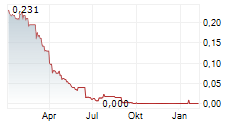

Leuven, BELGIUM - September 3, 2024 - 06:00 PM CET - Oxurion NV (Euronext Brussels: OXUR), a biopharmaceutical company headquartered in Leuven, today confirms that the last day of trading of its current shares on Euronext Brussels was September 2, 2024. This date marks a key step in the context of the consolidation of the Company's shares, which will take place on September 3, 2024.

Details of the Consolidation of Shares

The Consolidation of the Company's shares will be carried out based on one (1) new share for ten thousand (10,000) existing shares. This operation aims to increase the par value of the shares, simplify the capital structure and improve the liquidity of the shares on the market. Details of the operation can be found in the press release dated July 25, 2024.

Operation Schedule

Last trading day of old shares: September 2, 2024

Effective date of consolidation operations: September 3, 2024

First listing of new shares: September 3, 2024

Record date for the delivery of new shares: September 4, 2024.

Management of old Shares and Share Fractions

Treatment of multiples of 10,000: Shareholders holding a number of old shares forming a multiple of 10,000 have no steps or formalities to complete. These shares will be automatically consolidated by their financial intermediary at a ratio of one (1) new share for ten thousand (10,000) old shares.

Management of Fractional Shares: Shareholders who do not hold a number of old shares forming a multiple of 10,000 can buy or sell shares on the market to obtain this multiple between July 26, 2024, and August 30, 2024 (included).

At the end of this period, Financière d'Uzès, acting as the centralizing agent (see below), will handle the sale of new shares formed by the fractional shares on the market to compensate shareholders who do not hold a number of shares forming a multiple of 10,000 after August 30, 2024. The funds thus collected, minus any fees, will be paid to the relevant financial intermediaries.

These intermediaries will distribute the amount received among the concerned shareholders based on the number of old shares previously held no later than September 30, 2024, provided that the net proceeds to be received by a shareholder for their position with a financial intermediary is at least equivalent to 0.01 EUR.

Shareholders who do not have the required amount to obtain new shares and whose fractional share amount is less than 0.01 EUR (which is quite likely for a number of shareholders given the current share price of the Company of 0.0001 EUR) will not receive either shares or fractional shares in cash.

Objectives of the Grouping

This initiative is part of Oxurion's long-term growth strategy and reflects its commitment to an optimal financial structure.

The anticipated benefits of the consolidation are:

Improved market perception: a higher par value can improve the market perception of the security

Reduced volatility: stocks with a higher par value tend to be less volatile.

Trade Optimization: This simplifies stock management for investors and analysts.

About Oxurion

Oxurion (Euronext Brussels: OXUR) is engaged in developing next-generation standard of care ophthalmic therapies for the treatment of retinal disease. Oxurion is based in Leuven, Belgium. More information is available at www.oxurion.com.

Important information about forward-looking statements

Certain statements in this press release may be considered "forward-looking". Such forward-looking statements are based on current expectations, and, accordingly, entail and are influenced by various risks and uncertainties. The Company therefore cannot provide any assurance that such forward-looking statements will materialize and does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or any other reason. Additional information concerning risks and uncertainties affecting the business and other factors that could cause actual results to differ materially from any forward-looking statement is contained in the Company's Annual Report. This press release does not constitute an offer or invitation for the sale or purchase of securities or assets of Oxurion in any jurisdiction. No securities of Oxurion may be offered or sold within the United States without registration under the U.S. Securities Act of 1933, as amended, or in compliance with an exemption therefrom, and in accordance with any applicable U.S. state securities laws.

For further information please contact:

Oxurion NV

Pascal Ghoson

Chief Executive Officer

Pascal.ghoson@oxurion.com

- SECURITY MASTER Key: mmdtYcmXY5rJyG2ck5dll5JqmGZnlmnFaZSXl5WeZ5vHaG9nymtomMnHZnFomWxu

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-87478-oxur_consolidation-operations_3-sept-24_exe.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free