Channel Samples at Midnight Owl Return Excellent Lithium Grades and New Target Identified at The San Domingo Pegmatite Project

BRITISH VIRGIN ISLANDS / ACCESSWIRE / October 1, 2024 / Bradda Head Lithium Ltd (AIM:BHL)(TSXV:BHLI), the North America-focused lithium development group, is pleased to announce the results from surface samples at the San Domingo ("SD") pegmatite project in central Arizona. New channel samples at the Midnight Owl target contain high grade intercepts of 8.40 meters of 1.17% Lithium Oxide ("Li2O") with 623 ppm Cs (Cesium) and 625 Ta2O5(Tantalum Pentoxide). A new target, Ruby Soho, was also discovered as part of the Company's follow-up on anomalous soil samples.

Channel and Grab Sample Highlights:

8.40m @ 1.17% Li20 with 623 ppm Cs and 625Ta2O5at Midnight Owl

Seven grab rock samples ranging from 0.25% to 3.57% Li20 on newly discovered Ruby Soho Pegmatite

Grab sampling identifies 3.97% Li2O on spodumene-bearing pegmatite outcrop at the Thunder target

The abundance of Cs and Ta present in the Midnight Owl Samples holds potential for excellent by-products (Ta2O5 at $300/kg, CsCO3 at $142/kg)

Both Ruby Soho and Thunder are accessible by road, with clear drill targets emerging

Bradda's management believes that with the completion of the next drilling program, there will be sufficient data to develop a 43-101 compliant resource on not only one but several pegmatite bodies

Project Highlights

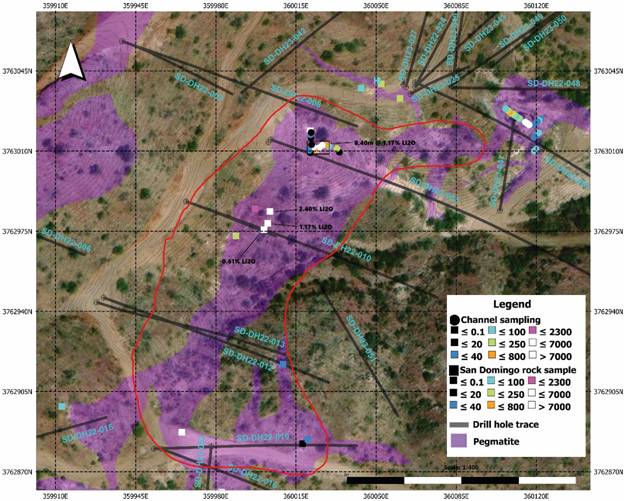

New channel sampling from the Midnight Owl target reveals significant lithium mineralization zones outside the main mine cut and on historic benches near drill holes SD-22-03, 04, and 05 (PR 06 February, 2023). As reported, Holes 03 and 05 contain 5.36m at 1.20% and 4.27m at 1.86% Li2O starting from surface, and appear to represent different portions of the same pegmatite.

These new Midnight Owl channel samples also contain exceptional Cesium at 623ppm and 625 Tantalum Pentoxide, both critical metals for the Department of Energy ("DOE") and potential byproducts at San Domingo.

Additional nearby rock chip samples located 35m to the southwest on the same bench contain 2.40%, 1.17%, and 0.61% Li2O from outcrops with visible spodumene and lepidolite.

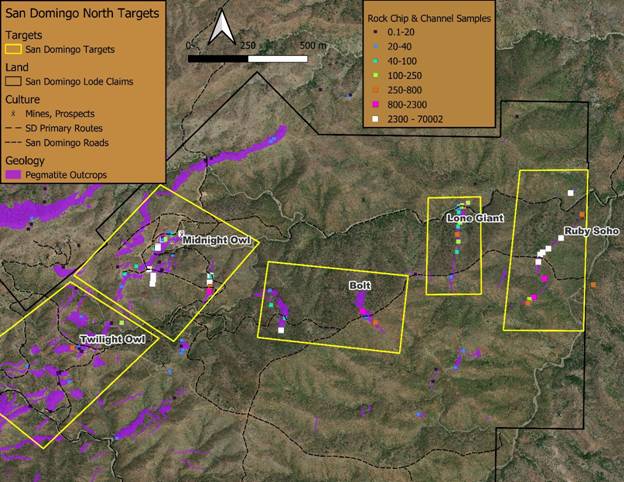

A new target called Ruby Soho was discovered about 1.5km east of Midnight Owl and mapping reveals a single pegmatite running 1.5 to 5.0m in width and exposed for over 250m, containing abundant visible spodumene.

Seven grab samples from Ruby Soho have a range of 0.25% to 3.57% Li2O and clearly represent a new target that is accessible by road.

A previously identified target, Thunder, was sampled, identifying outcrops with excellent high grades with one sample returning 3.97% Li2O. The target has not been drill-tested and has road access.

Ian Stalker, Executive Chair, commented:

"The identification of exceptional lithium values on new and older targets illustrates the ever-present and shallow potential for discovery of lithium mineralization at San Domingo. We continue to discover excellent mineralization on the surface around the Midnight Owl prospect and these new channel samples demonstrate that the potential for shallow, open cut mining is possible at San Domingo. Furthermore, the highly elevated cesium values constitute a highly strategic opportunity at San Domingo as the element is a distinctly sought after by the DOE and is a critical metal as designated by the USA."

Midnight Owl Channel Samples

A total of 15 new channel samples were collected at Midnight Owl on a historic bench (or hillside bulldozer cut) in pegmatite outcrop, exposing large spodumene crystals. Several large spodumene were newly exposed in outcrop upon clearing vegetation growing alongside the bench and determined to be significant, warranting channel sampling. The channel sampling returned promising values over the 8.40m with 1.17% Li2O and a remarkable 623ppm Cs and 625 Ta2O5. The samples were collected across a pegmatite exposure that represents surface mineralization potentially correlative with shallow lithium intercepts in 2022 core holes, 20 meters to the northwest. As reported on 6 February 2023, the holes, SD-22-03, 04, and 05, encountered 5.36m, 3.29m, and 4.27m of 1.20%, 1.01% and 1.86% Li2O respectively from surface, potentially suggesting sub-horizontal lithium mineralization in this pegmatite body. The prior channel sampling in the Midnight Owl Pit (PR 08 April, 2024) highlighted 2.90 meters of 2.31% Li2O, but has different structural context to the new channel sample results and appears to represent a separate pegmatite body.

The Company is conducting a re-interpretation of the shallow drill hole segments at Midnight Owl in context of the surface data as there is the potential for a broader, sub-horizontal lithium mineralized body. The pegmatite covering this area on surface measures 250 meters long by 80 meters in width. Thickness of the sub-horizontal and lithium mineralized pegmatite is interpreted to vary between 5 and 10 meters. Further detailed mapping is planned to ascertain better geologic and structural context and aid interpretation with re-examination of the drill core for structural data.

Lone Giant Channel Samples

Channel sampling conducted at Lone Giant was conducted opportunistically as continuous outcrops were limited or difficult to cut with the handheld core saw. The exposures are also in a large wash where the spodumene is evident but degraded due to erosion and seasonal water flow. The best sampling comes from 3.60m of 0.05% Li2O, with 385ppm Cs. The highly elevated Cs is an excellent indication of well mineralized pegmatite, but where lithium is locally weathered. The area remains a viable target as prior grab samples contain up to 0.43% Li2O and spodumene is visible over several outcrops on the pegmatite.

Recon Sampling

A new target called Ruby Soho was discovered, located 350 meters east of Lone Giant, consisting of 250 meters of exposed pegmatite. The seven samples collected along the 250-meter stretch have a lithium oxide range from 0.25% to 3.57% Li2O on a pegmatite that ranges in widths of 1.5 to 5.0 meters on the surface. This target has never been drill-tested and has road access to the highest-grade samples. One sample from the Thunder target ran 3.97% Li2O on a north-south trending pegmatite that has not been drill-tested. This pegmatite has limited strike length and good road access for future drill-testing.

QAQC

Channel samples were cut in the field under the supervision of Joey Wilkins. Sample location sites were labelled, rock channels were bagged, tied-off, then transported to the core shed under lock and key. Samples were shipped by the Company directly to SGS Laboratories in Burnaby, B.C., Canada where SGS prepped then analysed all samples using sodium peroxide fusion combined ICP-AES and ICP-MS, method GE_ICM90A50. Certified standards were inserted into the channel and rock chip sample stream and reviewed by the Qualified Person. Mr Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Qualified Person (Bradda Head)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at Bradda Head and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 38 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

For further information please visit the Company's website: www.braddaheadltd.com.

ENDS

Contact:

Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

Ian Stalker, Executive Chair Denham Eke, Finance Director |

|

|

|

Beaumont Cornish (Nomad) James Biddle / Roland Cornish | +44 20 7628 3396 |

|

|

Panmure Liberum (Joint Broker) | +44 20 7886 2500 |

Kieron Hodgson / Rauf Munir |

|

|

|

Shard Capital (Joint Broker) | +44 207 186 9927 |

Damon Heath / Isabella Pierre |

|

|

|

Red Cloud (North American Broker) | +1 416 803 3562 |

Joe Fars |

|

|

|

Tavistock (PR) | + 44 20 7920 3150 |

Nick Elwes / Josephine Clerkin | braddahead@tavistock.co.uk |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has a Measured Mineral Resource of 20 Mt at an average grade of 929 ppm Li for a total of 99 kt LCE and an Indicated Mineral Resource of 122 Mt at an average grade of 860 ppm Li and an Inferred Mineral Resource of 499 Mt at an average grade of 810 ppm Li for a total of 2.81 Mt LCE. The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a 100% equity basis and are in close proximity to the required infrastructure. Bradda Head is quoted on the AIM of the London Stock Exchange with the ticker of BHL and on the TSX Venture Exchange with a ticker of BHLI.

Technical Glossary

Kt | Thousand tonnes |

% | Percent |

Ppm | Parts per million |

Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

Sn | Tin |

Li2O % | Lithium Oxide |

Cs | Cesium |

Ta | Tantalum |

Ta2O5 | Tantalum pentoxide |

K | Potassium |

Rb | Rubidium |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals, or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited