Disclaimer: SAFE SA (the "Company") has arranged financing in the form of convertible bonds into new or existing shares (OCEANE) with Global Corporate Finance Opportunities 20 ("GCFO 20"), which, after receiving the shares resulting from the conversion of these bonds, is not intended to remain a shareholder of the Company.

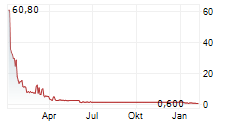

The shares resulting from the conversion of these bonds will generally be sold on the market at very short notice, which may create strong downward pressure on the share price.

Shareholders may suffer a loss of their invested capital due to a significant fall in the Company's share price, as well as significant dilution due to the large number of securities issued to the GCFO 20 fund.

Investors are advised to exercise extreme caution before deciding to invest in the securities of a listed company that carries out such dilutive financing transactions, particularly when they are carried out successively. The Company wishes to point out that this is not the first dilutive financing transaction it has undertaken. Investors are invited to familiarize themselves with the risks associated with these transactions, as mentioned in the March 14, 2023 press release.

Fleurieux-sur-l'Arbresle - France - September 6, 2024 at 8 p.m. - Safe SA (FR001400F1V2 - ALSAF) (the « Company ») announces the implementation of an amendment to the flexible bond financing entered into with Global Corporate Finance Opportunities 20 ("GCFO 20") on March 14, 2023 (the "Agreement"). Under this amendment, GCFO 20 has undertaken to finance the Company up to a minimum net amount of approximately 3 million euros under the Agreement, to support the implementation of the Company's continuation plan.

GCFO 20 undertakes that this financing will be carried out through the drawing, by the Company, of twenty (20) tranches (the "Additional Tranches") of bonds convertible into or exchangeable for new and/or existing shares (the "OCEANE") of a nominal amount of 209,000 euros each, to be subscribed by GCFO 20 at 97% of their nominal value in accordance with the terms of the Agreement (excluding any commitment and waiver fees that may be due).

The Company specifies that two (2) Additional Tranches have been issued to date and that, in the future, a period of twenty (20) trading days will separate the drawdown of each Additional Tranche.

Net proceeds from issue

The net proceeds of the issue of all twenty (20) Additional Tranches will be 3,006,600 euros.

Theoretical impact of the OCEANE issue

The theoretical impact of the issue of OCEANE bonds corresponding to the Additional Tranches is presented in Appendix 1 to this press release.

The Company maintains an up-to-date table on its website showing the number of OCEANE bonds and shares outstanding.

About Safe Group

Safe Group is a French medical technology group that brings together Safe Orthopaedics, a pioneer in ready-to-use technologies for spine pathologies, and Safe Medical (formerly LCI Medical), a medical device subcontractor for orthopedic surgeries. The group employs approximately 100 people.

Safe Orthopaedics develops and manufactures kits combining sterile implants and ready-to-use instruments, available at any time to the surgeon. These technologies are part of a minimally invasive approach aimed at reducing the risks of contamination and infection, in the interest of the patient and with a positive impact on hospitalization times and costs. Protected by 15 patent families, SteriSpineTM kits are CE marked and FDA approved. Safe Orthopaedics has subsidiaries in the United Kingdom, Germany, the United States.

For more information: www.safeorthopaedics.com

Safe Medical produces implantable medical devices and ready-to-use instruments. It has an innovation center and two production sites in France and in Tunisia, offering numerous industrial services: industrialization, machining, finishing and sterile packaging.

For more information: www.safemedical.fr

Contacts

SAFE GROUPAELYON ADVISORS

investors@safeorthopaedics.comsafe@aelyonadvisors.fr

Appendix 1

- Theoretical impact of the issuance of the OCEANEs corresponding to the Additional Sections (based on the closing price of the Company's share on August 30, 2024, i.e. €0.0002)

For illustrative purposes, the impact of the issue of the OCEANE bonds corresponding to Additional Tranches would be as follows:

- Impact of the issue on the investment of a shareholder currently holding 1% of the Company's share capital (on the basis of the number of shares making up the Company's share capital as at August 30, 2024, i.e. 3 803 594 504 shares):

| Shareholder participation | |

| Pre-issue | 1,00% |

| After issue of 1,077,319,588 new shares resulting from the conversion of 209 OCEANE of an Additional Tranche* | 0,779% |

| After issuance of 21,546,391,753 new shares resulting from the conversion of 4,180 OCEANE of Additional Tranches* | 0,150% |

*Theoretical calculations based on the closing price of the Company's shares on August 30, 2024, i.e. €0,0002, and a conversion price of the OCEANE bonds corresponding to 97% of this value, i.e. approximately €0,000194. This dilution is without prejudice to the final number of shares to be issued and their issue price, which will be determined on the basis of the market price, as described in the press release of March 14, 2023.

- Impact of the issue on shareholders' equity per share (based on shareholders' equity on June 30, 2022, i.e. -€6,849,091, and the number of shares comprising the Company's share capital at August 30, 2024, i.e. 3,803,594,504 shares):

| Consolidated shareholders' equity per share at June 30, 2023 | |

| Before issue of new shares | -0,00180 € |

| After issue of 1,077,319,588 new shares resulting from the conversion of 209 OCEANE of an Additional Tranche* | -0,00140 € |

| After issuance of 21,546,391,753 new shares resulting from the conversion of 4.180 OCEANE of Additional Tranches* | -0,00027 € |

*Theoretical calculations based on the closing price of the Company's shares on August 30, 2024, i.e. €0,0002, and a conversion price of the OCEANE corresponding to 97% of this value, i.e. approximately €0,000194. This dilution is without prejudice to the final number of shares to be issued and their issue price, which will be determined on the basis of the market price, as described in the press release of March 14, 2023.

- Theoretical impact of the issuance of the OCEANEs corresponding to Additionnal Tranches (on the basis of the par value of SAFE shares, i.e. €0.10

For illustrative purposes, the impact of the issue of the OCEANE bonds would be as follows:

- Impact of the issue on the investment of a shareholder currently holding 1% of the Company's share capital (on the basis of the number of shares making up the Company's share capital as at August 30, 2024, i.e. 3,803,594504 shares):

| Shareholder Participation | |

| Pre-issue | 1,00% |

| After issue of 2,090,000 new shares resulting from the conversion of 209 OCEANE bonds of an Additional Tranche* | 0,999% |

| After issuance of 41,800,000 new shares resulting from the conversion of 4,180 OCEANE of Additional Tranches* | 0,989% |

*Theoretical calculations based on the nominal value of the Company's shares, i.e. 0,10 euro. This dilution is without prejudice to the final number of shares to be issued and their issue price, which will be determined on the basis of the market price, as described in the press release of March 14, 2023.

- Impact of the issue on shareholders' equity per share (based on shareholders' equity at June 30, 2023, i.e. -€6,849,091, and the number of shares comprising the Company's share capital at August 30, 2024, i.e. 3,803,594,504 shares):

| Consolidated shareholders' equity per share at June 30, 2023 | |

| Before issue of new shares | -0,00180 € |

| After issue of 2,090,000 new shares resulting from the conversion of 209 OCEANE bonds of an Additional Tranche* | -0,00180 € |

| After issuance of 41,800,000 new shares resulting from the conversion of 4,180 OCEANE of Additional Tranches* | -0,00178 € |

* Theoretical calculations based on the nominal value of the Company's shares, i.e. 0,10 euro. This dilution is without prejudice to the final number of shares to be issued and their issue price, which will be determined on the basis of the market price, as described in the press release of March 14, 2023.