ST. JOHN'S, NL / ACCESSWIRE / October 3, 2024 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) ("Sokoman" or the "Company") provides an update on the maiden drilling program at the 100%-owned Fleur de Lys Property located in the mineral-rich Baie Verte Mining District of northwestern Newfoundland. To date, 1,442 metres of NQ-sized diamond core drilling has been completed in 16 holes. No assays have been received from the 465 core samples sent to Eastern Analytical Ltd. in Springdale, Newfoundland.

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals states; "We are pleased with the results of our first drill program on the Fleur de Lys gold property. Our drilling is the first in the area except for holes FDL-24-09 and 10 which undercut a 1988 drill hole by Noranda which tested a showing they discovered. The drilling has intersected previously unknown structures, shear and quartz vein zones with associated sulphide mineralization, that show the potential for gold mineralization. We are awaiting assays from all holes including four holes testing the area of the Golden Bull Prospect, an area of mineralized float with no bedrock exposure. To date only a narrow, 15 cm stylolitic quartz vein vaguely resembling the large float boulders has been intersected. Drilling will continue in the Golden Bull boulder field in the coming two to three weeks to locate the source of the mineralized boulders and additional targets in the northern portion of the property will also be tested.

Exploration during the past three years has targeted world-class "Dalradian-type" orogenic gold mineralization in a similar geological environment in the Caledonian domain of Northern Ireland and the United Kingdom where the Curraghinalt deposit in Northern Ireland is one of the largest undeveloped gold deposits in the Caledonian-Appalachian Orogen hosting more than 6 million ounces of gold."

Program to Date

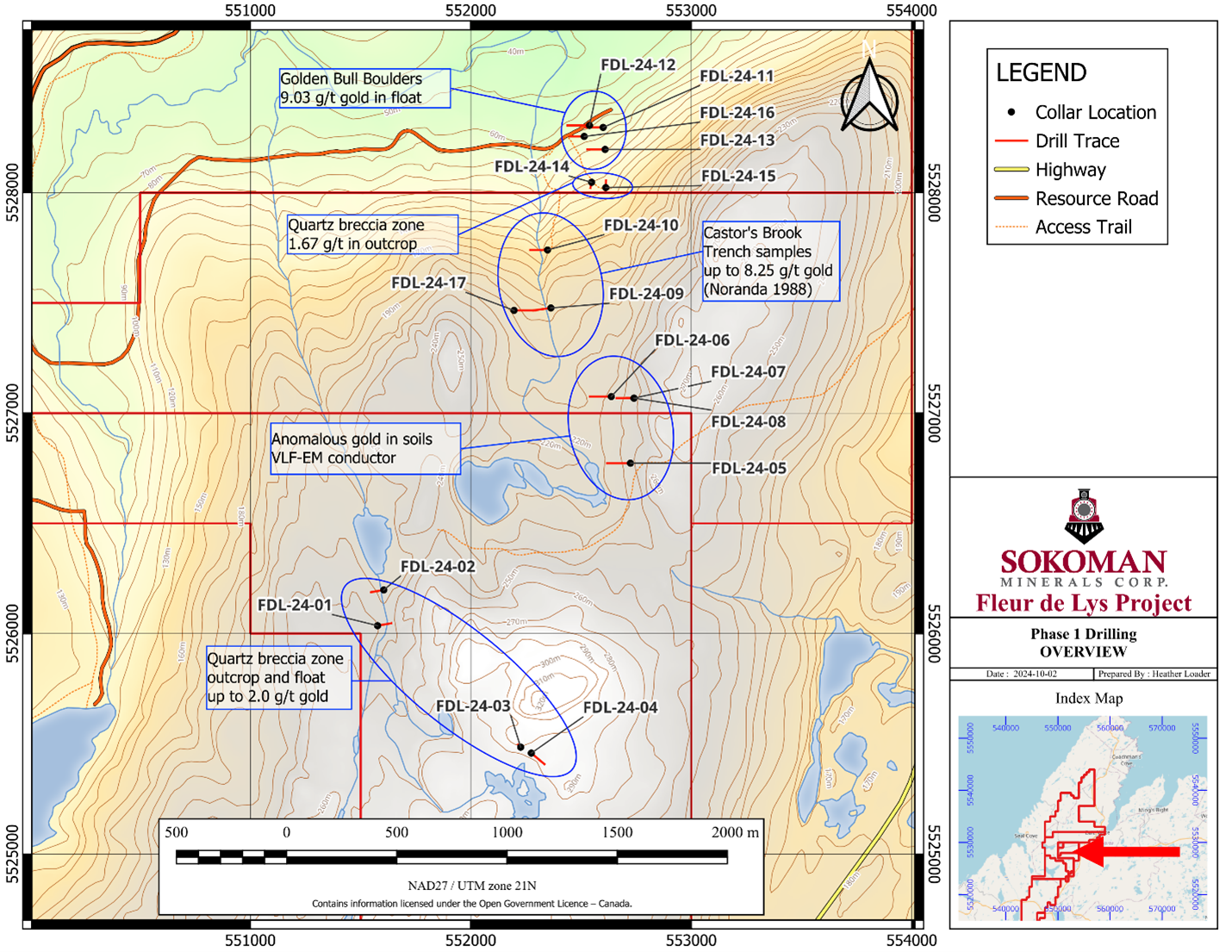

The 2,000 m Phase 1 program is testing two historical, as well as new targets generated by Sokoman's 2021-2024 till and prospecting programs that include the Golden Bull Prospect (boulder field) discovered late in 2023. Drilling is focussing on an approximately 8 km2 area that includes several discrete targets highlighted by the Golden Bull Prospect area. Drilling has tested six separate targets (see Map 1) with no assays received to date. Other targets located several kilometres further north will be tested in the coming weeks.

Holes FDL-24-01 to FDL-24-04 tested quartz breccia zones 2 km southwest of the Golden Bull Prospect target area and that gave anomalous gold values up to 2 g/t Au from random rock grab (outcrop and float) samples in 2022 and 2023. No previous drilling tested the zones. All four holes intersected sheared / locally brecciated psammitic schists with variable quartz veining and 1%-2% disseminated pyrite over core lengths of 0.5 m to 4.0 m (true thickness approximately 90% of core length).

Drill holes FDL-24-05 to FDL-24-08 tested geophysical / soil geochemical targets underlain by a strong north-trending structural corridor, originally defined by Noranda in 1988 but never tested. Two of the holes (FDL-24-07 and 08) intersected quartz veining with variable sulphide (1%-3% disseminated pyrite and pyrrhotite) over 2.9 m to 10.0 m core length (true thickness 80% of core length).

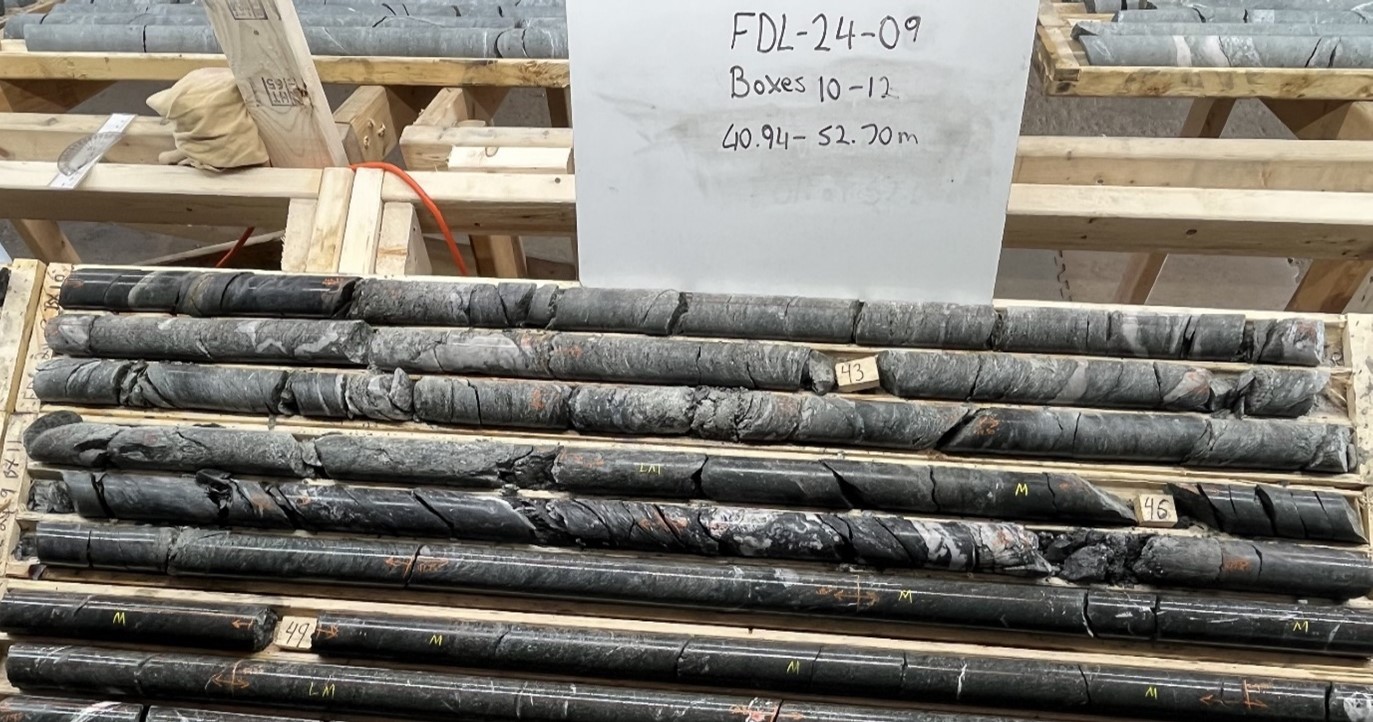

Drill holes FDL-24-09 and 10 tested two gold showings discovered by Noranda in 1988 with only one, the Castor's Brook showing, trenched and drill-tested by Noranda. It consists of a quartz breccia zone exposed in four trenches and tested by a single 107 m drill hole with drill assays of 0.42 g/t Au / 0.20 m and 0.30 g/t Au / 0.30 m. Noranda trench values range up to 8.25 grams per tonne gold (g/t Au) over 0.4 m, and 3.00 g/t Au over 0.70 m from trenches 50 m apart. Sokoman DDH FDL-24-09 was drilled to test the 8.25 g/t Au trench values. Results remain pending.

Diamond drill hole FDL-24-10 tested the Castor's North showing also discovered by Noranda in 1988 located 300 m north of the Castor's Brook showing. It is a 0.5 m to 3.0 m wide quartz breccia zone with reported Noranda grab sample results of 7.46 g/t Au and 3.4 g/t Au. The showing was not drilled by Noranda. FDL-24-10, a 100 m hole, which intersected a 10.3 m wide (core length - true thickness believed to be 80% of core length) zone of shearing with variable quartz veining and 1%-2% sulphide from 5.7 m to 16 m.

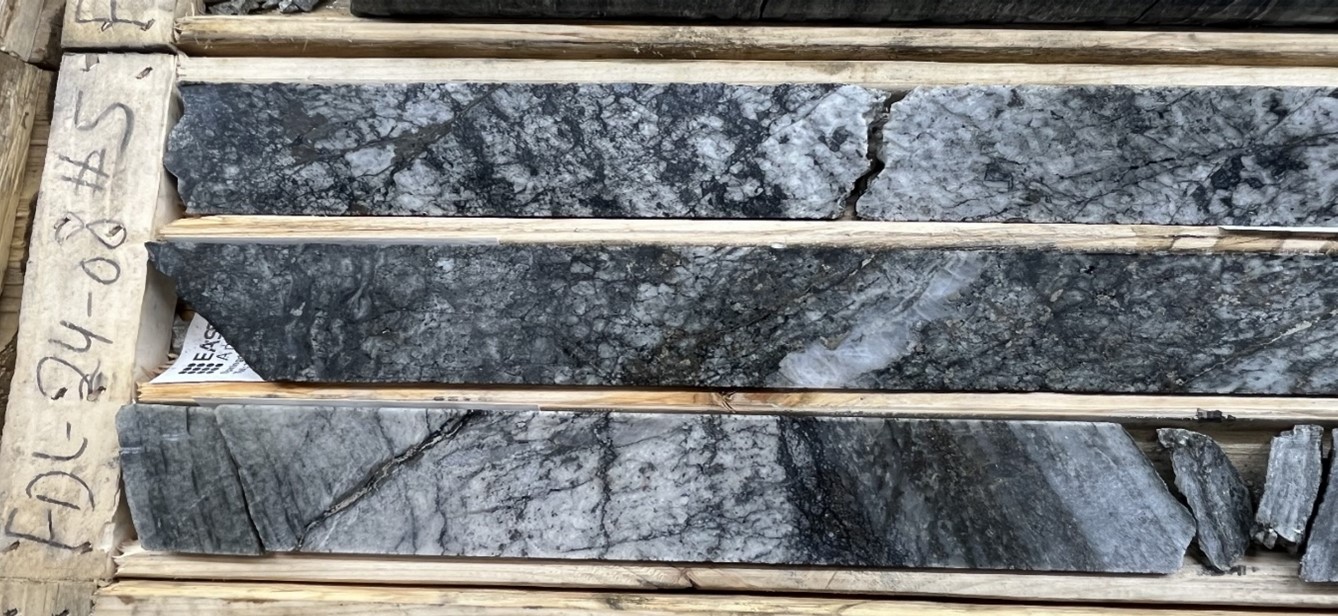

Holes FDL-24-11, 12, 13 & 16 tested anomalous gold values in float samples, including the stylolitic Golden Bull boulders, which gave up to 9.03 g/t and a north-south trending VLF EM conductor located just to the east of the anomalous boulders. Hole FDL-24-11 intersected psammites and amphibolites with zones of elevated sulphides, up to 1%. Hole FDL-24-12 intersected a 14 cm banded quartz vein with trace disseminated pyrite at 87.66 m. This vein was hosted in a 10.52 m graphitic zone with 2%-3% blebby sulphides from 79.8 m. Hole FDL-24-13 intersected a 72 cm smoky quartz breccia zone with 1% blebby pyrite from 115.72 m and a 2.54 m graphitic shear zone with 2% dusty disseminated pyrite from 124.39 m. Hole FDL-24-16 intersected 2.72 m of graphitic schist with up to 2% coarse / blebby pyrite at 46.95 m and a 50 cm quartz albite zone with up to 6% sulphides from 49.76 m.

Holes FDL-24-14 and 15 targeted a breccia zone outcrop which gave values up to 1.67 g/t Au in grab samples, located just south of the Golden Bull Prospect area. FDL-24-14 intersected 2.11 m of quartz cemented breccia comprising at least three phases of quartz from 11.4 m, with trace dusty, disseminated, pyrite in the quartz. FDL-24-15 intersected a 1.26 m breccia zone at 34.31 m.

Drilling will continue for two to three more weeks with a decision on follow-up drilling this fall to be made once all assays have been received.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. All samples of quartz vein material were submitted for total pulp metallics and gravimetric finish. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.