Move Aims to Ensure Continued Listing on Nasdaq

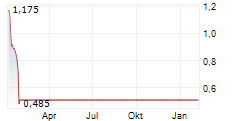

BOLINGBROOK, Ill., Sept. 6, 2024 /PRNewswire/ -- Hyzon (NASDAQ: HYZN) ("Hyzon" or the "Company"), a U.S.-based high-performance hydrogen fuel cell system manufacturer and technology developer focused on providing zero-emission power to decarbonize the most demanding industries, today announced that its Board of Directors and stockholders approved a 1-for-50 reverse stock split of the Company's Class A common stock, par value $0.0001 per share, which will be effective at 12:01 a.m., Eastern Time, on September 11, 2024 (the "Reverse Stock Split"). Hyzon's Class A common stock will continue to be traded on The Nasdaq Capital Market on a split-adjusted basis beginning on September 11, 2024, under the Company's existing trading symbol "HYZN."

The Reverse Stock Split is intended to increase the bid price of the Company's Class A common stock so that Hyzon can regain compliance with the minimum bid price requirement of $1.00 per share for continued listing on The Nasdaq Capital Market. The new CUSIP number following the Reverse Stock Split will be 44951Y201. The Company filed a Certificate of Amendment with the Secretary of State of the State of Delaware on September 6, 2024 to effect the Reverse Stock Split.

The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder's percentage ownership interest in the Company, except to the extent that the Reverse Stock Split results in that stockholder owning a fractional share as described in more detail below.

The Reverse Stock Split will reduce the number of shares of Class A common stock issued and outstanding from approximately 272.5 million to approximately 5.5 million. The total number of authorized shares of Class A common stock will also be reduced proportionally from 1,000,000,000 to 20,000,000. No fractional shares will be issued in connection with the Reverse Stock Split. In lieu, thereof, each stockholder who would be entitled to receive a fractional share will be entitled to receive a cash payment equal to the product of the closing price on the day immediately prior to effectiveness of the Reverse Stock Split and the amount of the fractional share.

The Reverse Stock Split will also result in proportional adjustments being made to all outstanding options, warrants, restricted stock units, performance stock units, or similar securities entitling their holders to receive or purchase shares of our Class A common stock.

The company's publicly-traded warrants will continue to be traded under the symbol "HYZNW" and the CUSIP identifier for the warrants will remain unchanged.

Continental Stock Transfer and Trust Company ("Continental"), the Company's transfer agent, will act as the exchange agent for the Reverse Stock Split. Continental will provide instructions to any stockholders with physical stock certificates regarding the process for exchanging their certificates for split-adjusted shares into "book-entry form." Shares held by stockholders in "street name" will have their accounts automatically credited by their brokerage form, bank or other nominee, as will any stockholders who held their shares in book-entry form at Continental.

About Hyzon

Hyzon is a global supplier of high-performance hydrogen fuel cell technology focused on providing zero-emission power to decarbonize demanding industries. With agile, high-power technology designed for heavy-duty applications, Hyzon is at the center of a new industrial revolution fueled by hydrogen, the most abundant natural element, and a clean energy source. Hyzon is focusing on deploying its fuel cell technology in heavy-duty commercial vehicles in Class 8 and refuse collection vehicles across North America, as well as new markets such as stationary power applications. To learn more about how Hyzon partners across the hydrogen value chain to accelerate the clean energy transition, visit www.hyzonfuelcell.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements regarding the Company's expectations, hopes, beliefs, intentions, or strategies for the future. You are cautioned that such statements are not guarantees of future performance and that the Company's actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company's actual expectations to differ materially from these forward-looking statements include the Company's ability improve its capital structure; Hyzon's liquidity needs to operate its business and execute its strategy, and related use of cash; its ability to raise capital through equity issuances, asset sales or the incurrence of debt; the possibility that Hyzon may need to seek bankruptcy protection; Hyzon's ability to fully execute actions and steps that would be probable of mitigating the existence of substantial doubt regarding its ability to continue as a going concern; our ability to enter into any desired strategic alternative on a timely basis, on acceptable terms; our ability to maintain the listing of our Common Stock on the Nasdaq Capital Market; retail and credit market conditions; higher cost of capital and borrowing costs; impairments; changes in general economic conditions; and the other factors under the heading "Risk Factors" set forth in the Company's Annual Report on Form 10-K, as supplemented by the Company's quarterly reports on Form 10-Q and current reports on Form 8-K. Such filings are available on our website or at www.sec.gov. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

SOURCE Hyzon