DIAMOND DRILLING INTERCEPTS HIGH GRADE AT LEVEL 18 EXPANDING POTENTIAL AT DEPTH

9.35 g/t Au over an estimated true width of 7.5m (including 33.1 g/t over an estimated true width of 1.25m) in hole PPL1102

FIVE ACCESS SUB-LEVEL HEADINGS PROGRESSING TO PROVIDE ROBUST FUTURE PRODUCTION PLATFORM

TORONTO, ON / ACCESSWIRE / September 5, 2024 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce it has progressed access development on five sub-levels on its newly defined high-grade BA zone at the Pilar mine in Brazil. In the second quarter (see press release dated August 7, 2024), the Company reported that its Pilar mine had begun to benefit from higher grades and incremental production contributed from this new BA zone, a trend that is expected to continue going forward. It should be noted that the adjacent Torre zone is generally narrower with more variable grades and more geotechnical challenges, however, it is a future opportunity for incremental ore once the necessary evaluation has been completed to safely mine this material.

To date in 2024, cumulative access development of approximately 374 m has been completed on five sub-levels. This development has generated 30,547 tonnes of run-of-mine ore feed at an average grade of 4.64 g/t producing 4,032 ounces of Au in the first half of 2024. In parallel with this development, approximately 3,985 metres of diamond drilling has been completed to date, while two diamond drill rigs remain focused on definition and expansion of the mineralized zone both up and down-plunge from the initial discovery holes on level 15. For the second half of the year, the Company expects to mine between 50-60,000 tonnes grading approximately 4.14 g/t from the BA zone.

Vern Baker, President and CEO of Jaguar Mining stated "We have continued to make good progress accessing the BA zone with lateral development on five separate sub-levels since March. The higher grades seen from BA development ore, along with positive step-out diamond drilling results and geological mapping are confirming structural continuity. The headline drill intercept on level 18 indicates the potential for a vertical panel of mineralization down to level 18, all of which supports our goal of achieving consistent production from this area going forward. We expect the overall contribution from the BA zone to increase over the next few quarters to a point where approximately 50% of mined production at Pilar in the second half of 2025 will be sourced from this new zone once fully accessed and developed."

Highlights from diamond drilling completed since Q1 2024 include:

8.80 g/t Au over an estimated true width of 5.00m - (Hole PPL1066)

9.30 g/t Au over an estimated true width of 4.70m - (Hole PPL1065)

9.35 g/t Au over an estimated true width of 7.50m - (Hole PPL1102) (including 33.1 g/t over an estimated true width of 1.25m)

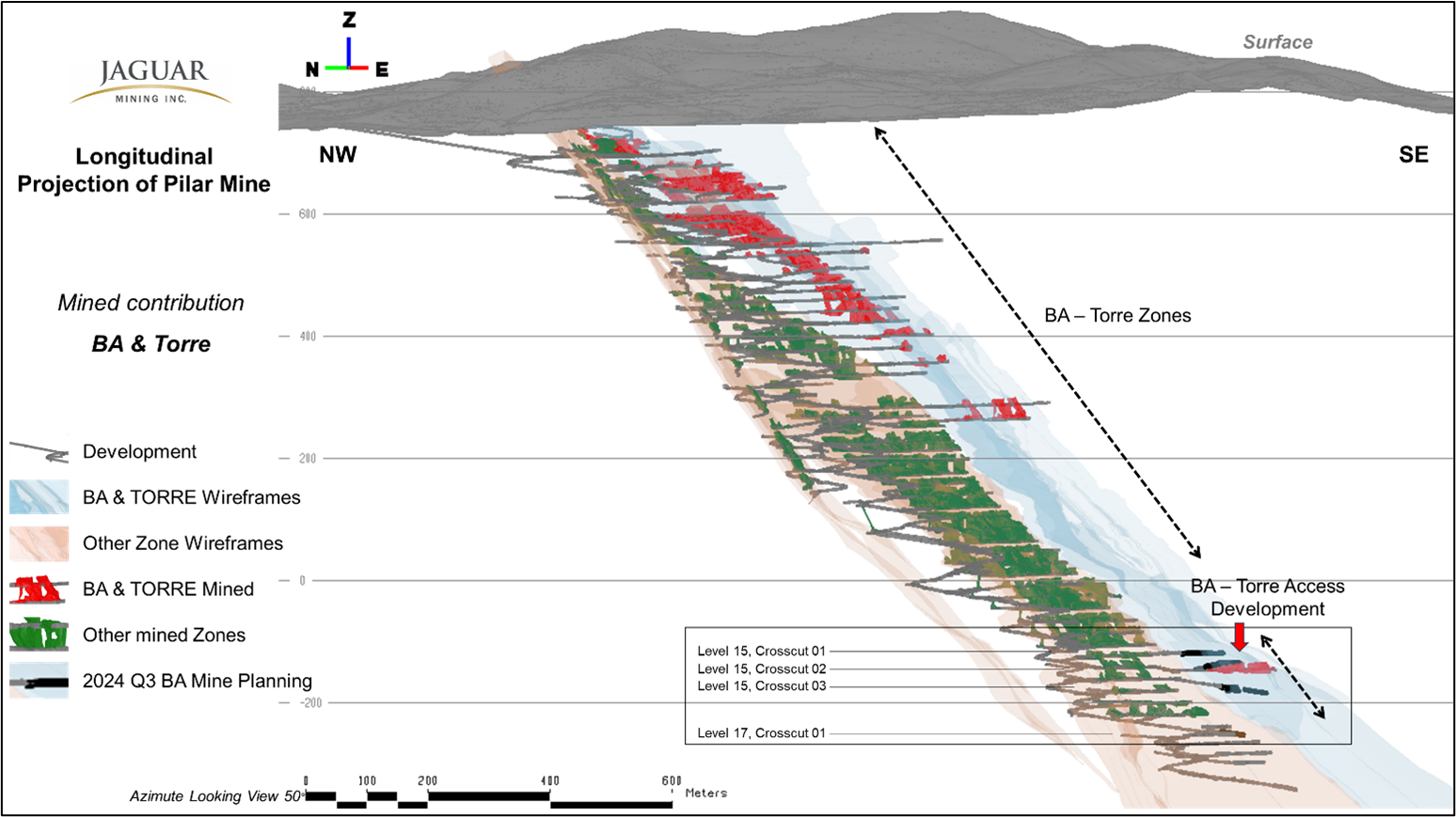

Figure 1 - Long Section showing the Pilar mine underground layout and the position of the BA zone relative to the other main orebodies. The location of the ongoing BA zone sub-level access development on level 15 and level 17 are highlighted at the bottom right corner of the figure.

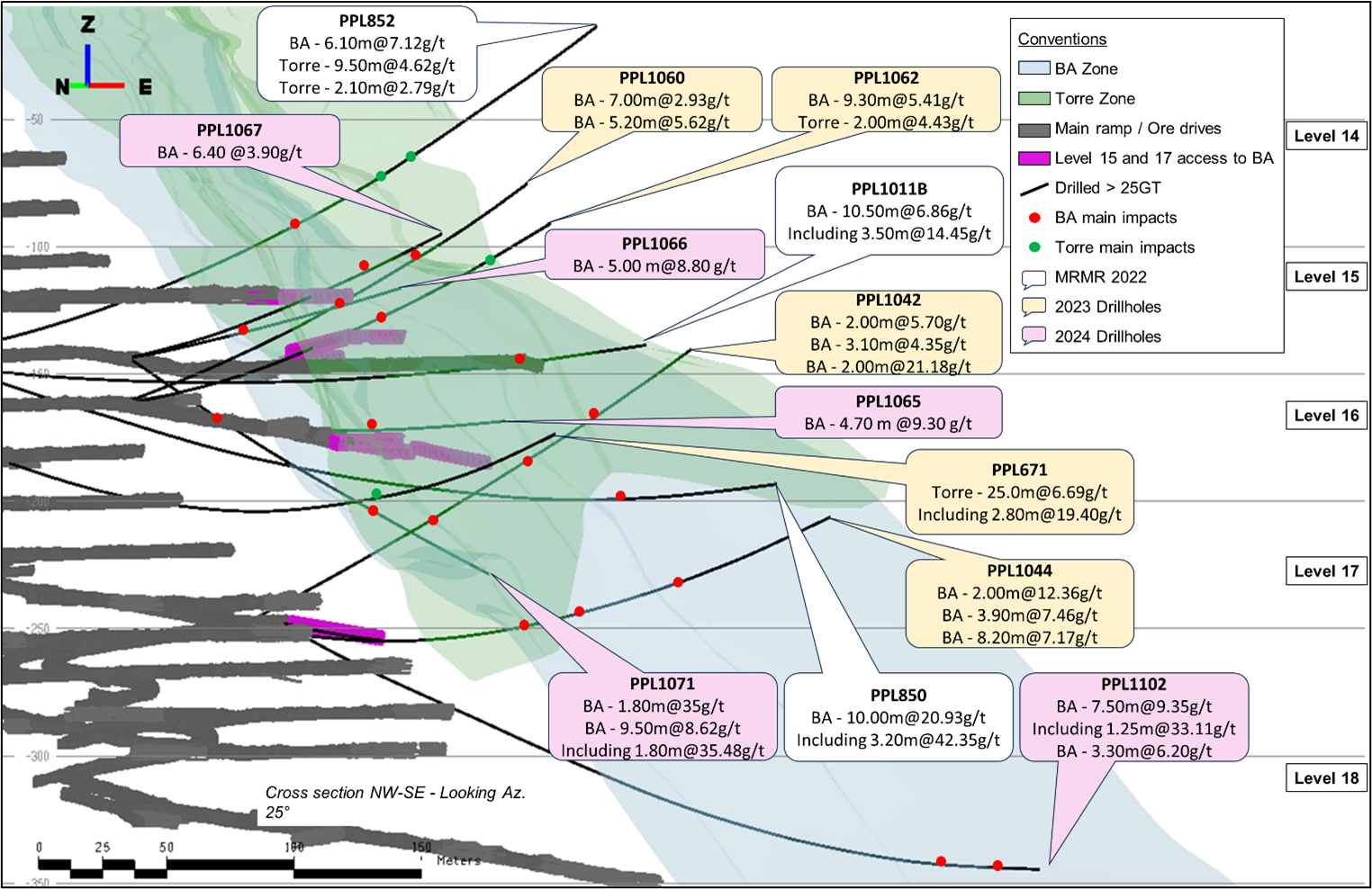

Figure 2 - Long sectional view showing the location of access development to evaluate the BA zone, and the best diamond drill mineralized intersections reported in this press release and previously in the press release dated February 28, 2024 (original holes in white and yellow background boxes/recent and current holes shown with pink - background text boxes).

Table 1 - Diamond drilling intersections with grade x thickness (GT) > 20 between level 14 and level 17 targeting the BA zone.

Summary of Significant Intersections, Drilling Program | ||||||||||

HOLE ID | From (m) | To (m) | Down Hole Interval (m) | Estimated True Width (m) | Gold Grade (g/t Au) | GT (ETW) | Date (mm/dd/yyy) | Orebody | Laboratory (RG or ALS) | Drilling Company |

PPL1060 | 94.4 | 100.5 | 6.2 | 5.2 | 5.62 | 29 | 07/06/2024 | BA | RG | JAGUAR |

PPL1065 | 83.6 | 90.6 | 7.0 | 4.7 | 9.3 | 43 | 16/04/2024 | BA | RG | JAGUAR |

PPL1066 | 40.4 | 48.4 | 8.0 | 5.0 | 8.8 | 44 | 29/05/2024 | BA | RG | JAGUAR |

PPL1067 | 96.0 | 107.5 | 11.6 | 6.4 | 3.9 | 25 | 14/06/2024 | BA | RG | JAGUAR |

PPL1102 | 265.9 | 269.6 | 3.7 | 2.3 | 9.6 | 22 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 302.9 | 319.3 | 16.4 | 7.5 | 9.4 | 70 | 22/08/2024 | BA | RG | JAGUAR |

Including | 312.5 | 315.3 | 2.8 | 1.3 | 33.1 | 41 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 329.5 | 336.0 | 6.6 | 3.3 | 6.2 | 20 | 22/08/2024 | BA | RG | JAGUAR |

PPL1071 | 74.5 | 100.7 | 26.3 | 9.5 | 8.6 | 82 | 28/08/2024 | BA | RG | JAGUAR |

Including | 94.9 | 100.0 | 5.1 | 1.8 | 35.5 | 65 | 28/08/2024 | BA | RG | JAGUAR |

Geological Description

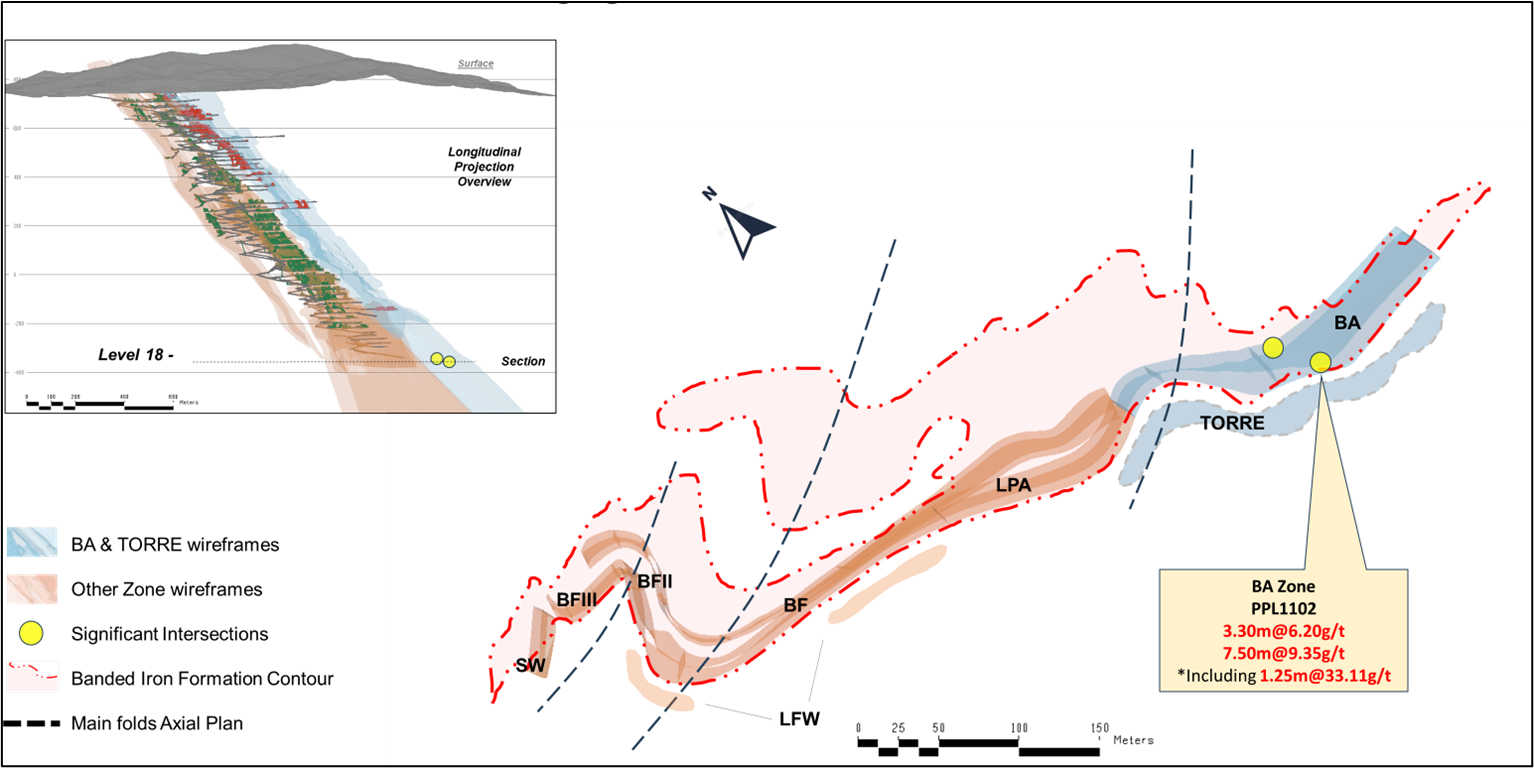

The high-grade gold mineralization is hosted by a well-developed layer of BIF as outlined by detailed geological mapping of development faces exposed in the access crosscuts. The BIF is comprised of both carbonate and silicate facies, surrounded by undifferentiated metavolcanic and sedimentary schists. The highest grades are associated with hydrothermal alteration (quartz-sericite-chlorite-carbonate) and 5-15% of semi-massive to disseminated coarse subhedral grains of Arsenopyrite and subsidiary Pyrrhotite.

The BIF exposures show a succession of overturned folds (synform-antiform pairs), with fold axes plunging to the south at medium to low angles.

Figure 3 - Schematic Plan View of the Pilar mine geology as interpreted from initial drilling and geological - structural projections on level 18 highlighting the location of the high-grade BA zone mineralized structure intersected in recent diamond drill holes.

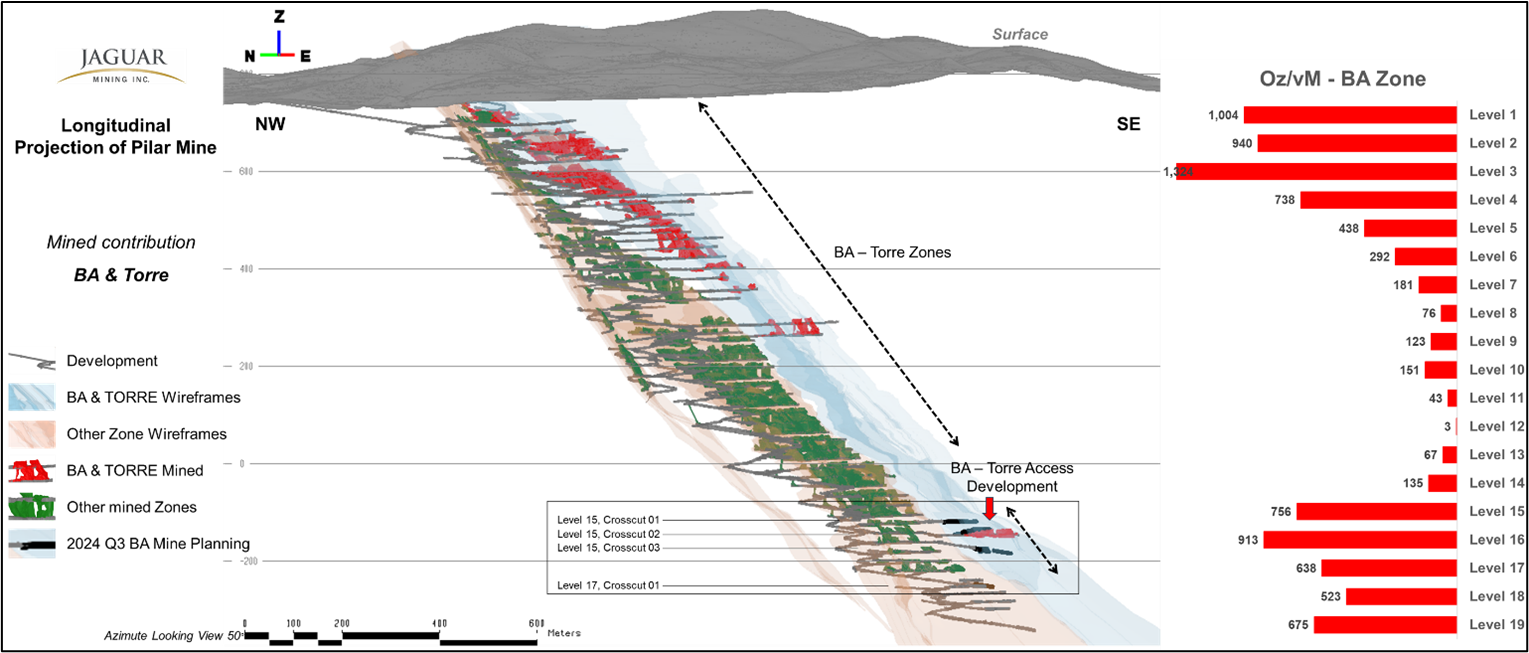

Mineral Resources per vertical meter - Comparison between historical and potential future production

Historically the BA zone was the main contributor to ounce production at Pilar in the upper levels of the mine reaching a peak of some 1500 mineral resource ounces per vertical meter around level 3. Over time and with increasing depth the mine saw a decrease in the ounce per vertical meter profile attributed to this orebody to sub-economic levels in the vicinity of level 8. As commonly occurs with structurally controlled mineralized systems of this nature the decreased ounces per vertical meter profile on the BA structure was accompanied by a concomitant increase in the ounces per vertical meter profile attributed to the nearby BIF structures south along strike and since 2016 the mine has produced the majority of ounces from the BIF structures. The discovery of higher grades on the BA structure in the vicinity of level 15 during late 2022 and subsequent exploration diamond drilling and access development described in this, and previous press releases is highlighting increased ounce per vertical meter on the BA structure now confirmed from levels 14 to levels 19 as presented in Figure 4 below.

Figure 4 - Long section of Pilar mine showing the ounces-per-vertical-meter profile with depth. The graph highlights the historically important contribution of ore from the BA zone to production at shallow levels in the mine from level 1 to level 8, diminishing from level 9 to level 14 and now, with recent drilling and exploration, demonstrating an increasing profile downwards from level 14 to level 19.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Vice President Geology and Exploration, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Alfred Colas

Chief Financial Officer

Jaguar Mining Inc.

alfred.colas@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the duration of the temporary suspension of the Company's 2023 production guidance in ounces and costs, the expected future release of new guidance for 2023, the anticipated impact of planned changes in mining systems and cost cutting initiatives on the Company's future performance and production results, information related to expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Appendix 1

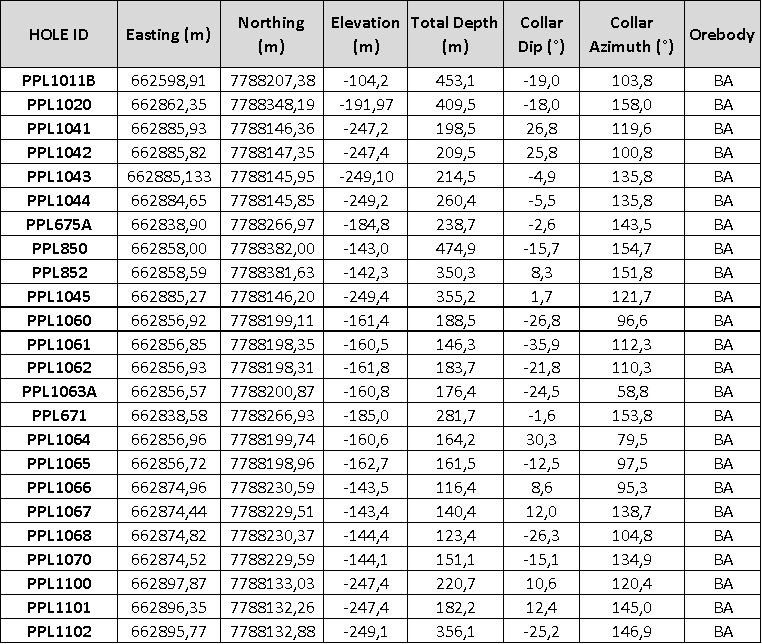

Table 2 - Diamond Drilling Collar Coordinates, Azimuth and Dip, levels 14-19 BA zone.

Table 3 - Diamond Drill Hole data - Pilar mine BA zone between level 14 and level 19, April-September 2024.

Summary of Significant Intersections, Drilling Program | ||||||||||

HOLE ID | From (m) | To (m) | Down Hole Interval (m) | Estimated True Width (m) | Gold Grade (g/t Au) | GT (ETW) | Date (mm/dd/yyy) | Orebody | Laboratory (RG or ALS) | Drilling Company |

PPL1064 | 94.3 | 100.7 | 6.4 | 4.5 | 1.6 | 7 | 15/04/2024 | BA | RG | JAGUAR |

PPL1065 | 20.6 | 29.6 | 9.0 | 3.0 | 3.1 | 9 | 16/04/2024 | BA | RG | JAGUAR |

PPL1065 | 83.6 | 90.6 | 7.0 | 4.7 | 9.3 | 43 | 16/04/2024 | BA | RG | JAGUAR |

PPL1065 | 98.6 | 104.8 | 6.2 | 4.0 | 2.2 | 9 | 16/04/2024 | BA | RG | JAGUAR |

PPL1066 | 40.4 | 48.4 | 8.0 | 5.0 | 8.8 | 44 | 29/05/2024 | BA | RG | JAGUAR |

PPL1067 | 65.9 | 68.4 | 2.4 | 2.5 | 2.4 | 6 | 14/06/2024 | BA | RG | JAGUAR |

PPL1067 | 96.0 | 107.5 | 11.6 | 6.4 | 3.9 | 25 | 14/06/2024 | BA | RG | JAGUAR |

PPL1067 | 111.1 | 115.7 | 4.6 | 2.7 | 1.5 | 4 | 14/06/2024 | BA | RG | JAGUAR |

PPL1068 | 32.5 | 37.5 | 5.0 | 2.5 | 1.9 | 5 | 01/07/2024 | BA | RG | JAGUAR |

PPL1068 | 42.3 | 45.8 | 3.6 | 2.0 | 4.9 | 10 | 01/07/2024 | BA | RG | JAGUAR |

PPL1068 | 61.5 | 65.5 | 4.0 | 2.1 | 2.7 | 6 | 01/07/2024 | BA | RG | JAGUAR |

PPL1070 | 89.4 | 92.4 | 2.9 | 2.2 | 4.4 | 10 | 31/07/2024 | BA | RG | JAGUAR |

PPL1100 | 74.8 | 77.2 | 2.4 | 3.5 | 3.0 | 10 | 19/07/2024 | BA | RG | JAGUAR |

PPL1100 | 92.4 | 95.0 | 2.6 | 5.3 | 3.0 | 16 | 19/07/2024 | BA | RG | JAGUAR |

PPL1100 | 195.4 | 197.7 | 2.3 | 4.0 | 2.5 | 10 | 19/07/2024 | TORRE | RG | JAGUAR |

PPL1101 | 18.3 | 22.3 | 4.1 | 2.5 | 2.6 | 7 | 05/08/2024 | BA | RG | JAGUAR |

PPL1101 | 43.4 | 47.2 | 3.8 | 2.1 | 4.3 | 9 | 05/08/2024 | BA | RG | JAGUAR |

PPL1101 | 58.8 | 61.9 | 3.1 | 2.0 | 1.7 | 3 | 05/08/2024 | BA | RG | JAGUAR |

PPL1102 | 243.4 | 246.6 | 3.2 | 2.0 | 4.8 | 10 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 265.9 | 269.6 | 3.7 | 2.3 | 9.6 | 22 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 281.5 | 287.1 | 5.7 | 2.8 | 3.8 | 11 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 293.5 | 299.5 | 6.0 | 3.2 | 2.9 | 9 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 302.9 | 319.3 | 16.4 | 7.5 | 9.4 | 70 | 22/08/2024 | BA | RG | JAGUAR |

Incluiding | 312.5 | 315.3 | 2.8 | 1.3 | 33.1 | 41 | 22/08/2024 | BA | RG | JAGUAR |

PPL1102 | 329.5 | 336.0 | 6.6 | 3.3 | 6.2 | 20 | 22/08/2024 | BA | RG | JAGUAR |

PPL1071 | 1.5 | 5.5 | 4.0 | 2.0 | 3.5 | 7 | 28/08/2024 | LPA | RG | JAGUAR |

PPL1071 | 12.4 | 16.5 | 4.2 | 2.1 | 3.0 | 6 | 28/08/2024 | LPA | RG | JAGUAR |

PPL1071 | 31.5 | 35.5 | 4.0 | 1.5 | 31.9 | 48 | 28/08/2024 | LPA | RG | JAGUAR |

PPL1071 | 74.5 | 100.7 | 26.3 | 9.5 | 8.6 | 82 | 28/08/2024 | BA | RG | JAGUAR |

Including | 94.9 | 100.0 | 5.1 | 1.8 | 35.5 | 65 | 28/08/2024 | BA | RG | JAGUAR |

PPL1071 | 104.5 | 112.5 | 8.0 | 2.9 | 3.3 | 10 | 28/08/2024 | BA | RG | JAGUAR |

PPL1071 | 113.5 | 118.0 | 4.6 | 1.8 | 2.3 | 4 | 28/08/2024 | BA | RG | JAGUAR |

SOURCE: Jaguar Mining, Inc.

View the original press release on accesswire.com