TORONTO, ON / ACCESSWIRE / October 1, 2024 / Justera Health Ltd. (CSE:VTAL)(OTC PINK:SCRSF) ("Justera"or the"Company") is pleased to announce that further to its news release dated June 13, 2024, it has signed a definitive agreement, dated September 30, 2024 (the "Definitive Agreement") to acquire 100% of the issued and outstanding share capital of Port NorthExtracts Inc. ("Port North"), a solventless cannabis brand (the "Transaction").

Port North is known for its specialized solventless extraction techniques and product lineup. This acquisition aligns with Justera's strategic plan to diversify its portfolio and expand its presence in the health and wellness sector, particularly in the burgeoning cannabis market.

Transaction Terms:

Under the terms of the Definitive Agreement, Justera will acquire 100% of the issued and outstanding shares of Port North, an arm's length party, in exchange for 80,000,000 common shares of Justera, issued pro rata to the shareholders of Port North at a deemed value of $0.02 per share (the "Payment Shares"). Additionally, each Port North warrant held by shareholders at closing will be cancelled and exchanged for a Justera common share purchase warrant, entitling the holder to acquire one common share of Justera at an exercise price of $0.05 per share, during the same term as the original Port North warrant. The Payment Shares will be subject to a hold period until 10 trading days following the ?date the ?Company either files (i) a business acquisition report, if required under ?applicable securities laws that includes audited financial statement ?in connection with ?the transaction or (ii) consolidated final statements including Port North are made ?available. ?No finder's fees or other commissions have been paid in connection with the Transaction.

Upon completion of the Transaction, it is anticipated that Joshua Herman, the current CEO of Port North will be joining the Board of Directors of the Company.

Young Cho Lee, CEO of Justera Health, commented, "We are thrilled to formalize this agreement and look forward to welcoming the Port North team to the Justera family. This acquisition is an important step in expanding our product offerings and strengthening our position in the cannabis industry."

Completion of the transaction is expected in the coming weeks, subject to the satisfaction of all necessary customary closing conditions, including regulatory approval, final due diligence, and Port North having a minimum cash on hand of $150,000. ?

Prior to entering into the Definitive Agreement, Port North completed its previously announced offering of units of Port North, issuing 7,500,000 units, which each unit being comprised of one common share of Port North and one warrant.

About Port North

Port North is a Solventless Cannabis Extract Brand. Operating from its extraction facility in Port Elgin, Ontario, Port North utilizes specialized extraction techniques to provide pure, 100% solventless extracts for the recreational and therapeutic cannabis markets.

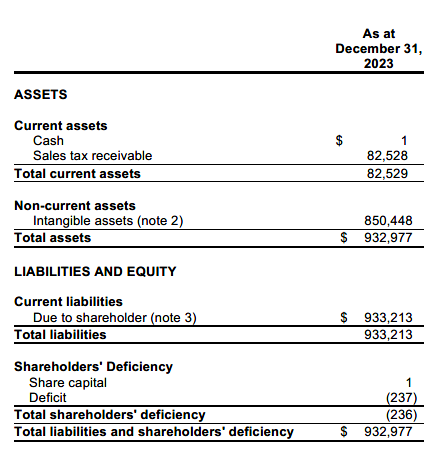

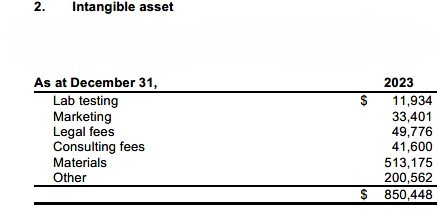

The below out the unaudited financial results of Port North for the year-ended December 31, 2023:

There were no cash flow activities during the years ended December 31, 2023.

The shareholder loan described above will remain outstanding upon completion of the Transaction; however, the loan is now an interest free loan, whereby the holder thereof has agreed to not call the loan within three years from the date of closing, and whereby the Company, at its option, my covert the loan into common shares of Justera at a rate of $0.07 per common share at any time while the loan is still outstanding.

About Justera Health

Established in 2020, Justera is a Canadian company focused on health and wellness. Through its services, innovative products, strategic partnerships, Justera empowers individuals to prioritize their well-being. With four subsidiaries, it offers personalized healthcare services and solutions, such as IV Vitamin Therapy, premium nutritional supplements through its Naturevan Nutrition brand, a full 360-degree wellness and spa experience through Juillet Wellness that provides registered massage therapy, acupuncture, and new retail stores in Vancouver. Justera's mission is to enhance Canadians overall well-being with diverse solutions catering to individual needs.

For additional information on Justera Health and other corporate information, please visit the Company's website at https://www.justerahealth.com/

For more information about the Company, please refer to the Company's profile on SEDAR+ at www.sedarplus.com.

For further information:

Investor Relations & Communications

Paul Haber, CFO

Tel: (416) 318-6501

Email: info@justerahealth.com

Forward-Looking Statements:

Certain statements contained in this news release may constitute forward-looking information, including statements relating to the future development of Justera's business. Forward-looking information is often, but not always, identified by the use of words such as "anticipate", "plan", "estimate", "expect", "may", "will", "intend", "should", and similar expressions. All statements included herein, other than statements of historical fact, are forward-looking ?statements, including but not limited to: the terms, timing and completion of the Transaction, if the Transaction is to close at all, the receipt of all necessary regulatory and CSE approvals, authorizations and consents in connection with the Transaction, and the completion or waiver, as applicable, of all conditions precedent required for the completion of the Transaction; the anticipated business plans, management structure, and future activities of the Company and Port North, including the Company's intention to integrate Port North into its business; and the anticipated benefits and synergies to be derived from the Transaction on the business of both Port North and the Company; and the date in which the Payment Shares may become free-trading.

Forward-Looking Statements are based on assumptions, estimates, analyses and opinions of management of the Company at the time they were provided or made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, including: (i) successful completion of the Financing; (ii) successful completion of the Transaction and the integration of the business of Port North in connection therewith; (iii) the ability to manage anticipated and unanticipated costs; (iv) achieving the anticipated results of the Company's strategic plans; (v) obtaining and maintaining all required licenses, approvals and permits, including regulatory approvals required to complete the Transaction; and (vi) general economic, financial market, regulatory and political conditions in which the Company operates.

Forward-looking information involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. The actual results of Justera could differ materially from those anticipated in this forward-looking information as a result of the inability of Port North to complete the Financing, the inability to consummate the Transaction, including the inability to obtain required regulatory approvals and third-party consents and the satisfaction of other conditions, inputs, suppliers and skilled labour being unavailable or available only at uneconomic costs; changes in general economic, business and political conditions, including changes in the financial markets, changes in applicable laws generally and adverse future legislative and regulatory developments involving medical and recreational marijuana, competitive factors in the industries in which Justera operates, prevailing economic conditions, changes to Justera's strategic growth plans, and other factors, many of which are beyond the control of Justera.

Management of Justera believes that the expectations reflected in the forward-looking information herein are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Any forward-looking information contained in this news release represents Justera's expectations as of the date hereof and is subject to change after such date. Justera disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events, or otherwise, except as required by applicable securities legislation.

Neither the Canadian Securities Exchange (the "CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

###

SOURCE: Justera Health Ltd.