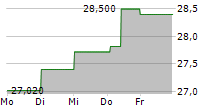

- Net asset value was SEK 319.6 per share compared to SEK 257.9

at the beginning of the year, corresponding to an increase of 23.9 per cent.

- Bures net asset value was SEK 23,695M compared to SEK 19,123M at the beginning of the year.

- Total return on the Bure share was 25.8 per cent; the SIX Return

Index rose 10.6 per cent in the same period.

- Group earnings after tax amounted to SEK 4,754M (3,150). Earnings per share were SEK 64.0 (42.4).

Interim report April - June 2024

- Net asset value was SEK 319.6 per share compared to SEK 298.2 at the beginning of the quarter, corresponding to an increase of 7.2 per cent.

- Bure signed an agreement on the acquisition of 14.5 per cent of Mentimeter for SEK 531M. The transaction was completed in July 2024.

- Bure acquired 700,000 shares in Cavotec for SEK 12M.

- In accordance with the AGM's decision, an ordinary dividend of SEK 2.5 per share was paid, amounting to SEK 185.4M.

Events after the end of the period

- Net asset value amounted to SEK 349.2 per share on 15 August 2024, corresponding to an increase of 35.4 per cent since the beginning of the year.

- Atle entered into an agreement to acquire a majority stake in the Norwegian fund company FIRST Fondene AS. FIRST manages approx. NOK 11 billion in equity and fixed interest funds. Atle also become a partner in Amaron Holding AB through a directed share issue. Amaron is a manager of alternative investment funds with a focus on real estate.

Comments from the CEO

Bure's net asset value per share continued to perform positively in the second quarter, increasing 7.2 per cent, while the SIX Return Index rose 2.5 per cent in the same period. During the first half of the year, Bure's net asset value increased 23.9 per cent, corresponding to an increase of approximately SEK 4.6 billion.

Order intake at Mycronic increased 22 per cent in the second quarter and by 12 per cent in the first six months of the year. Based in part on this, the company's board adjusted its assessment regarding net sales in 2024 to SEK 6.5 billion. Xvivo reported another strong quarter. Turnover rose 36 per cent and operating margin amounted to just under 16 per cent. Elsewhere, it was pleasing to see Cavotec report an increase in order intake, and especially encouraging that profitability and cash flow improved. In conclusion, yesterday Yubico reported. The company reported a greatly increased turnover, +35 percent, with an operating margin of 21 percent.

In June, we announced the acquisition of shares in Mentimeter. Mentimeter provides a so-called SaaS platform for engaging audiences in meetings and presentations through interactive presentation elements. More than 150,000 customers in 200 countries use Mentimeter's SaaS platform to create high-performance organisations through greater engagement and continuous learning. Mentimeter has had an

exceptional organic growth journey. Annual recurring revenue (ARR) grew at an average rate of 58 per cent in the company's first four years of operation. In 2023, Mentimeter achieved an ARR of approximately SEK 500 million. The company has impressively and continuously developed its technology and proven its business model on a global market. Bure has invested a total of SEK 531 million to establish

a holding of 14.5 per cent in the company.

In summary, several of the portfolio companies' quarterly reports were received very positively by the stock market. Happily, therefore, we can note a new highest level for Bure's net asset value per share, SEK 349.2. In a troubled world with volatile financial markets, most recently with large stock market correction in Japan, it is important to look to the results that the portfolio companies perform. These forms the basis for the asset value growth which Bure had this year.

For more information, contact

Henrik Blomquist

henrik.blomquist@bure.se

Telephone: +46 (0) 8-614 00 20

Max Jonson

max.jonson@bure.se

Telephone: +46 (0) 8-614 00 29

This information is information that Bure Equity AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-08-16 08:30 CEST.