ORTHAMPTON, MA / ACCESSWIRE / August 30, 2024 / FedEx Corporation:

Supported by a grant from FedEx, RMI developed GridUp to help forecast energy and power needs of electric vehicle charging.

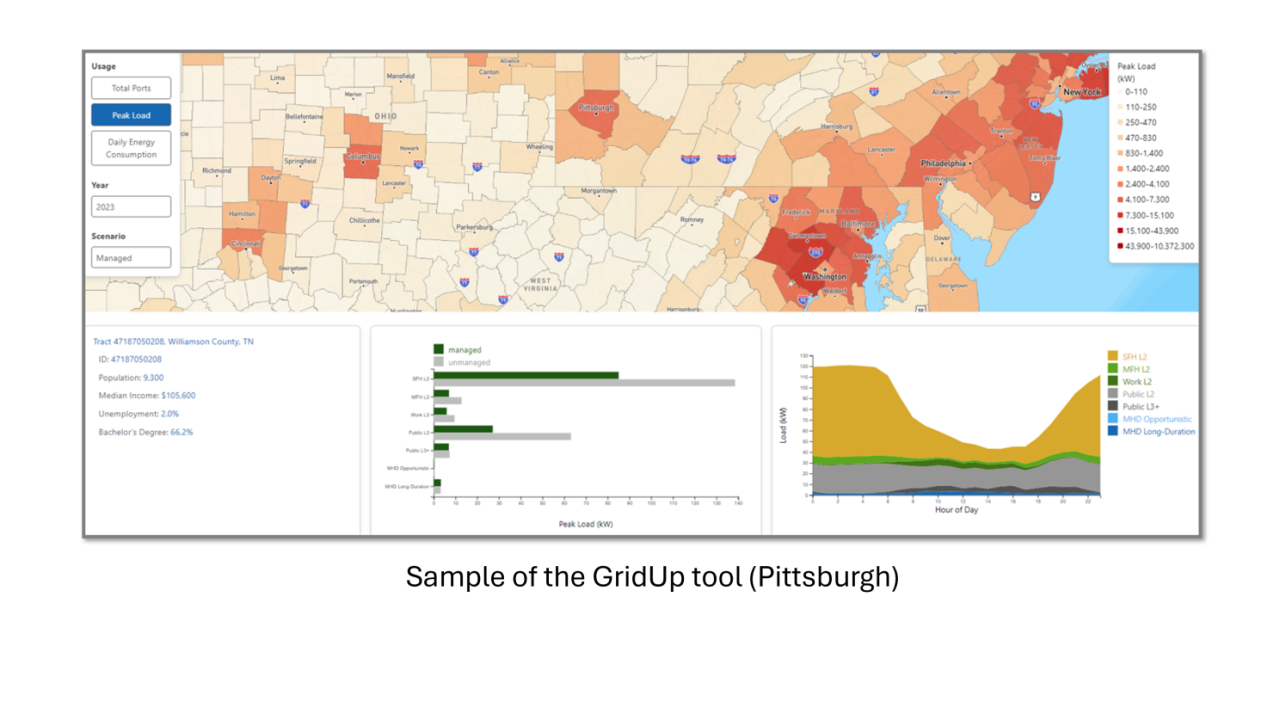

RMI recently released GridUp, a publicly accessible, state-of-the-art tool that helps utilities forecast when and where energy and power demands will materialize from vehicle electrification. The GridUp tool can forecast electric vehicle (EV) power needs at the census-block group level, arming decision makers for the first time with the detailed information they need to quickly, effectively, and confidently upgrade the grid to meet the increasing demand for EV charging infrastructure.

"Fleet electrification requires the cooperation of an entire ecosystem - utilities are as much a part of it as vehicle manufacturers, fleet owners, and charging infrastructure providers." said Pat Donlon, vice president of Global Vehicles, FedEx. "You can order all the electric vehicles in the world over the next few years, but none of that matters if the grid capacity isn't there to support charging them. That's why supporting a tool like GridUp is so vital to help utilities understand and plan for increased electricity needs from having more personal and commercial EVs on the road."

The transportation sector is already working toward electrification. However, existing US grid infrastructure will be insufficient to support additional electricity demand from future EV charging needs and needed upgrades have long lead times to deploy. This poses a key barrier for fleet operators and charging companies, as well as an emergent challenge for utilities and infrastructure planners: a lack of certainty regarding the specific charging needs EVs will have - when, where, and how much.

"One of the most consequential barriers to widespread transportation electrification is the grid's ability to reliably provide the power required for vehicle charging," said Clay Stranger, managing director at RMI. "GridUp addresses this barrier by projecting when and where EVs will need power with granular detail, enabling utilities, cities, and states to make informed planning and investment decisions. This will help provide charging that is equitable, ubiquitous, and available where and when it is needed most."

For example, GridUp can be used to help utilities forecast:

Which areas will see the largest amounts of EV growth, and what will drive that growth.

Areas with a high concentration of medium- and heavy-duty electric truck activity are likely to see some of the largest new demands for electricity.

The neighborhood of Cornell in southeast Atlanta, Georgia - where multiple logistics companies have distribution centers or freight depots - may see new loads of up to 7 MW, approximately as much power as the Atlanta Falcons's Mercedes-Benz Stadium during an NFL game

How much energy will be needed to support charging in a given area.

For example, Grid Up predicts EV charging in Allegheny County, which contains Pittsburgh, will require the equivalent of almost 68,000 single family homes-worth of energy by 2035.

For context, Pittsburgh currently has about 160,000 housing units.

What kinds of charging locations will need to be built in specific areas.

For example, GridUp demonstrates that Crown Heights, a relatively dense part of Brooklyn, mostly requires chargers in public locations and at multi-family homes, while Kew Gardens Hills, a less dense neighborhood of Queens, requires chargers at single-family homes and public locations.

RMI has piloted the GridUp tool since 2021, gaining important insights from utilities and regulators on how to provide the best data for proactive investments in the grid. Below are two quotes from two of the beta users of the GridUp tool:

"RMI's modeling and load forecasting support allowed us to get a window into a future that will be largely decarbonized, which armed us with the information we needed to develop projects to meet the near-, mid-, and long-term transport electrification needs of key corridors in our service territory." -Brian Wilkie, Director, Clean Energy Development - Transportation, National Grid NY.

"RMI's GridUp tool helps us and our local partners make stronger decisions about budget requests, program design, grid distribution plans, and EV-ready building codes. In Washington, we take pride in our role as innovators, and we are pleased to see the cutting-edge work behind our Transportation Electrification Strategy scaled up to a national tool."

-Steven Hershkowitz, Managing Director for Clean Transportation at the Washington State Department of Commerce.

To learn more about the issues GridUp addresses, check out RMI's Electrification 101 series.

Click here to learn about FedEx Cares, our global community engagement program.

View additional multimedia and more ESG storytelling from FedEx Corporation on 3blmedia.com.

Contact Info:

Spokesperson: FedEx Corporation

Website: https://www.3blmedia.com/profiles/fedex-corporation

Email: info@3blmedia.com

SOURCE: FedEx Corporation

View the original press release on accesswire.com