Transition to Spatial Core AI and Cloud Driven Revenues Gaining Traction

Expect Significantly Higher Revenue In The Upcoming Quarters

Expect to Be Cash Flow Positive In The Upcoming Quarters Based on Signed Contracts Alone

Extreme Valuation Disconnect A Catalyst For Strategic Review To Maximize Shareholder Value

NEW YORK, NY / ACCESSWIRE / September 30, 2024 / The Glimpse Group, Inc. ("Glimpse") (NASDAQ:VRAR), a diversified Immersive Technology platform company providing enterprise-focused Virtual Reality ("VR"), Augmented Reality ("AR") and Spatial Computing software and services, provided financial results for its fiscal year ended June 30, 2024 ("FY'24").

Business Commentary by President & CEO Lyron Bentovim

Strategic Summary:

Spatial Core:

As discussed in previous releases, in FY '24 we strategically transitioned the Company to primarily focus its development resources on providing enterprise-scale Spatial Computing, Cloud and AI driven Immersive recurring software solutions - "Spatial Core" - led by Brightline Interactive ("BLI").

Spatial Core Traction :

$4MM+, 12-month contract with a Department of Defense ("DoD") entity for a Spatial Computing ecosystem, integrating AI workflows and accelerated compute for a variety of defense use-cases.

Entered into a Cooperative Research and Development Agreement (CRADA) with the US Army Combat Capabilities Development Command (DEVCOM), Command, Control, Communication, Computers, Cyber, Intelligence, Surveillance and Reconnaissance (C5ISR) Center, to develop, assess and improve workflows to create and augment synthetic imagery for use in training and assessing AI and machine learning ML algorithms.

Extended partnership with a Fortune 500 government Systems Integrator (GSI) for VR Training in Digital Twin Environments to a key U.S. government agency with over 45,000 employees on a mid six figure contract.

BLI, Cesium & NVIDIA teamed up at the GEOspatial INTelligence (GEOINT) Symposium 2024 to introduce Brightline's Spatial Core which uses AI workflows for complex computations on top of real life data sets, enabling powerful real time, massive data driven, digital twin and simulation applications.

Successfully Completed the Cooperative Research and Development Agreement (CRADA) with the US Naval Surface Warfare Center, Dahlgren Division (NSWCDD) for the adaptation of immersive technologies.

Completed a contract to support a major immersive technology hardware provider to accelerate their computing interfaces into GPU-enabled cloud, with streaming and visualization capabilities.

We are in an advanced process of securing several additional multi-million dollar Spatial Core contracts with multiple Government, DoD and large enterprise customers. The short-term aggregate value for these contracts is in the $5-10 million range. While there is no guarantee that some or all of these will come to fruition, we anticipate that, subject to government annual budgeting timing, a good portion of these will be signed before yearend '24, with additional potential contract signings in CY '25.

Each of these potential contracts has significant growth elements built into them that could lead to significant annual recurring software revenue once the original contracts have been successfully performed.

Non Spatial Core:

We have continued the process of consolidating and pruning the rest of our business to focus on sustainable profitable growth. As a result, our other entities are generating positive momentum. For example:

In recent months, QReal has seen an increase in its revenues with Snap for AR 3D models and lenses.

Glimpse Learning entered into a two year, mid-six figure contract with the College of Staten Island CUNY ("CSI") Technology Incubator for the design, deployment and integration of a suite of immersive technologies in its new Innovation Hub. This is a cross Glimpse project, with a strong software license component

Sector 5 Digital ("S5D") entered into a 6-figure engagement with one of the world's largest architecture firms to visualize in AR the new business campus of a multinational retail company.

Foretell Reality entered into a 6-figure partnership with a large University to develop an AI-driven VR training system enabling students and trainees to learn various professional skills through conversation-centric simulations with an AI-based avatar in different immersive settings.

Financial Summary:

FY '24 revenue of approximately $8.8 million, a 35% decrease compared to FY '23 revenue of approximately $13.5 million, primarily driven by: i) our strategic shift to Spatial Core which led to a turnover in our legacy customer base, which was more Immersive marketing oriented iii) consolidation and divestiture of some of our entities and iii) a general slowdown in corporate disposable spending in general and in the Immersive industry in particular.

Q4 FY '24 (April - June) quarterly revenue of approximately $1.7 million, a 41% decrease compared to Q4 FY '23 revenue of approximately $2.9 million.

Looking forward, we expect: i) revenue for Q1 FY '25 (ending September '24) to be significantly higher than Q4 FY '24 revenue, and ii) revenue for Q2 FY '25 (ending December '24) and Q3 FY '25 (ending March '25) will each exceed $3 million per quarter.

Gross Margin for FY '24 was approximately 67% compared to 68% for FY '23. We expect our Gross Margins to continue to remain in the 60-70% range.

Adjusted EBITDA loss for FY '24 was approximately $4.63 million, compared to an EBITDA loss of approximately $6.46 million for FY '23. Our current cash operating expense base (pre revenue) is approximately $1.0 million/month. Given our projected revenue for Q2 FY '25 and Q3 FY '25, we expect to generate positive cash flow in each of those two quarters based on existing contracts only and our current operating expense base.

The Company's cash and equivalent position as of June 30, 2024 was approximately $1.85 million, with an additional $0.7 million in accounts receivable. We do not intend to raise capital in the foreseeable future, especially since we expect our operations to generate positive cash and add to our cash balance between now and year-end '24

We continue to maintain a clean capital structure with no debt, no convertible debt and no preferred equity.

For the full detail of our financial results, please refer to our 8K and 10K filed on 9/30/24.

VRAR Stock/Valuation

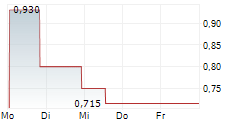

On September 3, 2024, the Company received a letter from Nasdaq notifying the Company that it no longer met the minimum bid price requirement for continued listing ($1.00/share). We have until March 3, 2025 to cure this deficiency and, if not cured by then, the Company can apply for an additional 180 day extension to cure (to approximately September 2, 2025).

The Company's receipt of the notification letter has no immediate effect on the listing of our common shares, which continue to trade uninterrupted on Nasdaq under the ticker "VRAR". In addition, it does not affect the Company's business, operations or reporting requirements with the Securities and Exchange Commission ("SEC").

In order to regain compliance with Nasdaq, the Company may consider various potential measures to resolve the deficiency, such as: leveraging its unutilized share buyback pool, insider buying and press releases announcing significant business developments when/if those materialize. Such measures, if any are taken, may help cure the deficiency in due time. The Company is not considering a reverse stock split at this time, a position that may change in the future.

In light of Spatial Core's AI and Cloud driven revenues with large DoD entities, our strong pipeline of revenues and our expectation to generate positive cash flows going forward, we believe that there is a sharp disconnect between our intrinsic value and our current public company valuation. As such, the Board of Directors of the Company is exploring strategic options to maximize shareholder value.

Fiscal Year 2024 Conference Call and Webcast

Date: Monday, September 30, 2024

Time: 4:30 p.m. Eastern time

USA Dial In: 888-506-0062

International: 973-528-0011

Participant Access Code: 228384

Webcast: https://www.webcaster4.com/Webcast/Page/2934/51301

Please dial in at least 10 minutes before the start of the call to ensure timely participation.

A playback of the webcast will be available through September 30, 2025. A replay of the teleconference will be available through October 14, 2024. To listen, please call USA: 877-481-4010 or International: 919-882-2331; Replay Passcode: 51301. A webcast will also be available on the IR section of The Glimpse Group website ( ir.theglimpsegroup.com ) or by clicking the webcast link above.

Note about Non-GAAP Financial Measures

A non-GAAP financial measure is a numerical measure of a company's performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States of America, or GAAP. Non-GAAP measures are not in accordance with, nor are they a substitute for, GAAP measures. Other companies may use different non-GAAP measures and presentation of results.

In addition to financial results presented in accordance with GAAP, this press release presents adjusted EBITDA, which is a non-GAAP measure. Adjusted EBITDA is determined by taking net loss and adding interest, taxes, depreciation, amortization and stock-based compensation expenses. The company believes that this non-GAAP measure, viewed in addition to and not in lieu of net loss, provides useful information to investors by providing a more focused measure of operating results. This metric is an integral part of the Company's internal reporting to evaluate its operations and the performance of senior management. A reconciliation of adjusted EBITDA to net loss, the most comparable GAAP measure, is available in the accompanying financial tables below. The non-GAAP measure presented herein may not be comparable to similarly titled measures presented by other companies.

About The Glimpse Group, Inc.

The Glimpse Group (NASDAQ: VRAR) is a diversified Immersive technology platform company, providing enterprise-focused Virtual Reality, Augmented Reality and Spatial Computing software & services. Glimpse's unique business model builds scale and a robust ecosystem, while simultaneously providing investors an opportunity to invest directly into this emerging industry via a diversified platform. For more information on The Glimpse Group, please visit www.theglimpsegroup.com

Safe Harbor Statement

This press release does not constitute an offer to sell or a solicitation of offers to buy any securities of any entity. This press release may contain certain forward-looking statements based on our current expectations, forecasts and assumptions that involve risks and uncertainties. Forward-looking statements, if provided, are based on information available to the Company as of the date hereof. Our actual results may differ materially from those stated or implied in such forward-looking statements, due to risks and uncertainties associated with our business. Forward-looking statements, if provided, include statements regarding our expectations, beliefs, intentions, or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "view," "could," "estimate," "expect," "intend," "may," "should," and "would" or similar words. All forecasts, if provided, are based on information available at this time and management expects that internal projections and expectations may change over time. In addition, any forecasts, if provided, are entirely on management's best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products and services. We assume no obligation to update the information included in this press release, whether as a result of new information, future events or otherwise.

Company Contact:

Maydan Rothblum

CFO & COO

The Glimpse Group, Inc.

(917) 292-2685

maydan@theglimpsegroup.com

THE GLIMPSE GROUP, INC.

CONSOLIDATED BALANCE SHEETS

| As of |

|

| As of |

| |||

ASSETS |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 1,848,295 |

|

| $ | 5,619,083 |

|

Accounts receivable |

|

| 723,032 |

|

|

| 1,453,770 |

|

Deferred costs/contract assets |

|

| 170,781 |

|

|

| 158,552 |

|

Prepaid expenses and other current assets |

|

| 778,181 |

|

|

| 562,163 |

|

Total current assets |

|

| 3,520,289 |

|

|

| 7,793,568 |

|

|

|

|

|

|

|

|

| |

Equipment, net |

|

| 167,325 |

|

|

| 264,451 |

|

Right-of-use assets, net |

|

| 452,808 |

|

|

| 627,832 |

|

Intangible assets, net |

|

| 487,867 |

|

|

| 4,284,151 |

|

Goodwill |

|

| 10,857,600 |

|

|

| 11,236,638 |

|

Other assets |

|

| 72,714 |

|

|

| 71,767 |

|

Total assets |

| $ | 15,558,603 |

|

| $ | 24,278,407 |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 181,668 |

|

| $ | 455,777 |

|

Accrued liabilities |

|

| 340,979 |

|

|

| 635,616 |

|

Accrued non cash performance bonus |

|

| - |

|

|

| 1,041,596 |

|

Deferred revenue/contract liabilities |

|

| 72,788 |

|

|

| 466,393 |

|

Lease liabilities, current portion |

|

| 364,688 |

|

|

| 405,948 |

|

Contingent consideration for acquisitions, current portion |

|

| 1,467,475 |

|

|

| 5,120,791 |

|

Total current liabilities |

|

| 2,427,598 |

|

|

| 8,126,121 |

|

|

|

|

|

|

|

|

| |

Long term liabilities |

|

|

|

|

|

|

|

|

Contingent consideration for acquisitions, net of current portion |

|

| 1,413,696 |

|

|

| 4,505,000 |

|

Lease liabilities, net of current portion |

|

| 178,824 |

|

|

| 423,454 |

|

Total liabilities |

|

| 4,020,118 |

|

|

| 13,054,575 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

Preferred Stock, par value $0.001 per share, 20 million shares authorized; 0 shares issued and outstanding |

|

| - |

|

|

| - |

|

Common Stock, par value $0.001 per share, 300 million shares authorized; 18,158,217 and 14,701,929 issued and outstanding, respectively |

|

| 18,158 |

|

|

| 14,702 |

|

Additional paid-in capital |

|

| 74,559,600 |

|

|

| 67,854,108 |

|

Accumulated deficit |

|

| (63,039,273 | ) |

|

| (56,644,978 | ) |

Total stockholders' equity |

|

| 11,538,485 |

|

|

| 11,223,832 |

|

Total liabilities and stockholders' equity |

| $ | 15,558,603 |

|

| $ | 24,278,407 |

|

THE GLIMPSE GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| June 30, |

| ||||||

| 2024 |

|

| 2023 |

| |||

Revenue |

|

|

|

|

|

| ||

Software services |

| $ | 8,130,515 |

|

| $ | 12,587,192 |

|

Software license/software as a service |

|

| 673,684 |

|

|

| 895,172 |

|

Total Revenue |

|

| 8,804,199 |

|

|

| 13,482,364 |

|

Cost of goods sold |

|

| 2,941,460 |

|

|

| 4,266,013 |

|

Gross Profit |

|

| 5,862,739 |

|

|

| 9,216,351 |

|

|

|

|

|

|

|

|

| |

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development expenses |

|

| 5,455,612 |

|

|

| 8,793,991 |

|

General and administrative expenses |

|

| 4,292,001 |

|

|

| 5,037,359 |

|

Sales and marketing expenses |

|

| 2,819,668 |

|

|

| 7,489,978 |

|

Amortization of acquisition intangible assets |

|

| 1,241,228 |

|

|

| 2,045,587 |

|

Goodwill impairment |

|

| 379,038 |

|

|

| 12,855,723 |

|

Intangible asset impairment |

|

| 2,563,331 |

|

|

| 2,496,119 |

|

Change in fair value of acquisition contingent consideration |

|

| (4,272,080 | ) |

|

| (696,722 | ) |

Total operating expenses |

|

| 12,478,798 |

|

|

| 38,022,035 |

|

Loss from operations before other income |

|

| (6,616,059 | ) |

|

| (28,805,684 | ) |

|

|

|

|

|

|

|

| |

Other income |

|

|

|

|

|

|

|

|

Interest income |

|

| 221,764 |

|

|

| 242,401 |

|

Net Loss |

| $ | (6,394,295 | ) |

| $ | (28,563,283 | ) |

|

|

|

|

|

|

|

| |

Basic and diluted net loss per share |

| $ | (0.38 | ) |

| $ | (2.05 | ) |

|

|

|

|

|

|

|

| |

Weighted-average shares used to compute basic and diluted net loss per share |

|

| 16,681,234 |

|

|

| 13,929,135 |

|

THE GLIMPSE GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Year Ended June 30, |

| ||||||

| 2024 |

|

| 2023 |

| |||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net loss |

| $ | (6,394,295 | ) |

| $ | (28,563,283 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Amortization and depreciation |

|

| 1,361,628 |

|

|

| 2,192,982 |

|

Common stock and stock option based compensation for employees and board of directors |

|

| 2,175,072 |

|

|

| 4,974,519 |

|

Accrued non cash performance bonus fair value adjustment |

|

| (551,239 | ) |

|

| - |

|

Acquisition contingent consideration fair value adjustment |

|

| (4,272,080 | ) |

|

| (696,722 | ) |

Impairment of intangible assets |

|

| 2,942,369 |

|

|

| 15,351,842 |

|

Gain on divestiture of subsidiary |

|

| 1,000,000 |

|

|

| - |

|

Reserve on note received in connection with divestiture of subsidiary |

|

| (1,000,000 | ) |

|

| - |

|

Issuance of common stock to vendors |

|

| 100,372 |

|

|

| 5,238 |

|

Adjustment to operating lease right-of-use assets and liabilities |

|

| (110,866 | ) |

|

| (8,330 | ) |

|

|

|

|

|

|

|

| |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

| 730,738 |

|

|

| 132,193 |

|

Deferred costs/contract assets |

|

| (12,229 | ) |

|

| 433,557 |

|

Prepaid expenses and other current assets |

|

| (216,018 | ) |

|

| (182,410 | ) |

Other assets |

|

| (948 | ) |

|

| 149,963 |

|

Accounts payable |

|

| (274,109 | ) |

|

| (419,716 | ) |

Accrued liabilities |

|

| (294,637 | ) |

|

| (120,181 | ) |

Deferred revenue/contract liabilities |

|

| (393,605 | ) |

|

| (2,412,066 | ) |

Net cash used in operating activities |

|

| (5,209,847 | ) |

|

| (9,162,414 | ) |

Cash flow from investing activities: |

|

|

|

|

|

|

|

|

Purchases of equipment |

|

| (31,548 | ) |

|

| (146,333 | ) |

Acquisitions, net of cash acquired |

|

| - |

|

|

| (2,627,261 | ) |

Payment of contingent consideration for acquisitions |

|

| (1,497,894 | ) |

|

| (1,000,000 | ) |

Sale of investments |

|

| - |

|

|

| 239,314 |

|

Net cash used in investing activities |

|

| (1,529,442 | ) |

|

| (3,534,280 | ) |

Cash flows provided by financing activities: |

|

|

|

|

|

|

|

|

Proceeds from securities purchase agreement, net |

|

| 2,968,501 |

|

|

| - |

|

Proceeds from exercise of stock options |

|

| - |

|

|

| 66,111 |

|

Cash provided by financing activities |

|

| 2,968,501 |

|

|

| 66,111 |

|

|

|

|

|

|

|

|

| |

Net change in cash, cash equivalents and restricted cash |

|

| (3,770,788 | ) |

|

| (12,630,583 | ) |

Cash, cash equivalents and restricted cash, beginning of year |

|

| 5,619,083 |

|

|

| 18,249,666 |

|

Cash and cash equivalents, end of year |

| $ | 1,848,295 |

|

| $ | 5,619,083 |

|

|

|

|

|

|

|

|

| |

Non-cash Investing and Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Issuance of common stock for satisfaction of contingent liability |

| $ | 974,646 |

|

| $ | 3,059,363 |

|

Issuance of common stock for non cash performance bonus |

| $ | 490,357 |

|

| $ | - |

|

Lease liabilities arising from right-of-use assets |

| $ | - |

|

| $ | 429,329 |

|

Common stock issued for acquisition |

| $ | - |

|

| $ | 2,846,144 |

|

Contingent acquisition consideration liability recorded at closing |

| $ | - |

|

| $ | 7,325,000 |

|

Common stock issued for purchase of intangible asset - technology |

| $ | - |

|

| $ | 326,435 |

|

Issuance of common stock for satisfaction of prior year acquisition liability |

| $ | - |

|

| $ | 734,037 |

|

Issuance of common stock for satisfaction of contingent liability, net of note extinguishment |

| $ | - |

|

| $ | 318,571 |

|

Extinguishment of note receivable for satisfaction of contingent liability |

| $ | - |

|

| $ | 250,000 |

|

The following table presents a reconciliation of net loss to Adjusted EBITDA for the three and nine months ended June 30, 2024 and 2023 (in $ million):

| For the Years Ended |

| ||||||

| June 30, |

| ||||||

| 2024 |

|

| 2023 |

| |||

| (in millions) |

|

|

|

| |||

Net loss |

| $ | (6.39 | ) |

| $ | (28.56 | ) |

Depreciation and amortization |

|

| 1.36 |

|

|

| 2.19 |

|

EBITDA loss |

|

| (5.03 | ) |

|

| (26.37 | ) |

Stock based compensation expenses |

|

| 2.28 |

|

|

| 4.98 |

|

Change in fair value of acquisition contingent consideration |

|

| (4.27 | ) |

|

| (0.70 | ) |

Intangible asset impairment |

|

| 2.94 |

|

|

| 15.35 |

|

Change in fair value of accrued performance bonus |

|

| (0.55 | ) |

|

| - |

|

Acquisition related expenses |

|

| - |

|

|

| 0.28 |

|

Adjusted EBITDA loss |

| $ | (4.63 | ) |

| $ | (6.46 | ) |

SOURCE: The Glimpse Group, Inc.