REYKJAVÍK, ICELAND / ACCESSWIRE / August 27, 2024 / Ubique Minerals Limited (CSE:UBQ) and Frankfurt (FRA:2UM) is pleased to announce the execution of a share purchase agreements" SPA" for the acquisition of shares in Resource 500 V Limited ("R500"), an Irish company engaged in mineral exploration in Namibia (the "Proposed Acquisition").

Ubique Minerals Limited ("Ubique", or the "Company") intends to purchase up to 1,752 shares in Resource 500 V Limited, which owns mineral exploration rights in Namibia through its subsidiary 95% owned Resource Five Hundred. The remaining 5% of Resource Five Hundred is held by Namibian nationals. Prior to the Proposed Acquisition Ubique owns 533 shares in R500 and after the Proposed Acquisition Ubique will own a minimum of 99.66% of the outstanding R500 shares. As of 26th August 2024 99.66% of the sellers have signed the binding SPA and closing is expected to occur on or before 20th September 2024.

As consideration for the purchase of the R500 shares, Ubique will issue three tranches of unsecured convertible debentures (the "Debentures") totaling a principal amount of C$1,500,000and bearing interest at 6% annually, payable in cash. The Debentures will mature 36 months from the closing of the Proposed Acquisition., and unless previously converted at the holder's option, will automatically convert into common shares of Ubique upon maturity. The conversion prices applicable to the three tranches of Debentures is as follows:

C$350,000 at a conversion price of $0.10

C$507,143 at a conversion price of $0.15

C$642,857 at a conversion price of $0.30

If all the Debentures are converted as above, Ubique would issue 10,648,096 common shares, representing an 11.26% increase in Ubique's outstanding shares, as presently constituted.

Conditions to Proposed Acquisition

The completion of the Proposed Acquisition is subject to satisfactory completion and delivery of all closing documentation.

Two of Ubique's directors own an aggregate of 9 R500 shares and propose to sell these shares pursuant to the Proposed Acquisition. These shares represent 0.39% of the total number of R500 shares being purchased in the transaction. Accordingly, the Proposed Acquisition constitutes a related party transaction within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101") as insiders of the Company are amongst the vendors of the shares of R500 pursuant to the Proposed Acquisition. The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in section 5.7(1)(a) of MI 61-101, as the Company's fair market value of the participation in the Proposed Acquisition by the insiders does not exceed 25% of the market capitalization of the Company in accordance with MI 61-101. The Company has filed a material change report in respect of the related party transaction at least 21 days before the closing of the of the Proposed Acquisition

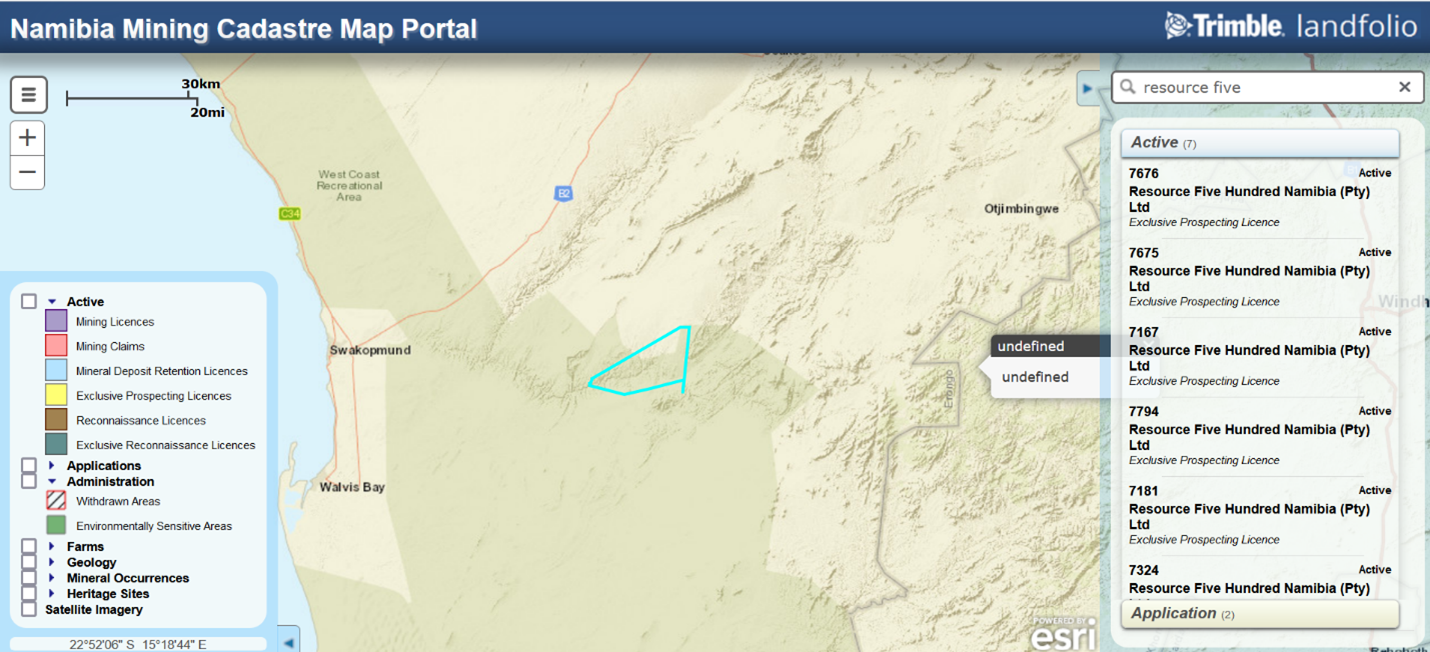

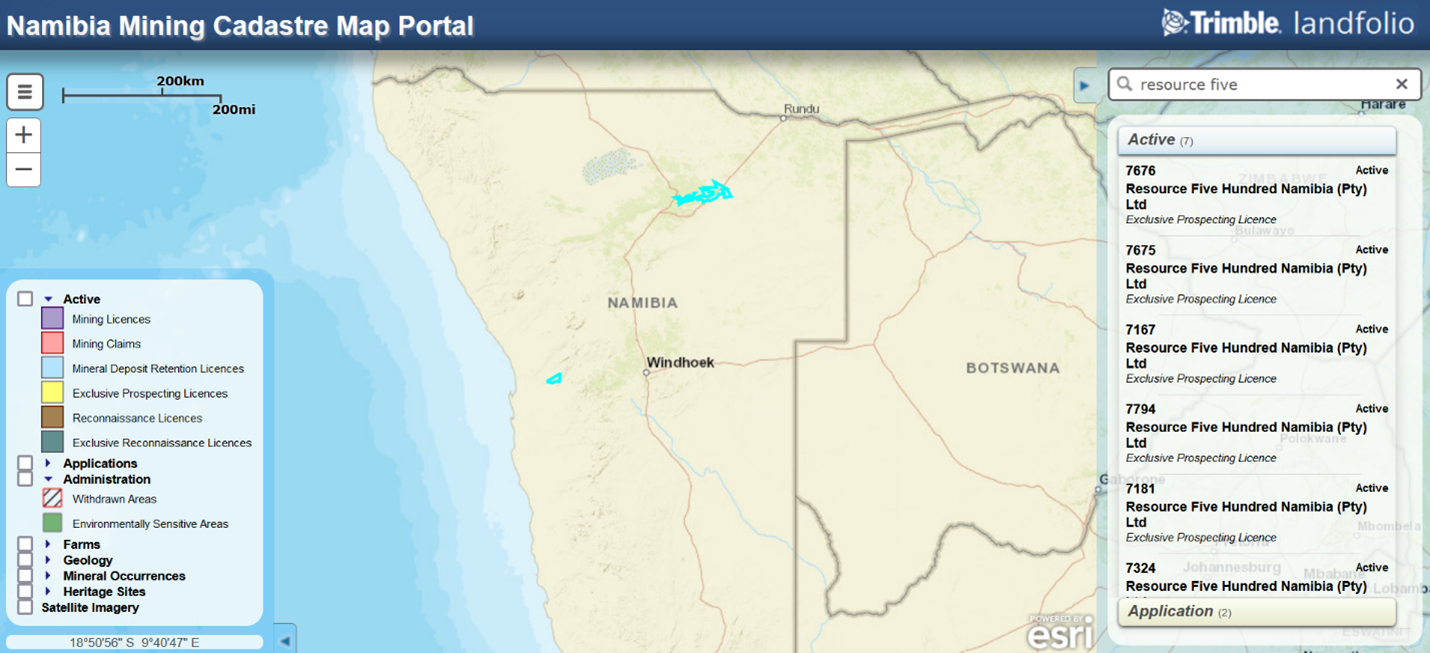

The projects.

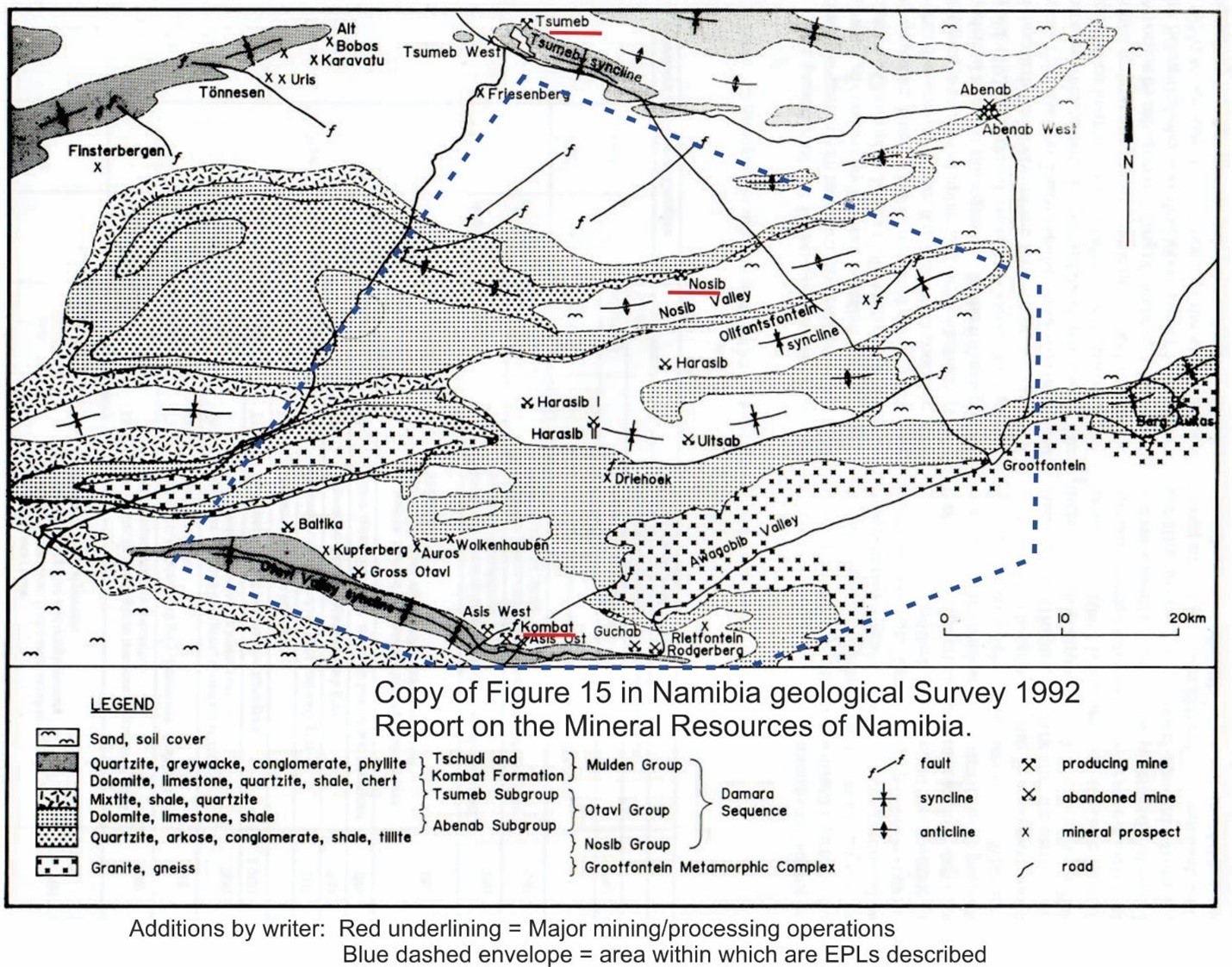

Readers are referred to the map below, which is copied from a Namibian Geological Survey Report (1992).

R500 has acquired exploration Licenses ("EPLs") in the Otavi Mountain Land of northern Namibia, largely covering similar geology to that which hosts the most prolific base metal mines in the history of Namibia. They include Tsumeb and Kombat. Tsumeb operated for over 100 years and produced very high-grade ore of copper, zinc, lead and cadmium. Other deposits in the area that have been mined included vanadium in the mix of metals extracted. Although Tsumeb has been mined out the smelter and surface plant are still operated as a custom processing plant. Kombat has recently been re-opened by a Canadian company, Trigon Metals Inc. Tsumeb lifetime production is at least 20 million tonnes with a grade of >5% copper, 10% lead, 3% zinc and several ounces per tonne of silver. At various times additional minerals recovered including germanium and gallium. Tsumeb ore reserves at the end of 1991 were stated as 1,065,000 tonnes grading 5.78% copper, 3.50% lead and 179 grams per tonne silver.

The region is formed of folded sediments of the Damara Sequence with Tsumeb on the northernmost fold limb and most of the other mines in the central or southern fold limbs. Golden Deeps Company is exploring the former Nosib mine area in the central belt and recent drilling has intersected copper, lead and vanadium mineralization at shallow depths and copper - silver mineralization at greater depth, according to their press release.

Work program

R500s' EPLs cover parts of the area bounded by a dashed blue line in the map below. R500 has undertaken preliminary level exploration surveys over their EPLs and located several anomalous areas by remote sensing. R500 plans to undertake geochemical surveys as the next stage of exploration.

Most of the targets identified are in the EPLs covering the southern fold belt running through the area hosting the Kombat and adjacent mines. While there has been extensive historic exploration in the western part of this area, the eastern area has had less exploration as it is largely covered by a layer of more recent "Kalahari sand" which hides the underlying geology and limits the geochemical signature of buried rocks. Recent advances in geochemical methodology enable greater depth penetration and better discrimination of anomalies.

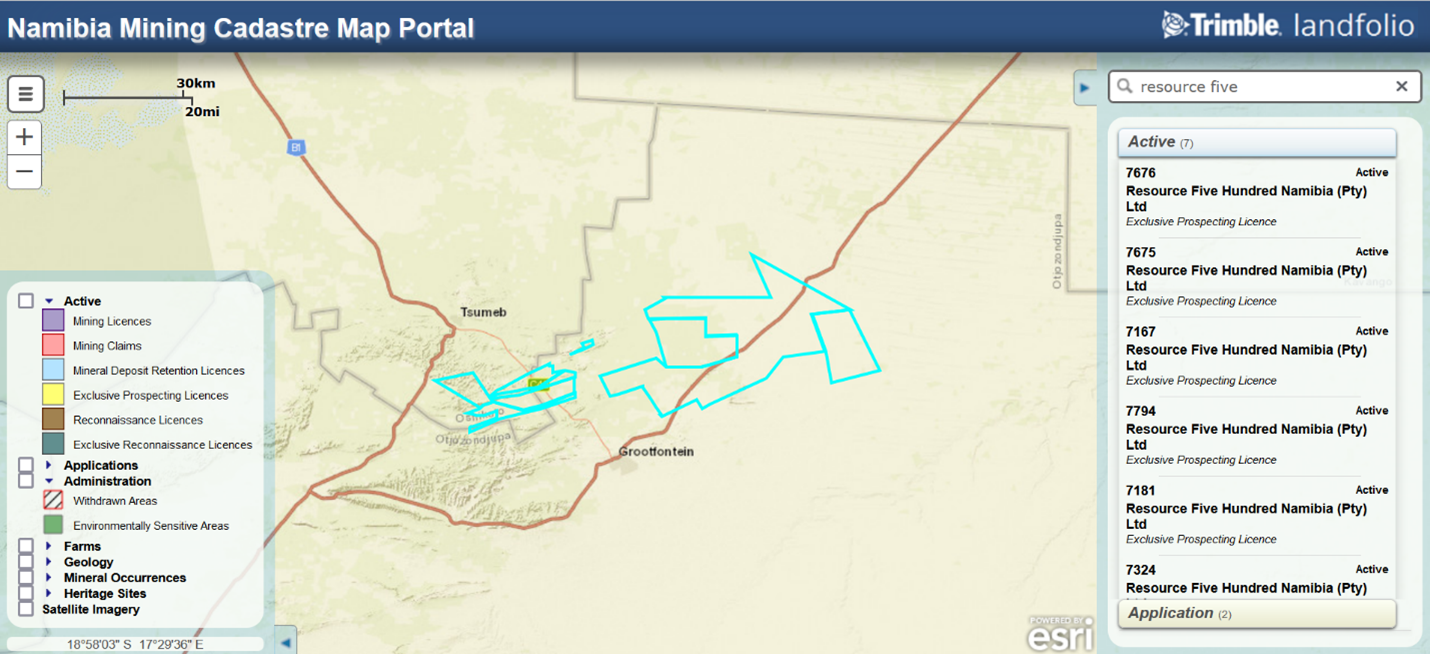

The Licences

License Status of Resource 500 V Limited

Status | License Number |

|

Active | 7675 |

|

Active | 7181 |

|

Active | 7781 |

|

Active | 7676 |

|

Active | 7167 |

|

Active | 7794 |

|

Active | 7166 |

|

Application | 9831 |

|

|

|

|

Vilhjalmur Thor Vilhjalmsson, CEO and Chairman of Ubique, commented, "We are pleased to increase our ownership to almost full in this promising Namibian exploration venture. The initial results are encouraging, and we believe this acquisition will strengthen our efforts in the region. We look forward to advancing our exploration activities and are optimistic about the potential this project holds for our growth strategy."

On behalf of the board of directors,

Vilhjalmur Thor Vilhjalmsson

CEO and Chairman

Contact: vilhjalmur@ubiqueminerals.com Tel: +3548697296

About Ubique Minerals Limited

Ubique Minerals Limited is an exploration company listed on the CSE (CSE:UBQ) and Frankfurt stock exchange (FRA:2UM) focused on exploration of its Daniel's Harbour zinc property in Newfoundland, and is also engaged in exploration in Namibia, Africa along with actively searching for other projects around the world. Ubique became a publicly listed company in September 2018. Ubique has an experienced management group with a record of multiple discoveries of deposits worldwide and owns an extensive and exclusive database of historic exploration results from the Daniel's Harbour area.

Dr. Gerald Harper, P.Geo.(NL), director of Ubique, is the qualified person as defined by NI 43-101 responsible for the technical data presented herein and has reviewed and approved this release.

For more information on Ubique please contact see www.ubiqueminerals.com or contact vilhjalmur@jvcapital.co.uk

Forward-Looking Information: This press release may include forward-looking information within the meaning of Canadian securities legislation, including, but not limited to, statements concerning the Proposed Acquisition, conditions to closing the Proposed Acquisition, mineral exploration, raising of additional capital and the future development of the business. The forward-looking information is based on certain key expectations and assumptions made by the company's management and is subject to a number of risks, including: the Proposed Acquisition might not be concluded as contemplated, or at all, and mineral exploration might not be adequately funded, completed or produce hoped for results Although the company believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Ubique can give no assurance that they will prove to be correct. These forward-looking statements are made as of the date of this press release and Ubique disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ubique Minerals Limited

View the original press release on accesswire.com