The transaction marks the eighth urological transaction for PGP in just the last four years, highlighting the firm's continued dedication to being the leading advisor and advocate for independent urologists as they evaluate private equity and strategic partnerships

BOSTON, MA / ACCESSWIRE / September 16, 2024 / Physician Growth Partners ("PGP") is pleased to have advised Lancaster, PA-based Keystone Urology Specialists ("KUS"), a leading comprehensive urology practice, in its partnership with Solaris Health (backed by Lee Equity).

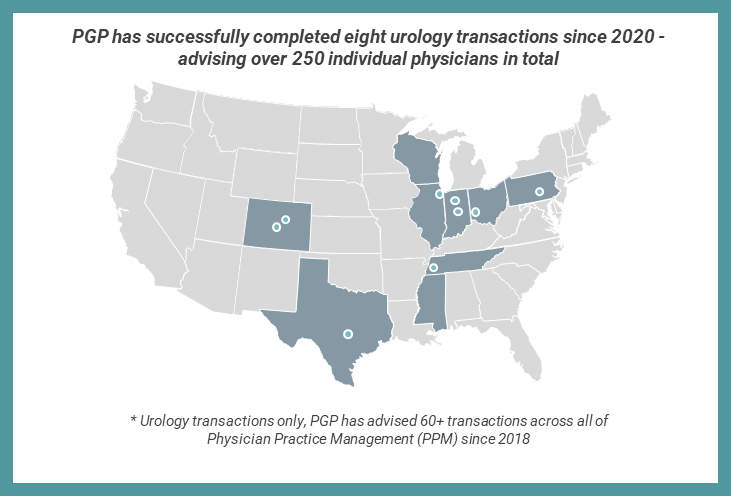

PGP served as the exclusive transaction advisor to Keystone Urology Specialists in its evaluation, negotiation, and execution of this partnership. The transaction marks the eighth urological transaction for PGP in just the last four years, highlighting the firm's continued dedication to being the leading advisor and advocate for independent urologists as they evaluate private equity and strategic partnerships.

PGP's most recent client, Keystone Urology Specialists, was established over 55 years ago and has grown into the leading urology practice in the Lancaster, Pennsylvania area with 17 providers, four clinic locations, an ASC, and a full suite of surgical, medical, and ancillary urological services. Keystone will utilize its newly consummated partnership with Solaris to strengthen its market position, bolster back-office support, and facilitate the addition of ancillary service offerings. Leveraging Keystone's existing regional dominance and clinical reputation, Solaris will continue to support the practice's focus on providing best-in-class care while enhancing provider recruitment, acquisition opportunities and supplemental growth initiatives in Central Pennsylvania. This partnership will also lead to greater access to innovative and industry leading technology and care for patients and citizens of Central Pennsylvania.

"The team at Keystone Urology Specialists is very excited to join Solaris Health and work together to continue delivering exceptional patient care. Solaris represents our ideal partner as a leading national platform that shares our priorities of patient focus and advanced treatments," stated Dr Mark Hockenberry, physician and shareholder at KUS. "We are grateful to Physician Growth Partners and their team, who were integral in facilitating the creation of this partnership."

PGP Partner and Managing Director, Robert Aprill said, "Keystone Urology's partnership with Solaris enables the practice to maintain its excellent, longstanding clinical reputation in the Lancaster market while continuing to execute on additional levers for growth and innovation. Surviving as an independent urology practice has never been harder; Keystone's alignment with other leading independent urology practices under the Solaris umbrella solidifies the future of independent urology in Central Pennsylvania. PGP is honored to have helped the physicians at KUS navigate this very important decision and stepping stone for their practice."

Aprill continued, "At PGP, we firmly believe that, when structured effectively, private equity can be a powerful tool for physician groups to preserve their independence and navigate the evolving healthcare landscape. With increasing costs and greater leverage held by payors and hospitals, it is more important than ever for practices to take control of their future. Partnering with the right private equity firm to invest in new technologies, service lines, and infrastructure-while also capitalizing on economies of scale-is vital for sustaining the independence of medical practices.."

About Physician Growth Partners

Physician Growth Partners is recognized nationally as a leading healthcare investment bank representing independent physician groups in transactions with private equity and strategic partners across all medical specialties. PGP advocates for doctors to achieve the most favorable economic outcome while retaining a significant level of control in their transactions. PGP has advised more than 60 practices in successful transactions with private equity and strategic partners.

For more information about Physician Growth Partners, please visit www.physiciangrowthpartners.com or contact us at press@physiciangrowthpartners.com.

432 N. Clark Street, Ste. 200, Chicago, IL 60654

SOURCE: Physician Growth Partners

View the original press release on accesswire.com