Quantum Blockchain Technologies Plc - Interim Results

PR Newswire

LONDON, United Kingdom, September 23

23 September 2024

Quantum Blockchain Technologies plc

("QBT", "the Group" or "the Company")

INTERIM RESULTS

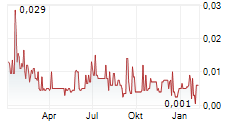

Quantum Blockchain Technologies (AIM: QBT), the AIM-listed investment company focusing on a R&D and investment programme within blockchain technology, is pleased to announce its Interim Results for the six months ended 30 June 2024.

For further information please contact:

Quantum Blockchain Technologies Plc

Francesco Gardin, CEO and Executive Chairman +39 335 296573

SP Angel Corporate Finance (Nominated Adviser & Broker)

Jeff Keating, John Mackay +44 (0)20 3470 0470

Leander (Financial PR)

Christian Taylor-Wilkinson +44 (0) 7795 168 157

About Quantum Blockchain Technologies Plc

QBT (AIM: QBT) is a London Stock Exchange AIM listed Research & Development and investing company focused on an intensive R&D programme to disrupt the Blockchain Technologies sector, and which includes, cryptocurrency mining and other advanced blockchain applications. The primary goal of the R&D programme is to develop Bitcoin mining tools and techniques, via its technology-driven approach, which the Company believes will significantly outperform existing market practices.

Chairman's Statement

During the first half of 2024, QBT continued to focus its efforts on developing the first commercial Bitcoin mining products and services that utilises its intensive R&D programme.

R&D

The R&D programme has achieved several positive milestones so far:

-Asic UltraBoost: Designed to improve Bitcoin mining by eliminating redundant computations in a key part of the mining algorithm, resulting in faster and more efficient operations. A patent application has been filed with patent offices in the UK and the EU (which also covers the UK), as well as the USA, Canada, Australia and South Korea.

-Asic Enhanced Boost: An optimised approach to SHA-256 computation for Bitcoin mining that enables partial pre-computation of future blockchain blocks. A patent application has also been submitted to the UK and EU patent offices.

-Quantum Mining: A quantum version of the Bitcoin mining algorithm that utilises qubit-based quantum computation and quantum logic gates. A patent application for this is being drafted and expected to be filed as soon as practicable in jurisdictions to be determined.

-Method A: A Machine Learning ("ML") based approach aimed at reducing the SHA-256 search space compared to the brute-force method used in Bitcoin mining currently.

-Method B: Another innovation leveraging ML and statistical optimisation to reduce the SHA-256 search space, but with a fundamentally different approach than Method A.

-Method C: An AI Oracle developed by the R&D Machine Learning team to assess in real-time the likelihood that an input to SHA-256 will generate a winning hash. A patent application is under consideration.

Company Objectives:

The Company's short-term goal is to develop commercial products and services from the above R&D activities, prioritising Methods A, B and C. The longer-term goals are to develop an in-house ASIC chip for Bitcoin mining as well as a quantum computing based miner.

Current Developments:

Currently, the Company is testing Methods A and B through pool-based live mining. These tests are being conducted in order to assess the improved performance of commercial ASIC chips when these chips are controlled by the two Methods. Significantly, the two Methods can be applied to existing ASIC-based mining machines simply as a client-server software upgrade. QBT's recent software switch from CG Miner to ESP-miner is expected to assist and facilitate the testing programme. If the results of the live testing are successful, Method A and B could thereafter be made available as SaaS products.

Method C, which requires its integration at chip-level, is undergoing real time mining tests using slower FPGA chips on historic blockchain blocks. This provides the Company with a Bitcoin mining difficulty compatible with the hashing power of available FPGAs in order to allow the team to understand the chip mapping process for the purpose of scaling up towards commercial ASIC integration.

Should any of the tests confirm the R&D team's findings, the Company may consider potential partnerships with either miners or chip manufacturers to quickly deploy Method A and Method B on ASIC Mining Machines and Method C on an ASIC chip. In preparation for this eventuality, QBT has already initiated high-level discussions with key industry players.

QBT's longer-term strategy of using its Quantum Mining Algorithm still requires more advanced quantum computing power than is currently available, so the Company will review this project in 2025.

QBT's previously announced project to build in-house its own Bitcoin mining chip. This is anticipated to commence once the relevant patents have been granted. As previously stated, the chip will be based on a large format ASIC and, while it will not be competitive in the market, it will serve as a demonstrator model for the major Bitcoin miners serving to prove the disruptive nature of QBT's enhancements. A second option under consideration whereby the Company may exploit its patents (once granted) would be to partner with a chip designer and, through a licensing arrangement share QBT's patented Method C intellectual property. This second option is less capital intensive than QBT manufacturing its own chips but the Company also anticipates that such an approach would be expected to reduce future revenue.

Conclusion

Despite the slower than anticipated progress with the results from the R&D programme, which should not be considered unexpected given QBT's stated objectives, the Company firmly believes in the results it has obtained so far and it is working diligently to complete all the necessary testing in order to launch one or more Bitcoin products.

Legacy Assets

The board believes that its legal matters are moving closer to a positive resolution.

The Company continues its court action against the former management and statutory committee of Sipiem Srl In Liquidazione ("Sipiem"). The claim is being conducted by QBT's wholly owned subsidiary, Clear Leisure 2017 Ltd ("CL17").

In April 2024, CL17 reached an agreement with certain of the Sipiem jointly liable defendants with an agreement to settle these defendants' liabilities for €700,000 (this amount, net of costs, was received by CL17). CL17 also secured the right to 30% of any future sums recovered through the litigation by acquiring the Sipiem Receiver's rights for €170,000. The intention was to provide CL17 with damages already received (€700,000) as well as maximise eventual receipt of those damages QBT hopes to recover pursuant to the 2022 judgment of the trial court in CL17's favour (the remaining €5.575 million plus interest and inflation adjustments - together with the damages already received, the "Settlement"). The Settlement, however, was itself subject to the approval of trial court in Venice being granted prior to the Venice Court of Appeal making a ruling on the appeal of the 2022 judgment filed by the defendants.

This sequence of events did not occur as foreseen in the Settlement, however, for in June 2024, the Venice Court of Appeal issued its appeal judgement upholding the 2022 ruling in favour of CL17, with a minor exception of certain items of damages that were judged as awarded on inadequate grounds amounting to €105,412,19 while confirming the award of €6,083,562 (plus interest and inflation adjustments) in damages, along with overall €134,176 in legal fees accrued since the start of legal proceedings. Since, however, the Appeals court's decision was issued before the trial court's approval of the Settlement, the terms of the Settlement were not confirmed.

The Company is currently reviewing the situation with its legal team but retains the funds received to date, less the €170,000 payment to the Sipiem Receiver. Discussions are ongoing with all relevant parties to assess the legal and contractual implications of the voided Settlement.

In other litigation activity, the Company continues to also pursue its claim against the former management of Sosushi Srl, amounting to approximately €1 million. The matter is subject to arbitration and although the arbitration process has stalled, QBT intends to relaunch it soon.

Regarding QBT's investee companies, the Company is happy to report that in late June 2024 Forcrowd Srl obtained authorisation to extend its crowdfunding licence across all EU jurisdictions. With respect to PBV Monitor Srl (now More Legal Srl), the Company's stake has decreased to approximately 0.45% following a recent fundraising round.

Finally, as announced on 9 January, QBT reached an agreement with MC Strategy S.A., the sole bondholder of its €3.5 million Zero-Coupon Bond issued in 2020, to extend the bond's maturity from 15 December 2024 to 15 December 2026, and to increase the yield on maturity from 1% to 3%. Similarly, bondholders of QBT's Zero-Coupon Bond issued in 2013 agreed to extend the maturity date from 15 December 2024 to 15 December 2026, and to amend the conversion price from £0.05 to £0.03.

Financial Review

The Group reported a total comprehensive loss for the period of €1.3 million (30 June 2023: loss €1.4m). The operating loss for the period was €1.1 million (30 June 2023: operating loss €1.2m). There were no charges relating to the recognition of share options within administrative expenses (2023: €370,000) however, within finance costs there are charges for the revaluation of derivatives totaling €231,000 (2023: €142,000). The difference of these items is strictly dependent on the volatility of the Company's share price during the first half of 2024, used for the calculation according to the relevant accounting standards.

At 30 June 2024, the Group is in a net liabilities position of €3.5 million, compared to a net liabilities position of €2.6 million at 31 December 2023. The Group is also at a net current assets position of €3.8m compared to net current liabilities of €3.1m at 31 December 2023.

The Company's cash position at the period end was €1.6m, compared to €2m at 31 December 2023.

Post 30 June 2024 Events

In August 2024 the Company announced that, with regards to the porting of the Methods to existing commercial ASIC-based, it decided to migrate away from CGMiner to AxeOS (ESP-miner), a more recently developed and, in the Company's opinion, a better designed public domain operating system software for Bitcoin mining devices.

In September 2024, the QBT announced the appointment of Mr. Jose Rios as Strategic Adviser Mr. Rios is the former General Manager of Blockchain and Business Solutions in the Accelerated Computing Systems and Graphics Group at Intel Corp, where he spent 25 years. He was instrumental in the Blockscale ASIC project - Intel's dedicated chip for Bitcoin mining - and he brings extensive expertise in ASIC chip design, production and proprietary architecture development to QBT.

Outlook

The Board remains committed to return value to its shareholders by:

- continuing to focus on its R&D programme, which is providing promising and consistent results;

- investing in the technology sector (both in a direct and an indirect manner);

- managing the Legacy Assets portfolio, where positive outcomes are expected from the Company's various legal claims; and

- Further reduction of the debt position (if and when the conditions are deemed appropriate).

The Board remains positive as the technology investments are deemed sound and promising in fast growth markets, while the legal claims have strong merit against defendants who are expected to remain solvent, thereby enhancing the prospect of collection of the judgment debts.

Francesco Gardin

Quantum Blockchain Technologies PLC

CEO and Chairman

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD ENDED 30 JUNE 2024

|

Note | Six months to 30 June 2024 | Six months to 30 June 2023 | Year ended31 December 2023 |

|

| (Unaudited) | (Unaudited) | (Audited) |

Continuing operations |

| €'000 | €'000 | €'000 |

Revenue |

| - | - | - |

|

| - | - | - |

Administrative expenses |

| (1,111) | (1,190) | (4,025) |

Other operating income |

| - | 1 | - |

Operating loss |

| (1,111) | (1,189) | (4,025) |

Other gains and losses |

| - | - | 32 |

Share of loss from equity-accounted associates |

| - | - | (59) |

Finance charges |

| (231) | (292) | (296) |

Loss before tax |

| (1,342) | (1,481) | (4,348) |

Taxation |

| - | 42 | 142 |

Loss for the period attributable to owners of the parent |

| (1,342) | (1,439) | (4,206) |

|

|

|

|

|

Other comprehensive income/(loss) |

| - | - | - |

TOTAL COMPREHENSIVE LOSS FOR THE PERIOD ATTRIBUTABLE TO OWNERS OF THE PARENT |

| (1,342) | (1,439) | (4,206) |

Earnings per share: |

|

|

|

|

Basic loss per share (cents) | 3 | (€0.104) | (€0.143) | (€0.382) |

Diluted loss per share (cents) | 3 | (€0.056) | (€0.090) | (€0.256) |

|

|

|

|

|

|

|

|

|

|

GROUP STATEMENTS OF FINANCIAL POSITION

AT 30 JUNE 2024

| Note | As at 30 June 2024 €'000 (Unaudited) | As at 30 June 2023 €'000 (Unaudited)

| As at 31 December 2023 €'000 (Audited) |

Non-current assets |

|

|

|

|

Intangible assets |

| 2 | - | 2 |

Property, plant and equipment |

| 141 | 198 | 169 |

Financial assets at fair value through profit and loss |

| 322 | 689 | 396 |

Investments in equity-accounted associates |

| 7 | 66 | 7 |

Total non-current assets |

| 472 | 953 | 574 |

|

|

|

|

|

Current assets |

|

|

|

|

Trade and other receivables |

| 3,067 | 4,643 | 3,243 |

Cash and cash equivalents |

| 1,584 | 752 | 2,057 |

Total current assets |

| 4,651 | 5,395 | 5,300 |

|

|

|

|

|

Total assets |

| 5,123 | 6,348 | 5,874 |

|

|

|

|

|

Current liabilities |

|

|

|

|

Trade and other payables |

| (744) | (369) | (413) |

Borrowings |

| - | - | (7,451) |

Derivative financial instruments |

| - | - | (459) |

Provisions |

| (98) | (210) | (98) |

Total current liabilities |

| (842) | (579) | (8,421) |

|

|

|

|

|

Net current assets/(liabilities) |

| 3,809 | 4,816 | (3,121) |

|

|

|

|

|

Total assets less current liabilities |

| 4,281 | 5,769 | (2,547) |

|

|

|

|

|

Non-current liabilities |

|

|

|

|

Borrowings |

| (7,079) | (8,286) | - |

Derivative financial instruments |

| (690) | (610) | - |

Total non-current liabilities |

| (7,769) | (8,896) | - |

|

|

|

|

|

Total liabilities |

| (8,611) | (9,475) | (8,421) |

|

|

|

|

|

Net liabilities |

| (3,488) | (3,127) | (2,547) |

Equity |

|

|

|

|

Share capital |

| 9,219 | 8,586 | 9,219 |

Share premium account |

| 54,165 | 51,497 | 54,165 |

Other reserves |

| 14,629 | 14,182 | 14,228 |

Retained losses |

| (81,501) | (77,392) | (80,159) |

Total equity |

| (3,488) | (3,127) | (2,547) |

GROUP AUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2023

Group | Share capital

€'000 | Share premium account €'000 | Other reserves

€'000 | Retained losses

€'000 | Total equity

€'000 |

|

|

|

|

|

|

At 1 January 2023 | 8,378 | 50,541 | 13,812 | (75,953) | (3,222) |

Total comprehensive loss for the year | - | - | - | (4,206) | (4,206) |

Issue of shares | 841 | 3,624 | - | - | 4,465 |

Grant of share options | - | - | 416 | - | 416 |

At 31 December 2023 | 9,219 | 54,165 | 14,228 | (80,159) | (2,547) |

GROUP UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 JUNE 2023

Group | Share capital

€'000 | Share premium account €'000 | Other reserves

€'000 | Retained losses

€'000 | Total equity

€'000 |

|

|

|

|

|

|

At 1 January 2023 | 8,378 | 50,541 | 13,812 | (75,953) | (3,222) |

Total comprehensive loss for the period | - | - | - | (1,439) | (1,439) |

Issue of shares | 208 | 956 | - | - | 1,164 |

Share based payment expense | - | - | 370 | - | 370 |

At 30 June 2023 | 8,586 | 51,497 | 14,182 | (77,392) | (3,127) |

|

|

|

|

|

|

GROUP UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS TO 30 JUNE 2024

Group | Share capital

€'000 | Share premium account €'000 | Other reserves

€'000 | Retained losses

€'000 | Total equity

€'000 |

|

|

|

|

|

|

At 1 January 2024 | 9,219 | 54,165 | 14,228 | (80,159) | (2,547) |

Total comprehensive loss for the period | - | - | - | (1,342) | (1,342) |

Modification of bond | - | - | 401 | - | 401 |

At 30 June 2024 | 9,219 | 54,165 | 14,629 | (81,501) | (3,488) |

|

|

|

|

|

|

GROUP UNAUDITED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2024

|

| Six months to 30 June 2024

(Unaudited) €'000 | Six months to 30 June 2023

(Unaudited) €'000 | Year ended 31 December 2023 (Audited) €'000 |

|

|

|

|

|

Cash used in operations |

|

|

|

|

Loss before tax |

| (1,342) | (1,189) | (4,348) |

Impairment of investments |

| 74 | - | 303 |

Share of post-tax losses of equity accounted associates |

| - | - | 59 |

Non cash foreign exchange movements |

| - | 10 | - |

Finance charges |

| 231 | (142) | 296 |

Depreciation expense |

| 28 | 28 | 55 |

Decrease/(increase) in receivables |

| 176 | (25) | 1,383 |

(Decrease)/increase in payables |

| 331 | 95 | (164) |

Share based payments |

| - | 370 | 416 |

R&D tax credit received |

| - | - | 154 |

Net cash (outflow)/inflow from operating activities |

| (502) | (853) | (1,846) |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Purchase of investments |

| - | (28) | (27) |

Purchase of intangible assets |

| - | - | (2) |

Interest received |

| 29 | 6 | - |

Net cash inflow from investing activities |

| 29 | (22) | (29) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from capital issue |

| - | 1,164 | 3,465 |

Net interest paid |

| - | - | (9) |

Net cash inflow/(outflow) from financing activities |

| - | 1,164 | 3,456 |

|

|

|

| |

Net increase/(decrease) in cash for the period |

| (473) | 289 | 1,581 |

Cash and cash equivalents at beginning of year |

| 2,057 | 463 | 463 |

Exchange differences |

| - | - | 13 |

Cash and cash equivalents at end of period |

| 1,584 | 752 | 2,057 |

NOTES TO THE FINANCIAL STATEMENTS

- General Information

Quantum Blockchain Technologies plc is a company incorporated and domiciled in England and Wales. The Company's ordinary shares are traded on the AIM market of the London Stock Exchange. The address of the registered office is First Floor, 1 Chancery Lane, London, England, WC2A 1LF.

The principal activity of the Group is that of an investment company with a portfolio of companies primarily encompassing the leisure and real estate sectors mainly in Italy and, more recently, technology sectors. The focus of management is to pursue the monetisation of all of the Company's existing assets, through selected realisations, court-led recoveries of misappropriated assets and substantial debt-recovery processes. The Company has also realigned its strategic focus to technology related investments, with special regard to interactive media, blockchain and AI sectors.

2. Accounting policies

The principal accounting policies are summarised below. They have all been applied consistently throughout the period covered by these consolidated financial statements.

Basis of preparation

The interim financial statements of Quantum Blockchain Technologies Plc are unaudited consolidated financial statements for the six months ended 30 June 2024 which have been prepared in accordance with UK adopted international accounting standards. They include unaudited comparatives for the six months ended 30 June 2023 together with audited comparatives for the year ended 31 December 2023.

The interim financial statements do not constitute statutory accounts within the meaning of section 434 of the Companies Act 2006. The statutory accounts for the year ended 31 December 2023 have been reported on by the company's auditors and have been filed with the Registrar of Companies. The report of the auditors was qualified in respect of the valuation of the investment in Geosim Systems Ltd. The report of the auditor also contained an emphasis of matter paragraph in respect of a material uncertainty regarding going concern. Aside from the limitation of scope relating to Geosim Systems Ltd, the auditor's report did not contain any statement under section 498 of the Companies Act 2006.

The interim consolidated financial statements for the six months ended 30 June 2024 have been prepared on the basis of accounting policies expected to be adopted for the year ended 31 December 2024, which are consistent with the year ended 31 December 2023.

Going concern

The Group's activities generated a loss of €1,342,000 (June 2023: €1,439,000) and had net current assets of €3,809,000 as at 30 June 2024 (June 2023: net current assets €4,816,000). The Group's operational existence is still dependent on the ability to raise further funding either through an equity placing on AIM, or through other external sources, to support the on-going working capital requirements.

After making due enquiries, the Directors have formed a judgement that there is a reasonable expectation that the Group can secure further adequate resources to continue in operational existence for the foreseeable future and that adequate arrangements will be in place to enable the settlement of their financial commitments, as and when they fall due.

For this reason, the Directors continue to adopt the going concern basis in preparing the interim accounts. Whilst there are inherent uncertainties in relation to future events, and therefore no certainty over the outcome of the matters described, the Directors consider that, based upon financial projections and dependant on the success of their efforts to complete these activities, the Group will be a going concern for the next twelve months. If it is not possible for the Directors to realise their plans, over which there is significant uncertainty, the carrying value of the assets of the Group is likely to be impaired.

Notwithstanding the above, the Directors note the material uncertainty in relation to the Group being unable to realise its assets and discharge its liabilities in the normal course of business.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company's medium-term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company's 2023 Annual Report and Financial Statements, a copy of which is available on the Company's website:

www.quantumblockchaintechnologies.com. The key financial risks are liquidity and credit risk.

Critical accounting estimates

The preparation of interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the end of the reporting period. Significant items subject to such estimates are set out in note 3 of the Company's 2023 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

3. Loss per share

The basic earnings per share is calculated by dividing the loss attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the period. Diluted earnings per share is computed using the same weighted average number of shares during the period adjusted for the dilutive effect of share options and convertible loans outstanding during the period.

The loss and weighted average number of shares used in the calculation are set out below:

| Six months to 30 June 2024 | Six months to 30 June 2023 | Year to 31 December 2023 | |

| (Unaudited) | (Unaudited) | (Audited) | |

€'000 | €'000 | €'000 | ||

(Loss)/profit attributable to owners of the parent company: |

|

|

| |

Basic earnings | (1,342) | (1,439) | (4,206) | |

Diluted earnings | (1,136) | (1,492) | (4,424) | |

Basic weighted average number of ordinary shares (000's) | 1,291,314 | 1,009,060 | 1,102,309 | |

Diluted weighted average number of ordinary shares (000's) | 2,043,195 | 1,664,647 | 1,727,130 | |

Basic and fully diluted earnings per share: |

|

|

| |

Basic earnings per share | (€0.104) | (€0.143) | (€0.382) |

|

Diluted earnings per share | (€0.056) | (€0.090) | (€0.256) |

|

IAS 33 requires presentation of diluted earnings per share when a company could be called upon to issue shares that would decrease earnings per share or increase net loss per share. No adjustment has been made to diluted earnings per share for out-of-the money options and warrants.

4. Investment Policy

The principal activities of the Company are focused on the R&D programme relating to bitcoin and as an investing company with a portfolio in technology sectors. The main focus of management is to successfully run the R&D programme and release new products to the market. The management is also pursuing the monetisation of all of the Company's Legacy Assets, through selected realisations, court-led recoveries of misappropriated assets and substantial debt recovery processes

5. Copies of Interim Accounts

Copies of the interim results are available at the Group's website at:

www.quantumblockchaintechnologies.co.uk.

Copies may also be obtained from the Group's registered office: Quantum Blockchain Technologies PLC, First Floor, 1 Chancery Lane, London, England, WC2A 1LF.

-ends-