New feature empowers employees to make personalized health insurance choices directly within the PeopleKeep platform.

INDIANAPOLIS, IN / ACCESSWIRE / August 27, 2024 / PeopleKeep, a leader in health benefits administration software for small and midsize employers, released a new integrated insurance policy shopping feature on its health reimbursement arrangement (HRA) platform.

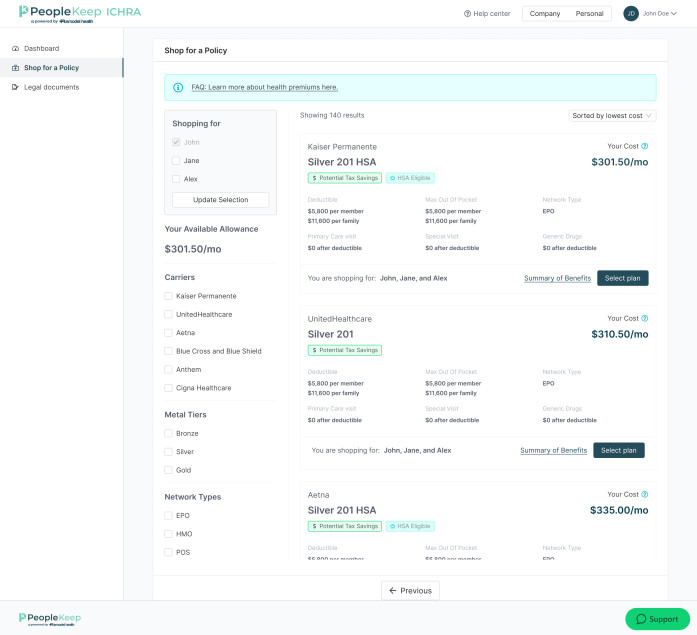

A screenshot of PeopleKeep's integrated shopping feature.

This new feature allows employees to seamlessly shop for and select health and ancillary insurance policies directly within the PeopleKeep platform, significantly enhancing the value of their HRA benefit.

As consumer-driven health benefits like the individual coverage HRA (ICHRA) continue to gain traction, the ability for employees to make informed and personalized choices is more critical than ever. Traditional group health plans often limit employees to one-size-fits-all options chosen by their employers. In contrast, PeopleKeep's integrated shopping feature empowers employees to select the coverage that best suits their unique needs, ensuring they get the most out of their HRA allowances.

"This feature represents a pivotal moment in the evolution of health benefits," said Justin Clements, President of PeopleKeep. "By making it easier for employees to choose their own coverage, we're not just adding a feature-we're helping to redefine what health benefits can be in a consumer-driven era."

Key highlights of the integrated shopping feature include:

Streamlined insurance shopping: Employees can now browse, compare, and purchase health, dental, and vision plans directly within the PeopleKeep platform.

Increased value of the HRA: Tailored plan selection ensures that employees maximize the value of their HRA, increasing engagement with their health benefit.

Enhanced employee empowerment: This feature reinforces the growing trend of consumer-driven health benefits, where employee choice and flexibility take center stage.

ICHRA and QSEHRA integration: Available across both the ICHRA and qualified small employer HRA (QSEHRA) products, this feature ensures that employees offered either employer-sponsored benefit can experience a more personalized insurance selection process.

This feature launch is a direct response to the shifting landscape of employee benefits, where the demand for flexibility and personalization continues to rise. As small and mid-sized employers increasingly adopt ICHRA, QSEHRA, and other consumer-driven health benefits to stay competitive, PeopleKeep's integrated shopping feature positions the company as a key player in supporting this transition.

About PeopleKeep

PeopleKeep helps small and midsize businesses thrive by enabling them to offer meaningful employee benefits. With a focus on a seamless employee experience, easy-to-use software, and automated compliance, PeopleKeep continues to drive innovation in the field of benefits administration.

Contact Information

Katherine Torres

VP of Marketing

pr@peoplekeep.com

801-462-4346

SOURCE: PeopleKeep

View the original press release on newswire.com.