April - June 2024

- Net sales amounted to 0 MSEK

- The operating result for the period was -2.4 MSEK

- The net result was -2.4 MSEK corresponding to earnings per share of SEK -0.02

- Cash flow from operating activities amounted to -2.9 MSEK

- Cash and cash equivalents amounted to 8.1 MSEK

January - June 2024

- Net sales amounted to 0 MSEK

- The operating result for the period was -2.4 MSEK

- The net result was -2.4 MSEK corresponding to earnings per share of SEK -0.02

- Cash flow from operating activities amounted to -3.0 MSEK

Significant events January - June 2024

- On the Extraordinary General Meeting of shareholders on the 9 January 2024 Daniel Lifveredson, Torbjörn Browall and Lars-Inge Sjöqvist were elected new members of the Board.

- In January it was announced that an agreement to acquire Noviga Research AB had been signed.

- In May, Mats Wiking was appointed new CEO from 1 September 2024.

CEO Statement

After some major changes in the company early in 2024, the second quarter has been quieter, with a focus on consolidation and cost control.

During the second quarter, work to reduce the company's operating costs continued. We have reviewed our consulting agreements and administrative costs and made the changes we can. When changing consultants, some increased costs may occur in the short term and this means that the effect has not fully taken effect yet, even if all significant differences are visible. It can also be difficult to get a clear picture of the costs by looking at the group figures. This due to the acquisition of Noviga being classified as a reverse takeover with negative goodwill as a result. To better understand the situation, it is easier to look at the legal parent company LIDDS and to add some minor costs for Noviga, to get a fair picture of the new group's costs.

Although some of our projects have been on hold for over a year, work has been carried out in the projects. Among other things, the evaluations of service providers for the regulatory toxicological and safety pharmacology studies, that need to be carried out before the drug candidate NOV202 is ready for clinical studies, have been completed. To carry out the study, funding is required, and the Board is currently evaluating funding directly to the subsidiary Noviga. We have also continued our discussions regarding the clinical study DTX-002 with Nanodotax. The study, a clinical phase Ib study on prostate cancer patients, is planned to be carried out, but the study design is being discussed in order to minimize costs for the company. LIDDS hopes to return with information about Nanodotax in the near future.

With that, it is time for me to say thank you. My time in LIDDS has been interesting and educational. I welcome my successor Mats and wish him well.

Jenni Björnulfson, CEO and CFO

The interim report is available on the company's website https://liddspharma.com/en/investors/financial-reports/

For additional information, please contact

Jenni Björnulfson, CEO and CFO

Phone: +46 (0)70 855 38 05

E-mail: jenni.bjornulfson@liddspharma.com

LIDDS' Certified Adviser is Redeye AB

LIDDS in brief:

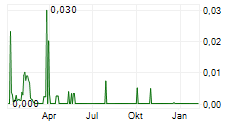

LIDDS is a Swedish pharmaceutical company focused on the development of oncology drugs. LIDDS has a proprietary drug delivery technology, NanoZolid®, on which several projects are based and NOV202. With NanoZolid, LIDDS can formulate drugs for local/intratumoral administration, with a maintained and controlled release for up to six months. LIDDS offers the NanoZolid technology to partners and has its own pipeline focused on oncology, where the technology enables delivery of a local and high drug dose, administered over time with very limited side effects. NOV202 is a small molecule developed for treatment of advanced cancer. NOV202 is in preclinical development. The company is listed on Nasdaq First North Growth market.