Highlights:

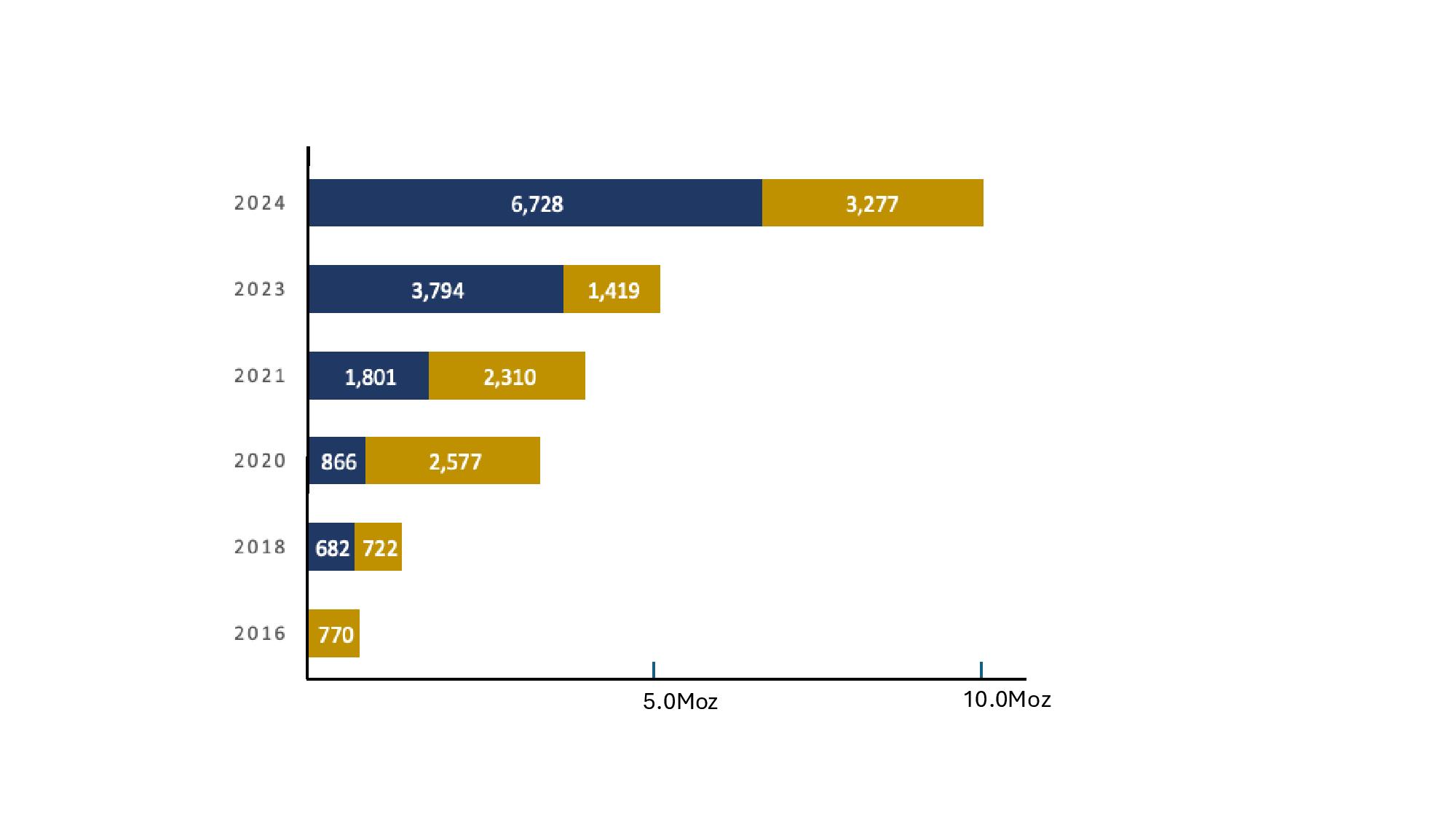

- Total Resources for all Val-d'Or East properties gold resources currently stand at 6,728,600 ounces Measured and Indicated ("M&I") and 3,277,100 ounces Inferred along all trends and deposits, almost doubling from the 2023 Resource Update; a 77% increase in M&I Resources; and a 131% increase in Inferred Resources.

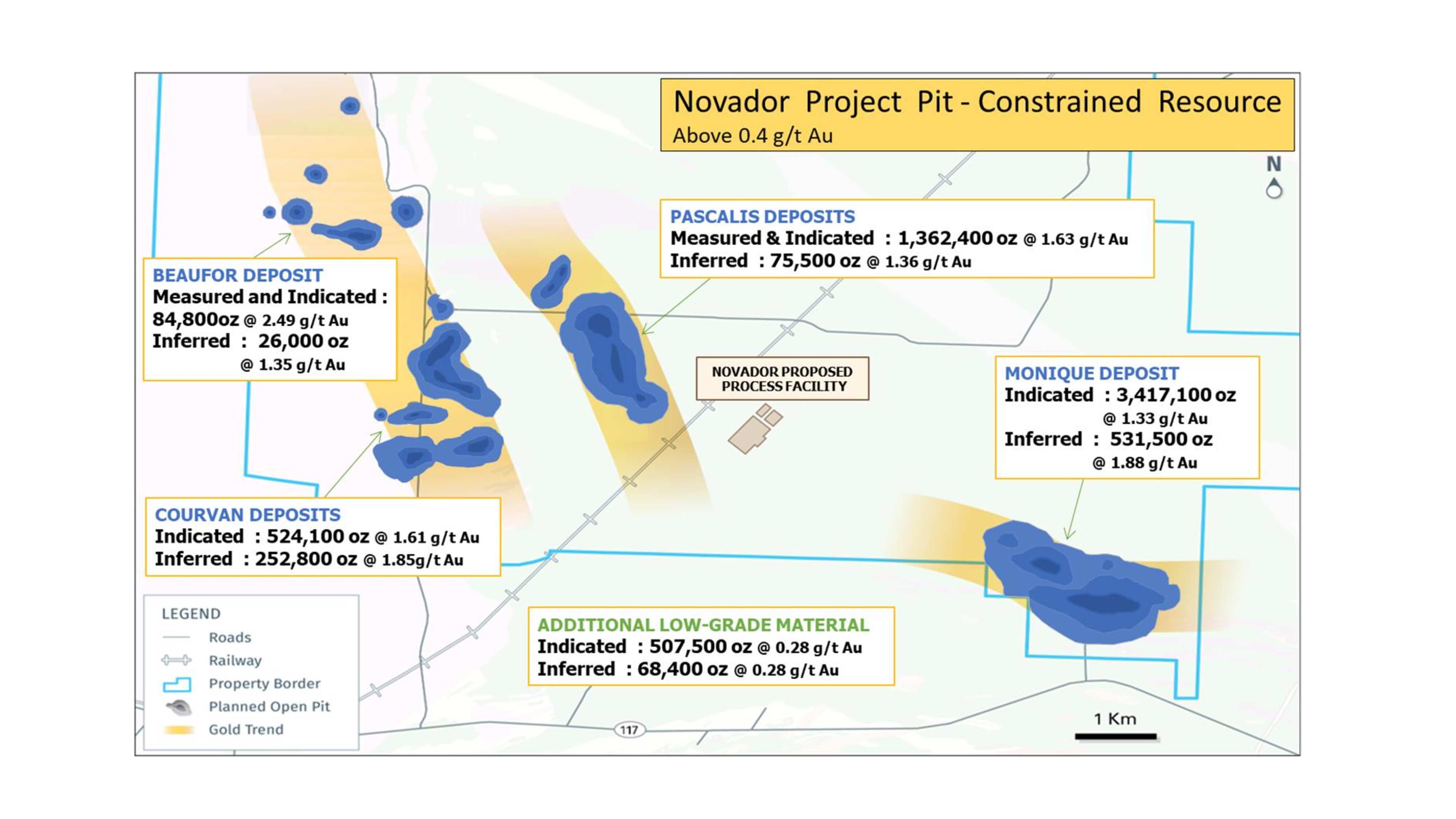

- Total Resources for the Novador Development Project currently stand at 6,405,000 ounces M&I and 1,550,200 ounces Inferred at the Monique, Pascalis, Courvan and Beaufor deposits, representing a 60% increase from the 2023 Resource Update.

- Strong conversion to M&I resources seen at the Monique, Pascalis and Courvan trends, with a 69% increase in overall M&I ounces.

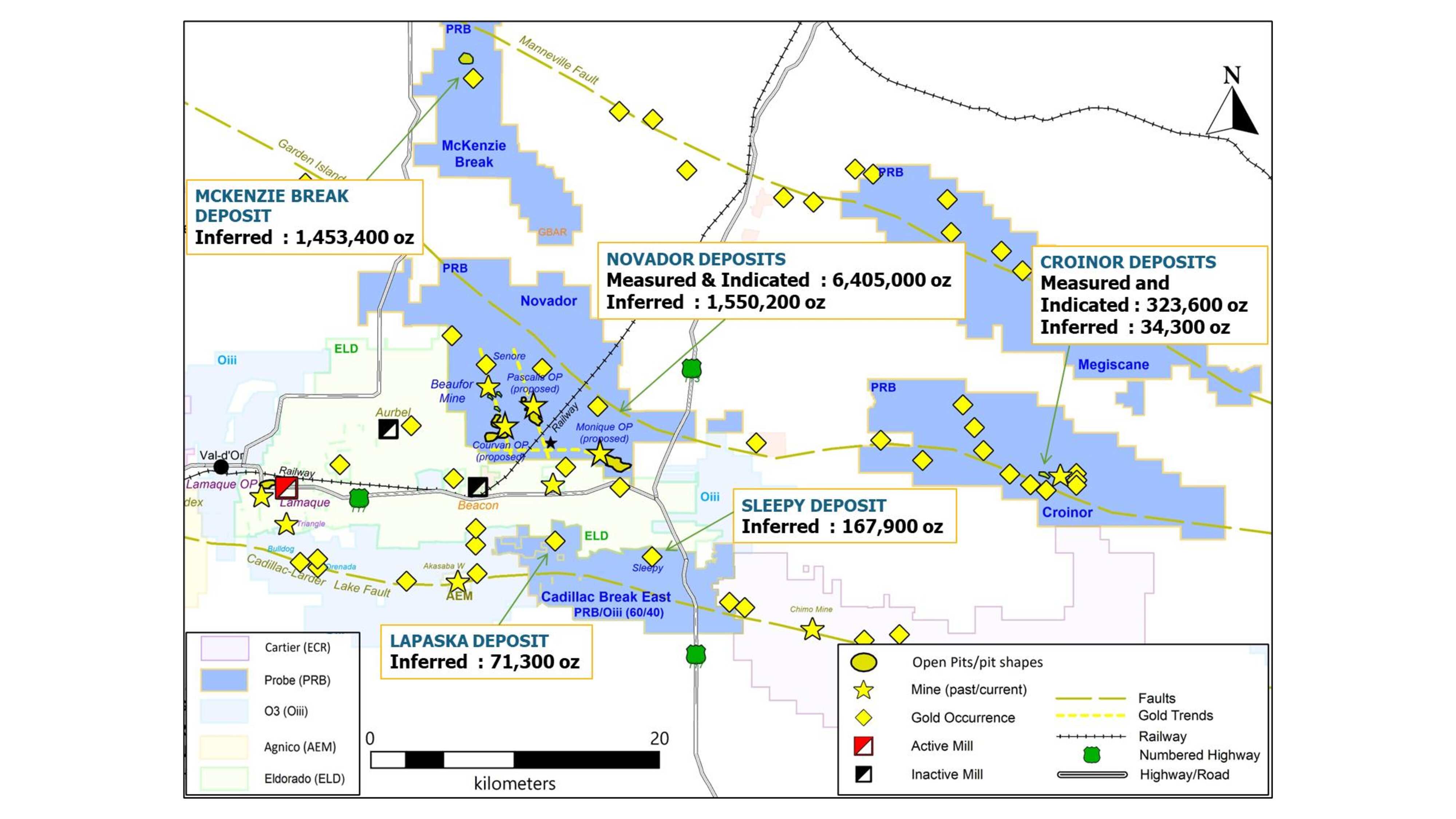

- Other Val-d'Or East properties gold resources currently stand at 323,600 ounces M&I and at 1,727,000 ounces Inferred, including the McKenzie Break, Croinor, Lapaska and Sleepy deposits.

- Over 82% of the gold is within the open pit-constrained resources, with strong potential for future near-surface resource growth.

- Monique and Pascalis gold trend deposits represent 86% of the Novador pit-constrained Mineral Resource Estimate.

- Development work is ongoing, with a new 50,000-metre infill drill program set to begin shortly.

- Permitting work is advancing well with Federal guidelines received for Phase II and a detailed project description submitted to the Province of Quebec.

TORONTO, Sept. 05, 2024 (GLOBE NEWSWIRE) -- Probe Gold Inc. (TSX-V: PRB) (OTCQB: PROBF) ("Probe" or the "Company") is pleased to announce the release of the Updated Mineral Resource Estimate (the "MRE") for its Val-d'Or properties (the "Properties") in Quebec that incorporates results from the 2023 and 2024 drilling programs. The updated estimates include close to 95,000 metres of new drilling completed by Probe on its 100 % owned Novador and Croinor properties, and close to 75,000 metres drilling completed by Monarch Mining Corporation prior to Probe's acquisition of the Beaufor and McKenzie Break properties, since their last respective MRE. Total gold resources currently stand at 6,728,600 ounces in the Measured and Indicated ("M&I") category and 3,277,100 ounces in the Inferred category along all trends and deposits. Integrating new drilling and an enhanced 3D geological model, the MRE has shown significant improvement in both expansion and conversion over the previous resource estimate and all the gold deposits remain open laterally and at depth. The new Novador resource, which comprises the Monique, Pascalis and Courvan mine trends including the recently acquired Beaufor deposit, stands at 6,405,000 ounces of gold in the M&I and 1,550,200 ounces of gold in the Inferred category, demonstrating a significant global increase for the overall mining development project, an excellent conversion rate from Inferred to Indicated resources and strong potential for future growth in the scale of mining operations and mine life, which currently stands at over 250,000 ounces/year of average annual production and 12.5 year mine life (see Updated PEA, January 2024). This updated aggregate MRE was independently prepared by InnovExplo Inc. and BBA E&C Inc. in accordance with National Instrument 43-101 ("NI 43-101") and is dated August 30, 2024.

David Palmer, President and CEO of Probe, states, "The increase in resources at Val-d'Or East have been nothing short of amazing and to see us almost double them again demonstrates the incredible potential of this area. We are now part of a very rare group of development assets with over 10 million ounces of gold in our mineral inventory. We are continuing to accelerate our timeline to production, and will commence a 50,000-metre drill program this Fall to complete our resource conversion in preparation of our upcoming Pre-Feasibility Study, targeted for next year. The entire team at Probe has done a phenomenal job in growing this resource and the success of this recent update provides a renewed energy to continue our drive to production. Our consolidation strategy has been a great contributor to this success, with significant growth seen at all three of our new properties, McKenzie Break, Beaufor and Croinor, and still significant exploration upside for continued growth. We have more than tripled our resources at McKenzie break, since acquisition, and have brought our acquisition costs to just over five dollars an ounce for these new projects. Our Val-d'Or East project is one of the few large-scale Canadian gold deposits that is still experiencing rapid growth and is situated within a mining-friendly jurisdiction with excellent access to infrastructure. We are extremely encouraged by the results of this Updated Resource and look forward to achieving more milestones in 2025."

Novador and Val-d'Or East Properties - Summary of Mineral Resources

The Novador Project includes the Monique, Pascalis, Courvan and recently acquired Beaufor gold deposits, which are 100% owned by Probe. As part of its land consolidation strategy in the Val-d'Or East area, Probe also earned a 100%-interest in the McKenzie Break, Croinor and Lapaska properties and a 60% interest in the Cadillac Break East Property in a joint venture with O3 Mining Inc., which includes the Sleepy gold deposit.

Figure 1: Growth in resource at Val-d'Or East since 2016 (M&I in blue; Inferred in gold; in koz)

Table 1: Novador Project (100% interest)

| All Deposits / Category1 | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au2 g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Measured | 3,672,100 | 2.49 | 293,700 | 546,400 | 4.55 | 80,000 | 4,218,500 | 2.76 | 373,700 |

| Indicated | 113,061,000 | 1.40 | 5,076,100 | 4,713,500 | 2.95 | 447,800 | 117,774,600 | 1.46 | 5,523,900 |

| M&I | 116,733,100 | 1.43 | 5,369,900 | 5,259,900 | 3.12 | 527,800 | 121,993,100 | 1.50 | 5,897,600 |

| Inferred | 16,231,200 | 1.72 | 898,900 | 6,506,600 | 2.79 | 582,700 | 22,737,800 | 2.03 | 1,481,700 |

| 1 Novador includes Monique, Pascalis, Courvan and Beaufor deposits. | |||||||||

| 2 Au symbol for Gold. | |||||||||

Table 2: Novador Project - Additional Pit Constrained Resource Low-Grade Material

| All Deposits / Category | Pit-Constrained Resources1 | Underground Resources | Total | ||||||

| Tonnes | Grade (Au1 g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Measured | 775,800 | 0.29 | 7,100 | -- | -- | -- | 775,800 | 0.29 | 7,100 |

| Indicated | 54,731,900 | 0.28 | 500,200 | -- | -- | -- | 54,731,900 | 0.28 | 500,200 |

| M&I | 55,507,700 | 0.28 | 507,400 | -- | -- | -- | 55,507,700 | 0.28 | 507,400 |

| Inferred | 7,600,000 | 0.28 | 68,500 | -- | -- | -- | 7,600,000 | 0.28 | 68,500 |

| 1 This additional pit-constrained Mineral Resource are characterized as "low-grade material" for stockpiling and potential later processing represents mineralization between cut-off grades of 0.19 g/t Au and 0.4 g/t Au for the Monique, Pascalis and Courvan deposits, exclusive of pit-constrained Mineral Resource from Table 1. | |||||||||

Table 3: Val-d'Or Other Properties

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Croinor Total Measured and Indicated | 926,000 | 3.22 | 95,900 | 1,574,000 | 4.50 | 227,700 | 2,500,000 | 4.03 | 323,600 |

| Croinor Total Inferred | 16,000 | 3.44 | 1,800 | 213,000 | 4.70 | 32,500 | 229,000 | 4.61 | 34,300 |

| McKenzie Break Total Inferred | 23,956,000 | 1.65 | 1,269,200 | 1,565,000 | 3.66 | 184,200 | 25,521,000 | 1.77 | 1,453,400 |

| Lapaska1 Total Inferred | 512,000 | 1.47 | 24,200 | 460,000 | 3.19 | 47,200 | 972,000 | 2.28 | 71,300 |

| Sleepy2 Total Inferred | 1,113,000 | 4.70 | 167,900 | 1,113,000 | 4.70 | 167,900 | |||

| 1 NI 43-101 Technical Report Val-d'Or East Project - July 14th, 2021, Lapaska property 100% interest. | |||||||||

| 2 NI 43-101 Technical Report Val-d'Or East Project - July 14th, 2021, Cadillac Break East property JV 60%, 60% presented. | |||||||||

As no new information is available, the 2021 Mineral Estimate is considered to be current by Goldminds, and the results are reported unchanged.

The following table presents the detailed gold resources for each of the trends/deposits that comprise the Novador Project:

Table 4: Novador Project - Detailed Resources

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

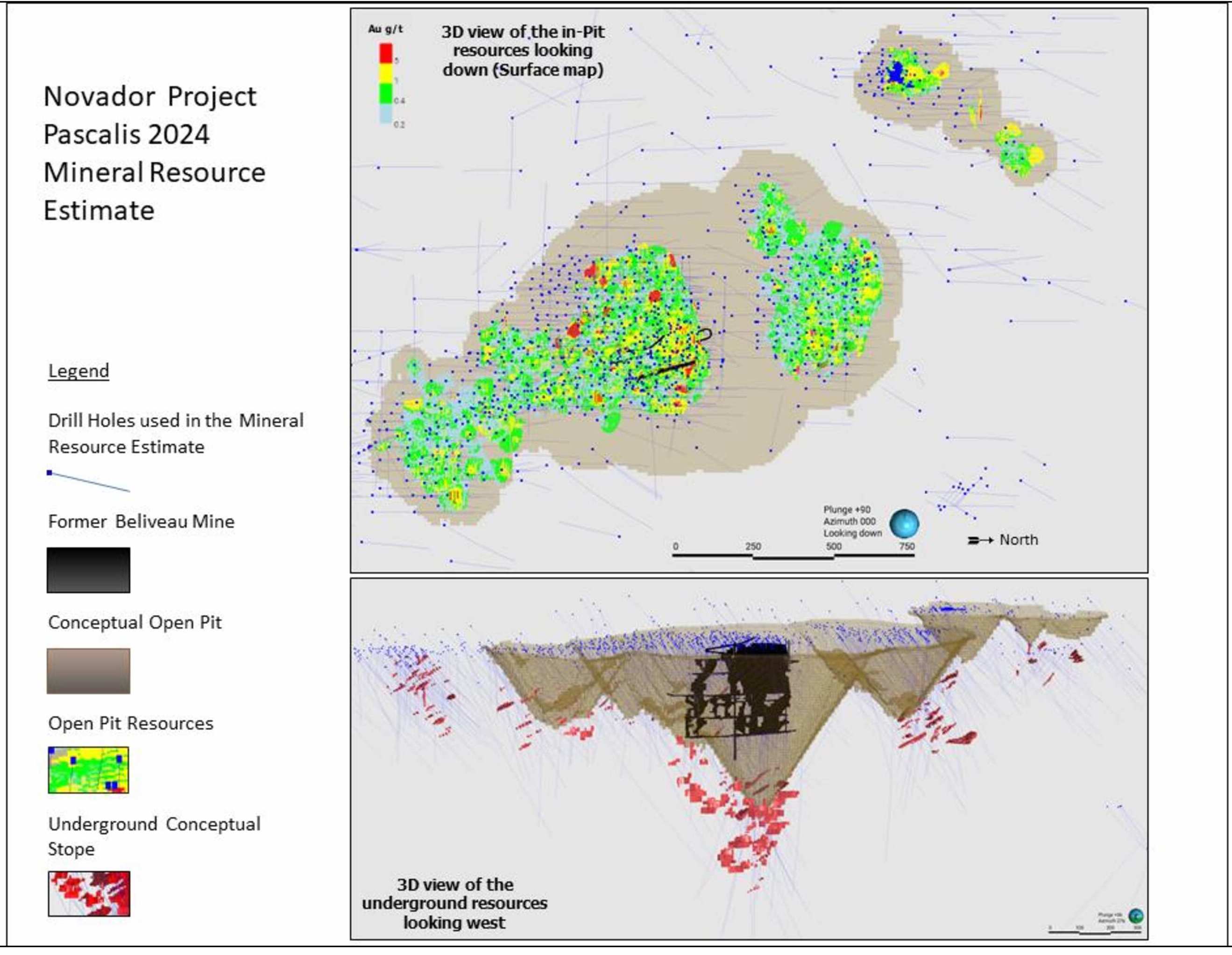

| Pascalis Gold Deposits | |||||||||

| Measured | 3,630,100 | 2.44 | 285,300 | 1,400 | 1.36 | 100 | 3,631,500 | 2.44 | 285,400 |

| Indicated | 22,324,700 | 1.50 | 1,077,000 | 826,100 | 2.12 | 56,300 | 23,150,800 | 1.52 | 1,133,300 |

| M&I | 25,954,800 | 1.63 | 1,362,400 | 827,500 | 2.12 | 56,300 | 26,782,300 | 1.65 | 1,418,700 |

| Inferred | 1,726,900 | 1.36 | 75,500 | 1,191,000 | 2.31 | 88,400 | 2,917,900 | 1.75 | 163,900 |

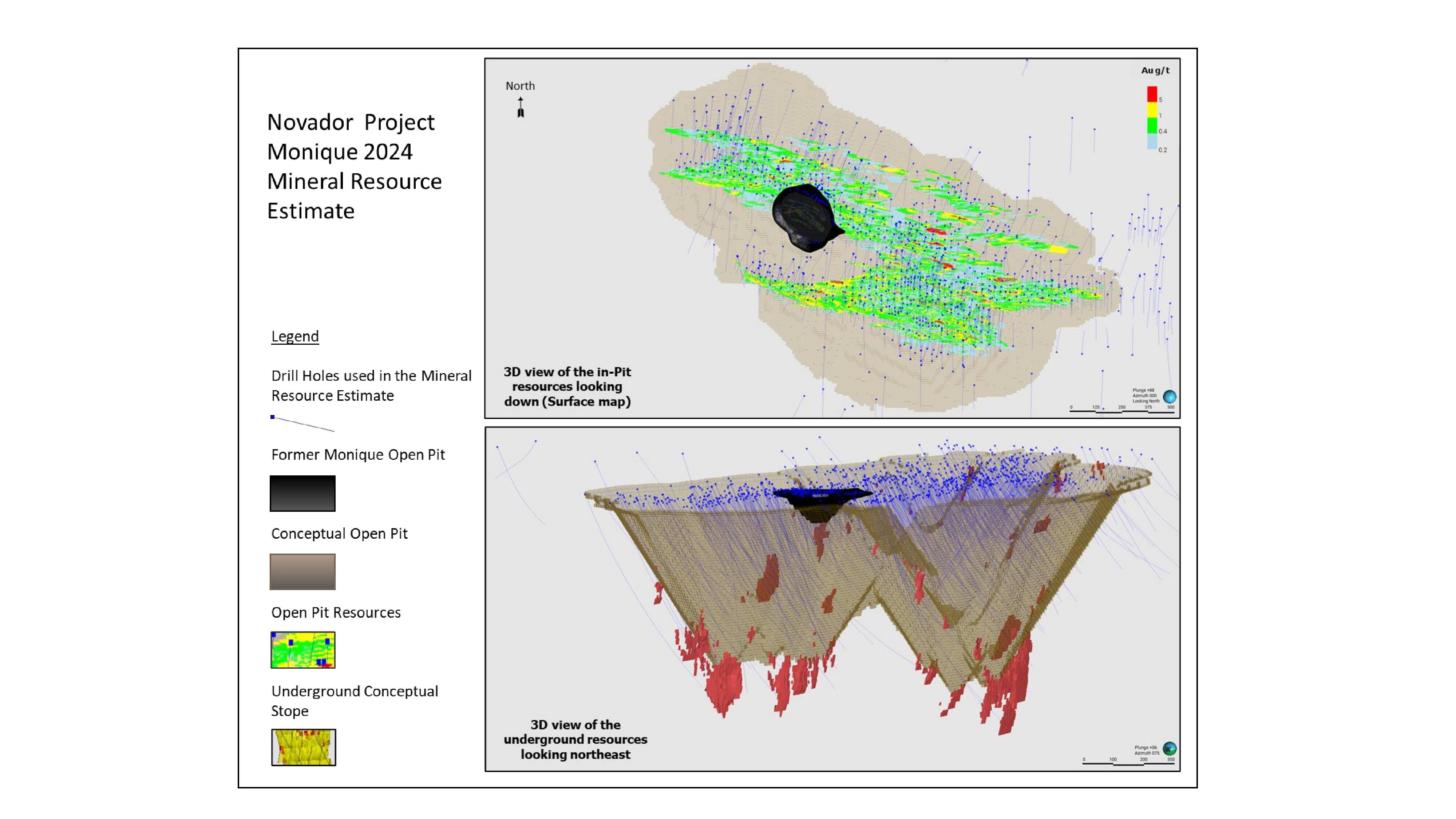

| Monique Gold Deposit | |||||||||

| Measured | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| Indicated | 79,576,300 | 1.33 | 3,396,600 | 2,046,300 | 2.48 | 163,000 | 81,622,600 | 1.36 | 3,559,600 |

| M&I | 79,576,300 | 1.33 | 3,396,600 | 2,046,300 | 2.48 | 163,000 | 81,622,600 | 1.36 | 3,559,600 |

| Inferred | 9,093,700 | 1.86 | 543,800 | 1,844,100 | 2.25 | 133,500 | 10,937,800 | 1.93 | 677,300 |

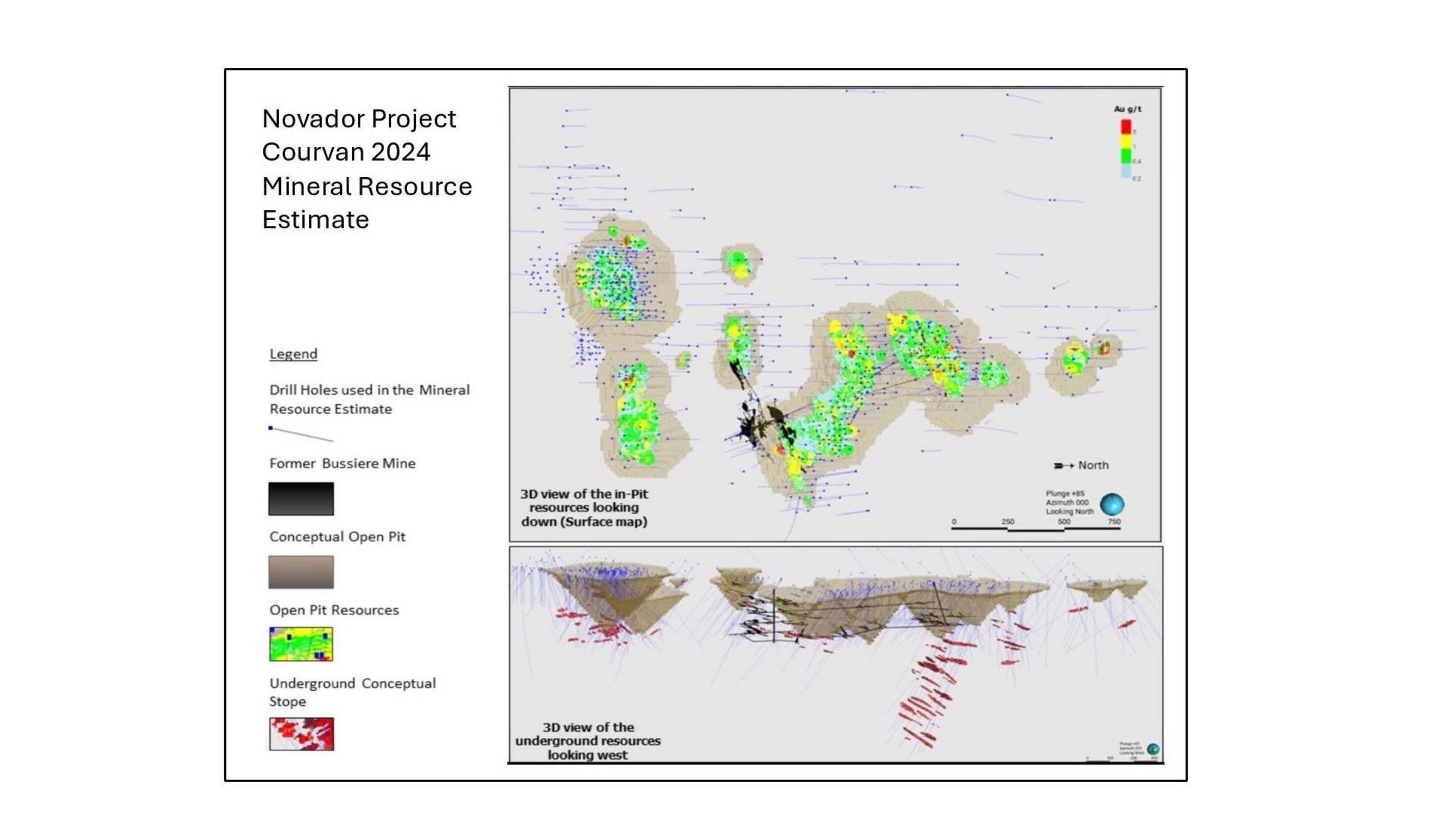

| Courvan Gold Deposits | |||||||||

| Measured | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| Indicated | 10,119,000 | 1.61 | 524,100 | 422,200 | 2.90 | 39,300 | 10,541,100 | 1.66 | 563,400 |

| M&I | 10,119,000 | 1.61 | 524,100 | 39,300 | 2.90 | 39,300 | 10,541,100 | 1.66 | 563,400 |

| Inferred | 4,795,600 | 1.64 | 252,800 | 2,045,500 | 3.62 | 238,300 | 6,841,100 | 2.23 | 491,200 |

| Beaufor Gold Deposit | |||||||||

| Measured | 42,000 | 6.19 | 8,400 | 545,000 | 4.56 | 79,900 | 587,000 | 4.68 | 88,300 |

| Indicated | 1,041,000 | 2.34 | 78,400 | 1,419,000 | 4.15 | 189,200 | 2,460,000 | 3.38 | 267,600 |

| M&I | 1,083,000 | 2.49 | 86,800 | 1,964,000 | 4.26 | 269,100 | 3,047,000 | 3.63 | 355,900 |

| Inferred | 615,000 | 1.36 | 26,800 | 1,426,000 | 2.67 | 122,500 | 2,041,000 | 2.28 | 149,300 |

Notes applied to all deposits:

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The mineral resource estimate follows current CIM Definitions (2014) and CIM MRMR Best Practice Guidelines (2019).

- The independent and qualified persons ("QPs") for the mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo. (Monique, Courvan and Pascalis,) Martin Perron, P.Eng. (all deposits but Lapaska, Sleepy and Beaufor), Alain Carrier, P.Geo. (McKenzie Break), Olivier Vadnais-Leblanc P.Geo. (Croinor) and Simon Boudreau, P.Eng. (all deposits but Lapaska, Sleepy and Beaufor) of InnovExplo Inc. and Todd McCracken, P.Geo, of BBA E&C Inc. (Beaufor deposit, part of the Courvan trend). The effective date is August 30, 2024.

- For the Senore deposit (part of the Courvan Trend), the 2021 MRE parameters and results were reviewed by the QP. As no new information were available and the 2021 MRE was deemed valid, the MRE 2021 results are reported unchanged.

- The mineral resource estimate is locally pit constrained. The out-pit mineral resource met the standard of reasonable prospects for eventual economic extraction by applying constraining volumes to all blocks (potential underground long-hole extraction scenario) using Deswik Stope Optimizer.

- The pit-constrained results are presented undiluted and are considered to have reasonable prospects of economic viability. The underground resources include all blocks within the mineable shapes and are also considered to have reasonable prospects of eventual economic extraction.

- Monique, Courvan and Pascalis deposits: The pit-constrained mineral resource estimate is reported at a 0.40 g/t Au cut-off grade for all deposits, a value above the base case cut-off grade. A base case cut-off grade of 0.19 g/t Au was calculated using the following parameters: mining cost = CA$2.88/t; mining overburden cost = CA$2.88; processing cost and G&A = CA$14.00; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz to CA$ 45.22/oz; gold price = US$1,850/oz; USD:CAD exchange rate = 1.33; bedrock slope angle of 43° to 54°; and mill recovery = 95%. The use of a higher cut-off could allow in-pit mineralized waste (0.19 - 0.40 g/t Au) to be selected for potential lower grade milling. The underground mineral resource estimate is reported at a cut-off grade of 1.35 to 1.82 g/t Au. The underground mineral resources estimate was based on two mining methods depending on the orientation of the mineralization. The cut-off grade was calculated using the following parameters: mining cost = CA$ 85.00 (Long-hole) to CA$ 120.00 (Cut&fill); processing cost and G&A = CA$ 14.00; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz to CA$ 45.22/oz; gold price = US$ 1,850/oz; USD:CAD exchange rate = 1.33; and mill recovery = 95%.

- Senore deposit: The pit-constrained mineral resource estimate is reported at a 0.40 g/t Au cut-off grade. The cut-off was calculated using the following parameters: gold price = US$ 1,600/oz; USD:CAD exchange rate = 1.33; mining cost = CA$3.00/t or CA$3.50/t; processing + G&A costs = CA$21.50/t; transport cost = $0.15/t.km; bedrock slope angle of 48° to 59°; and mill recovery = 95%. The underground mineral resource estimate is reported at a cut-off grade of 1.65 to 2.05 g/t Au. The underground mineral resources estimate was based on two mining methods depending on the orientation of the mineralization, long-hole retreat at a mining cost of CA$82/t and mechanized cut and fill at a mining cost of CA$110/t and using the same ground unit cost as for the pit-constrained scenario.

- Croinor deposit: The pit-constrained mineral resource estimate is reported at a 0.40 g/t Au cut-off grade. The cut-off was calculated using the following parameters: gold price = US$ 1,850/oz; USD:CAD exchange rate = 1.33; mining cost = CA$2.98/t or CA$4.25/t; processing + G&A costs = CA$14.00/t; transport cost = $15.36/t.km; bedrock slope angle of 50°; and mill recovery = 97%. The underground mineral resource estimate is reported at a cut-off grade of 1.90 g/t Au. The underground mineral resources estimate was based on long-hole retreat mining method depending on the orientation of the mineralization, at a mining cost of CA$158/t and using the same ground unit cost as for the pit-constrained scenario.

- McKenzie Break deposit: The pit-constrained mineral resource estimate is reported at a 0.32 g/t Au cut-off grade. The cut-off was calculated using the following parameters: gold price = US$ 1,850/oz; USD:CAD exchange rate = 1.33; mining cost = CA$2.98/t or CA$4.25/t; processing + G&A costs = CA$14.00/t; transport cost = $10.24/t.km; bedrock slope angle of 50°; and mill recovery = 95%. The underground mineral resource estimate is reported at a cut-off grade of 1.46 g/t Au. The underground mineral resources estimate was based on mechanized cut and fill mining method depending on the orientation of the mineralization, at a mining cost of CA$120/t and using the same ground unit cost as for the pit-constrained scenario.

- Beaufor deposit: Both underground and open pit conceptual mining shapes were applied as constraints to demonstrate reasonable prospects for eventual economic extraction. Cut-off grades for open pit constrained resources are 0.25 g/t Au and underground constrained resources are at 2.1 g/t Au. Open pit and underground Mineral Resource constraints are based on a gold price of USD1,850/oz, processing costs and G&A of CA$14.00/t milled, and mining costs of CA$140/t and CA$2.88/t underground and open pit respectively and an exchange rate of 0.74 USD/CAD. Beaufor estimation was completed using a combination of OK and ID2 in Leapfrog Edge software with search ellipse on specific domains. Drill hole composites at 1.5 m in length. Block size is 5 m x 5 m x 5 m with sub-blocking. Beaufor densities mineralized block were assigned a fix value of 2.75 g/cm3 corresponding to the density value used when the mine was operating. A fixed density of 2.00 g/cm3 was assigned to the overburden and 0.00 g/cm3 was assigned to underground workings. Host-rock blocks were assigned a fixed SG based on the field measurement average value (Courvan trend deposits) of their respective lithology.

- The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded, following the recommendations in NI 43-101. Any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) also rounded to the hundred.

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues or any other relevant issue not reported in the Technical Report that could materially affect the Mineral Resource Estimate.

Table 5: Comparison of the 2024 to previous Mineral Resource Estimates

| Deposit / Category | Pit-Constrained Resources | Underground Resources | Total | ||||||

| Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | Tonnes | Grade (Au g/t) | Gold (oz.) | |

| Novador 2024 | |||||||||

| M&I | 116,733,100 | 1.43 | 5,369,900 | 5,259,900 | 3.12 | 527,800 | 121,993,100 | 1.50 | 5,897,600 |

| Inferred | 16,231,200 | 1.72 | 898,900 | 6,506,600 | 2.79 | 582,700 | 22,737,800 | 2.03 | 1,481,700 |

| Novador 2023 1 | |||||||||

| M&I | 59,653,600 | 1.53 | 2,942,700 | 7,937,400 | 2.37 | 604,300 | 67,591,000 | 1.63 | 3,547,000 |

| Inferred | 9,915,600 | 1.48 | 472,800 | 6,802,400 | 2.82 | 616,500 | 16,717,900 | 2.03 | 1,089,300 |

| McKenzie Break 2024 | |||||||||

| Inferred | 23,956,000 | 1.65 | 1,269,200 | 1,565,000 | 3.66 | 184,200 | 25,521,000 | 1.77 | 1,453,400 |

| McKenzie Break 2021 2 | |||||||||

| M&I | 1,441,400 | 1.80 | 83,300 | 387,700 | 5.03 | 62,700 | 1,829,100 | 2.48 | 146,000 |

| Inferred | 2,243,600 | 1.44 | 104,000 | 1,083,500 | 4.21 | 146,550 | 3,327,100 | 2.34 | 250,550 |

| Croinor 2024 | |||||||||

| M&I | 926,000 | 3.22 | 95,900 | 1,574,000 | 4.50 | 227,700 | 2,500,000 | 4.03 | 323,600 |

| Inferred | 16,000 | 3.40 | 1,800 | 213,000 | 4.70 | 32,500 | 229,000 | 4.61 | 34,300 |

| Croinor 2022 3 | |||||||||

| M&I | - | - | - | 903,600 | 6.47 | 187,900 | 903,600 | 6.47 | 187,900 |

| Inferred | - | - | - | 200,100 | 6.19 | 39,800 | 200,100 | 6.19 | 39,800 |

| Lapaska 2024 | |||||||||

| Inferred | 512,000 | 1.47 | 24,200 | 460,000 | 3.19 | 47,200 | 972,000 | 2.28 | 71,300 |

| Lapaska 2021 4 | |||||||||

| Inferred | 512,000 | 1.47 | 24,200 | 460,000 | 3.19 | 47,200 | 972,000 | 2.28 | 71,300 |

| Sleepy 2024 | |||||||||

| Inferred | 1,113,000 | 4.70 | 167,900 | 1,113,000 | 4.70 | 167,900 | |||

| Sleepy 2021 5 | |||||||||

| Inferred | 1,113,000 | 4.70 | 167,900 | 1,113,000 | 4.70 | 167,900 | |||

Notes:

Pit-constrained resources presented without the low-grade material at Novador.

1 NI 43-101 Technical Report MRE Val-d'Or East Project, Novador property - September 1st, 2023

2 NI 43-101 Technical Report MRE McKenzie Break gold property - October 14th, 2021

3 NI 43-101 Technical Report MRE Croinor gold property - June 17th, 2022

4 NI 43-101 Technical Report MRE Val-d'Or East Project - July 14th, 2021, Lapaska property

5 NI 43-101 Technical Report MRE Val-d'Or East Project - July 14th, 2021, Cadillac Break East property JV 60%, 60% presented.

Additions to the Current Resource Estimate Relative to the 2023 Resource Estimate.

The 2023 MRE at Novador hosted a NI 43-101 mineral resource of 3,793,900 ounces of gold in the M&I category and 1,179,400 ounces of gold in the Inferred category. Over 95,000 metres has been drilled since the 2023 MRE on the Monique, Pascalis, Courvan and Croinor deposits. In addition, 75,000 metres has been drilled since the 2021 MRE at the Beaufor and McKenzie Break deposits. Using a gold price of USD $1,850 per ounce, the Novador 2024 updated NI 43-101 mineral resource hosts 6,405,000 ounces of gold in M&I, and 1,550,200 ounces gold in Inferred, representing an increase of 60% in total size and an increase of 69% in the M&I category. A total of 86% of the new, 2024 M&I resources are pit constrained at Novador.

Figure 2: Val-d'Or East deposits Location Map

Figure 3: Novador deposits Location Map

Upcoming Milestones

The Company is focused on continuing to advance the Novador project towards gold production and explore the other Val-d'Or East Properties and expects to complete the following key catalysts in the near term:

- Expand Development Activities: Increase focus on development activities, particularly infill and condemnation drilling, to support ongoing project advancement.

- Pre-Feasibility Study: Development activities carried out in 2024 and 2025 will form the basis of a comprehensive Pre-Feasibility Study. This study will incorporate all key factors into a mine plan, demonstrating potential future phases of operation and further enhancing the robust economics presented in the 2024 PEA.

- Advance Permitting: Continue progressing through the permitting process to align with project timelines and regulatory requirements.

- Showcase Upside Potential: Highlight the upside potential of the Novador project and all Val-d'Or East satellite properties. Provide visibility on resource growth, discovery potential, and extend known mineralization trends. Continue to advance regional exploration programs.

Figure 4: Block Model 3D view - Monique Gold Deposit

Figure 5: Block Model 3D view - Pascalis Gold Deposits

Figure 6: Block Model 3D view - Courvan Gold Deposits

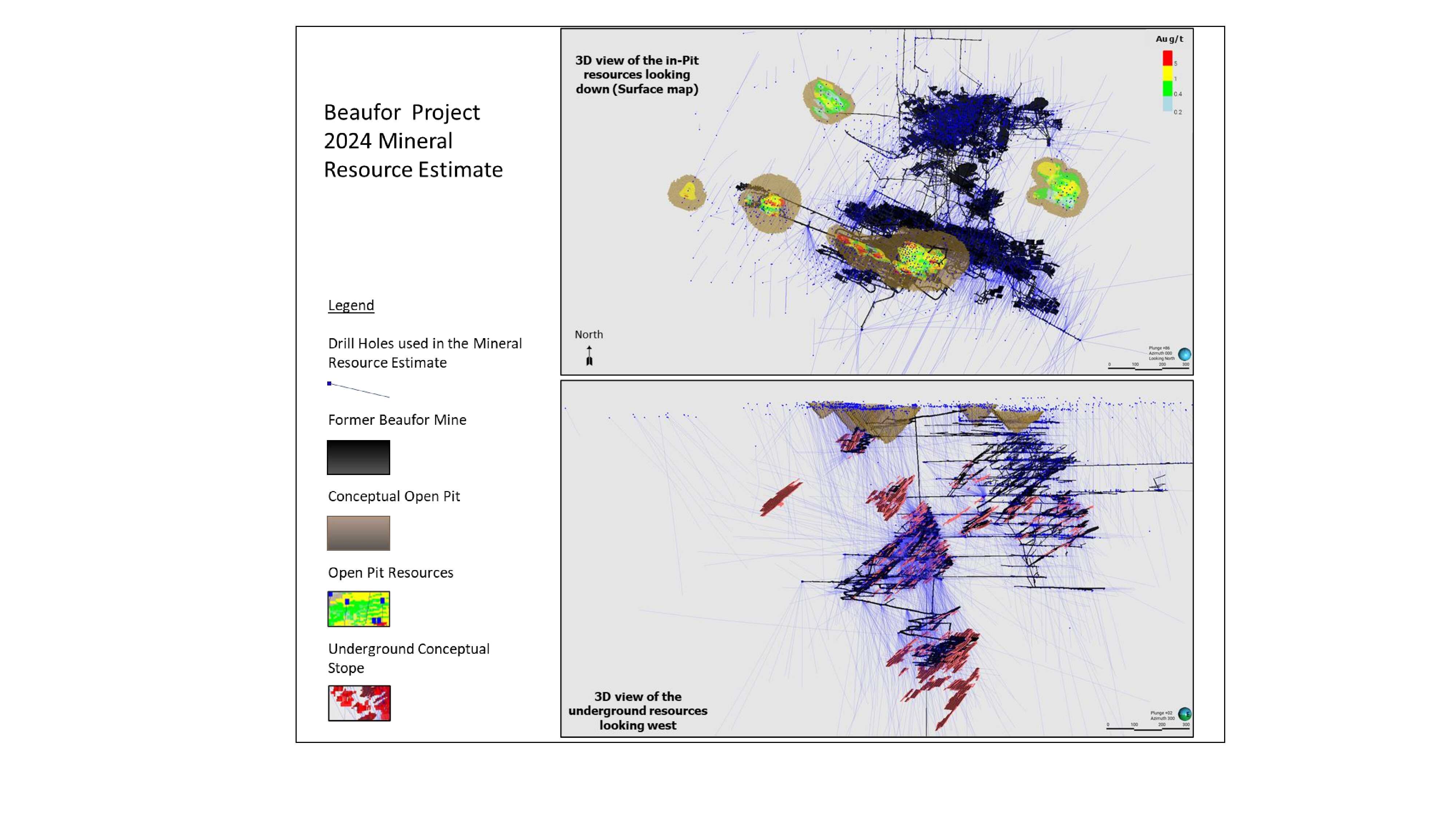

Figure 7: Block Model 3D view - Beaufor Gold Deposit

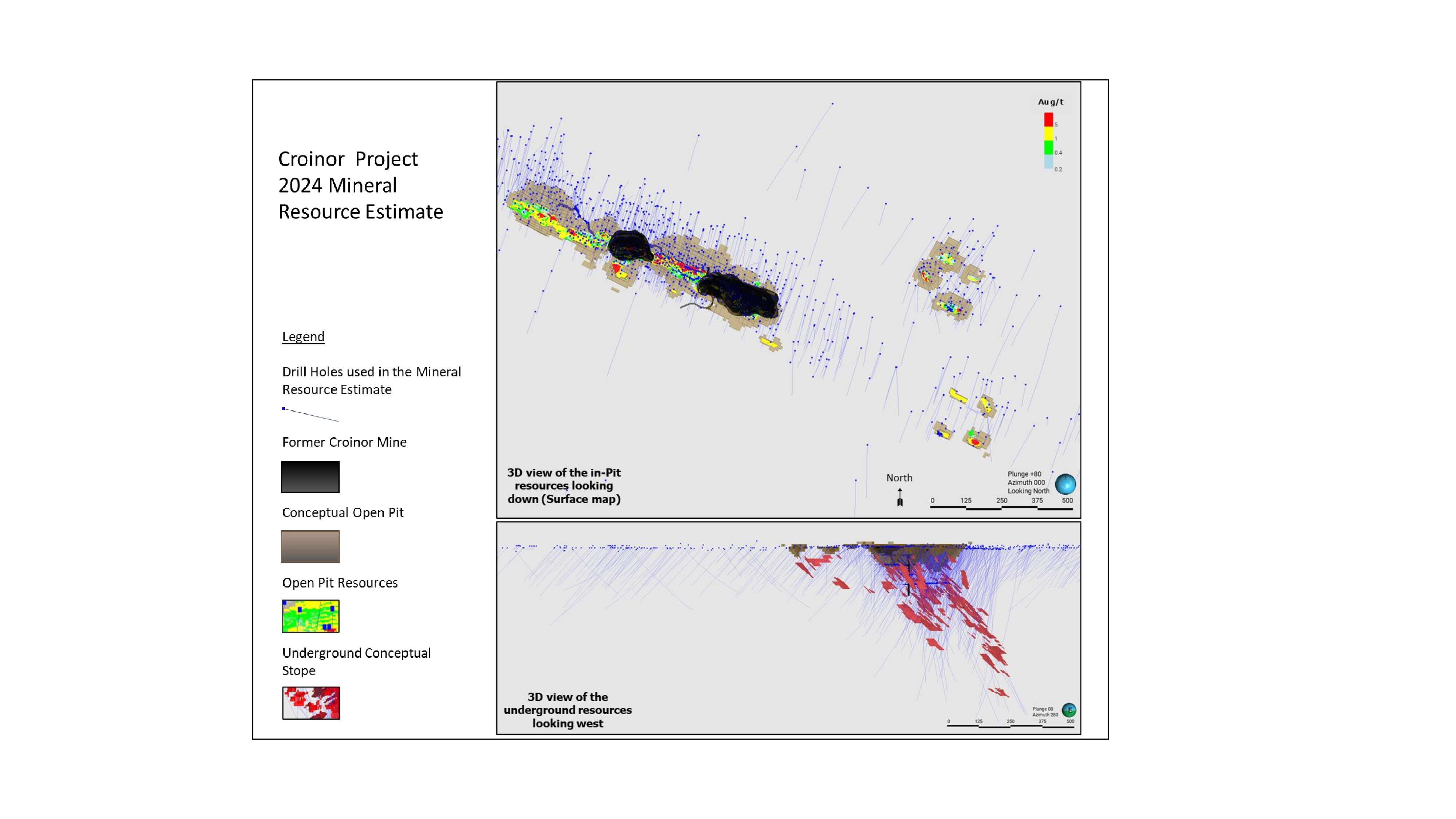

Figure 8: Block Model 3D view - Croinor Gold Deposit

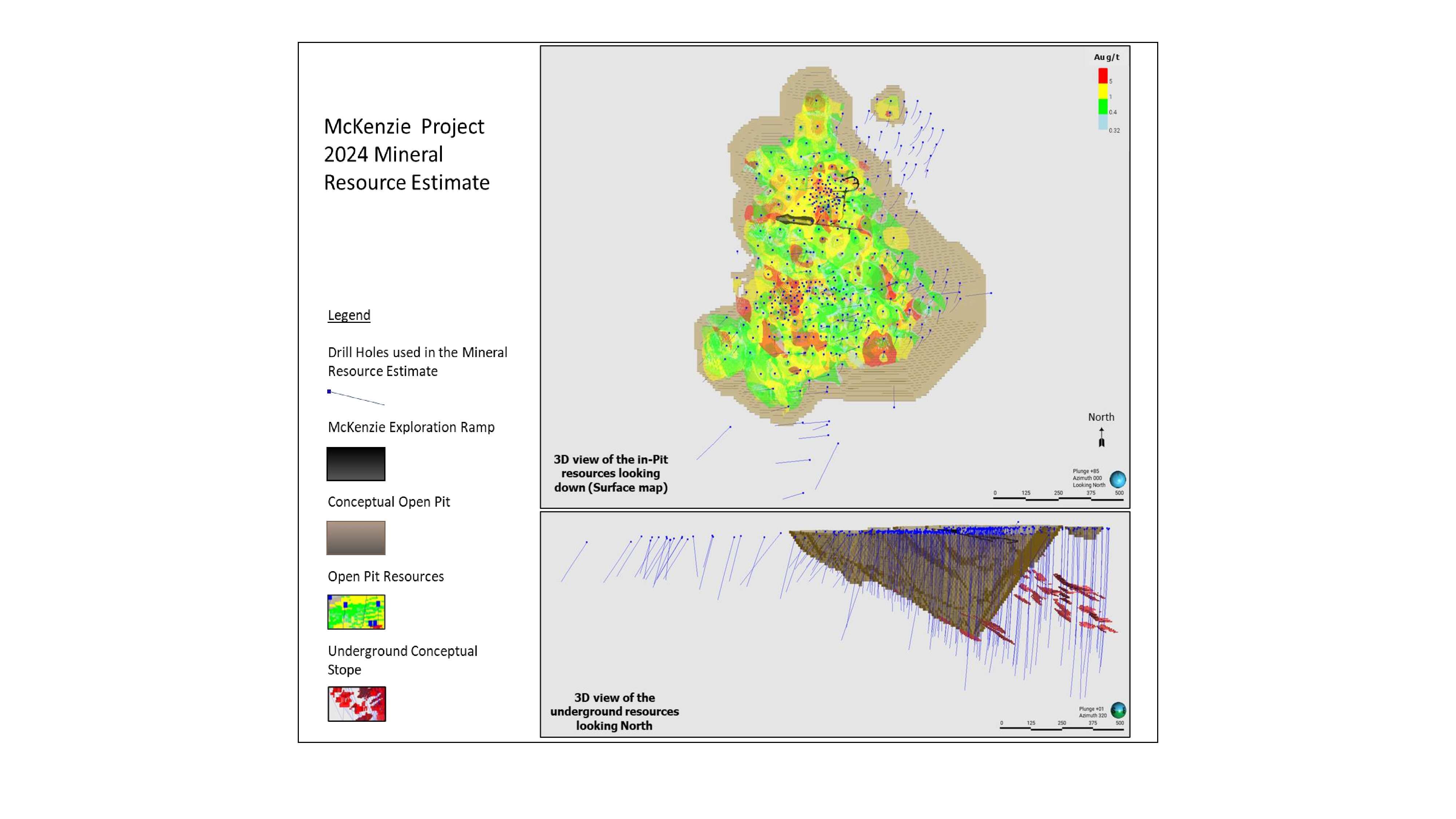

Figure 9: Block Model 3D view - McKenzie Break Gold Deposit

Resource Estimation Methodology and Parameters

As part of the resource estimation process, the Company, InnovExplo and BBA compiled, verified, and modelled all technical information available from the Project. 3D geological models were built for key structures hosting and constraining gold mineralization for the Monique, Pascalis, Courvan Beaufor, McKenzie Break and Croinor gold deposits. The last drill holes database closing date is June 3, 2024.

Next Steps

A technical report with respect to the latest mineral resource estimate disclosed today will be filed within 45 days in accordance with NI 43-101.

About Novador Project

Since 2016, Probe Gold has been consolidating its land position in the highly prospective Val-d'Or East area in the province of Quebec with a district-scale land package of 685 square kilometres that represents one of the largest land holdings in the Val-d'Or mining camp. The Novador project represents one property block of 175 square kilometres that hosts four past producing mines (Beliveau Mine, Bussiere Mine, Monique Mine and Beaufor Mine) and contains 80% of the Company's gold resources in Val-d'Or East. Novador is situated in a politically stable and low-cost mining environment that hosts numerous active producers and mills.

Independent Qualified Persons

The Updated Mineral Resource Estimate was prepared for Probe Gold Inc. by InnovExplo Inc and BBA E&C Inc. The Qualified Persons ("QPs") have reviewed and approved technical information provided on Monique estimate presented in of this news release. The independent QPs from InnovExplo who have prepared and supervised the preparation of the technical information relating to this Mineral Resource Estimate are:

Novador and Other Val-d'Or properties 2024 MRE (InnovExplo and BBA)

- Marina Iund, P.Geo., M.Sc., Senior Resources Geologist. Ms. Iund is a professional geologist in good standing with the OGQ (No. 1525), PGO (No. 3123) and the NAPEG (No. L4431).

- Olivier Vadnais-Leblanc, P.Geo., Resources Geologist. is a professional geologist in good standing with the OGQ (No. 1082), PEGNL (11337), PGO (No. 3123)

- Martin Perron, P.Eng., Director of geology. Mr. Perron is a professional engineer in good standing with the OIQ (No. 109185, PEO 100629167).

- Alain Carrier, M.Sc., Co-President Founder. Mr. Carrier is a professional geologist in good standing with the OGQ (No. 281), PGO (No. 1719) and the NAPEG (No. L2701).

- Simon Boudreau, P.Eng., Senior Mine Engineer. Mr. Boudreau is a professional engineer in good standing with the OIQ (No. 1320338).

- Todd McCracken, P. Geo., Director - Mining & Geology. Mr. McCracken is a professional geologist in good standing with the OGQ (No 02371) and PGO (0631).

Other Val-d'Or properties 2021 MRE (GoldMinds)

- Merouane Rachidi, Ph.D. P.Geo. Mr. Rachidi is a professional geologist in good standing with the OGQ (No. 1792)

- Claude Duplessis, Eng. Mr. Duplessis is a professional engineer in good standing with the OIQ (No. 45523)

The technical content of this press release has been prepared, reviewed, and approved by Mr. Marco Gagnon, P.Geo., Executive Vice President of Probe Gold Inc.

Quality Control

During the Company's 2023 and 2024 drilling program, assay samples were taken from the NQ core and sawed in half, with one-half sent to Activation Laboratories Ltd. and the other half retained for future reference. A strict QA/QC program was applied to all samples, which includes insertion of mineralized standards and blank samples for each batch of 20 samples. The gold analyses were completed by fire-assayed with an atomic absorption finish on 50 grams of materials. Repeats were carried out by fire-assay followed by gravimetric testing on each sample containing 3.0 g/t gold or more. Total gold analyses (Metallic Sieve) were carried out on the samples which presented a great variation of their gold contents or the presence of visible gold. Historical drilling program assay sampling procedures are disclosed in the NI 43-101 technical report: Mineral Resource Val-d'Or East Project - July 17, 2023, and available on SEDAR (www.sedar.com) under Company's issuer profile. The drilling results obtained from Monarch Mining Corporation and QA/QC sampling protocol is as follows: the drilled core is sawed into equal halves along its main axis and shipping one of the halves to ALS Canada, SGS Canada, or Agat Laboratories, for assaying. The samples are crushed, pulverized and assayed by fire assay, with an atomic absorption finish. Samples exceeding 10 g/t Au are re-assayed using the gravity method and samples containing visible gold are assayed using the metallic screen method. Monarch uses a comprehensive QA/QC protocol, including the insertion of standards, blanks and duplicates.

About Probe Gold:

Probe Gold Inc. is a leading Canadian company focused on the acquisition, exploration, and development of highly prospective gold properties. The Company is well-funded and dedicated to exploring and developing high-quality gold projects. Notably, it owns 100% of its flagship asset, the multimillion-ounce Novador Gold Project in Quebec, as well as an early-stage Detour Gold Quebec project. Probe controls a large land package of approximately 1685-square-kilometres of exploration ground within some of the most prolific gold belts in Quebec. The Company's recent Novador updated Preliminary Economic Assessment outlines a robust mining plan with an average annual gold production of 255,000 ounces over a 12.6-year mine life.

On behalf of Probe Gold Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probemetals.com or contact:

Seema Sindwani

Vice-President of Investor Relations

info@probemetals.com

+1.416.777.9467

Forward-Looking Statements

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/786bade4-d212-4329-919e-73d761d9e49b

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffb6e181-1aa4-4a1f-9b67-3fdbe2dc9606

https://www.globenewswire.com/NewsRoom/AttachmentNg/cde5c387-b279-4b7e-8e3f-4b7d45452eda

https://www.globenewswire.com/NewsRoom/AttachmentNg/4729243f-eb80-4953-91df-031268783577

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba54efe5-f22e-4757-981e-3d295c01846f

https://www.globenewswire.com/NewsRoom/AttachmentNg/64005f9d-3ae6-4485-ad5f-e26065ffe573

https://www.globenewswire.com/NewsRoom/AttachmentNg/24673415-fa76-4ba7-9b25-66dc3b6c1a5f

https://www.globenewswire.com/NewsRoom/AttachmentNg/c31a2b05-6be5-409b-aff1-309a4e9f30c5

https://www.globenewswire.com/NewsRoom/AttachmentNg/46fdddf8-b0dc-488d-b48a-bf64a6c7f70f