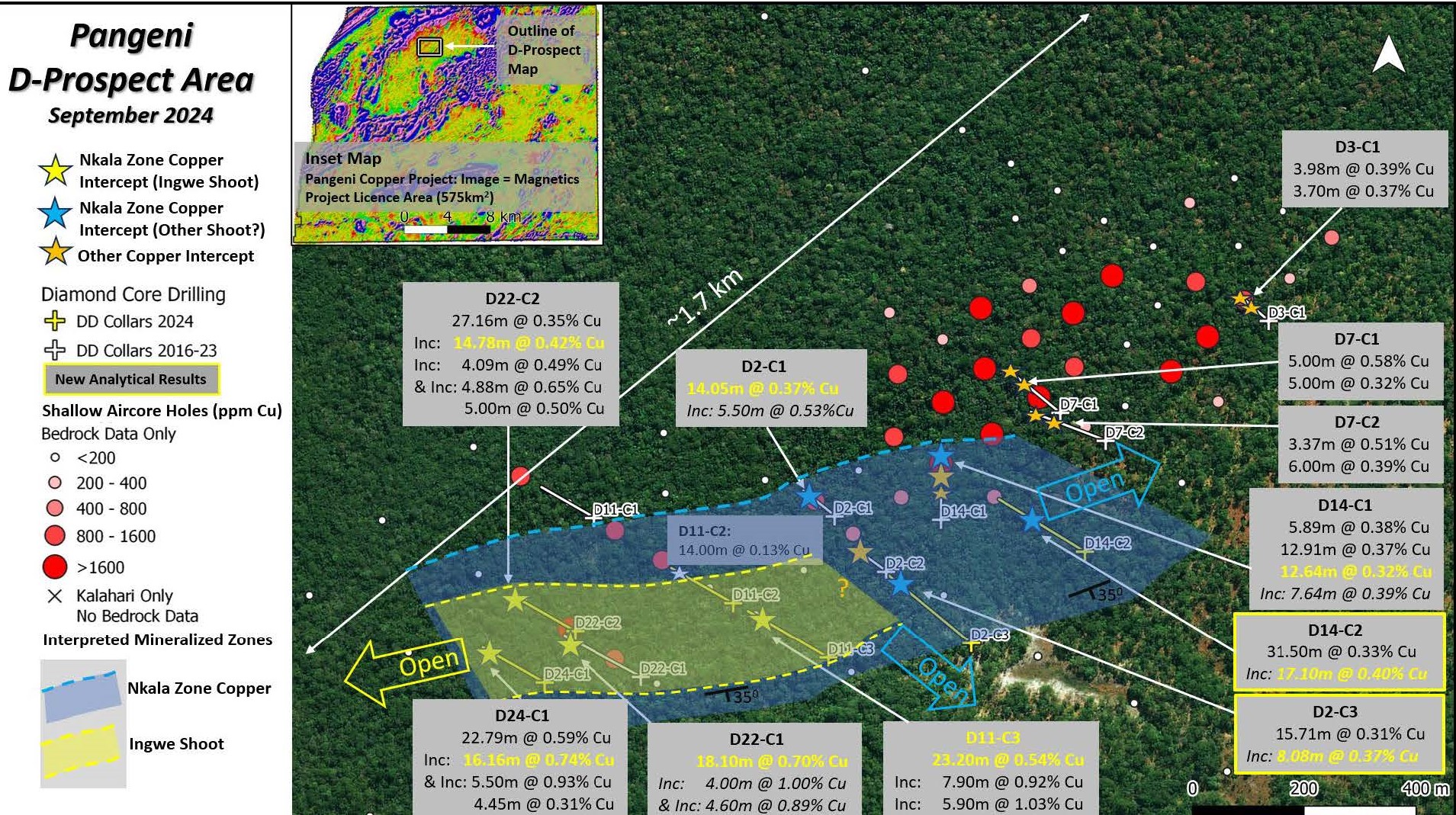

VANCOUVER, BC / ACCESSWIRE / September 4, 2024 / BeMetals Corp. (TSXV:BME)(OTCQB:BMTLF)(Frankfurt:1OI.F) (the "Company" or "BeMetals") is pleased to announce commencement of a new program of exploration drilling at the Pangeni Copper Project in Zambia ("Pangeni" or the "Project" or the "Property") in Zambia. To date, the Company has traced copper mineralization, under the sand cover, some 1.7 kilometres long with the higher-grade Nkala Zone currently extending for approximately 1.2 kilometres at the D-Prospect. The current program will focus on expanding the zones of copper mineralization at the D-Prospect, and test targets in its close proximity. In addition, the Company announces positive results from the two remaining holes of the drilling completed earlier this year.

HIGHLIGHTS OF RECENTLY COMMENCED FOLLOW-UP DRILLING PROGRAM AT THE D-PROSPECT:

BeMetals has commenced a new exploration program planned to comprise 5,000 metres of shallow aircore drilling and 2,000 metres of core drilling with the primary objective to further expand the footprint of the copper mineralization where multiple intercepts of similar widths and grade to major mines in the region have been discovered.

This drilling will also further assess the continuity of the Nkala Zone and Ingwe Shoot and test satellite targets close to the D-Prospect.

The Japan Organization for Metals and Energy Security ("JOGMEC") will continue to fund their pro-rata (27.8%) share of this exploration program.

NEW RESULTS FOR LAST TWO HOLES AND HIGHLIGHTS OF PREVIOUS 2024 DRILLING AT THE D-PROSPECT:

New results for Hole D2-C3 intersected 15.71 metres (m) grading 0.31% copper (Cu), including 8.08 metres grading 0.37% Cu (Nkala Zone).

New results for Hole D14-C2 intersected 31.50 m grading 0.33% Cu, including 17.10m grading 0.40% Cu (Nkala Zone).

The results of these two holes have confirmed the width and grade continuity of the Nkala Zone to the east northeast.

The intercepts in Holes D24-C1, D11-C3, D22-C2 and D14-C2 completed this year have copper grades and mineralized widths that meet or exceed those of certain large-scale copper mines in the Domes Region of the Zambian Copperbelt (1) (2)(3)*.

Hole D24-C1 intersected 16.16 m grading 0.74% Cu with 533 ppm Co, including 5.50 m grading 0.93% Cu with 701ppm Co.*

Hole D11-C3 intersected 23.20 m grading 0.54% Cu with 263ppm Co, including 7.90 m 0.92% Cu with 453ppm Co.*

Hole D22-C2 intersected 14.78 m grading 0.42% Cu, including 4.88 m grading 0.65% Cu.*

The copper mineralization discovered remains open along strike in both the SW and NE directions as well as down dip to the SE.

* Previously reported drill hole results.

John Wilton, President and CEO of BeMetals, stated "With the recent closing of our $4.8 million private placement, we are fully financed to complete this program of drilling at the Pangeni Copper Project, where we are becoming increasingly confident that we are on the verge of making the first major copper discovery in decades, under cover, along the extension to the western portion of the Zambian Copperbelt. Our technical understanding of the Project is improving with each hole and five out of our six-hole program completed earlier this year, intersected significant zones of copper mineralization. We look forward to the coming months of drilling as we receive and release batches of new results from Q4 2024 to Q1 2025."

PANGENI COPPER PROJECT: D-PROSPECT BACKGROUND AND CURRENT EXPLORATION PLANS

Earlier in 2024, BeMetals reported that Hole D22-C1 intersected 18.10 metres grading 0.70% Cu (see BeMetals news release January 9, 2024) in a zone characterized by consistent copper sulphide mineralization, comprising chalcopyrite and bornite which is generally hosted within a kyanite bearing schist unit. This zone is named the Nkala Zone and is interpreted to extend at least 1.2 kilometres along strike within an overall 1.7 kilometres of copper mineralization discovered at the D-Prospect. In the southwest of the currently drilled area of the D-Prospect, there are increased widths and copper grades in a lens or shoot which has been named the Ingwe Shoot (see Figure 1).

Today's new results are that Hole D2-C3 intersected 15.71 metres grading 0.31% Cu and 202 ppm Co and Hole D14-C2 intersected 17.10 metres grading 0.40% Cu at 184 ppm Co within an intercept of 31.50 metres grading 0.33% Cu. Both of these new holes' results include the Nkala Zone and other intervals of copper mineralization (see Table 1). The recently commenced drilling program will combine approximately 5,000 metres of shallow aircore to generate targets to extend the copper mineralization and approximately 2,000 metres of core drilling. At this time, initial core drill targets are planned with the overall objective to test and expand the Nkala Zone and other targets near the D-Prospect.

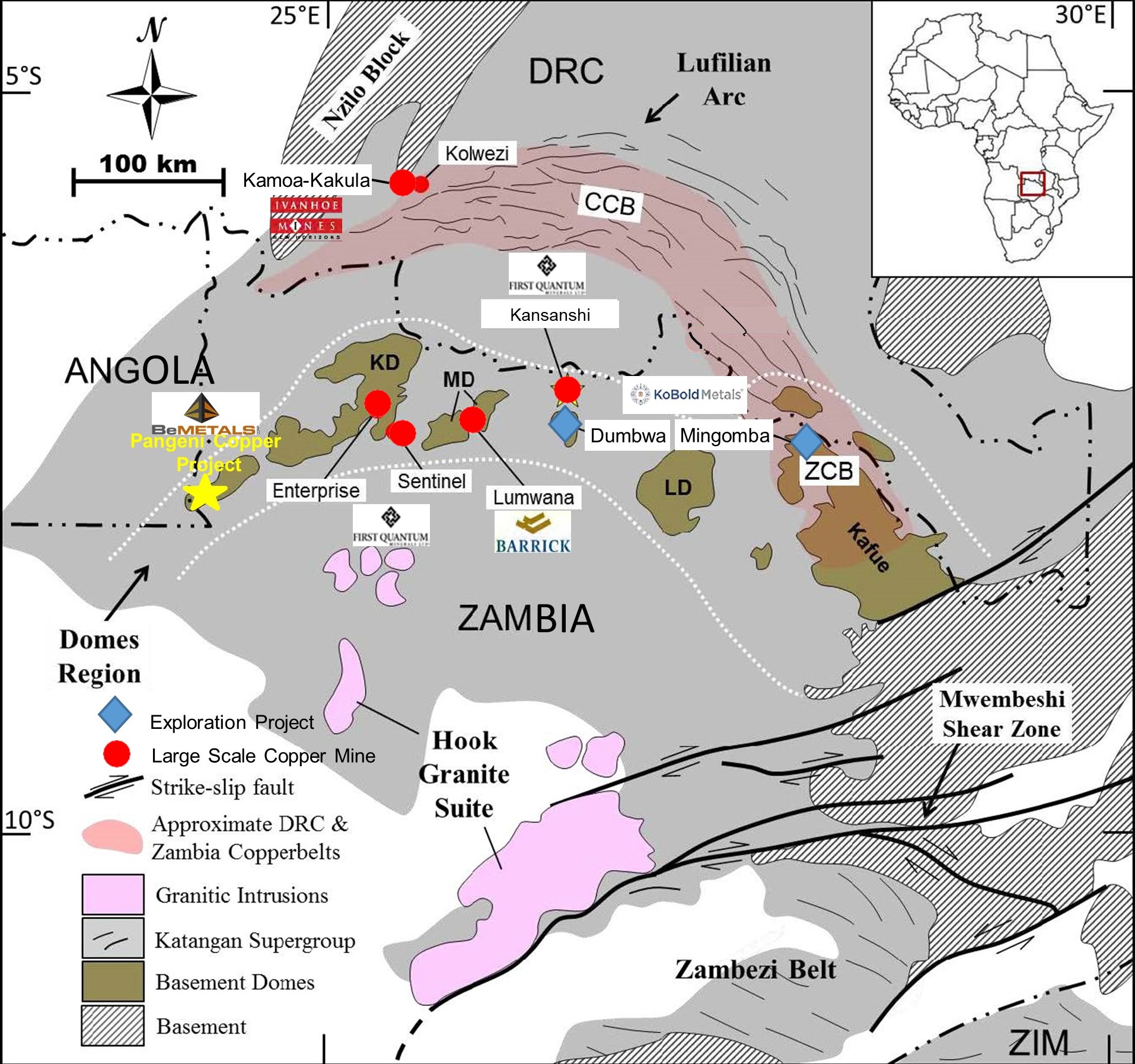

To date, holes D24-C1, D22-C1, D22-C2, and D11-C3 are interpreted to have intersected the Ingwe Shoot of the Nkala Zone (see Figure 1, yellow shading and symbols), with copper grades that meet or exceed those of several large-scale copper mines in the Domes Region of the Zambian Copperbelt (1) (2)(3) (see mines and locations in Figure 2). The Ingwe Shoot, with relatively higher-grade copper and width of intercepts, is interpreted to be structurally controlled, similar in style to the Equinox, Chimiwungo Main and East Shoots at the Lumwana Mine (2). Additional drilling will be required to define the northeastern extent of the Ingwe Shoot.

Thus far, the copper tenor of the Ingwe Shoot appears to be increasing to the southwest, and the current drilling will test for further extensions of this mineralization and confirm its grade continuity. In addition, there remains potential to expand the copper mineralization to the east northeast, down dip, and with drill testing of other satellite targets near to the D-Prospect.

Table 2 below provides azimuth, dip, end of hole depth and collar coordinates for the new drill holes.

(1) First Quantum Minerals Ltd. website, Mineral Reserves - as at December 31, 2022, and reported based on a long-term $3.00/lb Cu price. The current depleted in-pit Mineral Reserve as at December 31, 2022 for Sentinel.

(2) Barrick Gold Corporation website, Mineral Reserves - December 31, 2013, Technical Report on the Lumwana Mine, North-Western Province, Republic of Zambia, Barrick Gold Corporation, Report for NI 43-101, March 27, 2014.

(3) Bernau, R., Roberts, S., Richards, M., Nisbet, B., Boyce, A., Nowecki, J. (2013) The geology and geochemistry of the Lumwana Cu (± Co ± U) deposits, NW Zambia. Mineralium Deposita, 48:137-153.

Figure 1: Locations of latest drilling results D2-C3 and D14-C2 at D-Prospect with current Nkala Zone & Ingwe Shoot areas

Table 1: D Prospect: D2-C3 and D14-C2 Drill Hole Intersections Results

Prospect, Borehole ID & Interval | From (m) | To (m) | Core Interval (m) | Cu % | Co ppm |

D-Prospect |

|

|

|

|

|

D2-C3 | 235.00 | 240.73 | 5.73 | 0.31 | 120 |

Interval (Nkala Zone) | 321.20 | 336.91 | 15.71 | 0.31 | 202 |

Including | 321.20 | 325.30 | 4.10 | 0.38 | 192 |

Also including (Nkala Zone) | 328.83 | 336.91 | 8.08 | 0.37 | 209 |

And including | 332.00 | 336.91 | 4.91 | 0.46 | 226 |

|

|

|

|

|

|

D14-C2 | 211.50 | 243.00 | 31.50* | 0.33 | 154 |

Including (Nkala Zone) | 221.00 | 238.10 | 17.10 | 0.40 | 184 |

| 255.20 | 258.90 | 3.70 | 0.72 | 461 |

| 273.07 | 276.18 | 3.11 | 0.49 | 210 |

Table 1 Notes: Intertek Genalysis completed the analytical work with the core samples processed at their preparation facility in Kitwe, Zambia.All analytical procedures were conducted in an Intertek Genalysis laboratory in Perth, Australia. Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 85 and 90% of the drilled intersections. A nominal cut-off grade of 0.20% Cu has been used to determine the boundaries of these intersections with no more than 4.23 metres or *6.90 metres of internal dilution of the intercepts.

Figure 2: Map Showing Selected Large Scale Copper Mines and Projects in Zambia and DRC

Source: Modified after MacIntyre, T., Gysi, A., Hitzman, M., (2018). Geology and Geochemistry of the Kansanshi Cu-Au deposit, Zambia.

Table 2: Pangeni Project: D2-C3 & D14-C2: Drill Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

Drill Hole ID | Azimuth Degree | Dip Degree | End of hole Depth (m) | Easting (m) | Northing (m) | Elevation (m) | Status |

D2-C3 | 310 | -60 | 382.10 | 177525 | 8601062 | 1288 | Results received |

D14-C2 | 300 | -60 | 347.54 | 177726 | 8601231 | 1292 | Results received |

QUALITY ASSURANCE AND QUALITY CONTROL

The results reported here for this core drilling program were analyzed by Intertek Genalysis, an independent and accredited laboratory. Samples were prepared at their facility in Kitwe, Zambia and analytical work conducted in Perth, Australia. The results were determined using multi-acid, near total digest, and analyzed by Inductively Coupled Plasma ("ICP") Optical (Atomic) Emission Spectrometry ("OES"). The core sampling was conducted with a robust sampling protocol that included the appropriate insertion of standard reference material, duplicates and blanks into the sample stream. Field operations and management have been provided by Remote Exploration Services ("RES") an independent geological consulting and contracting company. The core drilling was conducted by BluRock Mining (Drilling) Services of Kitwe, Zambia.

Pangeni Project Earn-In and Option Agreement

As previously announced on August 1, 2024, the Company will be issuing 3,088,600 common shares to Karrek Metals Ltd. at a deemed price of C$0.10 per share representing a US$225,000 milestone value option payment using an exchange rate of US$1 to C$1.3727. The common shares to be issued will have a statutory hold period of four months and one day from the date of issuance, following final approval by the TSX Venture Exchange.

QUALIFIED PERSON STATEMENT

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a "Qualified Person" as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

"John Wilton"

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-928-2797

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward looking information" (as defined under applicable securities laws), based on management's best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future exploration, development and advancement of the Kazan Projects in Japan and the Pangeni Project in Zambia, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreement for the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company's most recent filings under its profile at www.sedarplus.ca for further information respecting the risks affecting the Company and its business.

SOURCE: BeMetals Corp.

View the original press release on accesswire.com