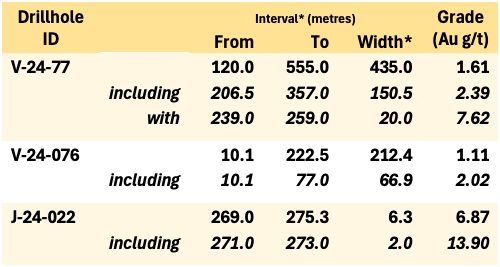

Hole V-24-077, along the northeast boundary of Valley's current mineral resource estimate, averaged 1.61 g/t Au over 435.0 m, including 2.39 g/t Au over 150.5 m

On Snowline's Jupiter target, Einarson Project, Hole J-24-022 returned 6.88 g/t Au over 6.3 m, including 13.9 g/t Au over 2.0 m downhole, along with other mineralized intersections in 170 m step-back from previous drilling

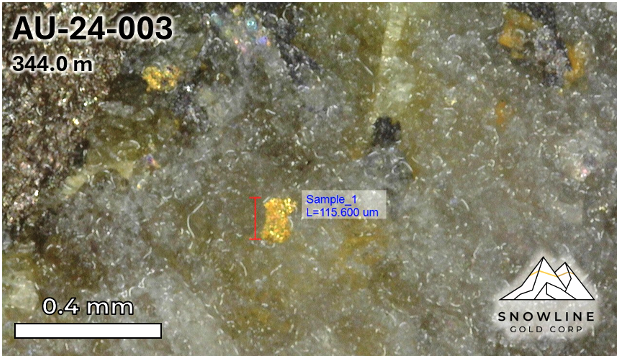

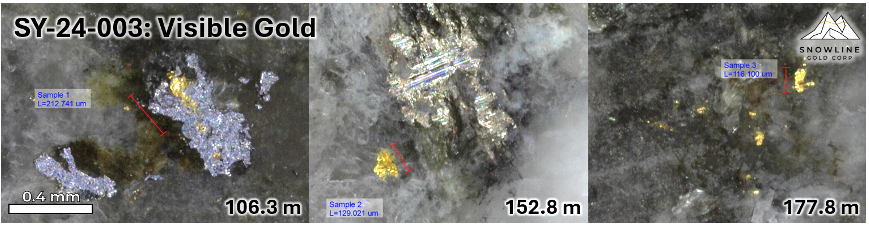

Trace amounts of visible gold seen in regional drilling at Aurelius target, Rogue Project and Sydney target, Cynthia Project

Assays pending for >21,000 m across 7 targets, with drilling ongoing.

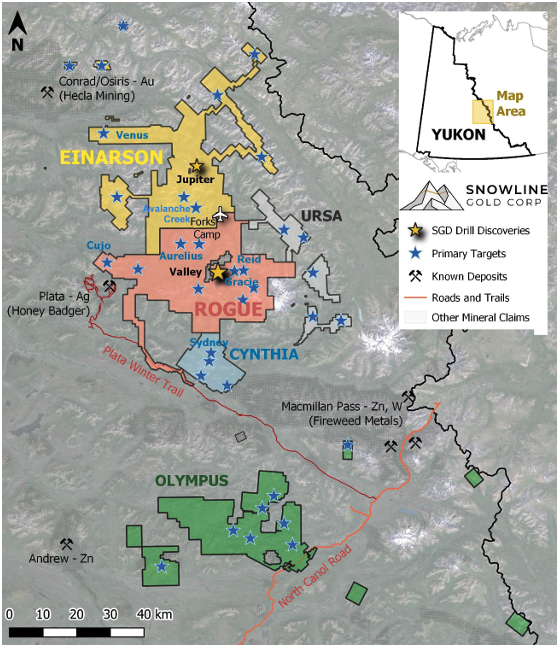

VANCOUVER, BC / ACCESSWIRE / August 29, 2024 / SNOWLINE GOLD CORP (TSX-V:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional analytical results from its 2024 Valley deposit drilling campaign on the Rogue Project in Canada's Yukon Territory, along with the first drill results from its Jupiter target, Einarson Project, since consolidation of 100% ownership of Einarson earlier this year. Highlight intervals from Valley and Jupiter are summarized in Table 1 below. The results from V-24-077 at Valley are near the northeastern edge of the current resource-limiting pit shell constraint for the initial mineral resource estimate (MRE) at Valley, confirming continuity of strong gold grades to the edge of the current resource, open to further expansion. At the Einarson Project's epizonal orogenic Jupiter target, roughly 32 km north of Valley, multiple zones of gold mineralization were encountered in a 170 m step-back from previous drilling, increasing the known width of the system. Drilling is ongoing at Valley and on other targets, with assays pending for an additional 21,278 m drilled to date.

"We are pleased to advance our flagship district on multiple fronts," said Scott Berdahl, CEO & Director of Snowline. "At Valley, drilling continues to de-risk and potentially grow our initial mineral resource estimate with holes expanding the footprint of near surface, >1 g/t Au gold mineralization. At Jupiter, our step-outs are hitting encouraging zones of gold mineralization within large areas of alteration and pathfinder minerals. Elsewhere, our regional exploration and drilling is ongoing, with drill results still pending from six regional targets outside of Valley this year."

VALLEY DRILLING, ROGUE PROJECT

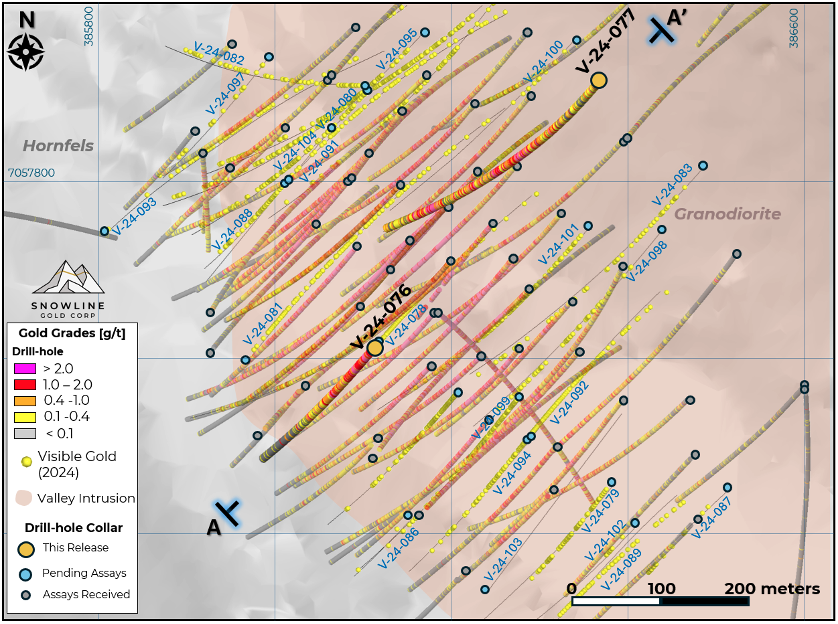

Drilling at the Rogue Project's Valley deposit is ongoing, with three drills currently active on the deposit. To date, roughly 17,400 m have been drilled at Valley in 37 holes in 2024 (Figure 1). Trace instances of visible gold and widespread sheeted quartz vein arrays have been observed both within and beyond the confines of the current, initial MRE for Valley. The Company awaits full assay results from the ongoing drill campaign to assess the significance of these observations and their impact on the MRE.

Hole V-24-077

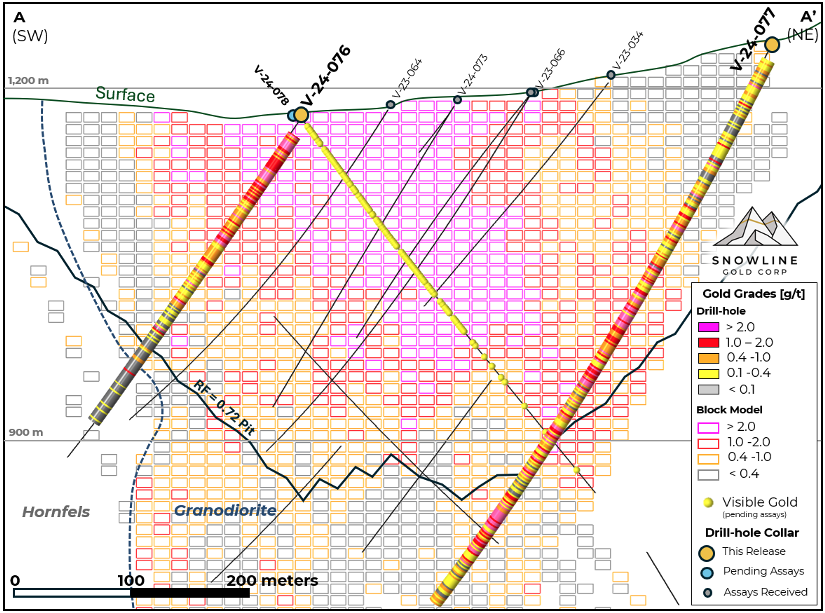

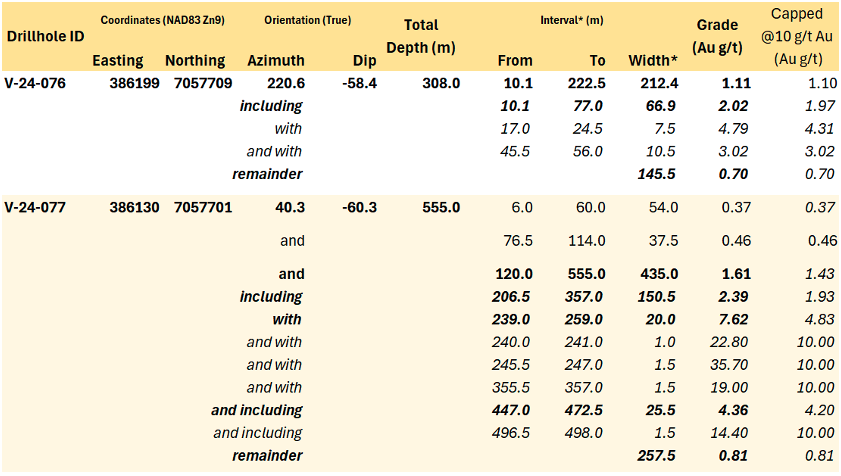

Hole V-24-077 is collared within the Valley intrusion, as a 140 m step back along section from V-23-034 (418.3 m @ 1.88 g/t Au from surface including 216.0 m @ 3.08 g/t Au, see Snowline news release dated July 5, 2023) (Figures 1 & 2). The nearest holes are V-23-045 (517.9 m @ 1.14 g/t Au from surface including 125.5 m @ 1.75 g/t Au, see Snowline news release dated September 11, 2023) at 84 m to the west and V-22-015 (442.0 m @ 0.65 g/t Au including 170.0 m @ 1.18 g/t Au, see Snowline news release dated December 22, 2022) at 72 m to the south.

V-24-077 tests material along the edge of the block model used for the initial Valley MRE and along the edge of the current revenue factor 0.72 pit shell used to constrain that MRE. The hole remains primarily in coarse-grained granodiorite, the dominant phase of the intrusion, until roughly 400 m downhole, at which point it transitions into a fine-grained porphyritic phase of the intrusion with zones of igneous breccia.

The hole begins with two intersections of lower grade mineralization (54.0 m averaging 0.37 g/t Au from bedrock surface at 6.0 m downhole and 37.5 m averaging 0.46 g/t Au from 76.5 m downhole) before hitting a sustained run of 435.0 m averaging 1.61 g/t Au from 120 m downhole until the end of the hole at 555.0 m, including a higher-grade interval of 2.39 g/t Au over 150.5 m beginning at 206.5 m downhole. Zones of higher grades include 7.62 g/t Au over 20.0 m (including 35.7 g/t Au over 1.5 m) from 239.0 m downhole (Table 2).

The results are expected to expand the limit of the current block model and to expand the extent of above cut-off (>0.4 g/t Au) and higher-grade domains. The ultimate effect of this result will be quantified along with analytical results of all subsequent holes in an updated mineral resource estimate at a later time.

EXPLORATION UPDATES

Snowline currently has two drill rigs active on regional targets: one active on an expanded Phase I drill program on the Rogue Project's Aurelius target, the other completing the first ever drill testing of the Einarson Project's Avalanche Creek orogenic gold target. Assays are currently pending for more than 8,100 m drilled on regional targets outside of Valley, namely: Aurelius (4 holes), Cujo (3 holes) and Reid (1 hole) on the Rogue Project, Sydney (3 holes) on the Cynthia Project, and Jupiter (6 holes) and Avalanche Creek (2 holes) on the Einarson Project.

Jupiter Target, Einarson Project

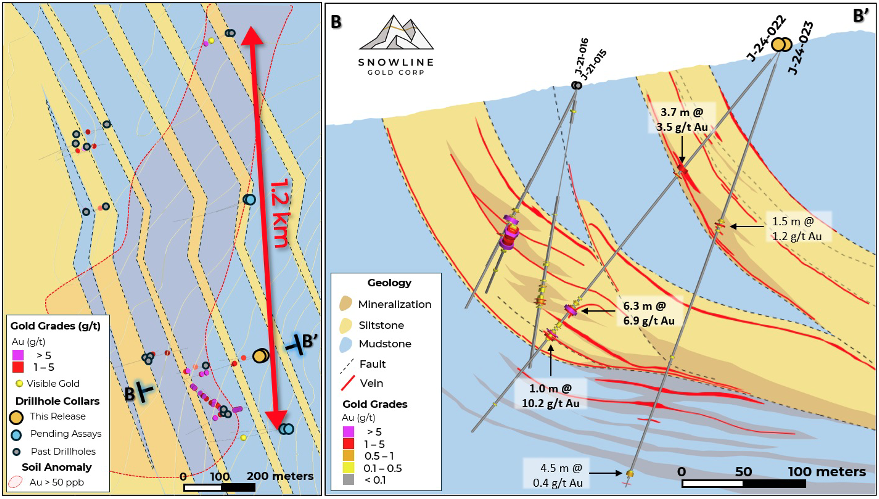

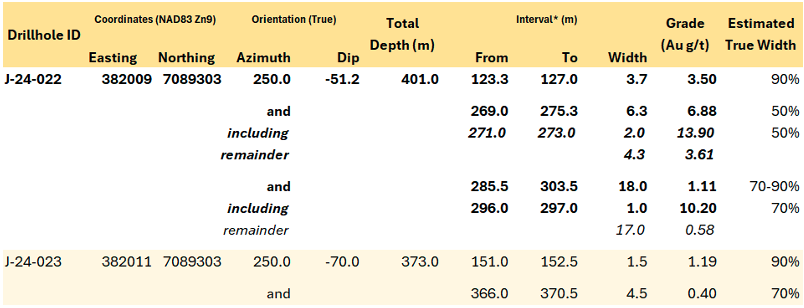

At Jupiter, assays have been received for the first two holes drilled in 2024. Both holes encountered elevated to anomalous (>1 g/t Au, to a high of 13.9 g/t Au over 2.0 m in J-22-024) gold mineralization, expanding the width and depth of the known mineralized system at Jupiter (Table 3).

Hole J-24-022 was drilled as a 170 m step-back from J-21-015 (3.6 m @ 13.7 g/t Au, including 0.95 m @ 25.2 g/t Au, see Snowline news release dated November 18, 2021). It encountered 3 primary zones of mineralization. The upper zone, averaging 3.50 g/t Au over 3.7 m, is interpreted as a new mineralized structural corridor subparallel to mineralization encountered in 2021. The lower two zones, including an interval of 6.87 g/t Au over 6.3 m downhole, along with mineralization seen in J-24-023, extend to depth the mineralized corridor encountered in 2021 (Figure 4). Assays for an additional 2,444 m in 6 holes from the Jupiter target are pending.

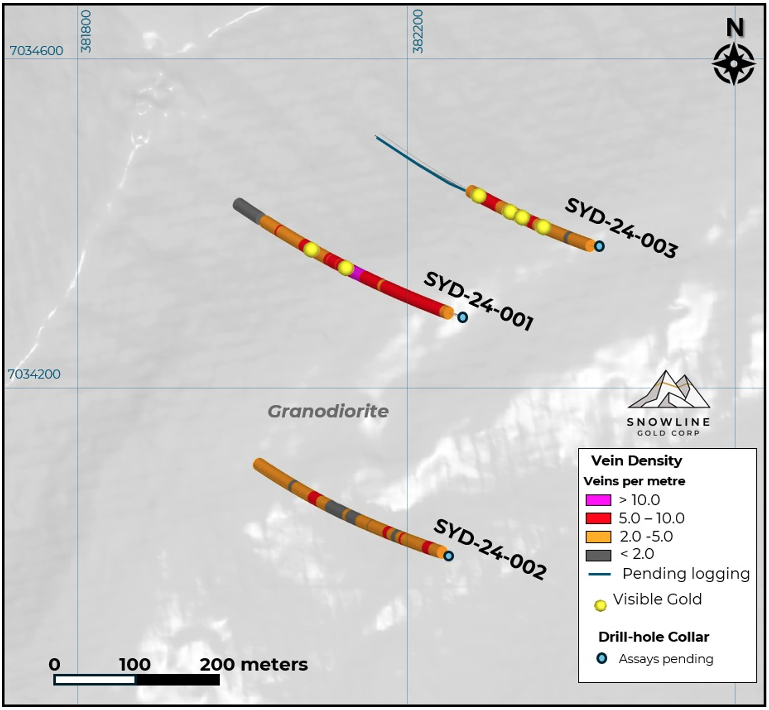

Sydney Target, Cynthia Project

A 3-hole, 1,344 m Phase I drilling program has recently been completed at the Sydney target, Cynthia Project, representing the first-ever drill testing of the recently delineated RIRGS target located south of Rogue, near the Plata winter trail. Widespread sheeted quartz veins are present in all three holes, with low to high vein densities (Figure 6) and at least two distinct vein generations. Veins appear to have a higher sulphide content than those at Valley. Six instances of visible gold, from two separate holes, were noted during core logging, which is ongoing. Assays for all holes at Sydney are pending.

ANNUAL GENERAL MEETING RESULTS

The Company held its Annual General Meeting (AGM) on August 27, 2024. Shareholders voted in favour of all items of business before the AGM, including the election of all director nominees, the appointment of the auditor, and re-approval of the Omnibus Incentive Plan.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's "Forks" Camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

For the purposes of this release, contiguous mineralized intervals at Valley are defined as runs of mineralization with no break >5.0 m assaying <0.1 g/t Au, including any subsections thereof.

ABOUT ROGUE

Snowline Gold's 100%-owned, flagship Rogue Project, in Canada's Yukon Territory, covers a 60 x 30 km cluster of intrusions in the eastern Tombstone Gold Belt known as the Rogue Plutonic Complex.

Since its launch in 2021, Snowline has progressed the Rogue Project's Valley target from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with 4.05 Moz gold indicated mineral resource at 1.66 g/t Au and an additional 3.26 Moz inferred mineral resource at 1.25 g/t Au within a pit-shell constraint. The resource estimate numbers are supported by the recent technical report for Rogue, prepared in accordance with NI 43-101 standards, entitled "Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate," authored by Heather Burrell, P. Geo., Daniel J. Redmond, P. Geo., and Steven C. Haggarty, P. Eng., with an effective date of May 15, 2024.

Exploration of the open Valley system is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross's Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering roughly 360,000 ha (3,600 km2). The Company is exploring its flagship 111,000 ha (1,110 km2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits. The Company's first-mover position and extensive exploration database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the significance of visual drill core observations and visible gold, the potential effects of current analytical results on future mineral resource estimates including expansion of the pit shell and de-risking of the current estimate, the discovery potential within the Valley intrusion and on other exploration targets, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com