VANCOUVER, BC / ACCESSWIRE / September 11, 2024 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) is pleased to provide an update on the integration and interpretation of historic data and the property wide upside potential at the Piuquenes Cu-Au Project, San Juan, Argentina.

Key Findings from Electrical Geophysical Data Integration:

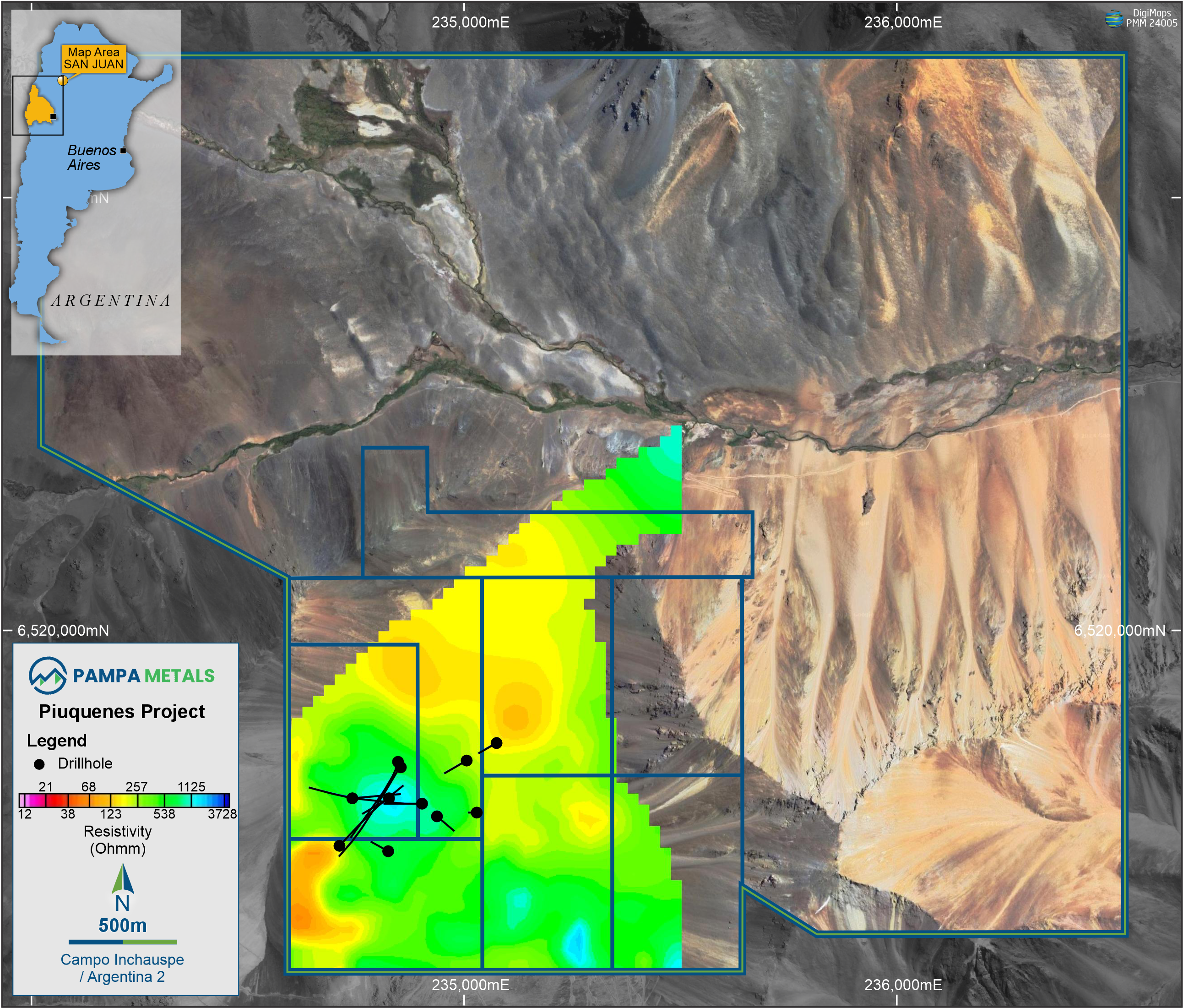

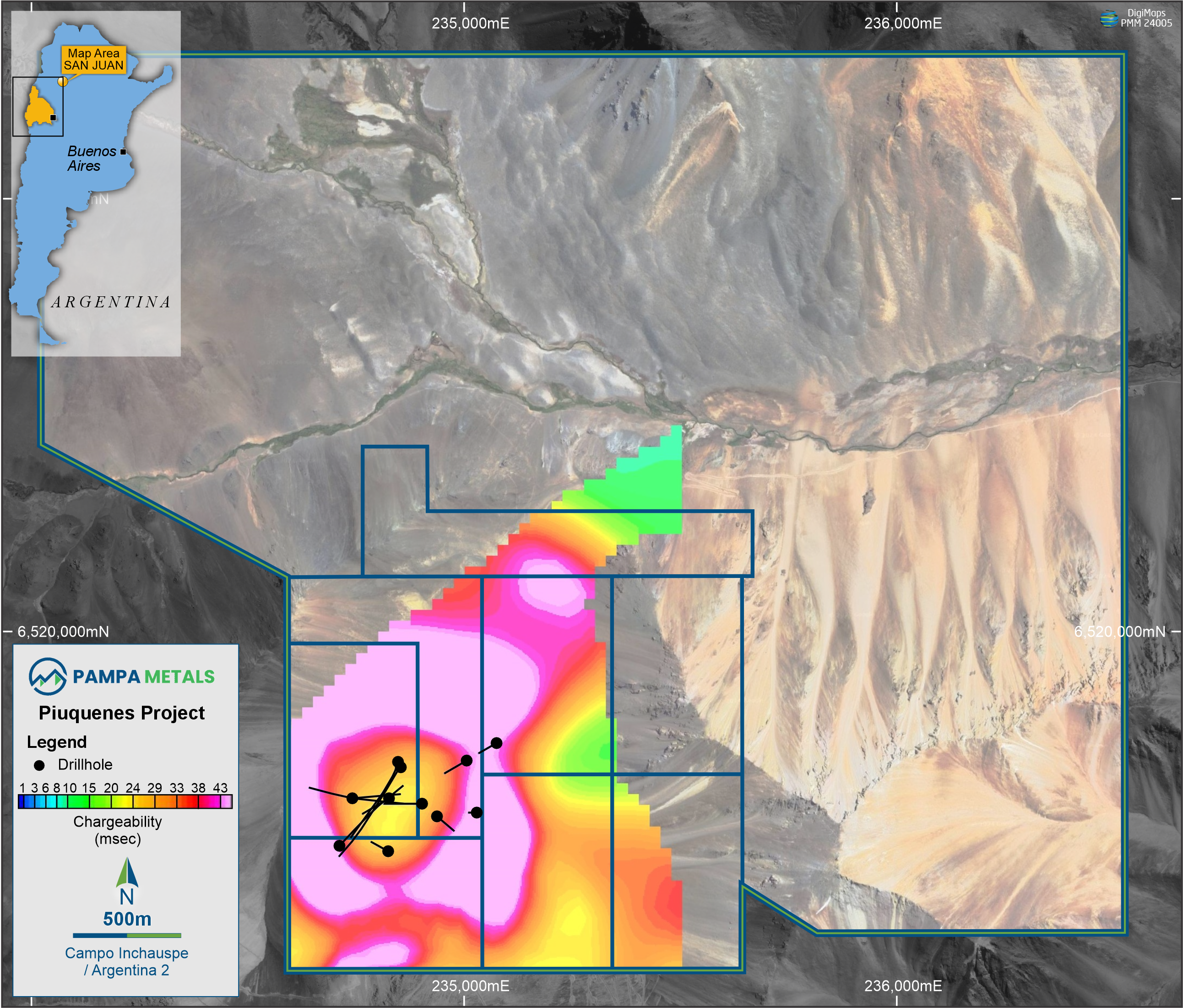

Key data sets used to-date include a 2016 Offset Pole-Dipole Induced Polarization-Resistivity survey ("IP") and a Natural Source Magneto-Telluric (gDAS24) survey ("MT").

Inversion models of this data have been evaluated in 3D, in conjunction with the preliminary 3D geological model currently being finalized.

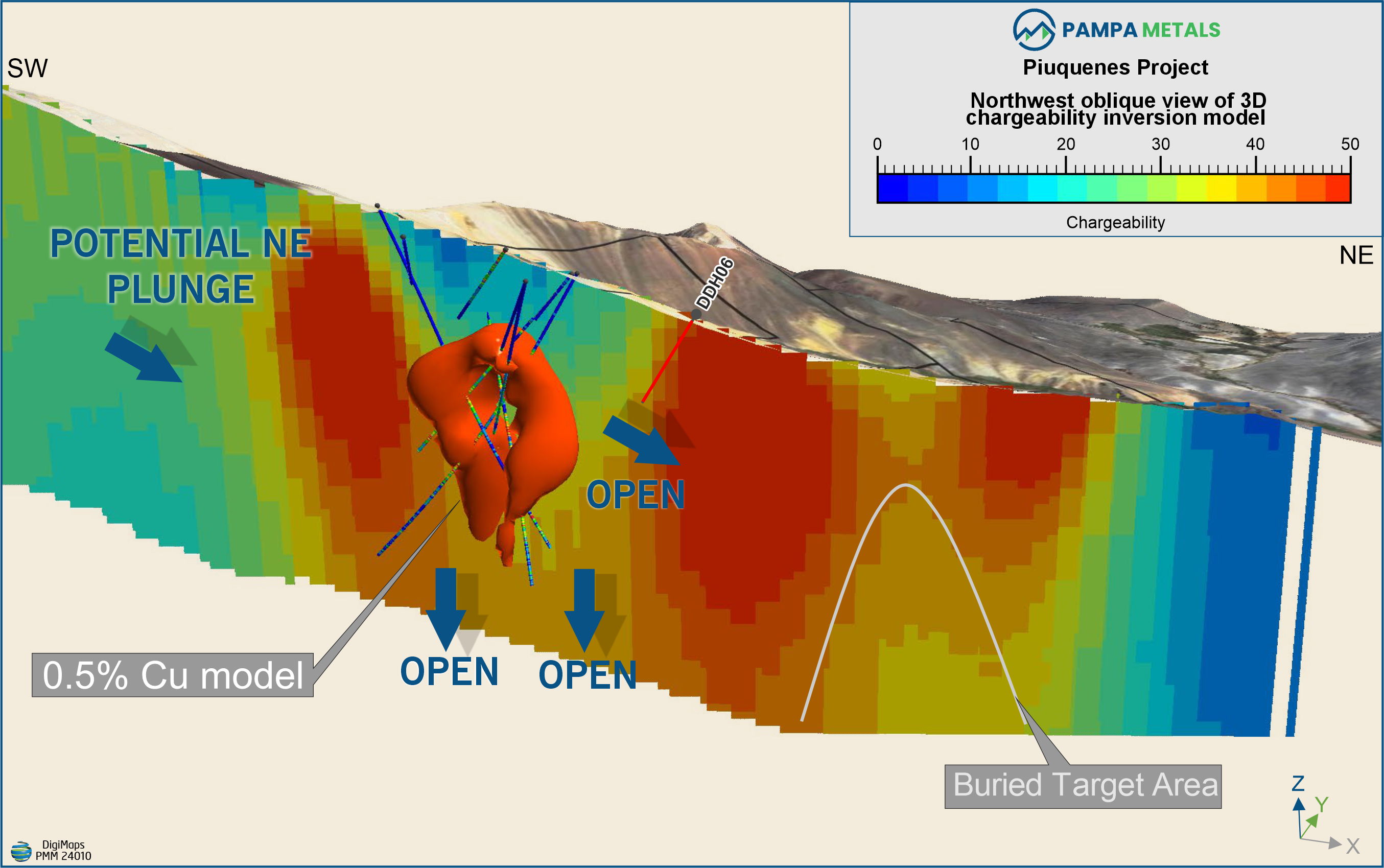

Chargeability data suggests a northeast trend to the Piuquenes system (refer Figures 1 & 4)

Piuquenes Central is marked by a prominent annular chargeability anomaly, with the highest chargeability zones peripheral to the currently defined mineralization (refer Figure 4), consistent with a peripheral pyritic zone associated with not yet well defined phyllic alteration.

The mineralized zone at Piuquenes Central is also defined by a moderate chargeability zone (refer Figure 4) interpreted to be associated with the low pyrite, high chalcopyrite mineralized core of the system.

A similar, although buried, chargeability feature is evident in the 3D inversion models along the north-east Piuquenes Central trend (refer Figure 1). This is considered a highly promising target for a separate mineralized center.

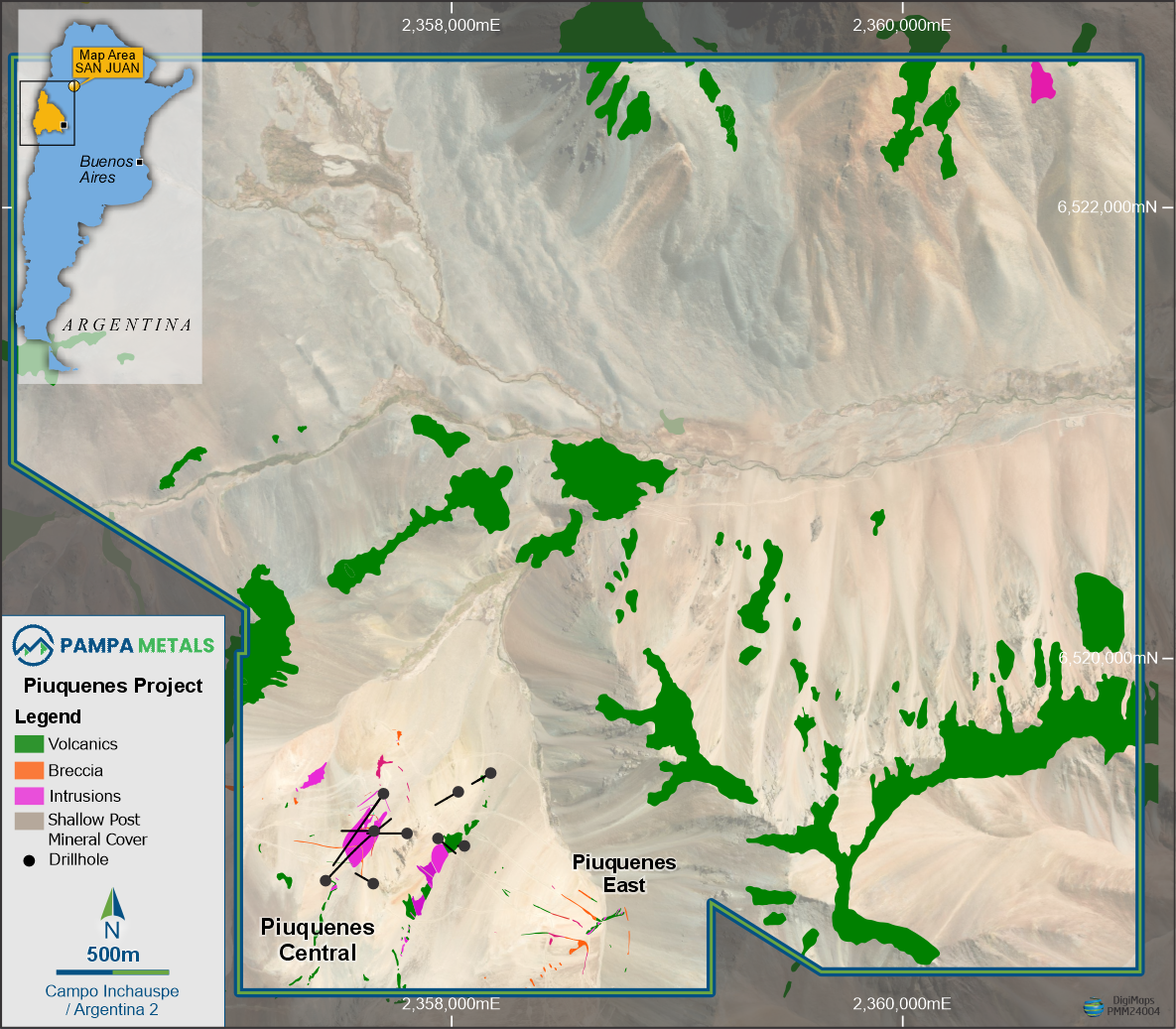

The Piuquenes Central area is also defined by a central resistivity high, with the Piuquenes East target displaying a similar scale anomaly (refer Figure 3).

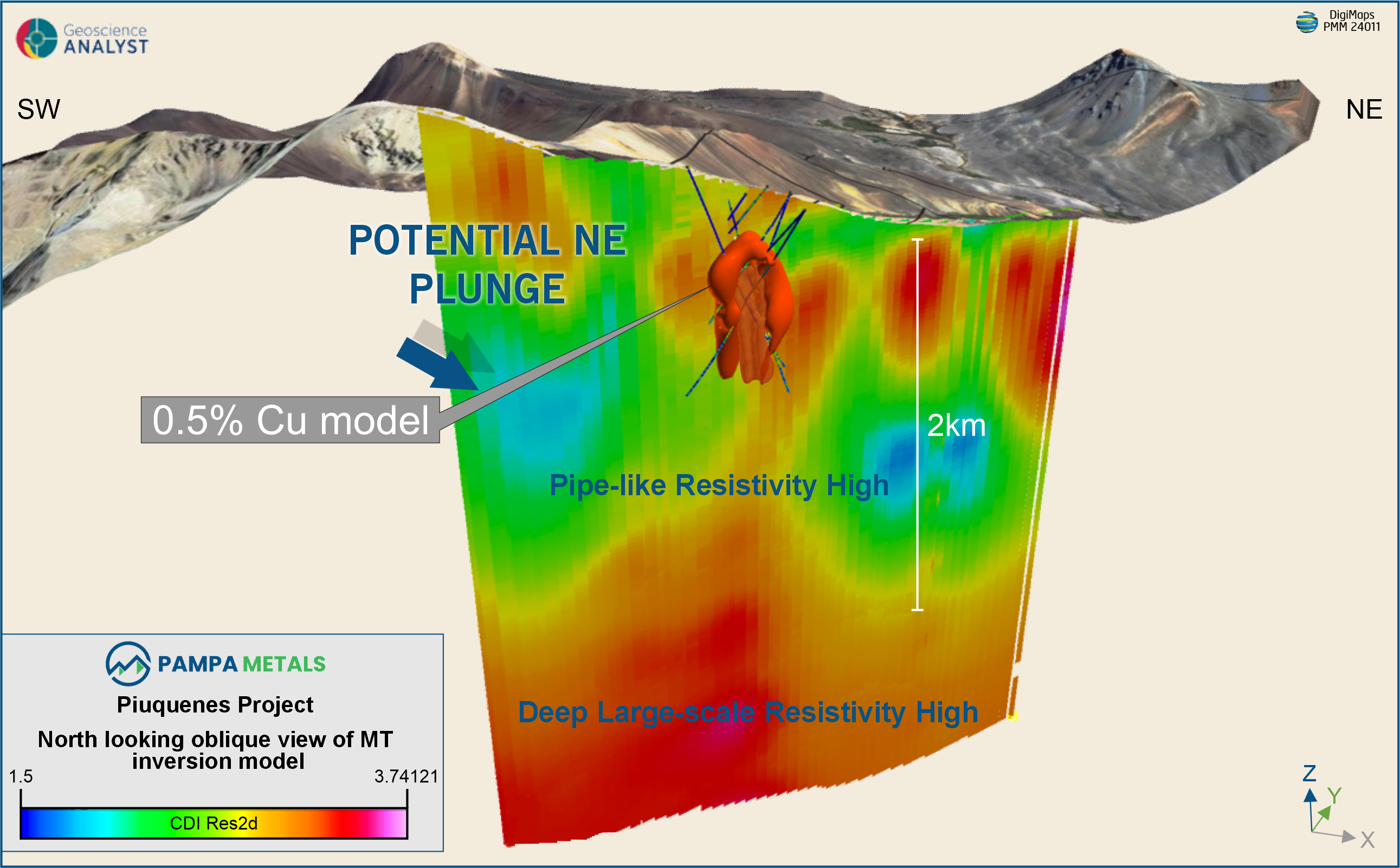

The Piuquenes Central porphyry is well defined by the deep looking Magneto-Telluric data as a pipe-like zone of high resistivity extending upward from a large, high-resistivity feature (refer Figure 2):

It is tentatively interpreted that the deep resistivity feature could represent an underlying large-scale intrusion and the pipe-like high-resistivity feature the mineralized porphyry complex extending upward from that deep intrusion

The currently defined mineralized zone at Piuquenes Central occurs on the margin of the pipe-like resistivity feature; the other margin of the high features and several other similar responses in the 3D inversion model remain untested

This clear definition of the Piuquenes Central and Piuquenes East systems by IP, resistivity and MT data implies that electrical geophysics will be an extremely useful first pass targeting tool for additional porphyry centres within the broader Piuquenes tenement package. Outside the Piuquenes Central - Piuquenes East area, most of the tenement package has not been subject to electrical geophysics (refer Figures 3, 4 & 5).

Figure 1: Chargeability Inversion Model - Potential NE Plunge & Buried Target Area

Figure 2: MT Inversion model - Potential NE plunge & large, pipe-like high-resistivity feature.

Current Activities

The Company is finalizing a preliminary 3D geological model, and grade and lithology interpretation of the Piuquenes Central porphyry Cu-Au deposit.

The Company also continues to integrate historical geophysical datasets, including the recently recovered ground magnetic data currently being modelled.

Targeting and planning for the 2024/25 field season is nearing completion and will include further drill evaluation at Piuquenes Central, where the Company recently reported 801m @ 0.40% Cu, 0.51 g/t Au, 2.87 g/t Ag, including 518m @ 0.53% Cu, 0.73 g/t Au, 3.45 g/t Ag (refer 17 June 2024 News Release). The Initial drill testing of Piuquenes East, field mapping to advance several other nearby targets, and further geophysics (if required) will also form part of the 2024/24 field season program.

Key in-country technical hires are anticipated in the short-term.

Figure 3: Central resistivity high - Piuquenes Central and Piuquenes East target

Joseph van den Elsen, Pampa Metals President and CEO commented: "The integration and interpretation of historic electrical geophysical data has further validated the Piuquenes project as a Company making asset. High-grade copper and gold remain open at Piuquenes Central, with an apparent north-east trend evident, and Piuquenes East represents a standalone, undrilled, outcropping porphyry target. We are now focused on the integration of the recently recovered magnetic survey and finalization of our 3D model, in order to more fully define approaches and targets for the upcoming 2024-25 field season. During this field season, we will delineate the size and grade potential of the first deposit, concurrently drill test Piuquenes East, and further explore the potential for a cluster of deposits through surface exploration and possibly geophysics."

Figure 4: Prominent annular chargeability anomaly, highest zones peripheral to currently defined mineralization

Figure 5: Piuquenes Project Tenure

ON BEHALF OF THE BOARD & INVESTOR CONTACT

Joseph van den Elsen | President & CEO I Joseph@pampametals.com

ABOUT PAMPA METALS

Pampa Metals is a copper-gold exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE: FIR), and OTC (OTCQB: PMMCF) exchanges.

In November 2023, the Company announced it had entered into an Option and Joint Venture Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina.

Qualified Person

Technical information in this news release has been approved by Mario Orrego G. Mr. Orrego G. is a Geologist, a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego G. is a consultant to the Company.

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View the original press release on accesswire.com