WARRINGTON, Pa., Aug. 20, 2024 (GLOBE NEWSWIRE) -- Windtree Therapeutics, Inc. ("Windtree" or the "Company") (NasdaqCM: WINT), a biotechnology company focused on advancing early and late-stage innovative therapies for critical conditions, today reported financial results for the second quarter ended June 30, 2024 and provided key business updates.

"The second quarter of 2024 was marked with significant progress with our lead asset, istaroxime in development for the treatment of cardiogenic shock. We expect the istaroxime Phase 2 SEISMiC Extension study to complete enrollment in the next few weeks and we plan to report topline data by the end of the third quarter of 2024. We are also supporting our regional partner, Lee's Pharmaceutical, in their planned istaroxime Phase 3 program in acute heart failure," said Craig Fraser, Chairman and CEO. "With trial execution and active operations comes the need for capital and we successfully completed transactions providing resources for our near-term needs as well as secured an equity line of credit to potentially support future requirements." Mr. Fraser added, "Looking to the next several months, besides the important data read out on the istaroxime SEISMiC Extension Study, based on available resources, we plan to accelerate enrollments in the istaroxime SCAI Stage C cardiogenic shock study as well as provide guidance on our strategy and planned activities with our oncology preclinical aPKCi inhibitor assets. Finally, we are excited about our two new independent board directors, Saundra Pelletier and Jed Latkin, who have joined our Board at a pivotal time and we look forward to their contributions to the next phase of our progress."

Key Business Updates

- Announced that the Company expects to complete enrollment and report topline data by the end of the third quarter in 2024 for its ongoing Phase 2 SEISMiC Extension Study.

- Began enrollment in the Phase 2 SCAI Stage C cardiogenic shock study. Expansion of global study sites and other additional start up activities continue.

- Closed two financial transactions in July 2024 for aggregate gross proceeds of approximately $13.9 million, which consists of approximately $4.4 million of new funding and a $9.5 million payment through the full cancellation and extinguishment of certain holders outstanding senior notes, including secured notes, and shares of the Company's Series B Convertible Preferred Stock.

- Entered into a Common Stock Purchase Agreement with an equity line investor, whereby the Company has the right, but not the obligation, to sell such investor, and, subject to limited exceptions, the investor is obligated to purchase, up to the lesser of (i) $35 million of newly issued shares of the Company's common stock, and (ii) 19.99% of the total number of shares of shares of the Company's common stock outstanding immediately prior to the execution of the Common Stock Purchase Agreement at volume-weighted average price less than the Nasdaq minimum price on the date of the agreement.

- Announced changes to the Company's board of directors, which include the appointment of Jed Latkin and Saundra Pelletier as two new independent directors. The Company believes that the addition of Mr. Latkin and Ms. Pelletier to its board adds significant public company and executive leadership experience across drug development, business development, licensing and commercialization of drug products.

Select Second Quarter 2024 Financial Results

For the second quarter ended June 30, 2024, the Company reported an operating loss of $11.5 million, compared to an operating loss of $6.8 million in the second quarter of 2023. Included in our operating loss for the second quarter of 2024 is $7.5 million of non-cash R&D expense related to costs in connection with the Varian asset acquisition. Included in our operating loss for the second quarter of 2023 is a $2.6 million loss on impairment of goodwill.

Research and development expenses were $9.9 million for the second quarter of 2024, compared to $1.8 million for the second quarter of 2023. The increase in research and development expenses is primarily due to (i) $7.5 million of non-cash R&D expense related to costs in connection with the Varian asset acquisition; (ii) an increase of $1.0 million as we continue the SEISMiC Extension trial of istaroxime for the treatment of early cardiogenic shock; partially offset by (iii) a decrease of $0.4 million in personnel costs.

General and administrative expenses for the second quarter of 2024 were $1.6 million, compared to $2.4 million for the second quarter of 2023. The decrease in general and administrative expenses is primarily due to (i) a decrease of $0.2 million in professional fees; (ii) a decrease of $0.2 million in personnel costs; (iii) a decrease of $0.3 million in non-cash stock-based compensation expense; and (iv) a decrease of $0.1 million in insurance costs.

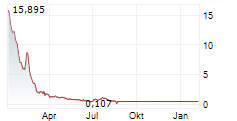

The Company reported a net loss of $12.0 million ($20.91 per basic share) on 0.6 million weighted-average common shares outstanding for the quarter ended June 30, 2024, compared to a net loss of $6.6 million ($29.47 per basic share) on 0.2 million weighted average common shares outstanding for the comparable period in 2023.

As of June 30, 2024, the Company reported cash and cash equivalents of $1.8 million and current liabilities of $8.8 million. We do not have sufficient cash and cash equivalents as of the date of this Quarterly Report on Form 10-Q to support our operations for at least the 12 months following the date that the financial statements are issued. These conditions raise substantial doubt about our ability to continue as a going concern.

Readers are referred to, and encouraged to read in its entirety, the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, which was filed with the Securities and Exchange Commission on August 19, 2024, and includes detailed discussions about the Company's business plans and operations, financial condition, and results of operations.

About Windtree Therapeutics, Inc.

Windtree Therapeutics, Inc. is a biotechnology company focused on advancing early and late-stage innovative therapies for critical conditions and diseases. Windtree's portfolio of product candidates includes istaroxime, a Phase 2 candidate with SERCA2a activating properties for acute heart failure and associated cardiogenic shock, preclinical SERCA2a activators for heart failure and preclinical precision aPKCi inhibitors that are being developed for potential in rare and broad oncology applications. Windtree also has a licensing business model with partnership out-licenses currently in place.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The Company may, in some cases, use terms such as "predicts," "believes," "potential," "proposed," "continue," "estimates," "anticipates," "expects," "plans," "intends," "may," "could," "might," "will," "should" or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are based on information available to the Company as of the date of this press release and are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from the Company's current expectations. Examples of such risks and uncertainties include, among other things: the Company's ability to secure significant additional capital as and when needed; the Company's ability to achieve the intended benefits of the aPKCi asset acquisition with Varian Biopharmaceuticals, Inc.; the Company's risks and uncertainties associated with the success and advancement of the clinical development programs for istaroxime and the Company's other product candidates, including preclinical oncology candidates; the Company's ability to access the debt or equity markets; the Company's ability to manage costs and execute on its operational and budget plans; the results, cost and timing of the Company's clinical development programs, including any delays to such clinical trials relating to enrollment or site initiation; risks related to technology transfers to contract manufacturers and manufacturing development activities; delays encountered by the Company, contract manufacturers or suppliers in manufacturing drug products, drug substances, and other materials on a timely basis and in sufficient amounts; risks relating to rigorous regulatory requirements, including that: (i) the U.S. Food and Drug Administration or other regulatory authorities may not agree with the Company on matters raised during regulatory reviews, may require significant additional activities, or may not accept or may withhold or delay consideration of applications, or may not approve or may limit approval of the Company's product candidates, and (ii) changes in the national or international political and regulatory environment may make it more difficult to gain regulatory approvals and risks related to the Company's efforts to maintain and protect the patents and licenses related to its product candidates; risks that the Company may never realize the value of its intangible assets and have to incur future impairment charges; risks related to the size and growth potential of the markets for the Company's product candidates, and the Company's ability to service those markets; the Company's ability to develop sales and marketing capabilities, whether alone or with potential future collaborators; the rate and degree of market acceptance of the Company's product candidates, if approved; the economic and social consequences of the COVID-19 pandemic and the impacts of political unrest, including as a result of geopolitical tension, including the conflict between Russia and Ukraine, the People's Republic of China and the Republic of China (Taiwan), and the evolving events in Israel and Gaza, and any sanctions, export controls or other restrictive actions that may be imposed by the United States and/or other countries which could have an adverse impact on the Company's operations, including through disruption in supply chain or access to potential international clinical trial sites, and through disruption, instability and volatility in the global markets, which could have an adverse impact on the Company's ability to access the capital markets. These and other risks are described in the Company's periodic reports, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, filed with or furnished to the Securities and Exchange Commission and available at www.sec.gov. Any forward-looking statements that the Company makes in this press release speak only as of the date of this press release. The Company assumes no obligation to update forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Contact Information:

Eric Curtis

ecurtis@windtreetx.com

+++++ Tables to Follow +++++

| WINDTREE THERAPEUTICS, INC. AND SUBSIDIARIES Consolidated Balance Sheets | ||||||||

| (in thousands, except share and per share data) | ||||||||

| June 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 1,803 | $ | 4,319 | ||||

| Prepaid expenses and other current assets | 256 | 1,060 | ||||||

| Total current assets | 2,059 | 5,379 | ||||||

| Property and equipment, net | 150 | 183 | ||||||

| Restricted cash | 9 | 150 | ||||||

| Operating lease right-of-use assets | 1,239 | 1,444 | ||||||

| Intangible assets | 25,250 | 25,250 | ||||||

| Total assets | $ | 28,707 | $ | 32,406 | ||||

| LIABILITIES, MEZZANINE EQUITY & STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 2,969 | $ | 809 | ||||

| Accrued expenses | 2,128 | 1,618 | ||||||

| Operating lease liabilities - current portion | 457 | 436 | ||||||

| Senior convertible notes payable, net | 1,311 | - | ||||||

| Derivative liability - senior convertible notes | 202 | - | ||||||

| ELOC commitment note payable | 306 | - | ||||||

| Derivative liability - ELOC commitment note | 286 | - | ||||||

| Senior secured notes payable | 391 | - | ||||||

| Loans payable | - | 233 | ||||||

| Other current liabilities | 725 | 900 | ||||||

| Total current liabilities | 8,775 | 3,996 | ||||||

| Operating lease liabilities - non-current portion | 912 | 1,161 | ||||||

| Restructured debt liability - contingent milestone payments | - | 15,000 | ||||||

| Other liabilities | 3,800 | 3,800 | ||||||

| Deferred tax liabilities | 4,772 | 5,058 | ||||||

| Total liabilities | 18,259 | 29,015 | ||||||

| Mezzanine Equity: | ||||||||

| Series B redeemable preferred stock, $0.001 par value; 5,500 and 0 shares authorized; 5,500 and 0 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 6,954 | - | ||||||

| Total mezzanine equity | 6,954 | - | ||||||

| Stockholders' Equity: | ||||||||

| Preferred stock, $0.001 par value; 4,994,500 and 5,000,000 shares authorized; 0 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | - | - | ||||||

| Common stock, $0.001 par value; 120,000,000 shares authorized; 591,910 and 333,145 shares issued at June 30, 2024 and December 31, 2023, respectively; 591,909 and 333,144 shares outstanding at June 30, 2024 and December 31, 2023, respectively | 1 | - | ||||||

| Additional paid-in capital | 853,175 | 851,268 | ||||||

| Accumulated deficit | (846,628 | ) | (844,823 | ) | ||||

| Treasury stock (at cost); 1 share | (3,054 | ) | (3,054 | ) | ||||

| Total stockholders' equity | 3,494 | 3,391 | ||||||

| Total liabilities, mezzanine equity & stockholders' equity | $ | 28,707 | $ | 32,406 | ||||

| WINDTREE THERAPEUTICS, INC. AND SUBSIDIARIES Consolidated Statements of Operations | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Expenses: | ||||||||||||||||

| Research and development | $ | 9,863 | $ | 1,763 | $ | 12,116 | $ | 3,178 | ||||||||

| General and administrative | 1,589 | 2,420 | 3,741 | 4,712 | ||||||||||||

| Loss on impairment of goodwill | - | 2,574 | - | 3,058 | ||||||||||||

| Total operating expenses | 11,452 | 6,757 | 15,857 | 10,948 | ||||||||||||

| Operating loss | (11,452 | ) | (6,757 | ) | (15,857 | ) | (10,948 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Gain on debt extinguishment | - | - | 14,520 | - | ||||||||||||

| Interest income | 20 | 108 | 50 | 152 | ||||||||||||

| Interest expense | (110 | ) | (13 | ) | (123 | ) | (25 | ) | ||||||||

| Other (expense) income, net | (285 | ) | 61 | (84 | ) | 109 | ||||||||||

| Total other (expense) income, net | (375 | ) | 156 | 14,363 | 236 | |||||||||||

| Loss before income taxes | (11,827 | ) | (6,601 | ) | (1,494 | ) | (10,712 | ) | ||||||||

| Income tax expense | (197 | ) | - | (311 | ) | - | ||||||||||

| Net loss | $ | (12,024 | ) | $ | (6,601 | ) | $ | (1,805 | ) | $ | (10,712 | ) | ||||

| Net loss per common share | ||||||||||||||||

| Basic and diluted | $ | (20.91 | ) | $ | (29.47 | ) | $ | (3.47 | ) | $ | (78.76 | ) | ||||

| Weighted average number of common shares outstanding | ||||||||||||||||

| Basic and diluted | 575 | 224 | 520 | 136 | ||||||||||||