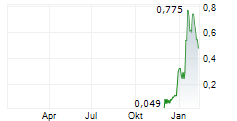

VANCOUVER, British Columbia, Aug. 28, 2024 (GLOBE NEWSWIRE) -- Patagonia Gold Corp. ("Patagonia" or the "Company") (TSXV: PGDC) announces its financial results for the quarter ended June 30, 2024 ("Q2 2024"). The financial statements together with the related management's discussion and analysis are available on the Company's website and under the Company's profile on SEDAR+ at www.sedarplus.ca.

Highlights

- Generated revenue of US$2.6 million in Q2 2024.

- Produced 761 gold equivalent ounces(1) and sold 1,107 gold equivalent ounces(1) in Q2 2024.

- Incurred exploration expenditures of US$0.7 million in Q2 2024 including completion of:

- A diamond drilling program in the Abril target to test the extension of mineralization identified in previous reverse circulation drill holes. A total of 284.2 meters were drilled, all as HQ-diameter core, and 289 samples were collected(2). The assays results varied significantly, with Au (gold) values ranging from 0.005 to 0.23 grams per ton (g/t) and Silver (Ag) values ranging from 1 to 25 g/t3.

Notes:

(1)Consisting of 488 gold and 21,624 silver ounces of production and 779 gold and 26,503 silver ounces sold, converted to a gold equivalent using a ratio of the average spot market price for the commodities each period. The ratio for three months ended June 30, 2024 was 79.23:1 (2023 - 80.54:1).

(2)Includes 18 samples submitted for QAQC purposes. All QAQC samples were within expected analytical limits.

(3)Assays were performed at Alex Stewart International, a certified, independent, commercial laboratory with sample preparation and analytical facilities in Mendoza, Argentina. Gold values were determined by fire assay techniques and silver values were determined by four acid digestion and ICP-MS.

Qualified Person's Statement

Donald J. Birak, an independent consulting geologist, Registered Member of SME, Fellow of AusIMM, and qualified person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical information in this news release.

About Patagonia Gold

Patagonia Gold Corp. is a South America focused, publicly traded, mining company listed on the TSX Venture Exchange. The Company seeks to grow shareholder value through exploration and development of gold and silver projects in the Patagonia region of Argentina. The Company is primarily focused on the Calcatreu project in Rio Negro and the development of the Cap-Oeste underground project. Patagonia, indirectly through its subsidiaries or under option agreements, has mineral rights to over 430 properties in several provinces of Argentina and is one of the largest landholders in the province of Santa Cruz, Argentina.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements with respect to, among other things, the advancement and development of gold and silver projects in the Patagonia region of Argentina, including the drilling program in the Abril target, and the anticipated growth in shareholder value. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.