Frankfurt/Main, 14 August 2024. LifeFit Group MidCo GmbH (the "Issuer") announces further details regarding Light AcquiCo GmbH's ("AcquiCo") (an entity indirectly held by investment funds advised by Waterland Private Equity Investments ) acquisition of LifeFit Group TopCo GmbH ("LifeFit Group"), the Issuer's sole direct shareholder (the "Acquisition"), which shall be part-financed by a new senior secured corporate bond under Swedish law (Nordic Bond) with a target volume of EUR 120,000,000 (the "New Bonds") by AcquiCo, where the net proceeds shall also be used to redeem the Existing Bonds. For this purpose, the Issuer gives conditional notice of early voluntary redemption of its maximum EUR 70 million (plus the aggregate amount of PIK interest settled by issuance of subsequent bonds) senior secured callable floating rate 2019/2025 bonds with ISIN NO0010856966 (the "Existing Bonds") in full.

Acquisition update

The German Federal Cartel Office (Bundeskartellamt) has cleared the Acquisition on 1 August 2024 and all other conditions precedent for the Acquisition, except for those which can by their nature only be fulfilled immediately upon the closing, have been fulfilled. The closing of the Acquisition is envisaged for 4 September 2024.

Issue of New Bonds

Pareto Securities AS, Frankfurt Branch has been mandated as sole bookrunner to arrange credit investor meetings in connection with the private placement of the New Bonds. The New Bonds are fully underwritten based on subscription commitments from certain institutional investors.

Notice of conditional redemption of Existing Bonds

A notice of a conditional early voluntary redemption of the Existing Bonds will be sent to Verdipapirsentralen ASA (Euronext Securities Oslo) ("VPS") for delivery to persons registered in the securities account with VPS as holders of Existing Bonds.

The redemption of the Existing Bonds is conditional upon (i) successful settlement of the New Bonds and the receipt of such generated net proceeds by AcquiCo from a designated escrow account prior to the lapse of 3 September 2024, (ii) a EUR 10,000,000 super senior term loan facility being readily available to AcquiCo on or prior to the closing date of the Acquisition and (iii) a EUR 10,000,000 super senior revolving credit facility being available to AcquiCo from the closing date of the Acquisition (together, the "Condition"). Should the Condition not be fulfilled by the lapse of 3 September 2024, the Redemption will not occur (unless the Condition has been waived by the Issuer at its sole discretion) which will, in such case, be communicated to the holders of the Existing Bonds through a subsequent announcement.

Subject to the fulfilment or waiver of the Condition, the date for redemption is set at 5 September 2024 and the record date for the redemption will be 3 September 2024, i.e. two business days prior to the redemption date. The Existing Bonds will then be redeemed at an amount equal to 101.25 per cent. of the total outstanding nominal amount (i.e., EUR 1.0125 per Existing Bond) together with any unpaid interest accrued until but excluding the redemption date.

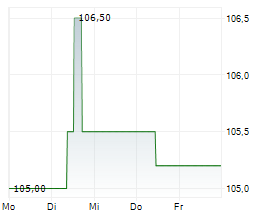

In connection with the redemption, the Existing Bonds will be delisted from Frankfurt Stock Exchange and Nasdaq Stockholm.

This announcement is for information purposes only and is not to be construed as an offer to purchase or sell or a solicitation of an offer to purchase or sell with respect to any securities of the Issuer or AcquiCo.

This information is information that LifeFit Group MidCo GmbH is obliged to make public pursuant to the EU Market Abuse Regulation (EU 596/2014). The information in this publication has been made public through the agency of the responsible person set out below for publication at the time stated by the Issuer's news distributor, Adel & Link Public Relations, at the time of publication.

About LifeFit Group

LifeFit Group is a leading fitness and health platform in Germany, uniting several fitness brands under one roof. The Group is committed to inspiring and supporting its customers to improve their lives through personalized, varied and purposeful health and fitness experiences. Fitness First is LifeFit Group's best -known and largest brand. With Fitness First BLACK, the gym chain offers upscale benefits and services, while Fitness First RED offers a special workout space concept for a wide range of customers with an appealing modular pricing. Elbgym complements the multi-brand offering as an exclusive performance fitness provider with its unique and strong community. The fitness concepts of Barry's, the pioneer of indoor high-intensity interval training, The Gym Society, the innovative compact studio concept from the Netherlands, as well as the Club Pilates brand and YogaSix from Xponential Fitness complete the LifeFit Group portfolio. For more information, visit www.lifefit-group.com

About Waterland

Waterland is an independent private equity investment company that supports companies in realizing their growth plans. With substantial financial resources and industry expertise, Waterland enables its portfolio companies to achieve accelerated growth both organically and through acquisitions. Waterland has offices in the Netherlands (Bussum), Belgium (Antwerp), France (Paris), Germany (Hamburg and Munich), Poland (Warsaw), the UK (London and Manchester), Ireland (Dublin), Denmark (Copenhagen), Norway (Oslo), Spain (Barcelona) and Switzerland (Zurich). The company currently has approximately EUR 14 billion in equity funds. Since its foundation in 1999, Waterland has consistently achieved above-average performance with its investments. Globally, the company is ranked fourth in the HEC/Dow Jones Private Equity Performance Ranking (January 2023) and is ranked seventh among global private equity firms in the Preqin Consistent Performers in Global Private Equity & Venture Capital Report 2022.

Press contact

LifeFit Group

Mareike Scheer

Group Communications Manager

Tel: +49 (0)152 22930014

E-Mail: presse@lifefit-group.com

Adel & Link Public Relations

PR-Team LifeFit Group

Olivia Dudek / Natalie Link

Tel: +49 (0) 173 5658546

E-Mail: lifefit-group@adellink.de

Important notice

THE SECURITIES MENTIONED HEREIN HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE US SECURITIES ACT. THEY MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES, EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE U.S. SECURITIES ACT. NO PUBLIC OFFERING WILL BE MADE IN THE UNITED STATES AND THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFER TO SELL NOR A SOLICITATION TO BUY OR SUBSCRIBE FOR SECURITIES OF LIFEFIT GROUP MIDCO GMBH AND/OR LIGHT ACQUICO GMBH AND NO EXCHANGE OFFER IS BEING MADE IN THE UNITED STATES, AUSTRALIA, CANADA, CYPRUS, HONG KONG, ITALY, JAPAN, NEW ZEALAND, SOUTH AFRICA, THE UNITED KINGDOM OR ANY OTHER JURISDICTION WHERE SUCH DISTRIBUTION/SUCH OFFER WOULD REQUIRE ANY FURTHER MEASURES FROM LIFEFIT GROUP MIDCO GMBH, LIGHT ACQUICO GMBH, PARETO SECURITIES AS, FRANKFURT BRANCH OR ANY OTHER PARTY OR BE PROHIBITED BY APPLICABLE LAW.

© 2024 EQS Group