The Company and Mr. Royal have entered into an employment agreement dated as of September 27, 2024. The term of the employment agreement is 2 years. Mr. Royal will receive an annual base salary of $300,000 which will be paid quarterly in the form of Company stock based on the average share price over the previous quarter. Mr. Royal will be eligible to receive a discretionary bonus annually as determined by the Compensation Committee. Additionally, the Company has agreed to match additional purchases of Company stock up to 30,000 shares in the aggregate over the term of his employment agreement.

Mr. Royal, expressing gratitude for Mr. Rost's contributions to the Company, stated "The entire Board of Directors is grateful for Mike's service to the Company and its stockholders and wishes him well in his future endeavors."

Change in Corporate Headquarters.

On September 27, 2024, the Company announced it has moved its Corporate Headquarters from 26133 U.S. Hwy 19 North, Suite 300, Clearwater, FL,33763 to 1601 Dodge St., Suite 3350, Omaha, NE, 68102.

Company Name & Ticker Change

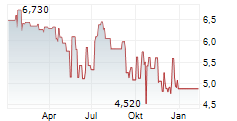

Effective as of September 27, 2024, the Company amended its Certificate of Incorporation to change its name from "Nicholas Financial, Inc." to "Old Market Capital Corporation", in conjunction with the Company's exit of the auto finance business. The Company's ticker symbol will change from "NICK" to "OMCC" to align with the new name, effective as of market open on Monday, September 30, 2024.

Cautionary Note regarding Forward-Looking Statements

This press release may contain various "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, that represent the Company's current expectations or beliefs concerning future events. Statements other than those of historical fact, as well as those identified by words such as "anticipate," "estimate," intend," "plan," "expect," "project," "explore" "believe," "may," "will," "should," "would," "could," "probable" and any variation of the foregoing and similar expressions are forward-looking statements. These statements, are inherently uncertain and subject to certain risks, uncertainties and assumptions that may cause results to differ materially from those expressed or implied in forward-looking statements, including without limitation:

© 2024 PR Newswire