DJ Thalassa Holdings Ltd: 2024 Interim Results

Thalassa Holdings Ltd (THAL)

Thalassa Holdings Ltd: 2024 Interim Results

27-Sep-2024 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Thalassa Holdings Ltd

Thalassa Holdings Ltd

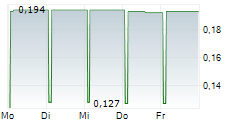

(Reuters: THAL.L, Bloomberg: THAL:LN)

("Thalassa" or the "Company")

Interim Results for the period ended 30 June 2024

The Company is pleased to announce its results for the six months ended 30 June 2024. The unaudited interim results

have been submitted to the FCA and will shortly be available on the Company's website: www.thalassaholdingsltd.com

Highlights for the 6 months ended 30 June 2024

GROUP RESULTS 1H 2024 versus 1H 2023, unless otherwise stated (Unaudited)

. Profit /(loss) after tax for the year GBP0.24m vs (GBP0.53)m

. Group Earnings Per Share (basic and diluted)*1 GBP0.03 vs (GBP0.07)

. Book value per share*2 GBP1.19 vs GBP1.20

. Investment Holdings *3 GBP8.8m vs GBP7.7m

. Cash GBP1.4m vs GBP0.6m

*1 based on weighted average number of shares in issue of 7,945,838 (2023: 7,945,838)

*2 based on actual number of shares in issue as at 30 June 2024 of 7,945,838 (2023: 7,945,838)

*3 including all holdings excl. cash

Chairman's Statement

2024 Observations

-- The US Federal Reserve cut the Fed Funds Rate by 0.5% to 5.0% from 5.5%

-- First US Rate cut for 4 years

-- Dow Jones and S&P hit new highs

-- NASDAQ leads 2024 performance +20% YTD.

-- Through 7 September 2023, the tech-heavy NASDAQ Composite (CCMP) has risen 20%; Notable Mega Caps AAPL+18.87%, NVDA +138.02%, TSLA -1.84% GOOGL +16.07%, META +57.96% EBAY +44.93%, MSFT +16.66%.

-- NVDA's performance alone accounts for 20% of S&P 500 's YTD performance of +19.8%.

-- Buffett Index at an all-time high; Total US Market Value recently @ 200% of US GDP. Next stop infinity!

-- On Aug 30, 2021, the Buffett Index stood at 199.5%, shortly before falling over 30%.

-- A reversion to the Mean from current levels would indicate a possible (porbable) decline of between 30 to50% - assuming no overshoot!

-- US Household Debt at the end of Q2 2024 stood at a record USD17.8 trillion. (Source, New York Fed Aug 6,2024); +505bn from Q2 2023.

-- Over the last year, approximately 9.1% of US credit card balances and 8.0% of US auto loan balancestransitioned into delinquency. (Source, as above).

-- US Federal Debt USD35.4 trillion, 123.44% of GDP.

Holdings -

Restitution -

-- As at the time of writing I have so far covered GBP2,086,00 for the losses incurred by the Company due tothe collapse of Tappit, due wholly, in my opinion, to the incompetence of the Company's Board. I will continue tocontribute funds up to a total of GBP3m.

NWT - https://newmarksecurity.com/

-- Newmark Security recently published Full Year 2024 (Yr end 30 April) results, which confirmed our view onrecovery with Revenues up +10% and EBITDA up +50%. NWT shares have also performed well since the beginning of theyear and have increased 26.67% YTD.

ALNA - https://www.alina-holdings.com/

-- ALNA posted improved results for H1 2024 which can be found on the Company's website, as above.

AMOI - https://anemoi-international.com/

-- Please refer to Anemoi website

SUN - https://www.sigroupplc.com/

-- Surgical Innovations Group PLC (SUN LN)

is a leading UK-based designer, manufacturer, and exporter of innovative high quality medical products primarily for use in laparoscopic and robotic minimally invasive surgery.

THAL has recently taken a 15.8% stake in SUN. In the early 90's I was the first Wall Street banker to visit Conmed (CNMD US), at the time it had a market cap. of USD30m, today its mkt cap. is USD2.3bn. The Medical Device Market (including Laparoscopy) is dominated by Medtronic plc USD31.6bn revenues, Abbott Labs USD31.3bn revenues, Dasher Corp USD29.6bn, John & Johnson USD27.4bn, as well as Siemens, Fresenius Medline, Becton Dickinson, GE Healthcare, Stryker, Philips NV, Cardinal Health, Baxter Intl., Boston Scientific all with annual revenues in excess of USD10bn.

SUN's H1 2024 results are due 30 September, and whilst our expectations are muted, we believe that the Company has exceptional leadership in place for such a small company and can and should, in due course, return to profitability.

ALSAF - https://safegrp.com/

-- Safe Group is a leader of ready-to-use solutions for the treatment of Spinal Diseases.

THAL has recently acquired a 10% stake in SAFE.

Conclusion

Warren Buffett is quoted as saying, "Be fearful when others are greedy, and greedy when others are fearful. Now is not the time to be greedy but fearful. Berkshire Hathaway has a record amount of cash USD300bn and continues to sell holdings. The US market is experiencing peak earnings and multiples whilst Federal and Consumer debt are both at all-time highs.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

26 September 2024

Responsibility Statement

We confirm that to the best of our knowledge: a. the condensed set of financial statements has been prepared in accordance with IAS 34 'Interim FinancialReporting' and gives a true and fair view of the assets, liabilities, financial position and profit or loss of theCompany and the undertakings included in the consolidation as a whole as required by DTR 4.2.4 R; b. the interim management report includes a fair review of the information required by DTR 4.2.7R(indication of important events during the first six months and description of principal risks and uncertaintiesfor the remaining six months of the year); and c. the interim management report includes a fair review of the information required by DTR 4.2.8R(disclosure of related parties' transactions and changes therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to provide additional information to shareholders to assess the Company's strategies and the potential for those strategies to succeed. The IMR should not be relied on by any other party or for any other purpose.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

26 September 2024

Financial Review

Total income from operations for the period to 30 June 2024 was GBP0.3m (1H23: GBP0.2m). Income benefited from a GBP0.2m unrealised gain on Thalassa's holding in NWT.

Cost of Sales was GBP5k (1H23: GBP15k) comprising development costs (net of capitalised costs) at ARL and direct financial holdings expenses, resulting in a Gross Profit of GBP0.3m (1H23: gross profit GBP0.2m).

Administration expenses were negative GBP0.1m, i.e. a slight income (1H23: GBP0.4m expense). This was positively impacted by the decision of the Chairman to waive all of his consultancy fees carried forward from 2022 and 2023. We should like to point out that, as in past periods, Mr Soukup's 2024 fees have been accrued, but not yet paid. Depreciation costs were GBP0.01m (1H23: GBP0.16m). This reduction was due to the surrender of the Swiss office lease by the Company's subsidiary Alfalfa.

Operating Profit improved to GBP0.3m (1H23 Loss: GBP0.4m).

Other income benefited from a GBP17k net gain on book value on the surrender of the afore mentioned lease. Until surrender, some of this property had been sublet, which covered total lease expenditure.

Profit before tax was GBP0.2m (1H23 loss: GBP0.5m).

Net assets at 30 June 2024 amounted to GBP9.5m (1H23: GBP9.6m).

Net cash (being cash balances less any financial borrowings) was GBP1.4m as at 30 June 2024 (1H23: GBP0.6m).

Current and Non-current lease liabilities became nil on the surrender of the Villa Kramerstein lease.

The reduction in other receivables and other payables was driven by the formal offsetting of most of a receivables balance from an entire payables balance to a single counterparty, ID4 AG / Apeiron AG. The payable was from Alfalfa in relation to an assets purchase from id4 AG prior to the acquisition by the Company; and the receivable is in relation to a balance owed to the Company from the former Apeiron AG.

Net cash outflow from operating activities amounted to GBP0.15m compared to GBP0.10m in 1H23.

Net cash outflow from investing activities amounted to GBP0.02m, compared to 1H23 inflow of GBP0.39m.

Net cash inflow from financing activities amounted to GBP1.45m (1H23: outflow GBP0.14m). This was driven by the Tappit restitution agreement. The Chairman contributed GBP1.5m in the 6 month period to 30 June 2024. A further GBP0.6m was contributed by the Chairman in August 2024.

Interim Condensed Consolidated Statement of Income

For the six months ended 30 June 2024

Six months Six months Year

ended ended ended

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

Note GBP GBP GBP

Income 102,599 118,673 252,129

Net gains/(losses) on investments at fair value 198,600 118,426 282,809

Investment dividend income 4,153 770 770

Currency gains/(losses) 440 - 48

Total Income 305,792 237,869 535,756

Financial holdings expenses (4,987) (7,958) (15,199)

Other cost of sales (312) (7,096) (12,926)

Total Cost of sales (5,299) (15,054) (28,125)

Gross Profit 300,493 222,815 507,631

Administrative expenses excluding exceptional costs 102,674 (429,067) (900,853)

Operating profit/(loss) before depreciation 403,167 (206,252) (393,222)

Depreciation and Amortisation 4&5 (92,676) (164,488) (256,425)

Operating profit/(loss) 310,491 (370,740) (649,647)

Net financial income/(expense) (3,414) (11,454) (23,888)

Other gains/(losses) 16,675 - 17,734

Share of losses of associated entities (82,642) (143,962) (307,940)

Profit/(loss) before taxation 241,110 (526,156) (963,741)

Taxation (435) (528) 72,036

Profit/(loss) for the year 240,675 (526,684) (891,705)

Attributable to:

Equity shareholders of the parent 240,675 (526,684) (891,705)

Non-controlling interest - - -

240,675 (526,684) (891,705)

Earnings per share - GBP (using weighted average number of shares)

Basic and Diluted 3 0.03 (0.07) (0.11)

The notes on pages 13 to 18 form an integral part of this consolidated interim financial information. Interim Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2024

Six months Six months Year

ended ended ended

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

GBP GBP GBP

Profit/(loss) for the financial year 240,675 (526,684) (891,705)

Other comprehensive income:

Exchange differences on re-translating foreign operations 15,851 (83,113) (200,015)

Total comprehensive income 256,526 (609,797) (1,091,720)

Attributable to:

Equity shareholders of the parent 256,526 (609,797) (1,091,720)

Non-Controlling interest - - -

Total Comprehensive income 256,526 (609,797) (1,091,720)

The notes on pages 13 to 18 form an integral part of this consolidated interim financial information.

Interim Condensed Consolidated Statement of Financial Position

As at 30 June 2024

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Note Unaudited Unaudited Audited

Assets GBP GBP GBP

Non-current assets

Intangible assets 4 1,810,615 1,514,815 1,697,313

Property, plant and equipment 5 30,369 1,838,423 1,729,924

Loans 7 3,305,798 4,776,479 4,785,629

Investments in associated entities 8 1,946,174 2,199,253 2,019,367

Total non-current assets 7,092,956 10,328,970 10,232,233

Current assets

Trade and other receivables 311,219 714,821 788,782

Investments at fair value through profit or loss 6 1,352,143 726,371 1,159,250

Cash and cash equivalents 1,445,949 614,365 143,295

Total current assets 3,109,311 2,055,557 2,091,327

Liabilities

Current liabilities

Trade and other payables 739,362 1,221,922 1,539,749

Lease liabilities 9 - 159,783 173,325

Total current liabilities 739,362 1,381,705 1,713,074

Net current assets 2,369,949 673,852 378,253

Non-current liabilities

Lease liabilities. 9 - 1,404,237 1,404,107

Total non-current liabilities - 1,404,237 1,404,107

Net assets 9,462,905 9,598,585 9,206,379

Shareholders' Equity

Share capital 11 128,977 128,977 128,977

Share premium 21,717,786 21,717,786 21,717,786

Treasury shares (8,558,935) (8,558,935) (8,558,935)

Other reserves (1,696,321) (1,696,320) (1,696,321)

Foreign exchange reserve 4,246,691 4,258,024 4,230,840

Retained earnings (6,375,293) (6,250,947) (6,615,968)

Total shareholders' equity 9,462,905 9,598,585 9,206,379

Total equity 9,462,905 9,598,585 9,206,379

The notes on pages 13 to 18 form an integral part of this consolidated interim financial information.

These financial statements were approved by the board on 26 September 2024.

Signed on behalf of the board by:

Duncan Soukup

Interim Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2024

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

Notes GBP GBP GBP

Profit/(Loss) before financing from: 310,491 (370,740) (649,647)

Adjustments for:

Net finance costs (24,879) (94,190) (279,715)

Other income - - 17,734

(Increase)/decrease in trade and other receivables 477,563 50,481 (23,480)

(Decrease)/increase in trade and other payables (800,387) 11,112 328,938

(Gain)/loss on disposal of portfolio investments 18 60,404 -

Net exchange differences (3,108) 141,680 (65,125)

Depreciation/Amortisation 4&5 92,676 164,488 256,425

Fair value movement on portfolio investments (198,843) (62,226) -

Cash generated by operations (146,469) (98,991) (414,870)

Taxation (435) (528) 72,036

Net cash flow from operating activities (146,904) (99,519) (342,834)

Sale/(purchase) of property, plant and equipment 100,724 (2,320) (2,320)

Sale/(purchase) of intangible assets 4 (117,484) (184,244) (385,983)

Net (purchase)/sale of portfolio investments 6 (4,495) 648,613 (177,912)

Investments in associated entities - (68,642) -

Investment in subsidiaries - - 29,217

Net cash flow in investing activities (21,255) 393,407 (536,998)

Cash flows from financing activities

Interest Income 619 7,731 13,437

Interest Expense (1,948) (1,522) -

Loans collected 1,511,575 - -

Repayment of borrowings 9 (55,284) (145,128) (173,982)

Net cash flow from financing activities 1,454,962 (138,919) (160,545)

Net increase in cash and cash equivalents 1,286,803 154,969 (1,040,377)

Cash and cash equivalents at the start of the year 143,295 629,215 1,383,687

Effects of exchange rate changes on cash and cash equivalents 15,851 (169,819) (200,015)

Cash and cash equivalents at the end of the year 1,445,949 614,365 143,295

The notes on pages 13 to 18 form an integral part of this consolidated interim financial information.

Interim Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2024

Share Share Treasury Other Foreign Exchange Retained

Capital Premium Shares Reserves Reserve Earnings Total

GBP GBP GBP GBP GBP GBP GBP

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 4,430,855 (5,724,263) 10,298,100

31 December 2022

Foreign exchange on translation - - - - (89,718) - (89,718)

Total comprehensive income - - - - (83,113) (526,684) (609,797)

Balance as at 128,977 21,717,786 (8,558,935) (1,696,320) 4,258,024 (6,250,947) 9,598,585

30 June 2023

Exchange on conversion to GBP - - - (1) - - (1)

Total comprehensive income - - - - (27,184) (365,021) (392,205)

Balance as at 128,977 21,717,786 (8,558,935) (1,696,321) 4,230,840 (6,615,968) 9,206,379

31 December 2023

Total comprehensive income - - - - 15,851 240,675 256,526

Balance as at 128,977 21,717,786 (8,558,935) (1,696,321) 4,246,691 (6,375,293) 9,462,905

30 June 2024

The notes on pages 13 to 18 form an integral part of this consolidated interim financial information. Notes to the Interim Condensed Consolidated Financial Information

1. General information

Thalassa Holdings Ltd (the "Company") is a British Virgin Island ("BVI") International business company ("IBC"), incorporated and registered in the BVI on 26 September 2007. The Company is a holding company with various interests across a number of industries.

Autonomous Robotics Limited ("ARL" - formerly GO Science 2013 Ltd) is a wholly owned subsidiary of Thalassa and is an Autonomous Underwater Vehicle ("AUV") research and development company.

Apeiron Holdings (BVI) Ltd is a BVI registered company and is wholly owned by Thalassa. It owns 100% of Alfalfa Holdings AG which is a company registered in Switzerland.

WGP Geosolutions Limited is a wholly owned subsidiary of Thalassa currently non-operational.

Thalassa Holdings (II) Ltd is a wholly owned subsidiary of Thalassa which is non-operational, incorporated and registered in the BVI on 30 January 2023.

DOA Alpha Ltd is a wholly owned subsidiary of Thalassa which is non-operational and registered in the BVI. It has two additional subsidiaries, DOA Exploration Ltd registered in England and Wales and DOA Delta Ltd registered in the BVI, both non-operational.

2. Significant Accounting policies

The Company prepares its accounts in accordance with applicable UK Adopted International Accounting Standards.

The accounting policies applied by the Company in this unaudited consolidated interim financial information are the same as those applied by the Company in its consolidated financial statements as at and for the period ended 31 December 2023 except as detailed below.

The financial information has been prepared under the historical cost convention, as modified by the accounting standard for financial instruments at fair value.

2.1. Basis of preparation

The condensed consolidated interim financial information for the six months ended 30 June 2024 has been prepared in accordance with International Accounting Standard No. 34, 'Interim Financial Reporting'. They do not include all of the information required for full annual financial statements and should be read in conjunction with the consolidated financial statements of the Company as at and for the year ended 31 December 2023. Prior year comparatives have been reclassified to conform to current year presentation.

These condensed interim financial statements for the six months ended 30 June 2024 and 30 June 2023 are unaudited and do not constitute full accounts. The comparative figures for the period ended 31 December 2023 are extracted from the 2023 audited financial statements. The independent auditor's report on the 2023 financial statements was not qualified.

All intra-company transactions, balances, income and expenses are eliminated in full on consolidation.

2.2. Going concern

The financial information has been prepared on the going concern basis as management consider that the Company has sufficient cash to fund its current commitments for the foreseeable future.

Notes to the Interim Condensed Consolidated Financial Information Continued

3. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

The calculation of earnings per share is based on

the following loss and number of shares:

Profit/(loss) for the period 240,675 (526,684) (891,705)

Weighted average number of shares of the Company 7,945,838 7,945,838 7,945,838

Earnings per share:

Basic and Diluted (GBP) 0.03 (0.07) (0.11)

Number of shares outstanding at the period end: 7,945,838 7,945,838 7,945,838

4. Intangible assets

Development

costs Patents Software Total

GBP GBP GBP GBP

At 31 December 2023

Cost 1,512,237 180,894 25,096 1,718,227

Accumulated amortisation - - (20,914) (20,914)

Net book amount 1,512,237 180,894 4,182 1,697,313

Half-year ended 30 June 2024

Opening net book amount 1,512,237 180,894 4,182 1,697,313

1,512,237 180,894 4,182 1,697,313

Additions 108,636 8,848 - 117,484

Disposals - - (696) (696)

Amortisation charge - - (3,486) (3,486)

Closing net book amount 1,620,873 189,742 - 1,810,615

At 30 June 2024

Cost 1,620,873 189,742 - 1,810,615

Accumulated amortisation - - - -

Net book amount 1,620,873 189,742 - 1,810,615

The intangible assets held by the Company increased as a result of capitalising the development costs of Autonomous Robotics Ltd ("ARL").

Notes to the Interim Condensed Consolidated Financial Information Continued

5. Property, plant and equipment

Plant

Land and and Motor

Total buildings Equipment Vehicles

Cost GBP GBP GBP GBP

Cost at 1 January 2024 2,516,307 2,146,991 132,803 236,513

FX movement (30,630) (30,630) - -

2,485,677 2,116,361 132,803 236,513

Additions - - - -

Disposals (2,118,090) (2,116,361) (1,729) -

Cost at 30 June 2024 367,587 - 131,074 236,513

Depreciation

Depreciation at 1 January 2024 786,383 462,300 130,237 193,846

FX movement 69,318 69,318 - -

855,701 531,618 130,237 193,846

Charge for the year on continuing operations 89,190 74,326 642 14,222

Disposal (606,188) (604,459) (1,729) -

Foreign exchange effect on year end translation (1,485) (1,485) - -

Depreciation at 30 June 2024 337,218 - 129,150 208,068

Closing net book value at 30 June 2024 30,369 - 1,924 28,445

6. Securities

The Company classifies the following financial assets at fair value through profit or loss (FVPL):-

Equity investments that are held for trading.

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

GBP GBP GBP

Securities

At the beginning of the period 1,159,250 504,877 504,877

Additions 8,700 521,167 880,004

Unrealised gain/(losses) 198,824 179,051 283,031

Disposals (4,205) (475,713) (636,895)

Reclassification of Motor Vehicles to Afs investments - - 120,244

Forex on opening balance (10,426) (3,011) 7,989

At period close 1,352,143 726,371 1,159,250

Investments have been valued incorporating Level 1 inputs in accordance with IFRS7.

Notes to the Interim Condensed Consolidated Financial Information Continued

7. Loans and holdings

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

GBP GBP GBP

Loans at period open 1,501,158 1,532,469 1,532,469

Accrued interest - to be waived 22,794 22,186 45,239

Forex on opening balance 8,950 (62,647) (76,550)

Loans at period close 1,532,902 1,492,008 1,501,158

Portfolio Holdings at 1 January 3,284,471 4,038,944 3,284,471

Repaid (1,511,575) - -

Reclassification under portfolio holdings - (754,473) -

Portfolio holdings at period close 1,772,896 3,284,471 3,284,471

Total of loans and holdings 3,305,798 4,776,479 4,785,629

The Loan is to the THAL Discretionary Trust, the terms of the loan are set with a 0% interest rate however interest has been accrued at 3% as per IFRS requirements, it is the intention of the Company to waive this interest upon repayment of the capital.

8. Investments in associated entities

On 17 December 2021, the acquisition of id4 was complete by Anemoi International Ltd with consideration in the form of shares issued to Thalassa and its subsidiary Aperion BVI totalling 36.92% of the voting rights. The investment is recognised using the equity method as described in the financial statements for December 2022. During 2023 further shares were purchased to equal a total of 40.77% of the voting rights. The investment is recognised using the equity method.

Athenium Consultancy Ltd in which the Company owns 35% shares was incorporated on 12 October 2021.

Movement on interests in associates can be summarised as follows:

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

GBP GBP GBP

Fair value of investment at beginning of period 2,019,367 2,356,526 2,356,526

Share of losses for the period (82,854) (143,803) (307,862)

Additions - 68,642 68,642

Exchange Variance 9,661 (82,112) (97,939)

1,946,174 2,199,253 2,019,367

There are no other entities in which the Company holds 20% or more of the equity, or otherwise exercises significant influence over the affairs of the entity.

Notes to the Interim Condensed Consolidated Financial Information Continued

9. Lease liabilities

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

Non-current liabilities GBP GBP GBP

Lease liabilities - 1,404,237 1,404,107

- 1,404,237 1,404,107

Current liabilities

Lease liabilities - 159,783 173,325

- 159,783 173,325

The lease liabilities comprise of amounts owed in relation to office leases held by ARL and Alfalfa Holdings AG. The lease held by ARL was surrendered June 2024. The lease held by Alfalfa Holdings AG was entered in to in Feb 2021 and surrendered Apr 2024.

10. Related party balances and transactions

Under the consultancy and administrative services agreement initially entered into on 3 January 2011 and most recently updated 1 February 2018 with a company in which the Chairman has a beneficial interest, the Company waived GBP535,295 related to 2022 & 2023 and accrued GBP133,100 (1H23 accrued: GBP130,362) for consultancy and administrative services provided to the Company. As at 30 June 2024 the amount owed to this company was GBP251,690 (1H23: GBP524,868).

Athenium Consultancy Ltd, a company in which the Company owns shares invoiced the Company for financial and corporate administration services totalling GBP90,750 for the period (June 2023: GBP90,750).

The Company was due GBP13,149 (June 2023: GBP9,372) from Anemoi International Ltd, a company in which through its subsidiary Apeiron Holdings BVI holds shares and is related by common control through the Chairman, Duncan Soukup.

As at the period end the Company was due GBP44,380 (June 2023: GBP49,887) from Alina Holdings Limited, a company under common directorship.

Notes to the Interim Condensed Consolidated Financial Information Continued

11. Share capital

As at As at As at

30 Jun 24 30 Jun 23 31 Dec 23

Unaudited Unaudited Audited

GBP GBP GBP

Authorised share capital:

100,000,000 ordinary shares of USD0.01 each 1,000,000 1,000,000 1,000,000

Exchange Rate for Conversion 1.61674 1.61674 1.61674

100,000,000 ordinary shares of USD0.01 each in GBP 618,529 618,529 618,529

Allotted, issued and fully paid:

20,852,359 ordinary shares of USD0.01 each 208,522 208,522 208,522

Average Exchange Rate for Conversion 1.61674 1.61674 1.61674

20,852,359 ordinary shares of USD0.01 each in GBP 128,977 128,977 128,977

The exchange rate used for conversion is the aggregate rate for the transactions as they occurred.

12. Subsequent events

There were no reportable subsequent events.

13. Copies of the Interim Report

The interim report is available on the Company's website:

www.thalassaholdingsltd.com.

END

For further information, please contact:

Enquiries: enquiries@thalassaholdingsltd.com Thalassa Holdings Ltd

----------------------------------------------------------------------------------------------------------------------- Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG878801114 Category Code: IR TIDM: THAL LEI Code: 2138002739WFQPLBEQ42 OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews Sequence No.: 349410 EQS News ID: 1996719 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1996719&application_name=news&site_id=dow_jones%7e%7e%7ef1066a31-ca00-4e1a-b0a4-374bd7d0face

(END) Dow Jones Newswires

September 27, 2024 02:00 ET (06:00 GMT)