London, United Kingdom--(Newsfile Corp. - September 5, 2024) - Fineqia International Inc. (CSE: FNQ) (OTC: FNQQF) (Frankfurt: FNQA) (the "Company" or "Fineqia"), a leading digital asset and fintech investment business, announces that its analysis of worldwide Exchange Traded Products (ETPs) with digital assets as underlying collateral revealed Assets Under Management (AUM) year-to-date (YTD) increased to $83.6 billion, marking a 69% increase from $49.5 billion.

The growth in ETPs' AUM has outpaced the rise in the value of underlying crypto assets year-to-date more than 3.8 times. ETPs' AUM increased by 69%, compared to a 18% rise in the overall digital assets market cap. This premium growth is persisting in Q3, following strong performances in Q1 and Q2.

In August, the AUM of ETPs holding digital assets as their underlying decreased by 4%, down to $83.6 billion from $87.1 billion at the end of July. During the same period, the total digital assets market cap fell by 8.4%, dropping to $2.09 trillion from $2.29 trillion at the end of July. The substantial premium continues due to net inflows observed for BTC ETPs, which have been the primary driver of ETP growth throughout the year.

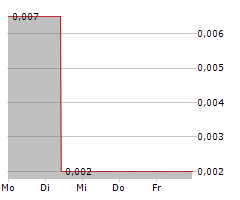

BTC's price dropped by 4.9% in August to $59,050 from $62,050 at the end of July. Year-to-date, BTC price increased 39.6% from $42,290 at the beginning of the year. The AUM of BTC-based ETPs fell by 1.7% in August, to $67.7 billion from $68.9 billion in July, but has grown 90.3% year-to-date from $35.6 billion.

The inflows during August were highest in Canada, Brazil, and Switzerland, while BTC Spot ETFs in the U.S. remained steady, keeping the total inflow since inception at around $17.5 billion, similar to the end of July.

"BTC ETPs are spreading like mini-wildfires across different jurisdictions, fueled by the success of US Bitcoin ETFs," said Fineqia's CEO Bundeep Singh Rangar. "The US might have struck the match, but the blaze is now global."

In August, Ethereum (ETH) saw its value decrease by 16%, dropping to $2,520 from $3,000 at the end of July. During the same period, the AUM of ETPs holding ETH as the underlying asset declined by 16.9%, falling to $9.9 billion from $12 billion. The data show neutral flow in ETH ETPs during the month of August.

The newly launched ETH spot ETFs attracted over $2 billion in net inflows, but these gains were offset by around $2.5 billion in outflows from the Grayscale Ethereum ETF (ETHE). This pattern is similar to what occurred with the launch of BTC Spot ETFs, where inflows into the new ETFs were partially offset by outflows from the Grayscale Bitcoin Trust (GBTC) after its conversion into an ETF.

ETHE recorded its first day without net outflows on August 30th, with total net outflows of $28 million in the last week of August, down from $117 million the previous week, indicating a possible slowdown in outflows. Less favourable market conditions, combined with the typically low trading activity in July and August, may have contributed to the slower net inflows into the recently issued ETH spot ETFs in their first few weeks of trading.

ETPs representing an index of alternative coins declined 4.9% in AUM during August, to $3.14 billion, from $3.3 billion recorded at the end of July. ETPs representing a diversified basket of cryptocurrencies decreased by 5.9% in August, to $2.77 billion from $2.94 billion recorded at the end of July.

The total number of ETPs increased by 54 to 216, or 33% more, than those of Jan.1 this year. In August alone, the number of ETPs rose by 6, from 210 at the end of July.

ETPs include Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs). Fineqia Research's AUM calculation factors in the launch or closure of ETPs during any stated period. The number of tracked ETPs stood at 216 as of the end of August.

All references to price are quoted in USD, and the cryptocurrency prices are sourced from CoinMarketCap and CoinGecko.

The ETP and ETF AUM data referenced in this announcement were compiled from reputable sources, including 21Shares AG, Grayscale Investment LLC, VanEck Associates Corp., Morningstar, Inc., and TrackInSight SAS, by Fineqia's dedicated in-house research department.

About Fineqia International Inc.

Fineqia (www.fineqia.com) is a digital asset business that builds and targets investments in early and growth stage technology companies that will be part of the next generation of the Internet. Publicly listed in Canada (CSE: FNQ) with quoted symbols on the Nasdaq and the Frankfurt Stock Exchange, Fineqia's portfolio of investments includes businesses at the forefront of tokenization, blockchain technology, NFTs, AI, and fintech. Fineqia's VC fund in formation, Glass Ventures, backs category-defining Web 3.0 and Web 4.0 companies built by world-class entrepreneurs. https://twitter.com/FineqiaPlatform and https://www.linkedin.com/company/fineqia/.

Media Contacts

Athraa Bheekoo

Luna PR

Athraa@lunapr.io

FOR FURTHER INFORMATION, PLEASE CONTACT:

Katarina Kupcikova, Marketing & Communications Manager

E. katarina.kupcikova@fineqia.com

T. +44 7806 730 769

FORWARD-LOOKING STATEMENTS

Some statements in this release may contain forward-looking information (as defined under applicable Canadian securities laws) ("forward-looking statements"). All statements, other than of historical fact, that address activities, events or developments that Fineqia (the "Company") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential acquisitions and financings) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, the failure to obtain sufficient financing, and other risks disclosed in the Company's public disclosure record on file with the relevant securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made except as may be required by applicable securities laws. The Company disclaims any intent or obligation to update any forward-looking statement except to the extent required by applicable securities laws. Crypto assets are generally unregulated, subject to sudden and significant changes in value and carry a high risk of total loss of the investment. As these are unregulated assets, investors are unlikely to have recourse to any regulatory protections or access to investor compensation schemes. If you are unsure as to the appropriateness of these assets for your circumstances, you should take independent financial and legal advice. Fineqia Inc. is not a crypto asset exchange and is not registered with any Authority as such. This material is general economic commentary and does not constitute a recommendation to buy, sell or otherwise transact in any of the assets discussed.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222233

SOURCE: Fineqia International Inc.