EQS-News: CPI PROPERTY GROUP

/ Key word(s): Half Year Results

CPI Property Group "CPIPG's consistent growth in rental income demonstrates once again the benefits of our diversified, resilient and high-quality portfolio," said David Greenbaum, CEO. "Further reducing leverage and complexity remain our key priorities."

Completion of independent review of short seller allegations Earlier today, CPIPG published an update for our stakeholders regarding the completion of an independent review by Global Law firm White & Case relating to the allegations raised by a short seller. The investigation found no evidence to substantiate the short seller's claims. The separate press release and further information can be found here. Other selected events occurring post-H1 On 12 July, S IMMO completed the sale of the HOTO Business Tower in Zagreb. On 20 August, IMMOFINANZ sold the myhive Victorei office development in the old town of Bucharest for approximately €27 million. Half-year results webcast CPIPG will host a webcast in relation to its financial results for the six-month period ending 30 June 2024. The webcast will be held on Thursday, 5 September 2024, at 11:00 am CET / 10:00 am UK. Please register for the webcast in advance via the link below: https://edge.media-server.com/mmc/p/5vj8vceb

[1] Due to the sale of a 50% stake in CPI Hotels, the hotel operating entity, income due from most hotel properties have been reclassified as rental income, as opposed to hotel income previously. Thus, the current hotel income figures are not comparable on a like-for-like basis to last year's figures. CONSOLIDATED INCOME STATEMENT

Gross rental income Gross rental income increased by €14.5 million (3.17%) to €472 million in Q2 2024 compared to Q2 2023. The change was driven by reclassification of hotels from PPE to Investment property (and related revenue from hotels revenue to gross rental income) of €5.1 million and inflation indexation of rental income by the Group. Administrative expenses increased by €3.8 million in Q2 2024 compared to Q2 2023, primarily due to increase of overall advisory costs. Net valuation loss of €153.7 million in Q2 2024 was represented primarily by revaluation loss generated by S IMMO (€84.2 million), Immofinanz (€28.4 million) and selected office portfolio in Prague. Net interest expense increased by €4.0. million in Q2 2024 compared to Q2 2023, mainly due to an overall increase in the cost of financing. IMMOFINANZ and S IMMO net interest expense increased by €4.6 million and €6.5 million, respectively. Net hotel income decreased by €11.5 million due to disposal of part of the Group's hotels portfolio in March 2024.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Total assets Total assets decreased by €699 million (3.2%) to €21,231.3 million as at 30 June 2024 compared to 31 December 2023. The decrease relates primarily to disposals of investment property (€692.7 million including €281.6 million of investment property classified as asset held for sale as at 31 December 2023). Total liabilities decreased by €874 million (6.4%) to €12,799 million as at 30 June 2024 compared to 31 December 2023, primarily due to a decrease in financial debts (€ 1,103.2 million). Total equity increased by €175.0 million from €8,257.3 million as at 31 December 2023 to €8,432.3 million as at 30 June 2024. The movements of equity components were as follows:

EPRA NRV was €5,372 million as at 30 June 2024, representing a decrease of 3.5% compared to 31 December 2023. The decrease of EPRA NRV was driven by the above changes in the Group's equity attributable to the owners, primarily a decrease of retained earnings and a decrease of translation, revaluation and hedging reserve.

Management Report 2024, chapters Glossary of terms, Key ratio reconciliations and EPRA performance; accessible at http://cpipg.com/reports-presentations-en.

http://www.cpipg.com/reports-presentations-en

30.08.2024 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group AG. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Language: | English |

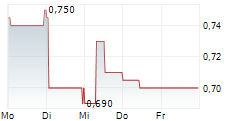

| Company: | CPI PROPERTY GROUP |

| 40, rue de la Vallée | |

| L-2661 Luxembourg | |

| Luxemburg | |

| Phone: | +352 264 767 1 |

| Fax: | +352 264 767 67 |

| E-mail: | contact@cpipg.com |

| Internet: | www.cpipg.com |

| ISIN: | LU0251710041 |

| WKN: | A0JL4D |

| Listed: | Regulated Market in Frankfurt (General Standard); Regulated Unofficial Market in Dusseldorf, Stuttgart |

| EQS News ID: | 1978999 |

| End of News | EQS News Service |

1978999 30.08.2024 CET/CEST