Highlights

Historic Resource Estimate is of up to 2.9Mlbs U3O8 within 300-500 feet of the surface1.

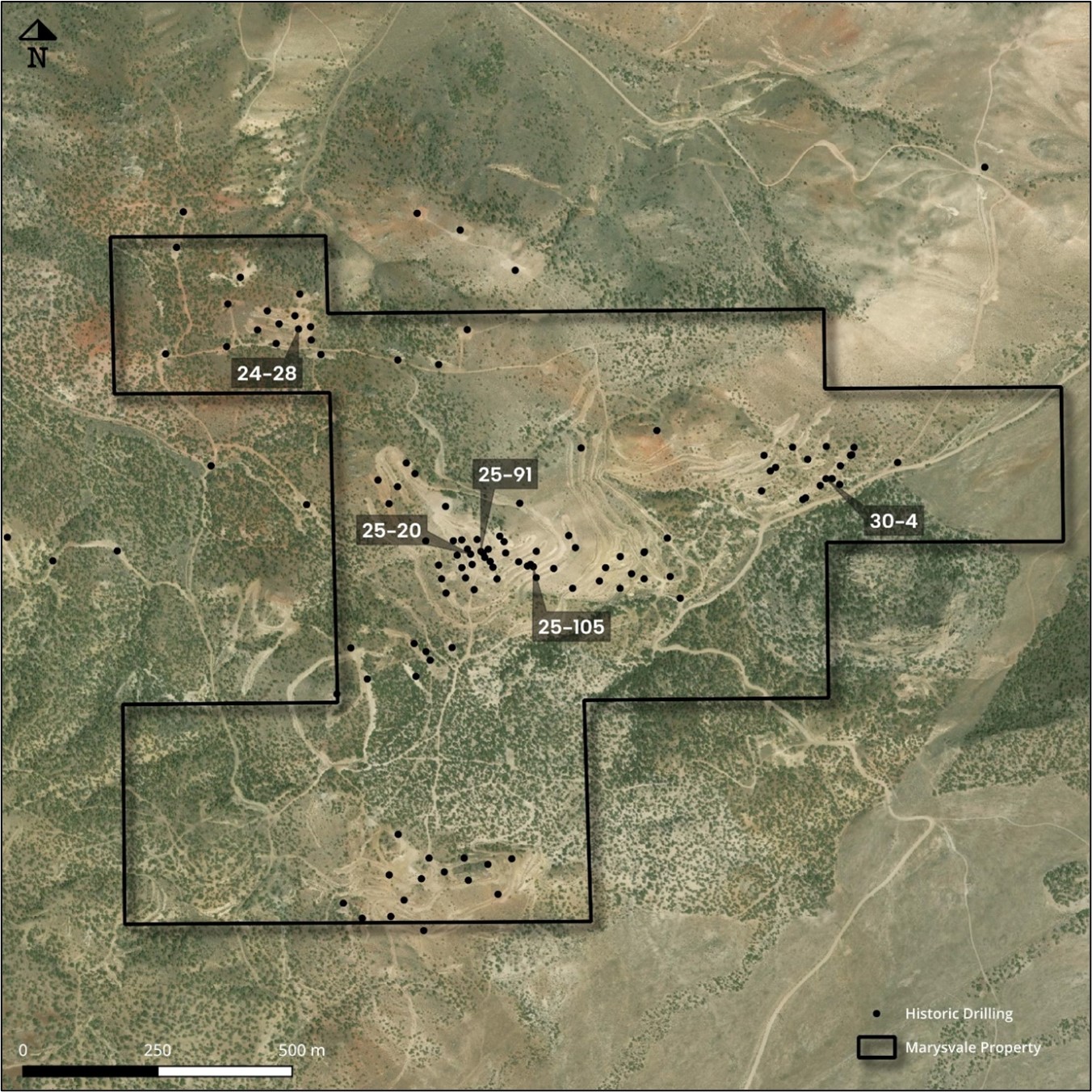

Historic Drilling of 115 holes (102 by Phillips Minerals in the 1970s, 13 by Trigon Exploration in 2007).

Potential to double or triple historic estimate.

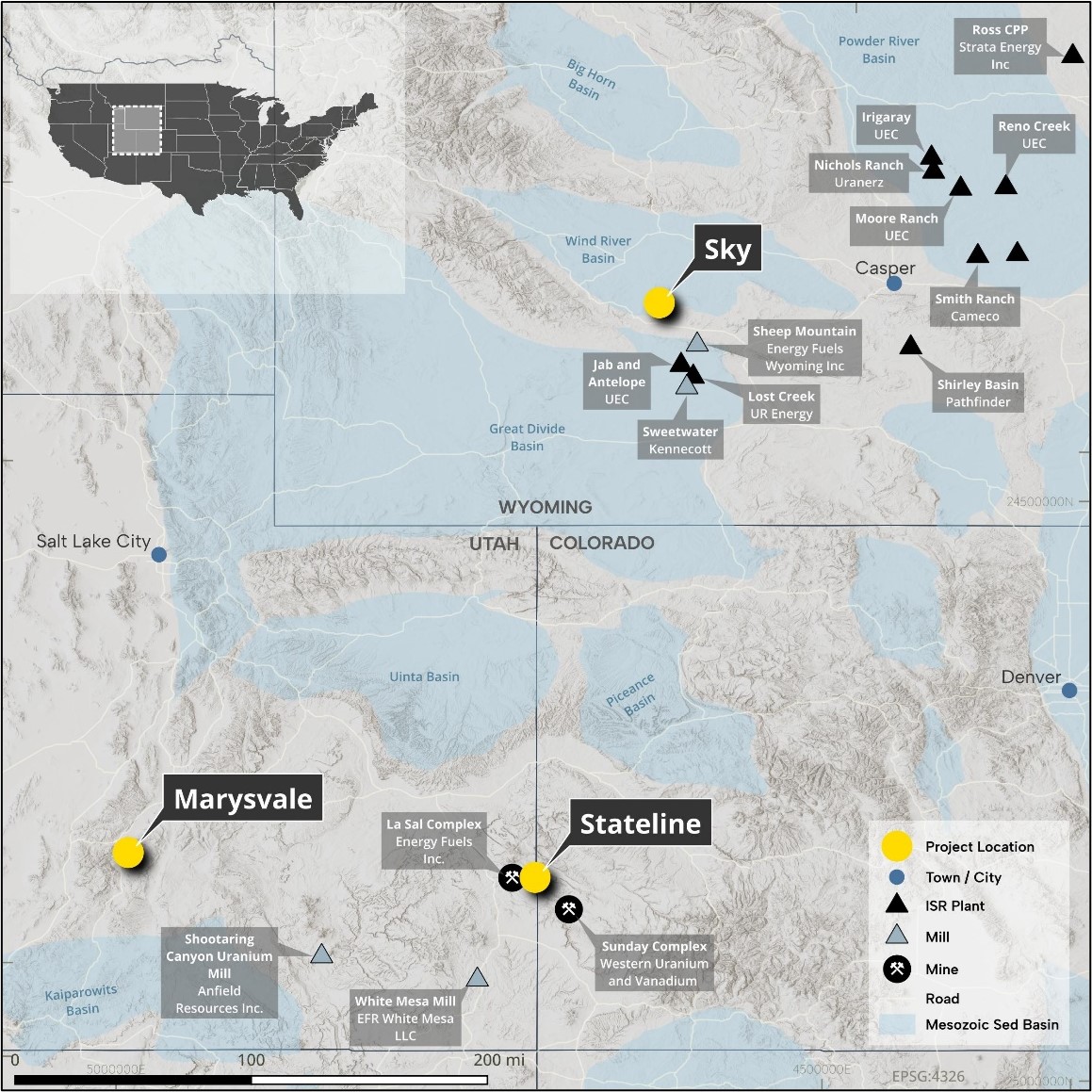

WOODLAND HILLS, CA / ACCESSWIRE / September 12, 2024 / TONOGOLD Resources Inc. (OTC PINK:TNGL) ("TONOGOLD" or the "Company") and its merger partner, JAG Minerals USA, Inc are pleased to provide an update on the historic resource estimates for their Marysvale Project, Southwestern Utah. This news release provides a detailed summary of the historic data and the future potential.

1 Proctor, P.D. (pre-2000). Private Report on the Marysvale Uranium Project. (Referenced in the NI 43-101 report by Havenstrite and Hardy, 2006)

Project Background

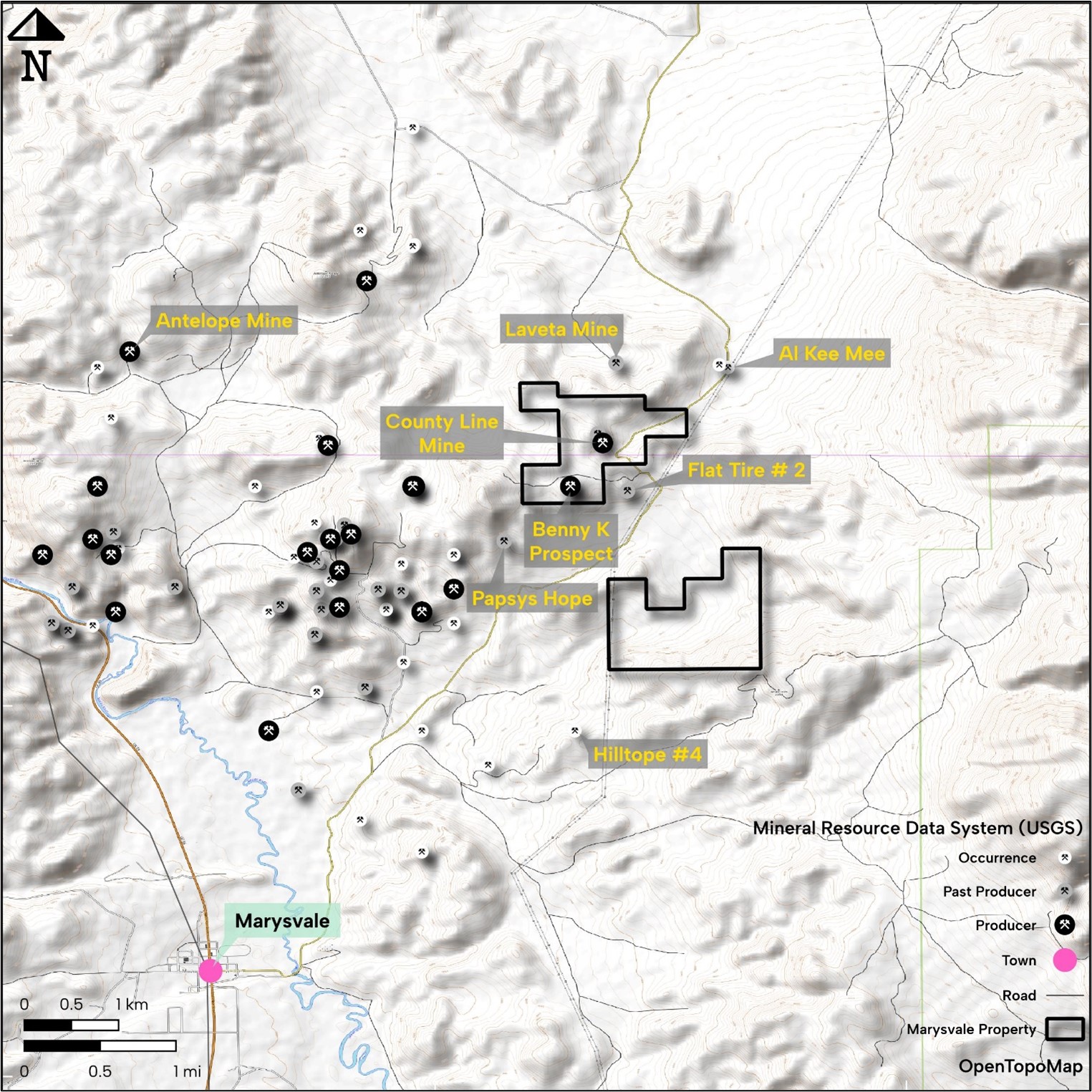

The Marysvale Mining District, located in Southwestern Utah, has a rich history of exploration and production. The Company currently holds 20 lode mining claims in this district, strategically positioned adjacent to the historic Central Mining Area. This area produced an estimated 1.39 million lbs. of U3O8 at an average grade of 0.22% from more than 10 mines between 1949 and 19662.

2 Geology and uranium-vanadium deposits of the La Sal quadrangle, San Juan County, Utah, and Montrose County, Colorado, Carter, W.D., and Gualtieri, J.L. USGS, PP 508, 1965

Historic Drilling

The Marysvale Mining District has a rich history of exploration:

Phillips Minerals (1970s): Conducted 102 drill holes across the district, providing substantial initial data on the mineralization.

Trigon Exploration (2007): Added 13 drill holes, which confirmed and expanded upon the data collected by Phillips Minerals.

Notable Drill Intercepts:

Hole 24-91: 88.0 ft @ 0.07% eU3O8 (equivalent U3O8)

Hole 24-105: 47.5 ft @ 0.13% eU3O8

Hole 24-28: 64.5 ft @ 0.09% eU3O8

Hole 24-20: 45.5 ft @ 0.12% eU3O8

Hole 30-4: 56.0 ft @ 0.07% eU3O8

Historic Resource Estimate

The Proctor Report, prepared by Paul Dean Proctor, PhD., a professor of geology at Brigham Young University, provides a historical estimate of uranium reserves at the Marysvale Project based on drilling conducted by Phillips Uranium Company in the late 1970s and early 1980s. Although this estimate predates National Instrument 43-101 standards and current US SEC Regulation S-K reporting standard and is not compliant with modern requirements, it offers valuable insights into the potential size and grade of uranium deposits at the site.

Historical Estimate of Uranium Reserves

Total Estimated Reserves: At least 2.9 million lbs. U3O8.

Grade and Tonnage:

0.75 million tons at 0.075% U3O8 (1.125 million lbs. U3O8).

3.0 million tons at 0.03% U3O8 (1.8 million lbs. U3O8).

Depth: Mineralization occurs within 300-500 feet of the surface.

Potential for Expansion

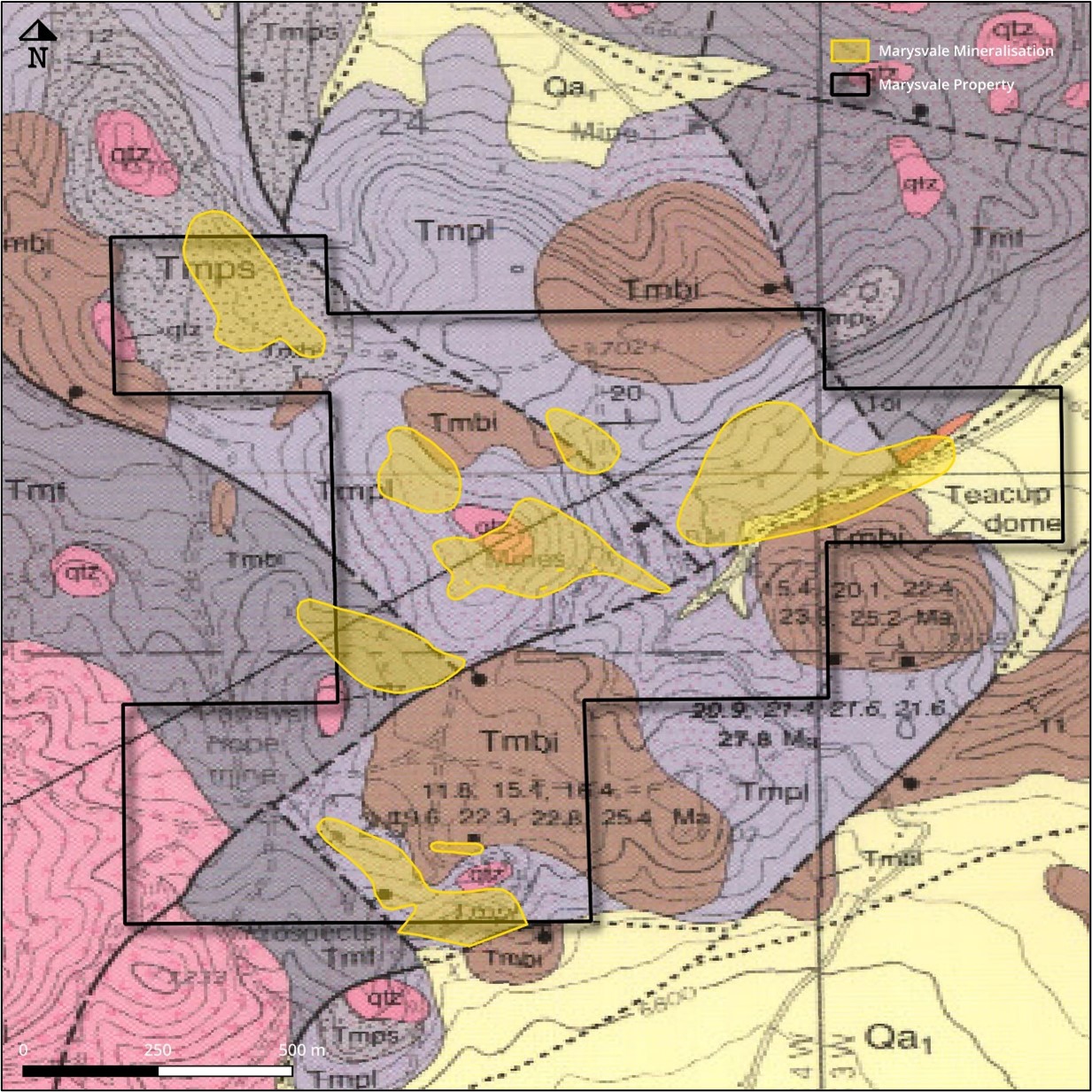

Proctor suggests that additional potential uranium ore exists on the property, which could double or triple the current reserves. This is based on gamma ray (eU) anomalies detected over a large alteration system along a major northwest-trending fault zone.

Drilling Data

The Proctor Report references drill intercepts from Phillips Uranium Company's drilling program, including intervals such as "25 feet of 0.22% and 15 feet of 0.50% U3O8." These intercepts indicate significant primary uranium mineralization below the zone of secondary minerals.

Survey Data

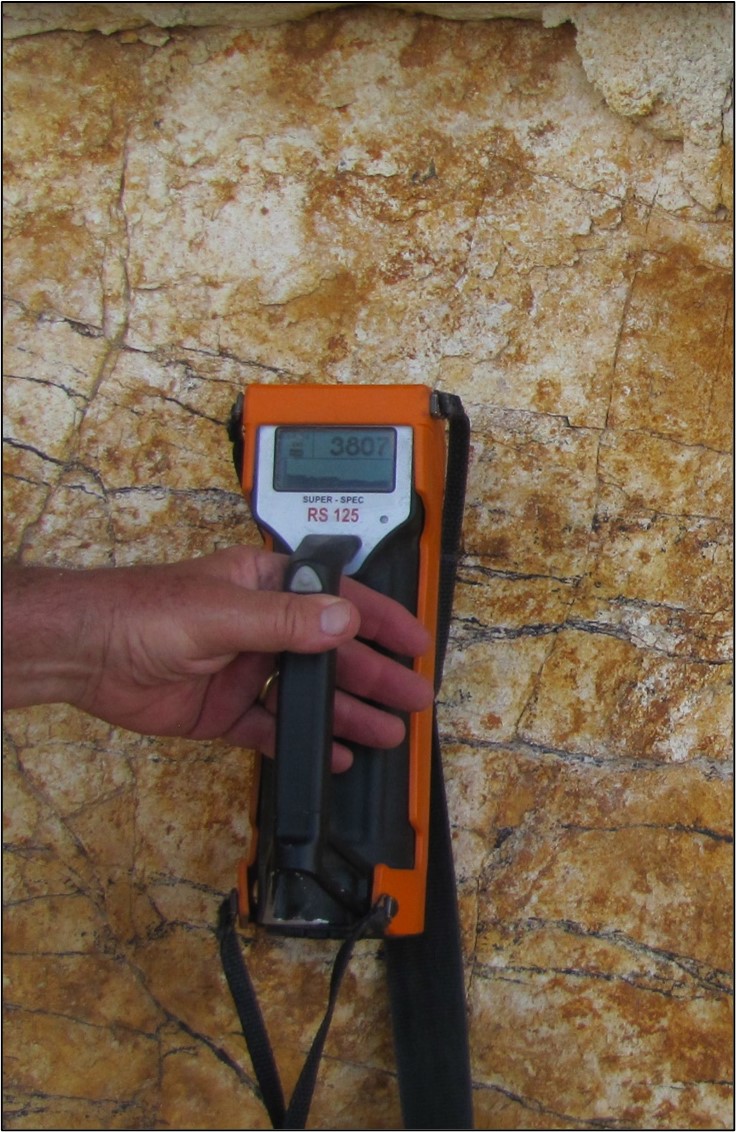

A surface radiometric survey conducted by Phillips in 1981 detected areas of anomalous radiation (>200 counts per second), although the correlation with argillic alteration zones was imperfect. Locations of these anomalies remain unknown, but they indicate potential targets for further exploration.

Conclusion

The Proctor Report provides a detailed historical perspective on the Marysvale Uranium Project, highlighting significant uranium mineralization and the potential for resource expansion. Although the data predates modern standards, it underscores the importance of further exploration to fully realize the property's potential. The Company has not yet independently validated or confirmed the historic resource estimates under current reporting and disclosure standards.

Reference:

Proctor, P.D. (pre-2000). Private Report on the Marysvale Uranium Project. (Referenced in the NI 43-101 report by Havenstrite and Hardy, 2006)?

Geology and Mineralization

Favorable Geology: The property lies within the Cenozoic Marysvale volcanic field, astride the transition zone between the Colorado Plateau and the Great Basin.

Mineralization Depth: Uranium mineralization occurs from the surface to a depth of approximately 500 ft in strongly clay-altered rhyolitic volcanics.

Structural Control: Mineralization is structurally controlled within fault blocks, making it favorable for both surface and underground mining methods.

Mineralization remains open-ended, suggesting further potential for resource expansion.

Future Plan

Enhance the project's value by advancing the understanding and resource base through targeted drilling and gamma logging of 15-20 holes with geochemical analysis to define disequilibrium and test extensions. Update the NI 43-101 Technical Report with these findings, and strategically focus exploration efforts on delineating and expanding the known mineral inventory, emphasizing bulk tonnage supergene deposits and higher-grade vein deposits.

TONOGOLD CEO William Hunter stated: "During the 2023 geological field season JAG Minerals USA, Inc. was active in expanding its Uranium and Vanadium claims in Wyoming, Utah and Colorado. Specifically focused on claims that have detailed historic Uranium data and / or published resources open for potential expansion. Further, the areas need access to mills to process the mined Uranium products. This development is very positive to the combined Company and will be very positive for the Company in the recently announced transaction JAG Minerals USA, Inc.

Disclaimer Regarding Historic Estimates

The historical resource estimates provided in this release are based on data obtained and prepared by previous operators and have not been verified by either the Company or a qualified person as defined by NI 43-101 or in US SEC Regulation S-K and the rules promulgated thereunder regarding the reporting of historical resource estimates. These estimates are considered historical and do not conform to current NI 43-101 standards or to current US SEC reporting standards. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves, and the Company is not treating these historical estimates as current mineral resources or mineral reserves. Further work, including drilling and analysis, is required to verify these historical estimates and upgrade them to meet NI 43-101 standards and current US SEC reporting standards.

This estimate was made prior to implementation of National Instrument 43-101 standards and prior to the implementation of current US SEC Regulation S-K and related reporting standards, and does not qualify as a resource or reserve, and thus, the historical estimate should not be relied upon.

Qualified person

Mr Andrew Hawker, BSc. Geol, MAIG, is a member of the Australasian Institute Geoscientists, is a consultant to JAG Minerals USA, Inc. and is a Qualified Person as defined in National Instrument 43-101. Mr Hawker is in charge of exploration programs and has reviewed and approved the technical information contained in this news release.

Enquiries

For further information, please contact:

William Hunter

Interim CEO Tonogold Resources Inc

M: +1 203 856 7285

E: bhunter@tonogold.com

SOURCE: Tonogold Resources, Inc.

View the original press release on accesswire.com