the exclusive right to properties in two provinces in Argentina. The Company's flagship Amarillo Grande Project was an in-house discovery of a new district that has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier. The Company is a member of the Grosso Group, a resource management group that has pioneered exploration in Argentina since 1993.

ON BEHALF OF THE BOARD

"Nikolaos Cacos"

______________________________________

Nikolaos Cacos, President, CEO and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. All statements, other than statements of historical fact, that address activities, events or developments the Company believes, expects or anticipates will or may occur in the future, including, without limitation, statements about the Company's plans for its mineral properties; the Company's business strategy, plans and outlooks; the future financial or operating performance of the Company; and future exploration and operating plans are forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: the impact of COVID-19; risks and uncertainties related to the ability to obtain, amend, or maintain licenses, permits, or surface rights; risks associated with technical difficulties in connection with mining activities; and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations. Actual results may differ materially from those currently anticipated in such statements. Readers are encouraged to refer to the Company's public disclosure documents for a more detailed discussion of factors that may impact expected future results. The Company undertakes no obligation to publicly update or revise any forward-looking statements, unless required pursuant to applicable laws. We advise U.S. investors that the SEC's mining guidelines strictly prohibit information of this type in documents filed with the SEC. U.S. investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.

SOURCE Blue Sky Uranium Corp.