Press release - regulated information

- Continued progress in regulatory review of its first candidate biofungicide EVOCA*

- Dutch Authority CTGB approved large scale demonstration trials with EVOCA while allowing sale of harvest

- Commenced field trials for second biofungicide to expand potential product line

- Initiated an AI project with Google DeepMind and Devoteam using AlphaFold2

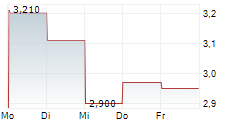

- Cash and cash equivalents amounted to €14.7 million as of the end of June 2024

- Management to host a conference call and live webcast at 15:00 CEST / 14:00 GMT / 09:00 AM ET today, details below

Ghent, BELGIUM, Aug. 22, 2024, an Agricultural Technologyon the Biotalys website.

Kevin Helash, Chief Executive Officer of Biotalys, noted: "The first half of 2024 heralded key milestones for Biotalys in our mission to transform crop protection, such as the partnership with Novonesis for EVOCA NG and the initiation of field trials for BioFun-6, our second biofungicide candidate. Further to the development of EVOCA, I am very pleased to announce we just received approval by the Dutch regulatory authority to do large scale demonstration trials with the product in the Netherlands. The authority has also allowed the sale of the harvested produce for human consumption."

Helash added: "As a result of the measures implemented at the end of last year to control costs, we have been able to considerably reduce our operating cash burn in the first half of this year. We will continue to concentrate our resources on applying the targeted approach to our research platform, as well as on progressing our various pipeline programs. We will consider additional financing such as through equity, newly awarded grants and partnerships to execute our strategy to transforming crop protection."

Regulatory update for EVOCA

- Biotalys continues to work closely with the EPA (Environmental Protection Agency) in the United States and the CTGB (College voor de Toelating van Gewasbeschermingsmiddelen en Biociden) in Europe on EVOCA's regulatory review.

- In the U.S., the EPA's review is progressing and Biotalys has not received additional questions from the authority on the dossier in 2024. Meanwhile, Biotalys is preparing a regulatory dossier for its next generation of the product, EVOCA NG, for submission. As EVOCA NG has the same bioactive as EVOCA with an optimized production process and formulation which is expected to lower production costs, the company plans to apply for an amendment procedure, which is anticipated to have a shorter review time compared to a standard procedure.

- In Europe, the rapporteur Member State is The Netherlands where the CTGB (College voor de Toelating Gewasbeschermingsmiddelen en Biociden) is currently reviewing the regulatory dossier. CTGB recently requested additional information, which the company plans to submit next week allowing the authority to finalise its review and send its report to the European level for peer review by EFSA and the European Member States. For EVOCA NG, the company plans to apply at EU level for an equivalency procedure, with a significantly shorter review timeline.

- On 21 August 2024, the same CTGB granted Biotalys the approval to test EVOCA in large scale demonstration trials, allowing application of the product against powdery mildew in 40 hectares of tomatoes, 20 hectares of cucumbers and 10 hectares of strawberries. Importantly, it will also be allowed to sell the fruits and vegetables resulting from these trials for human consumption.** This is an exemption to standard practices requiring crop destruction when a product is used that has not yet received regulatory approval. This decision reinforces Biotalys' confidence that the product is safe to use.

H1 2024 highlights

- Biotalys has continued to take major steps forward on the path to commercialization of EVOCA's next generation version, EVOCA NG, which is expected to be the company's first margin-generating product. Thereto, Biotalys and Novonesis entered into a long-term collaboration agreement (https://biotalys.com/media/news/biotalys-and-novonesis-announce-manufacturing-and-commercialisation-partnership-evoca-ng), advancing EVOCA NG to the final stage of development.

- Leveraging its advanced fermentation capabilities, Novonesis will serve as the global manufacturing partner for the production of EVOCA NG. Novonesis will have the rights to distribute and sell EVOCA NG in select crops outside of the United States, while Biobest will sell the product in select markets to help control the devastating fungal disease botrytis in fruits and vegetables. The companies are also discussing the potential of additional collaborations such as combining the Biotalys AGROBODY platform with Novonesis' biosolutions technology.

- Field trials for BioFun-6 (https://biotalys.com/media/news/biotalys-starts-field-trials-second-biofungicide), the company's second biofungicide program targeting botrytis, powdery mildew and anthracnose in high-value fruits and vegetables, are now also underway in both Europe and the United States. Initial results are expected later this year.

- Biotalys entered into additional academic collaborations with leading researchers in plant science (https://www.biotalys.com/media/news/biotalys-enters-academic-collaborations-key-scientific-leaders-europe-and-us) to advance its biocontrols pipeline. Building on its established relationships with top academics, Biotalys is now progressing its research for BioFun-4, targeting Phytophthora infestans, an Oomycete (water mould) that causes late blight/potato blight, with the University of Aberdeen, and furthering BioFun-7, its ongoing R&D program in partnership with the Gates Foundation targeting leafspot disease, with the University of California-Davis.

- Biotalys continued to advance its first bioinsecticide in collaboration with SyngentaCrop Protection, a top producer of insecticides, to target harmful insect pests.

- Embracing the opportunity to apply artificial intelligence (AI) technology to its AGROBODY 2.0 technology platform, Biotalys recently initiated a collaboration with Google DeepMind and Devoteam on AlphaFold2 (https://www.linkedin.com/feed/update/urn:li:activity:7205821861094404096), an AI platform, to predict the precise 3D shapes of proteins. As the AGROBODY platform applies a targeted approach requiring the detailed characterization of target proteins of the fungal diseases or pests, Biotalys is leveraging AlphaFold2 to speed the validation of AGROBODY bioactive discoveries and improve its R&D and go-to-market workflows.

- Biotalys' scientific team also recently published a scientific paper exploring the biocontrol breakthroughs afforded by its AGROBODY platform, the promise of biocontrols in crop protection, and EVOCA specifically in the Journal of Plant Diseases and Protection: https://rdcu.be/dAEEh (https://rdcu.be/dAEEh).

- Early in 2024, Biotalys again earned Top 100 status in Forward Fooding's FoodTech 500 list, (https://forwardfooding.com/foodtech500/?edition=2023) climbing to #62. FoodTech 500 ranks global entrepreneurial talent at the intersection of food, technology and sustainability. And as announced yesterday, Biotalys was granted the 2024 AgTech Breakthrough Award (https://biotalys.com/media/news/biotalys-named-sustainable-crop-protection-company-year) for Sustainable Crop Protection Company of the Year.

- In May, Biotalys announced (https://www.biotalys.com/media/news/biotalys-appoints-laura-j-meyer-board-directors) the appointment of Laura J. Meyer to its Board of Directors, effective 25 September 2024. Her career in agriculture spans more than 28 years in various financial roles. Until recently, she was Vice President, Investor Relations at Bayer, responsible for the Crop Science division. Laura Meyer will be a great asset to Biotalys in its commercialization and growth ambitions.

* EVOCA: Pending Registration. This product is not currently registered for sale or use in the United States, the European Union, or elsewhere and is not being offered for sale.

**Decisions of the CTGB are subject to appeal during a period of six weeks following the publication of the decision.

Select financial information

| In € thousands | June 30, 2024 | June 30, 2023 |

| Other operating income | 1,452 | 1,318 |

| Research and development expenses | (5,135) | (8,661) |

| General and administrative expenses | (2,777) | (2,771) |

| Marketing expenses | (113) | (741) |

| Operating loss | (6,574) | (10,855) |

| Loss of the period | (6,489) | (10,664) |

| Net cash used in operations | (6,527) | (8,516) |

| Net cash outflow of the period | (6,890) | (2,208) |

| Cash and cash equivalents | 14,680 | 31,886 |

- Other operating income for the first half of 2024 amounted to €1.5 million, and mainly relates to amounts recognized for R&D tax incentives received and grants awarded to support ongoing R&D activities.

- Research and development expenses amounted to €5.1 million for the first half year, a decrease of €3.5 million compared to the same period of 2023. These decreases primarily relate to lower costs for external R&D and material costs (-€2.3 million), partly due to lower spending in the EVOCA project while pending EPA approval. Other decreases include lower wages & benefits (-€0.6 million) as the result of re-organization in the second half of 2023, and overall decrease in other miscellaneous operational R&D spendings.

- General and administrative expenses remain at €2.8 million for the first half of 2024, compared to €2.8 million in the same period of 2023.

- Net cash used in operating activities decreased by €2.0 million, to €6.5 million for the six months ended 30 June 2024. This decrease was primarily caused by decreases in spending on research and development expenses.

Outlook

- Biotalys will continue to concentrate resources on obtaining registration for its first product candidate EVOCA as well as on advancing the targeted approach to our research platform.

- Pending the regulatory decision for EVOCA, the company will continue the development of its first margin-generating product EVOCA NG in collaboration with Novonesis.

- Biotalys expects the results of initial field trialswith BioFun-6 in grapes by the end of 2024.

- The company will progress its pipeline programs and expects to initiate a new R&D biofungicide program for a new pathogen later this year.

- Together with the cash and cash equivalents balance of €14.7 million at the end of H1 2024, the company expects the current financial runway to extend into Q2 2025 without considering additional financing through equity, newly awarded grants, partnerships or other sources of financing.

Auditor statement

The condensed consolidated financial statements for the six-months' period ended 30 June 2024 have been prepared in accordance with IAS 34 'Interim Financial Reporting' as adopted by the European Union. They do not include all the information required for the full annual financial statements and should therefore be read in conjunction with the financial statements for the year ended 31 December 2023. The condensed consolidated financial statements are presented in thousands of Euros.

Upcoming IR events

Biotalys updated its investor presentationand published it on its website. For a list of upcoming events, please check https://biotalys.com/media/events.

Live webcast and conference call

Company management will host a live webcast to discuss its half-year 2024 results and recent business performance today, 22 August 2024 at 15:00 CEST / 14:00 BST / 09:00 AM EDT.

Webcast link: https://edge.media-server.com/mmc/p/igtczv4g

Dial-in details: To ask questions live to the management, please also register for the conference call via https://register.vevent.com/register/BI369eee1a131a4309b0a6aabb088c0f6a

About Biotalys

Biotalys is an Agricultural Technology.

For further information, please contact

Toon Musschoot, Head of IR & Communication

T: +32 (0)9 274 54 00

E: IR@biotalys.com

Important Notice

Biotalys, its business, prospects and financial position remain exposed and subject to risks and uncertainties. A description of and reference to these risks and uncertainties can be found in the 2023 annual reporton the consolidated annual accounts and the full half-year report.

This announcement contains statements which are "forward-looking statements" or could be considered as such. These forward-looking statements can be identified by the use of forward-looking terminology, including the words 'aim', 'believe', 'estimate', 'anticipate', 'expect', 'intend', 'may', 'will', 'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans', 'target', 'seek', 'would' or 'should', and contain statements made by the company regarding the intended results of its strategy. By their nature, forward-looking statements involve risks and uncertainties and readers are warned that none of these forward-looking statements offers any guarantee of future performance. Biotalys' actual results may differ materially from those predicted by the forward-looking statements. Biotalys makes no undertaking whatsoever to publish updates or adjustments to these forward-looking statements, unless required to do so by law.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| ASSETS (in thousands of euros) | Note | 30 June 2024 | 31 December 2023 |

| Non-current assets | 11,023 | 11,671 | |

| Intangible assets | 606 | 642 | |

| Property, plant and equipment | 7.8 | 4,509 | 4,863 |

| Right-of-use assets | 7.8 | 3,148 | 3,571 |

| Deferred tax assets | 19 | 18 | |

| Other non-current assets | 2,742 | 2,577 | |

| Current assets | 18,459 | 24,910 | |

| Receivables | 952 | 750 | |

| Other financial assets | 2,110 | 2,100 | |

| Other current assets | 7.9 | 717 | 490 |

| Cash and cash equivalents | 7.10 | 14,680 | 21,570 |

| TOTAL ASSETS | 29,482 | 36,582 |

| EQUITY AND LIABILITIES (in thousands of euros) | Note | 30 June 2024 | 31 December 2023 |

| Equity attributable to owners of the parent | 19,576 | 25,569 | |

| Share capital | 7.11 | 4,755 | 46,198 |

| Share premium | 7.11 | 15,588 | 15,488 |

| Accumulated losses | 7.11 | (5,103) | (40,200) |

| Other reserves | 4,336 | 4,082 | |

| Total equity | 19,576 | 25,569 | |

| Non-current liabilities | 5,151 | 5,467 | |

| Borrowings | 7.12 | 4,521 | 4,841 |

| Employee benefits obligations | 26 | 23 | |

| Provisions | 92 | 91 | |

| Other non-current liabilities | 7.13 | 512 | 512 |

| Current liabilities | 4,755 | 5,546 | |

| Borrowings | 7.12 | 964 | 1,232 |

| Trade and other liabilities | 1,895 | 2,591 | |

| Other current liabilities | 7.13 | 1,896 | 1,723 |

| Total liabilities | 9,905 | 11,013 | |

| TOTAL EQUITY AND LIABILITIES | 29,482 | 36,582 |

The accompanying notes are an integral part of these condensed consolidated financial statements. Please see the full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE 6 MONTHS ENDED 30 JUNE

| in € thousands | Note | 2024 | 2023 |

| Other operating income | 7.15 | 1,452 | 1,318 |

| Research and development expenses | 7.16 | (5,135) | (8,661) |

| General and administrative expenses | 7.16 | (2,777) | (2,771) |

| Sales and marketing expenses | 7.16 | (113) | (741) |

| Operating loss | (6,574) | (10,855) | |

| Financial income | 335 | 422 | |

| Financial expenses | (161) | (191) | |

| Loss before taxes | (6,400) | (10,624) | |

| Income taxes | (89) | (40) | |

| LOSS FOR THE PERIOD | (6,489) | (10,664) | |

| Other comprehensive income (OCI) | |||

| Items of OCI that will be reclassified subsequently to profit or loss | |||

| Exchange differences on translating foreign operations | 7 | (3) | |

| TOTAL COMPREHENSIVE LOSS OF THE PERIOD | (6,482) | (10,667) | |

| Basic and diluted loss per share (in €) | 7.17 | (0.20) | (0.34) |

| Loss for the period attributable to the owners of the Company | (6,489) | (10,664) | |

| Total comprehensive loss for the period attributable to the owners of the Company | (6,482) | (10,667) |

The accompanying notes are an integral part of these condensed consolidated financial statements. Please see the full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE 6 MONTHS ENDED 30 JUNE

| (in € thousands) | Attributable to equity holders of the Company | |||||

| Other reserves | ||||||

| Share capital | Share premium | Share-based payment reserve | Currency translation reserve | Accumulated losses | Total Equity | |

| Balance at 31 December 2022 | 44,548 | 10,164 | 3,035 | 29 | (19,662) | 38,114 |

| Share-based payments | - | - | 723 | - | - | 723 |

| Exercise of ESOP Warrants | 16 | 12 | (12) | - | - | 16 |

| Issuance of shares | 1,634 | 5,366 | - | - | - | 7,000 |

| Total comprehensive loss | - | - | - | (3) | (10,664) | (10,667) |

| Balance at 30 June 2023 | 46,198 | 15,542 | 3,746 | 26 | (30,326) | 35,187 |

| (in € thousands) | Attributable to equity holders of the Company | |||||

| Other reserves | ||||||

| Share capital | Share premium | Share-based payment reserve | Currency translation reserve | Accumulated losses | Total Equity | |

| Balance at 31 December 2023 | 46,198 | 15,488 | 4,060 | 22 | (40,200) | 25,569 |

| Share-based payments | - | - | 347 | - | - | 347 |

| Exercise of ESOP Warrants | 142 | 100 | (100) | - | - | 142 |

| Reduction of capital by absorption of losses | (41,585) | - | - | - | 41,585 | 0 |

| Total comprehensive loss | - | - | - | 7 | (6,489) | (6,482) |

| Balance at 30 June 2024 | 4,755 | 15,588 | 4,307 | 29 | (5,103) | 19,576 |

The accompanying notes are an integral part of these condensed consolidated financial statements. Please see the full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE 6 MONTHS ENDED 30 JUNE

| in € thousands | Note | 2024 | 2023 |

| CASH FLOW FROM OPERATING ACTIVITIES | |||

| Operating result | (6,574) | (10,855) | |

| Adjustments for: | |||

| Depreciation, amortization and impairments | 918 | 888 | |

| Share-based payment expense | 348 | 723 | |

| R&D tax credit | (440) | (355) | |

| Other | 9 | (41) | |

| Operating cash flows before movements in working capital | (5,739) | (9,640) | |

| Changes in working capital: | |||

| Receivables | 73 | 447 | |

| Other current assets | (227) | (106) | |

| Trade and other payables | (718) | (953) | |

| Other current and non-current liabilities | 84 | 1,861 | |

| Cash used in operations | (6,527) | (8,392) | |

| Taxes paid | 0 | (124) | |

| Net cash used in operating activities | (6,527) | (8,516) | |

| CASH FLOW FROM INVESTING ACTIVITIES | |||

| Interest received | 283 | 251 | |

| Purchases of property, plant and equipment | 7.8 | (93) | (224) |

| Proceeds from disposal of property, plant and equipment | 41 | - | |

| Investments in other financial assets | (10) | (8) | |

| Net cash provided by investing activities | 221 | 20 | |

| CASH FLOW FROM FINANCING ACTIVITIES | |||

| Repayment of borrowings | 7.12 | (215) | (211) |

| Repayment of lease liabilities | 7.12 | (429) | (438) |

| Interests paid | (82) | (79) | |

| Proceeds from issue of equity instruments of the Company | 7.11 | 142 | 7,016 |

| Net cash provided by (used in) financing activities | (584) | 6,289 | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (6,890) | (2,208) | |

| CASH AND CASH EQUIVALENTS at beginning of period | 21,570 | 34,096 | |

| Effect of foreign exchange rates | 0 | (2) | |

| CASH AND CASH EQUIVALENTS at end of period | 14,680 | 31,886 |

The accompanying notes are an integral part of these condensed consolidated financial statements. Please see the full interim report available on www.biotalys.com.

Attachments

- Biotalys Reports HY 24 Financial Results and Business Highlights_22 August 2024 (https://ml.globenewswire.com/Resource/Download/86f44d73-2b03-4852-874a-3bc912e9bc68)

- Persbericht Financiële Resultaten en Bedrijfshoogtepunten_22 augustus 2024 (https://ml.globenewswire.com/Resource/Download/3c757496-82fb-4af4-86fc-6fd8c982f12a)