NEW YORK CITY, NY / ACCESSWIRE / September 12, 2024 / The Horizon Kinetics Inflation Beneficiaries ETF (NYSE:INFL) will host an Investor Update Call on September 19th, 2024 at 11am Eastern Time. INFL was launched in January 2021 and has navigated various inflation, interest rate and economic regimes with compounded returns of 12.65% per annum (as of July 31, 2024), including positive returns in every calendar year.

The "capital light, hard asset" companies emphasized by the Fund are uniquely able to generate strong cash flows throughout market cycles. Despite the recent moderation in inflation, U.S. price levels are over 21% higher than at the end of 2019, and annual inflation is still rising nearly 3%. This is a distinctly different investment regime as compared to the previous decade and will likely require differentiated investment solutions. INFL focuses on quality real asset businesses, that are trading at attractive valuations, that are positively positioned for such a market regime.

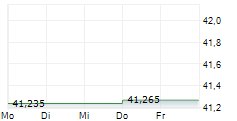

As of July 31, 2024 | YTD | 1 Year | 3 Year | Since | YTD 2021 | 2022 | 2023 |

INFL (Market) | 16.11 | 14.49 | 7.93 | 12.65 | 26.96 | 2.64 | 1.62 |

INFL (NAV) | 16.10 | 14.61 | 7.99 | 12.70 | 26.98 | 2.57 | 1.86 |

Inception date: Jan 11, 2021

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to most recent month end please call 646-495-7333.

James Davolos, co-portfolio manager of INFL, will share market observations, portfolio positioning and outlook. Mr. Davolos is a portfolio manager and research analyst at Horizon Kinetics and serves as Lead Portfolio Manager for the Inflation Beneficiaries ETF (INFL), while co-managing several private funds and institutional separate accounts. Mr. Davolos has 19 years of investment experience.

In order to attend the webinar, please click on the link below to register. The event can be accessed both online and by phone. By registering in advance of the session, you will receive a confirmation email with login access information and a calendar invite. Individuals attending the webinar online will have the opportunity to ask questions following the presentation. The webinar will be available for replay following the meeting.

Date: September 19, 2024 at 11am EST

Online webinar: REGISTER HERE

Phone Access: (415) 655-0060 Audio Access Code: 912-897-873

For further information on the Horizon Kinetics Inflation Beneficiaries ETF please visit the Fund's website at https://horizonkinetics.com/products/etf/infl/ or contact INFL@horizonkinetics.com.

About Horizon Kinetics LLC

Horizon Kinetics LLC is the parent holding company of one SEC-registered investment advisory subsidiary: Horizon Kinetics Asset Management LLC, and two limited purpose broker dealers: Kinetics Funds Distributor, LLC and KBD Securities, LLC, which are SEC-registered and members of FINRA. Horizon Kinetics LLC is a wholly owned subsidiary of an OTC Pink listed parent company, Horizon Kinetics Holding Corporation (Ticker: HKHC).

Horizon Kinetics is an owner-operated investment boutique that adheres to a research-driven, long-term, contrarian, fundamental value investment philosophy that the founders established more than 30 years ago at Bankers Trust Company. Horizon Kinetics has over 70 employees and has primary offices in New York City and White Plains, New York. For more information about Horizon Kinetics, visit www.horizonkinetics.com

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory prospectus and summary prospectus by contacting 646-495-7333. Read it carefully before investing.

To access the Top 10 Holdings for INFL, please click here: INFL Top 10 Holdings

To access the Prospectus for INFL, please click here: INFL Prospectus

To access INFL Performance, please click here: INFL Performance

To access INFL Gross Expense Ratio, please click here: INFL Expense Ratio

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The Fund's investments in securities linked to real assets involve significant risks, including financial, operating, and competitive risks. Investments in securities linked to real assets expose the Fund to potentially adverse macroeconomic conditions, such as a rise in interest rates or a downturn in the economy in which the asset is located. The Fund may invest in the securities of smaller and mid-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The fund is actively managed and may be affected by the investment adviser's security selections. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets.

The Horizon Kinetics Inflation Beneficiaries ETF (INFL) is distributed by Foreside Fund Services, LLC ("Foreside").

SOURCE: Horizon Kinetics Inflation Beneficiaries ETF

View the original press release on accesswire.com